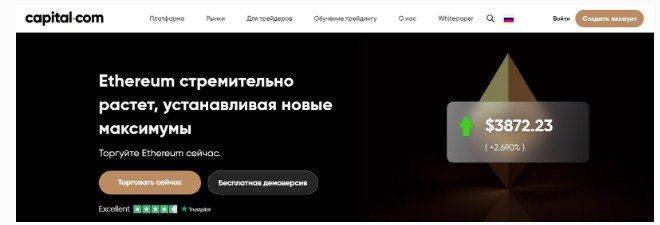

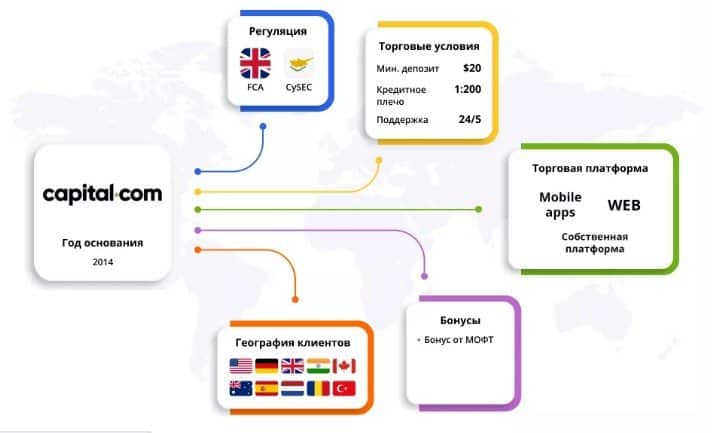

Does Capital.com provide an opportunity to earn? Capital.com was founded in 2016. Three years later, the Internet platform opened up access to clients from Russia, who highly appreciate the functionality of the platform, distinguishing it from others. The financial broker offers trading services to professionals and beginners, providing access to well-known world markets. The functionality of the trading platform is distinguished by its diversity, the presence of effective tools.

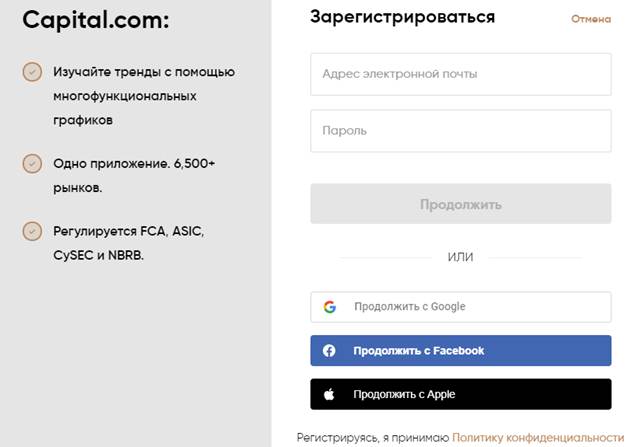

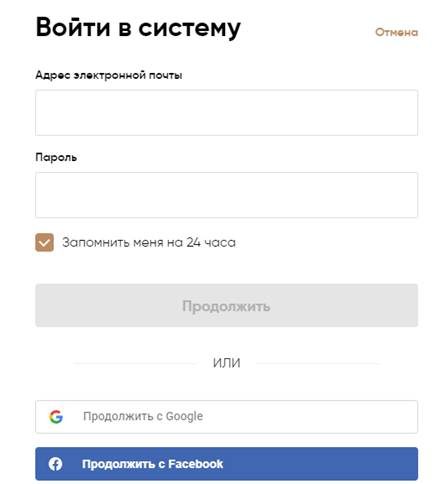

Registering an account on the official website of Capital.com

To start earning, you need to log in.

Attention! To do this, you need to go to the official website capital com and click “Create an account” in the upper right corner. If you already have a profile, you can use it.

Registration on the site is carried out by filling out the form.

- Identification with a passport, driver’s or military card, refugee card.

- An indication of the address of residence, which can be confirmed by utility bills, bank statements and other papers.

- Use of a personal account.

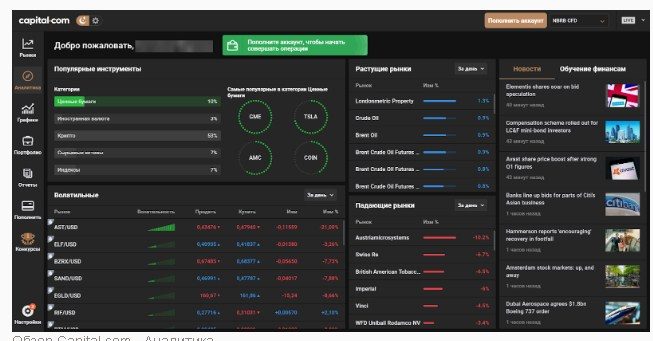

The site interface is easy to understand. The trading terminal is located along with the personal account on the same page. Various types of graphs help users who use the available drawing tools. The organizers of the site have provided a quick ability to switch between mobile and stationary versions. This allows you to be always up to date, wherever users are. Technical indicators help identify trading potential.

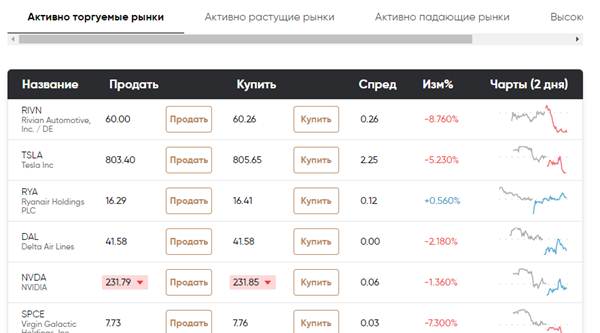

The trading process is available to registered users Trading on stocks, indices, commodities are available for trading. Financial instruments are popular in the market, which takes into account the company’s industries, analyzes securities. Users receive profit reports, performance indicators by sector, as well as in all structures. The site provides an opportunity to earn during trading hours, depending on the activity of the exchange on which the shares are listed. Out-of-hours can be used to determine a trade order. It will require a lot of liquidity as there are no market participants. There are two options for the bidding process. The first involves the purchase of shares of companies on different exchanges, thanks to which the trader receives a share in the company. The price of securities is growing, forecasts are made by experts. Long-term plans for increasing the value are months or years. Lack of liquidity, leverage of derivative products does not attract financiers. The advent of online trading solves the problem of acquiring assets, making a profit, thanks to

contracts for difference . The current value of the object does not match the price at the time of the conclusion of the agreements. If the difference is negative, then the seller will pay the buyer. Such a CFD scheme is popular, it is an alternative to traditional transactions.

Terms of trade

Capital.com is a quality popular platform that provides security to users. A variety of markets, instruments, the ability to use charts, low commissions allow you to make a profit. Capital.com features are designed for profitable trading with negative balance protection, correct stop loss, fast order execution. Trading conditions provided by the capital com exchange:

- The minimum deposit is $100.

- The maximum leverage that a user can count on is 1:500.

- There is a protection against a negative account number, which applies to operations with a valid leverage of 1:50.

- Availability of market orders, Stop and Limit.

- Absence of accounts without exchange of assets with transactions and counter-transactions.

- Provision of quotes by the broker 5 digits.

- The spread value does not depend on the tariff, user account.

- The minimum order is 0.01.

- Hedging is allowed.

The educational section https capital com helps to master the innovations of trading on the stock exchange. Also, the site organizers provide some analytics for free. Education in English is available to every trader.

The demo version will help you calculate the forces

Traders can try their hand with the help of virtual money. The demo version is available to beginners and experienced users in the Personal Account, without additional registration. A demo account can be opened in any currency, there are no time limits for its use. You can activate up to ten accounts. You can try trading on the stock exchange by buying assets for virtual money without risking personal funds. A demo account reflects all changes in trading conditions, helps beginners to get acquainted with the broker. Traders learn with the help of virtual money information about the stock markets, the size of the commission, standard payments, get acquainted with the mechanisms of regulation. Capital com accepts a minimum deposit of $20. More than two thousand companies from around the world are present on the broker’s website. There are various ways to replenish the account: debit card or credit card, e-wallet, bank transfer. A demo account helps you choose a company for trading by analyzing the broker. A beginner should pay attention to the supported markets. https://articles.opexflow.com/trading-training/torgovlya-na-demo-schete.htm Capital com provides access to foreign stock exchanges, fixes $50,000 in a virtual account so that beginners can do real-life training. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market. A demo account helps you choose a company for trading by analyzing the broker. A beginner should pay attention to the supported markets. https://articles.opexflow.com/trading-training/torgovlya-na-demo-schete.htm Capital com provides access to foreign stock exchanges, fixes $50,000 in a virtual account so that beginners can do real-life training. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market. A demo account helps you choose a company for trading by analyzing the broker. A beginner should pay attention to the supported markets. https://articles.opexflow.com/trading-training/torgovlya-na-demo-schete.htm Capital com provides access to foreign stock exchanges, fixes $50,000 in a virtual account so that beginners can do real-life training. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market. //articles.opexflow.com/trading-training/torgovlya-na-demo-schete.htm Capital com provides access to foreign stock exchanges, fixes $50,000 in a virtual account so that beginners can complete training close to reality. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market. //articles.opexflow.com/trading-training/torgovlya-na-demo-schete.htm Capital com provides access to foreign stock exchanges, fixes $50,000 in a virtual account so that beginners can complete training close to reality. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market. A demo account is also used by experienced traders to test new systems. Overview of the broker Capital Com (Capital Com): conditions, platform, withdrawal of funds: https://youtu.be/OcxLa0MvVtM The best virtual versions have full functionality, reflect the real trading conditions. An interface close to the original appears on the screen to monitor the market.

Note! Switching to a demo portfolio takes a few minutes, just click “Try Demo”. Once connected, the user can enter into transactions, as well as choose specific actions, without fear for unreasonable deposits.

Reports, charts, which are available for free, will be displayed on the screen for the trader to review. Beginners place their first order in demo mode, so it’s easier to switch to real transactions. To switch to money, click “Switch to Live”. The registration window will pop up if the client has not filled out the form before. The procedure for using virtual funds is free. After checking the possibilities, you can start real financing operations, make a profit on the trading platform.

Pros and cons of trading

Broker capital com performs registration in a few minutes, providing traders with quick access to services. The advantages of the exchange over other financial platforms are in the following characteristics:

- A variety of ways to replenish an account, withdraw funds, the choice is made at the personal discretion of customers.

- Segregated accounts securely store traders’ money.

- Webinars, lectures are available to obtain the necessary knowledge. On the site you can find out the latest news on the financial markets.

- Support is provided in more than ten languages.

- Trading instruments are presented in a large number.

- High level of security. All personal information is confidential.

- The interface is clear on an intuitive level, if desired, the help of specialists is available.

- Price alerts happen instantly.

Interesting to know! More than 300 thousand traders prefer capital com. User reviews contain positive ratings.

Capital offers to use mobile applications for the convenience of trading on the stock exchange. The platform for CFD trading on a smartphone provides quick access to tools that is not inferior to a PC. The capital com company quickly processes orders, works transparently, without hidden fees. All information is reflected in the user’s personal account. Among the shortcomings that the site organizers are working on, clients note the lack of active proposals for investing in individual programs. Some are dissatisfied with the verification procedure, which is necessary for security. Capital com uses reliable tools, presents a variety of markets, improves analytical charts so that traders have more options.