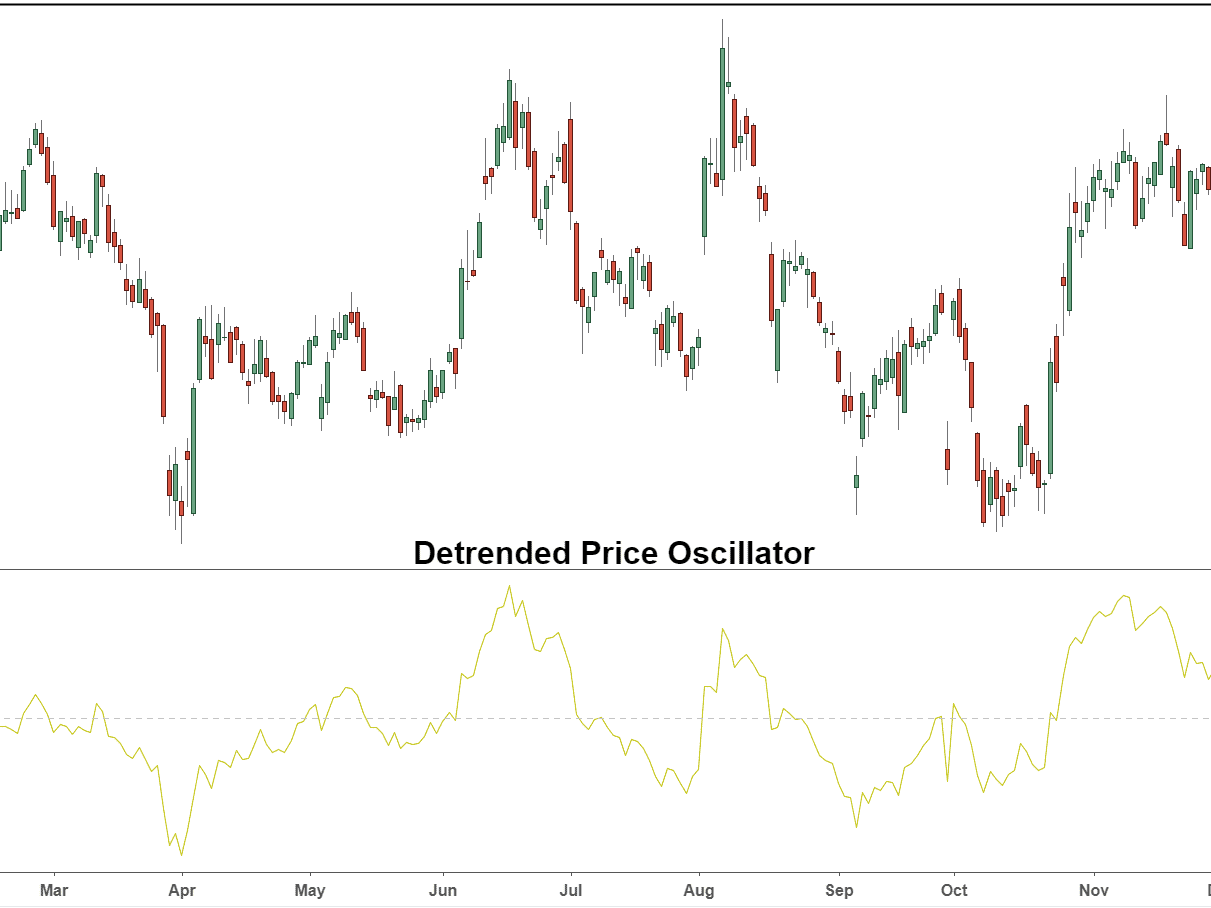

An irrefutable fact is that the price of an asset moves in a flat most of the time. In such a situation, trend indicators cannot help in finding a point to enter the market. For flat trading, oscillators show effective analysis. The article provides an overview of the Detrended Price Oscillator – DPO, describes the instrument itself, its settings, trading strategies and rules for its use.

What is Detrended Price Oscillator – DPO aka untrended price oscillator

The DPO oscillator is a tool for analyzing sideways price movements. This oscillator is an advanced

moving average (MA) indicator. The main difference from the moving average is that the calculation of the oscillator readings includes only information for the current time period, with a slight smoothing. The logic of work is the following:

- A working period is selected for the instrument, for example, M5.

- Work cycles longer than 5 minutes are not taken into account by the oscillator formula.

- Working cycles less than 5 minutes are taken into account (M1-M5).

- Reading smoothing is calculated from half the total length of the previous values.

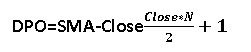

Calculation formula

Calculation of the position of the oscillator in relation to the current price is done according to the formula:

- SMA is the value of the simple moving average.

- Close – the current price at the close of the candle.

- N is the price cycle, which has a standard value of 12.

- 2 parameter 2 SMA.

- 1 smoothing factor.

Based on the formula, we can conclude that the oscillator is able to show a more average value than a simple SMA, smoothing out the market noise. This increases the percentage of accurate signals and reduces the risk of losing funds.

Rules for using the price oscillator

The DPO Oscillator is very easy to use, but requires a lot of concentration on the part of the trader. The basic rules for using the tool are as follows:

- When in the oversold zone (lower limit), the oscillator indicates the possibility of buying an asset. At the same time, the market participant must take into account the state of the market. With a trend, a small rebound is possible and a return to its original position.

- The same principle is used when the DPO line is in the overbought zone (upper limit).

- The most accurate signal occurs when the central, zero range is broken. A breakdown indicates an exact reversal of the average price value (does not indicate a trend in a flat).

- Market volatility should be taken into account . If there is a lot of hype, a breakout of the range is considered a strong signal.

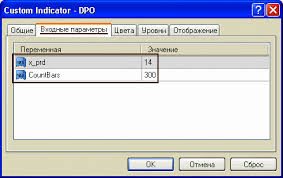

Setting

The oscillator is suitable for trading on time frames from 5 minutes to 4 hours. Therefore, it is worth considering the time frame when setting it up. The tool is not basic for

trading terminals , so you must first download it https://doc.stocksharp.ru/topics/IndicatorDetrendedPriceOscillator.html and install it. The setting is carried out as follows:

- Select the DPO oscillator in the “Custom” subsection of the “Indicators” section.

- Next, the tool settings menu will open, where you need to open the “Input parameters” tab.

- In this tab, you can change the “x_prd” parameter, which is responsible for the period of the moving average. The default value is 14. For periods M5-30, the value is suitable. At high intervals, the period should be increased.

- The second value “Count Bars” determines the number of bars to calculate. The default is 300 bars. This value should be changed only when changing the moving period.

- Then you can change the color, thickness of the line and zones of the oscillator.

- The tool is ready to go.

It is important for the user to take into account that with an increase in the values in the settings, the number of accurate signals will significantly decrease. You need to “play” with the settings in order to adjust the instrument exactly to your trading style.

Strategies example

You can use this tool in different ways, but only 2 strategies are considered effective, which will be described below.

Strategy 1

The meaning of this strategy is to trade from the range zones of the oscillator. This strategy is suitable for trading in a trend, on its change and flat. Below is a description of the trading situation at the time of price movement in the side corridor.

- The price is at the support level and tends to turn in the opposite direction. In this case, the oscillator line leaves the lower zone.

- The line overcomes the zero, middle range from below, and the price fixes above on the chart (joint position).

- At this moment, a deal is opened to buy the asset. The target is the upper range.

- Set stop loss at the support area or 10 pips beyond it.

Strategy 2

This strategy has the highest efficiency. It is based on the ability of DPO to indicate the formation of a divergence – a divergence from the price position on the chart. The trading rules are as follows:

- There is a downward movement on the chart, which tends to a significant price level.

- The oscillator reacts to this movement with the opposite direction of the line (up).

- When approaching the level, it is worth opening a buy position.

- Stop loss is set behind the support level.

- In such a position, it is better to fix the profit by shifting the stop loss relative to the price.

Advantages and disadvantages

The DPO oscillator has long appeared in the community of traders, having managed to find supporters and opponents. Among the advantages of the tool are:

- Indicates market pullbacks.

- Smoothes out noise.

- Able to show divergence.

Disadvantages:

- It has a delay, which will be difficult to reduce the settings.

- Cannot be used as the main and only tool.

Despite the disadvantages, the oscillator can be used to determine entry points, but with considerable experience.

What platforms use DPO

DPO is a versatile and non-standard tool. It can be used on platforms that allow you to supplement the standard list of indicators. These platforms include:

- MT 4. The oscillator was originally built for this platform, so it installs and works without errors.

- IQ Option platform for binary options trading. Also easy to use and accepts added tools.

- Tradingview platform. Here it is worth considering what version of the terminal the broker uses. If with full functionality, then the oscillator can be used in work.

RSI tools to increase the accuracy of the signals. More experienced traders can use DPO as a divergence indicator.