What is Alfa Investments, how to register a personal account, tariffs, functionality and terminal, brokerage services. Alfa-Bank is one of the largest Russian banks. It ranks fourth in terms of its assets.

- Investments are made in mutual funds . In this case, you need to deposit an amount of 1000 rubles. The fund’s funds are managed by experienced professionals, receiving a steady and significant profit. The depositor receives payments during the term of the deposit. After the expiration of the term, the previously invested amount is returned to him.

- It is available to conduct transactions for the purchase or sale of shares . At the same time, it is possible to work with both Russian and foreign securities. A prerequisite for conducting such activities is the presence of a brokerage account in the company.

- When buying bonds , investors receive coupon payments. Once these securities expire, their value will be returned.

- Investment life insurance is available . This requires defining a strategy and making contributions that are conditional on the agreement. Income can be paid during the time of investment or one-time, at the end of the contract.

- It is possible to use an impersonal metal account for trading precious metals. By executing trades in gold, platinum, silver or palladium, investors have the opportunity to maximize profits.

In some cases, users may involve professionals to manage their investments. They will help you make good profits, but at the same time, their services must be paid for with a part of the profits. Investors usually receive detailed reports on their performance three times a month.

general description

Working with Alfa-Investments (link https://alfabank.ru/make-money/investments/), clients can enjoy the following benefits:

- You can invest in the purchase of assets, starting from the minimum amount available to almost every investor. Its exact value depends on the type of activity.

- Here you have the opportunity to get acquainted with profitable investment ideas offered by experienced professionals.

- Access is provided not only to Russian, but also to foreign securities. This can be done using access to the St. Petersburg Stock Exchange, which is provided by Alfa-Investments.

- Individuals have the opportunity to work with the help of an individual investment account, which, under certain conditions, allows you to receive significant income tax deductions.

- The company’s specialists provide all the necessary advice on taxation and the procedure for using tax deductions.

- If an investor needs to withdraw funds, he can do this both on working days and on weekends.

- As you know, securities are kept in depositaries. When buying or selling, they are transferred from the seller’s account to the buyer’s account. Firm Alfa-Investments renders depositary services.

- There is a wide range of investment instruments.

- There is a high-quality software that provides customers with everything they need to work. In particular, there is a smartphone application that allows you to invest almost anywhere in the world.

- Credit implies that some issuers may not fulfill their obligations towards the owners of their securities.

- Legal risk refers to changes in the legal conditions for the activities of economic entities.

- The economic is associated with a change in the business environment for a particular firm, which may affect the quotes and payments associated with securities.

- Tax risk includes possible changes in legislation that will lead to different tax rules.

- An unfavorable change in the value of securities is referred to as market risk. It is associated with changes in supply and demand, which can be unpredictable.

The investor should strive to minimize them. Alfa Investments: an overview of the application, is it worth opening an account, tariffs, functionality, bonuses: https://youtu.be/TueNLag–cw

IIS in Alfa Investments

The provision of an individual investment account became possible on the basis of a special state support program. It provides very profitable opportunities for private investors. If they have invested in securities, they can use the income tax deduction. To take advantage of this opportunity, you need to open an IIS like any other account. The term of his work should not be less than three years. The client has the right to choose one of two types of deductions:

- By depositing money over a three-year period for each year separately, you will receive 13% deductions. In this case, the upper limit is the annual amount of 400 thousand rubles. You can deposit more funds, but the rest will not be credited.

- Receiving profit from investments in securities, the investor can be exempted from paying income tax for three years.

With the deliberate use of an individual investment account, a person has the opportunity to make significant profits.

Brokerage services in Alfa Bank

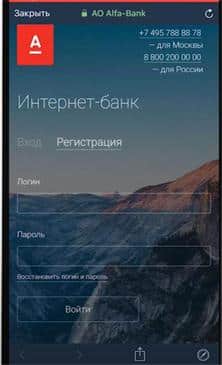

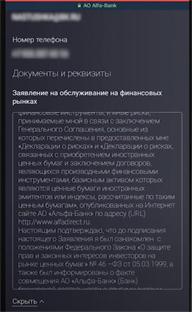

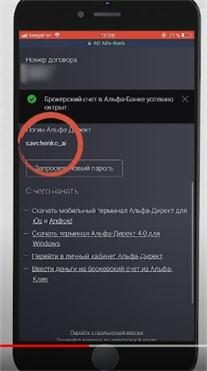

Opening a brokerage account is a prerequisite for investing in this company. The registration procedure is free. The procedure is different for those who are already Alfa Investments clients and those who are not yet. In the latter case, you can open an account by leaving an online application on the official website in the “Investments” section. In this case, it will be necessary to obtain an Alfa-Bank card and deposit any amount on it. In the application, you will need to indicate personal and passport data, as well as provide your contacts. The client can also choose the tariff that he sees fit. If the user is already a client of the Alfa-Click Internet Bank, then he has a username and password to enter it. This data can also be used to log into the application. If he is not yet a bank customer, then it will be necessary to first draw up documents and become a client of the bank. A brokerage account can be opened by contacting a bank branch, via the Internet or using a smartphone application. For example, the last design option will be described in detail. After entering the application, a brokerage account is opened. To do this, you need to perform the following steps in the application.

It is important not only to remember this data, but also to write it down, and then securely store it. The received login and password will be required in the future to enter the system to work with a brokerage account. After it is completed, the client will immediately be able to start working.

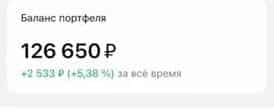

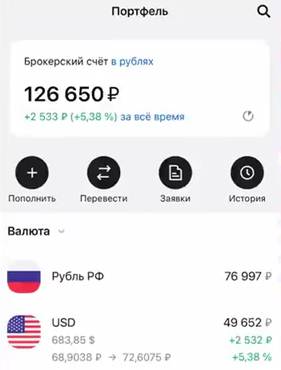

After the brokerage account is opened, it is necessary to deposit the amount that will be required to complete transactions. It should be borne in mind that the more funds an investor can use in his work, the more opportunities he has for making a profit. There are several ways to replenish. To do this, you can contact a specialist at the branch of the institution, deposit money through the Internet bank or use a specialized application for this purpose. To replenish, you can use rubles, dollars, euros and pounds sterling. The duration of the operation cannot exceed 20 minutes. After completing the documents and depositing money into the account, you can immediately start working. Access to the Moscow Exchange is provided immediately after registration. If a client wants to work with the St. Petersburg Exchange, then he must undergo the appropriate registration.

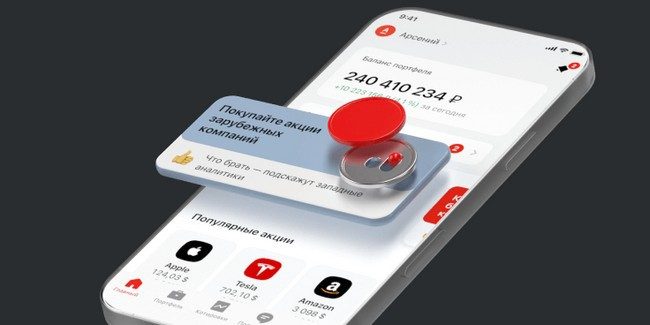

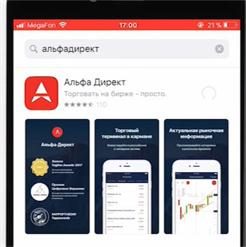

Application for investments Alpha investments

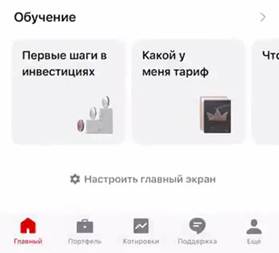

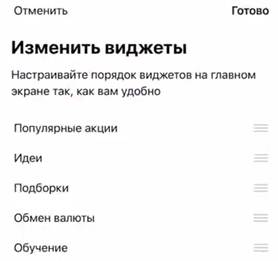

Alfa-Investment Company provides an opportunity to use the application for a smartphone. It is made for phones using Android https://play.google.com/store/apps/details?id=ru.alfadirect.app&hl=ru&gl=US or iOS https://apps.apple.com/ru/app/ %D0%B0%D0%BB%D1%8C%D1%84%D0%B0-%D0%B8%D0%BD%D0%B2%D0%B5%D1%81%D1%82%D0%B8% D1%86%D0%B8%D0%B8/id1187815798. Through it it is convenient to open a brokerage account and work with it. To get started, you need to download the program from the official application store and install it on your smartphone. After launch, the main window of the application will open.

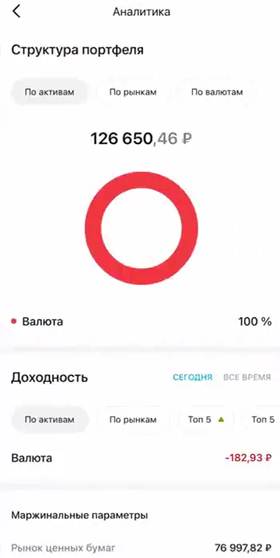

of the application :

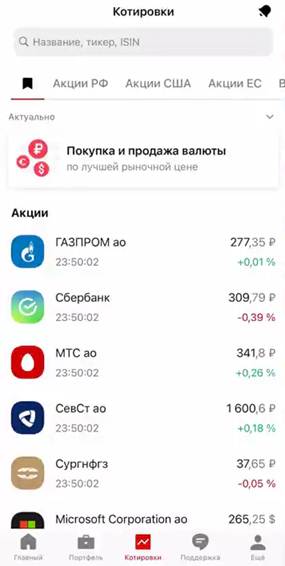

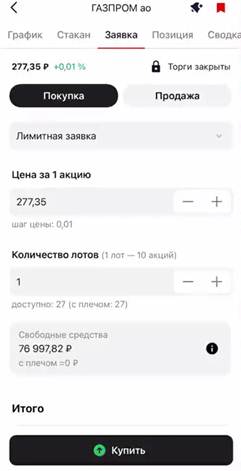

- Conduct transactions to buy or sell securities. At the same time, not only Russian, but also foreign shares are available. To do this, go to the “Application” tab, fill it out and indicate the type of transaction: purchase or sale.

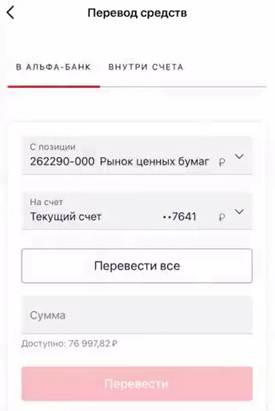

- By going to the “Withdraw funds” section, you can transfer money from a brokerage account to a card or to your current account.

- With the help of Alfa-Bank, you can replenish your brokerage account.

- The application allows the investor to receive detailed reports on the activities carried out. They may relate to a portfolio of securities, trading operations, as well as the calculation and payment of taxes.

Users can also activate their electronic signature in the application. The Alfa-Investments app for Android smartphones is available for download and installation at https://play.google.com/store/apps/details?id=ru.alfadirect.app&hl=ru&gl=US. For smartphones running iOS, this application can be downloaded and installed from https://apps.apple.com/en/app/alfa-investments/id1187815798.

Alfa Direct trading terminal

The user can use the Alfa Investments terminal for work. It used to be called Alpha Direct. The program provides detailed instructions for users. You can download and install the application from the page https://alfabank.ru/make-money/investments/terminal-alfa-direct/. Trading terminals provide users with a variety of options for working with securities:

- Real-time data is displayed, and a glass of quotes is also provided.

- You can make short and long trades. Both market and pending orders are executed. Stop Loss and Take Profit are supported.

- There are over 50 built-in technical analysis indicators. It is possible to add your own to them. You can view several instruments on the chart at the same time.

- It is possible to place orders from the chart or from the order book, which makes the trader’s work more accurate and efficient.

How to connect a robot

The company makes it possible to conduct automated trading. To do this, you need to find a suitable robot and install it. This requires the following actions:

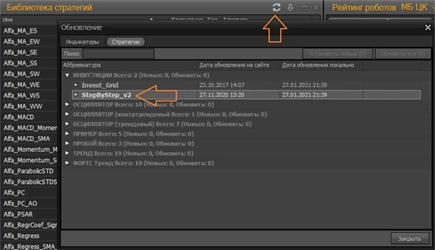

- In the terminal, open the “Robots” item, then go to the strategy library.

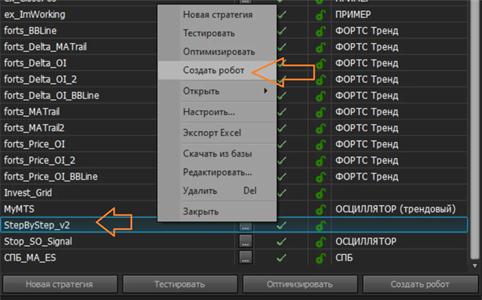

- Find the desired option in the list. Then – “Create a robot”.

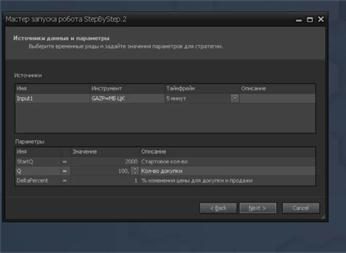

- Next, indicate the input parameters for work.

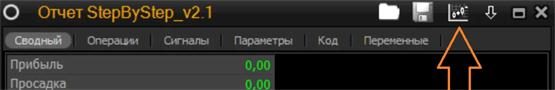

- In the “Robot Manager” click on the button Next, you need to view the schedule and make sure that the robot has started to work.

In the course of work, to obtain detailed information, it is necessary to receive reports. To do this, click on the appropriate button.

I chose an individual investment account for Alpha investment in order to receive a decent profit. Invested in management funds. I was wrong in my expectations. Thanks to the professionalism of the managers, he received the profit he was counting on, and also took advantage of the tax deductions provided by the state.

Vitaly

Tariffs for Alfa investments

Users can choose from “Investor”, “Trader” and “Advisor” tariffs. Each of them has its own characteristics. It is necessary to choose the one that is more suitable for the chosen system of work. The following is a description of the pricing features.

“Investor”

Maintenance cost is zero. It uses a commission equal to 0.3% for transactions with securities. This choice is beneficial for those who invest less than 82 thousand rubles. monthly.

“Trader”

This tariff is intended for those who are actively trading in securities. Monthly service costs 199 rubles. provided that purchase and sale transactions took place in this month. Otherwise, you don’t have to pay anything for the month. The cost of the commission for the exchange market is from 0.014%, for the over-the-counter market – from 0.1%.

“Advisor”

On this tariff, the client receives assistance from professionals in portfolio management. The cost of services depends on the level of risk and profitability. Service cost from 0.5% of the amount of funds that have been invested. Commissions from operations on the exchange market – from 0.1%, on the over-the-counter market – from 0.2%.