How to find out the current stock quotes online in real time, look at stock quotes of foreign and Russian companies on the Moscow, London and other stock exchanges, where you can find out prices, how to read, where to look at statistics. Stock quotes are one of the most important indicators that investors use when trading. It provides an indication of the value of a financial instrument in real time.

What are stock quotes

Stock quotes provide important information about the current trading activity of a particular company on the stock exchange. During a trading session, traders can see both prices, i.e. what buyers are willing to pay and what sellers are willing to offer, as well as other information.

Understanding how stock quotes work

The quoted price, which is the last trading price of the shares, is based on negotiations between buyers and sellers. The difference between the bid and offer price of a stock is known as the bid/ask spread. The lower the spread, the more liquid the shares, which means that there will be more demand for those shares. Conversely, the higher the spread, the lower the demand. The stock quote is the last price at which the stock was actually traded. The information included in a share price is used by investors and other market participants to price shares and negotiate purchase and sale prices. Stock quotes are now available online in real time.

History of stock quotes

The first “stock quotes” were transmitted by semaphore control codes in France in the early 19th century. The information contained was sparse, noting only the price of shares traded in Paris. The ticker tape that followed on November 15, 1867 provided much more detailed stock quotes until it was replaced in the 1960s. Prior to 2001, the stock was quoted in fractions—in other words, 201⁄2 at $20.50 ($20.50). After 2001 and to this day, quotes have been in decimals representing dollar amounts. The change from fractions to decimals resulted in a significant reduction in bid and ask spreads. Prior to 2001, fractions were used in stock quotes and the smallest spread was $1/16 ($0.0625). In the current decimal system, the smallest spread is equivalent to $0.01, which results in increased liquidity (closer spreads) in the stock market.

Importance in investing

Stock quotes provide very important information. All this additional information and data helps investors make more informed trading decisions. Investors keep a close eye on whether a stock is going up or down in price, and they usually focus on relative changes, which are fixed in percentages. It is important for investors to see changes in value in order to make selling decisions. Current prices reflect the supply and demand of all investors in the market. Therefore, a lot of information is transmitted from stock quotes. The main conclusion drawn from stock quotes is the company’s future expectations. When prices rise, it reflects increased demand for stocks, meaning more people are buying. This shows that the company’s future expectations are promising. Conversely, if prices decrease, this reflects a decrease in demand for shares, i.e. more people are selling. This shows that future expectations from the company are deteriorating. Such a fact is very evident in the quarterly earnings updates that all public companies must adhere to. In updates, companies publish their quarterly financial results, as well as management commentary, and hold conferences to answer analyst questions. Once you understand how to read a stock quote, you will be able to make the right trading decisions. Tracking stock quotes helps in identifying stocks that meet the required trading criteria, as well as revealing patterns that can help guide trading decisions. which all public companies must adhere to. In updates, companies publish their quarterly financial results, as well as management commentary, and hold conferences to answer analyst questions. Once you understand how to read a stock quote, you will be able to make the right trading decisions. Tracking stock quotes helps in identifying stocks that meet the required trading criteria, as well as revealing patterns that can help guide trading decisions. which all public companies must adhere to. In updates, companies publish their quarterly financial results, as well as management commentary, and hold conferences to answer analyst questions. Once you understand how to read a stock quote, you will be able to make the right trading decisions. Tracking stock quotes helps in identifying stocks that meet the required trading criteria, as well as revealing patterns that can help guide trading decisions.

What parameters are in stock quotes

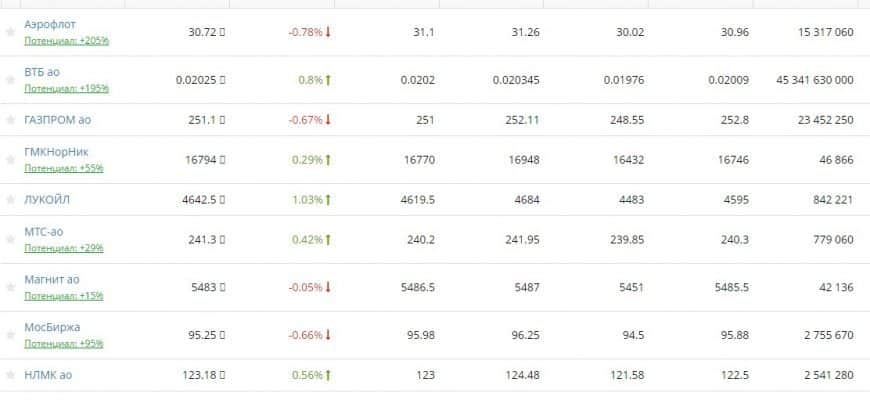

The following are the terms that can be seen in stock quotes:

- A ticker is a stock symbol that identifies a company.

- Close/Current Price – price at the closing stage of previous trades (at the end of the previous day).

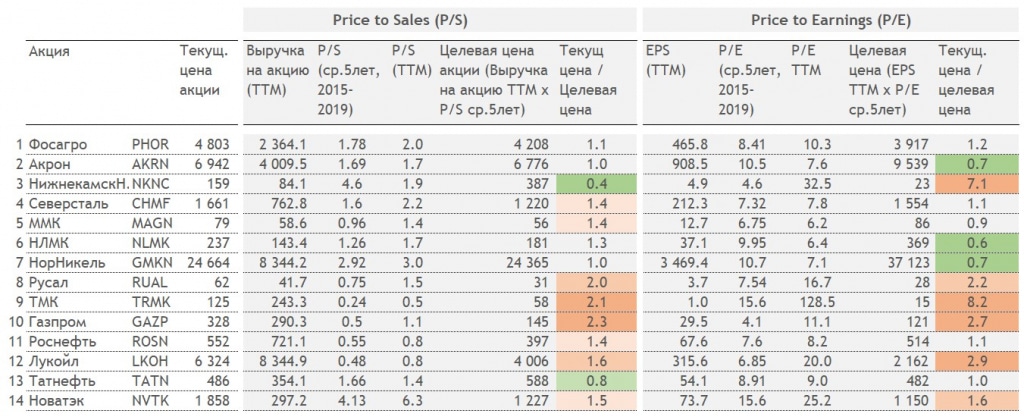

- EPS (TTM) : Abbreviation for earnings per share, which is equal to a company’s total earnings divided by shares outstanding. Higher value means the company is more profitable.

- 52W high/low is the range of low and high prices per share last year.

- P/E – Price/earnings ratio. This is earnings compared to the value of the stock.

- Div – dividends that were paid per share.

- EPS – Earnings per share.

- % Yield – Yield.

- Vol – Volume (the number of shares that were traded on the stock exchange on the previous day).

- High/Low – The maximum and minimum value of the previous day.

- Net chg – Cost at the stage of opening new trades.

- Shares – The number of shares held by investors.

- Mkt cap – Market capitalization (total value of the firm in the market).

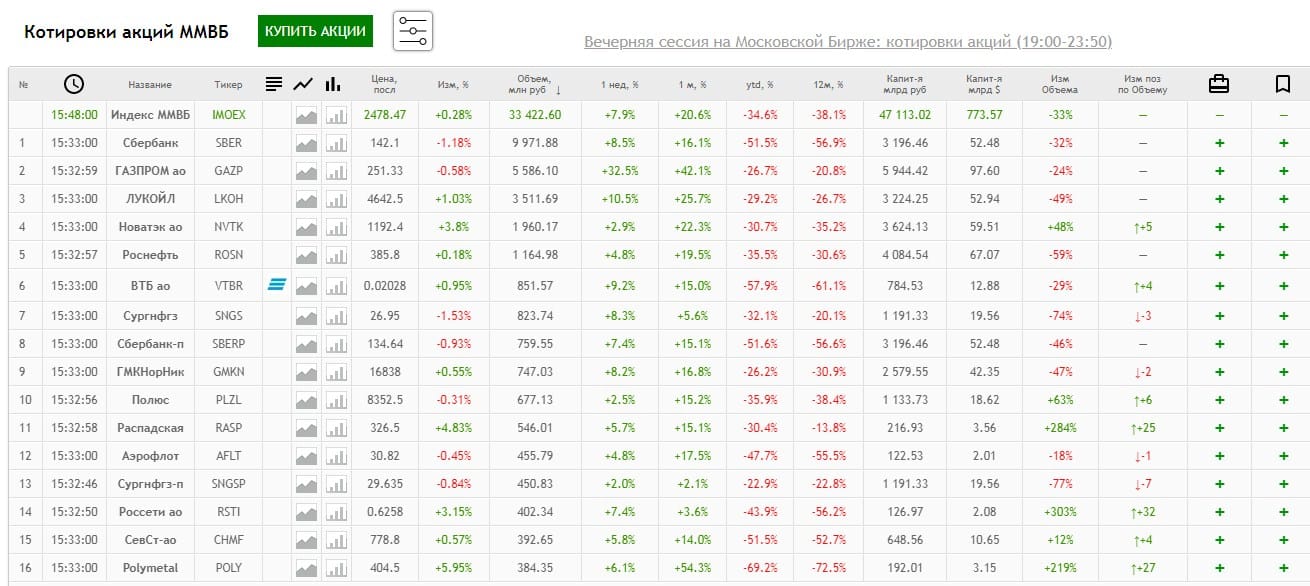

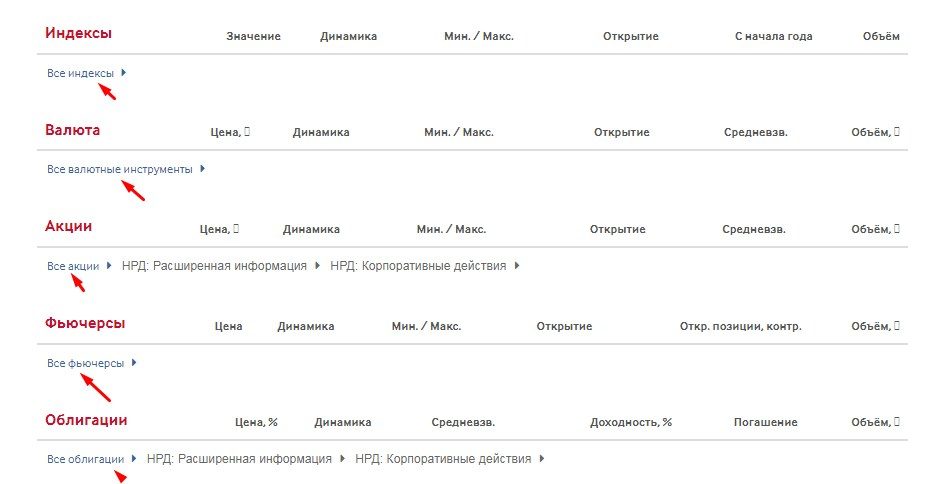

Where to look online quotes of foreign and Russian stocks and how to read the data correctly

To look at quotes, you should use financial resources. There are paid and free sites where you can check quotes. Many sites, including Google, MSN, and Yahoo, offer free data. These portals provide detailed information and graphics that are not available in the media.

- https://www.finam.ru – American and world exchanges.

- https://bcs-express.ru/ — quotes of foreign shares of the St. Petersburg stock exchange.

- https://ru.tradingview.com – stocks of American companies.

- https://ru.investing.com/ – stocks of the Russian Federation, the USA online.

- https://finance.yahoo.com – on this site you can see a detailed history of quotes.

- Share price . The price at which investors buy a company’s shares. When the market is open, the stock price changes almost every second. It remains unchanged when the market closes for trading.

- Ticker . When studying quotes, it is important to first understand what the company symbol means. When a company is listed on a stock exchange, it is assigned a unique code or symbol. The symbol allows investors to understand the name of the company and its price. It may also contain the name of the company. If the name is too long, the symbol may only contain a few letters or numbers. When searching for shares on stock exchange websites, information about the share price can be obtained from the security code.

- Volume : The number of shares bought and sold during the session. Whenever 1 share is sold, 1 share is purchased. You can’t buy 1 share if no one is selling it, and you can’t sell 1 share if no one is buying it.

- Opening price . The price at which a stock trades at the opening of the stock market.

- Previous closure . The closing price set for the previous day. Trading may take place outside business hours and the opening price may differ from the previous day’s closing price.

- Net change . Shows whether the stock price is rising, falling and how it changes. Net change can be expressed as an absolute value or as a percentage.

- 52 week range : The highest and lowest stock price in a year or 52 weeks. This helps investors understand the performance of stocks over a longer period of time.

- Market capitalization : This is the total market value of a company. This criterion is equal to the current share price multiplied by the number of shares outstanding.