Increasingly, traders use trading robots in their activities

, which automatically execute transactions based on a specific trading strategy. Thanks to the efforts of the developers, there is no shortage of bots for trading stocks and bonds today. However, the abundance of robots often complicates the selection process. Below you can find a description of the best bots for trading in the United States.

Review of trading robots for trading in the USA – the best bots for automatic trading in stocks and futures

The robots for trading stocks and bonds in the United States, listed below, according to traders’ reviews, have the most reliable and intuitive interface.

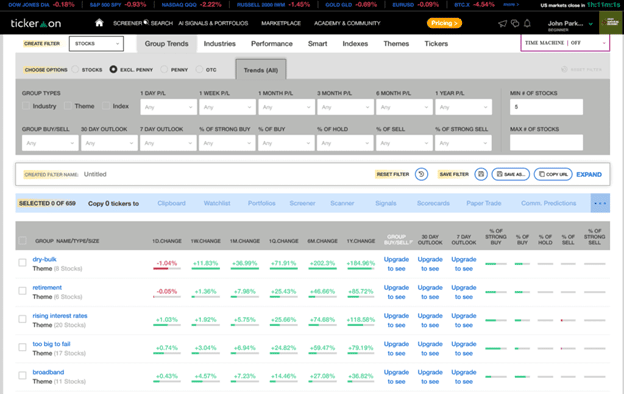

Tickeron, Inc

Tickeron is a robust bot that uses sophisticated artificial intelligence to improve trading and investment performance. The company’s website provides users with access to an extensive collection of free trading resources. Tickeron publishes e-books, the study of which helps traders to constantly develop and achieve success in such a difficult business. Many options users can use for free. Another key feature of Tickeron is the presence of a portfolio optimizer based on artificial intelligence. It is fully customizable, so users can program it to accurately target stocks based on what goals they are pursuing and how willing to take risks. After the portfolio is

programmedon the platform, AI trading tools will start to automatically analyze the trader’s positions and send recommendations on how to tune them for optimal performance. It’s free to create an account, but users will need to pay $ 15 each month to access the advanced features. Note! The Tickeron Portfolio Optimizer takes into account a wide range of customizable inputs such as risk tolerance, investment horizon, and more. The strengths of the Tickeron bot include:

- user-friendly interface;

- reliability;

- research and analysis of the stock market based on artificial intelligence;

- provision of training materials.

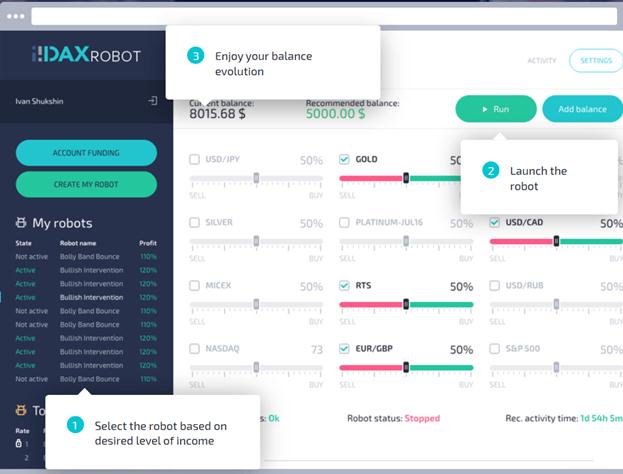

DAXrobot

DaxRobot is a popular bot for the automated trading of stocks and bonds in the US stock market. The robot is actively used by US traders in their activities. DaxRobot generates signals by examining a variety of algorithms and pattern recognition systems to identify the correct signals and use them to generate profits. The robot’s profitability reaches 130%, and the profit rate is within 110%.

- simple and user-friendly interface;

- round-the-clock customer support;

- reliability;

- no additional commissions.

The weak points of DaxRobot are:

- too short duration of using the demo version (60 s);

- lack of regulation by a large regulatory body.

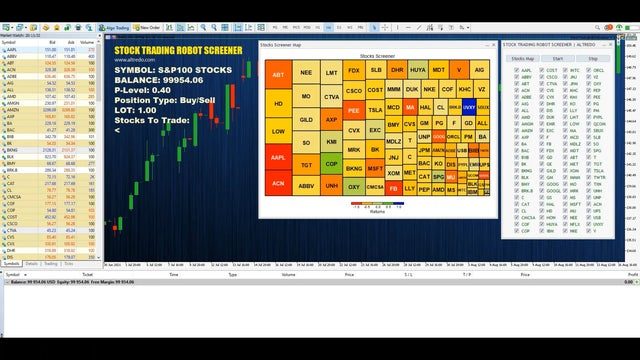

StocksToTrade

StocksToTrade is an effective stock market scanning and research tool. The robot is suitable for both novice traders and experienced traders. The platform has many tools and features that are easy to integrate. This bot has all the functions a trader needs to trade. The charts run smoothly with a variety of popular indicators and tools. Traders can choose between candlestick / line charts and histograms. In addition, users have the ability to set different time frames (from one minute to one month). The strengths of StocksToTrade for trading stocks and bonds in the United States include:

- the possibility of almost free use of the robot for a week (only $ 1);

- provision of training materials;

- reliability;

- wide functionality.

The only drawback is the lack of integration with the broker. The rest of the bot suits traders quite well.

For your information! StocksToTrade users can create multiple watchlists at the same time.

How to choose a robot for auto-trading on the exchange – there is an opinion: https://youtu.be/FnqfaYL1rvI

Robot for automated trading on the TrendSpider exchange

TrendSpider is a popular bot that is capable of performing multi-timeframe analysis. A distinctive feature of the robot is the automatic recognition of candlestick patterns. US stocks and ETFs are priced in real time. Pending data indices and EOD data for futures are part of the subscription package. TrendSpider automatically draws trend lines if the user enables this option. Automatic drawing of trend lines is more accurate than drawing by hand, which saves time and improves the accuracy of this feature.

- reliability;

- user-friendly interface;

- availability of the possibility to use the robot for free for 7 days;

- automatic trend line detection.

TrendSpider’s AI-powered smart engine simplifies technical analysis by reducing the time it takes to view charts and helping to identify opportunities that the user might be missing out on. The weaknesses of the program are:

- difficulties encountered by users who want to view several charts at the same time;

- slow loading of charts.

Trade Ideas

Trade Ideas is a trading robot that is rapidly growing in popularity. The program is equipped with advanced scanning tools and artificial intelligence. Trade Ideas allows up to 10 or 20 chart windows depending on the subscription plan. This makes the process of creating a diagram directly on the platform more convenient. Users can also add price alerts directly to selected charts. The number of chart indicators is limited. They are needed only for the convenience of links to stocks that appear when scanning. The company provides its users with a large number of educational materials. Traders can choose to study on their own or attend daily live seminars from Monday to Thursday.

- 3 trading algorithms of artificial intelligence;

- fully automated backtesting;

- automatic trading using AI signals;

- free access to the trading room in real time.

The downside of the robot for trading stocks and bonds in the United States is the lack of a mobile application and not particularly attractive design.

Black box stocks

Black Box Stocks is a popular stock trading robot in the United States that uses real-time algorithms, advanced social networking features and many other equally useful tools. The program displays all the necessary information on one screen, which is a significant advantage. To use the bot, a trader will have to pay $ 99.97 every month. Black Box Stocks is suitable for both beginners and experienced traders. Due to the fact that all the necessary information is displayed on one screen, traders immediately see the whole perspective. Additional tools for in-depth analysis can be used as needed. The bot is ideal for traders looking to avoid the complexities of creating and configuring scans. The strengths of Black Box Stocks include:

- displaying all the necessary information on one screen;

- simple and intuitive interface;

- reliability;

- wide functionality.

The only thing that can be a little upsetting is the fact that the company provides a minimal amount of training materials. The rest of the Black Box Stocks bot suits traders quite well.

SwingTradeBot

SwingTradeBot focuses on over 100 custom screeners designed to identify technical patterns that have been developed over the course of a day or longer. Screeners are classified according to the signals they pay attention to. These are not the only categories, there are others such as strength or weakness, expansion and contraction of the range. SwingTradeBot is ideal for beginner to intermediate traders. The bot will help traders scan potential deals. However, it is worth remembering that you cannot create your own custom screen in this program. SwingTradeBot is a bot that, like any other program, has advantages and disadvantages.

- the ability to simultaneously combine up to three technical screens;

- simple interface;

- reliability;

- Receive intraday email alerts.

Lack of consistency in research notes is considered a significant disadvantage.

Note! As soon as the technical evaluation of the stock is carried out, the bot will provide the trader with the results, which will make it possible to choose the best stocks to trade and make the right decision.

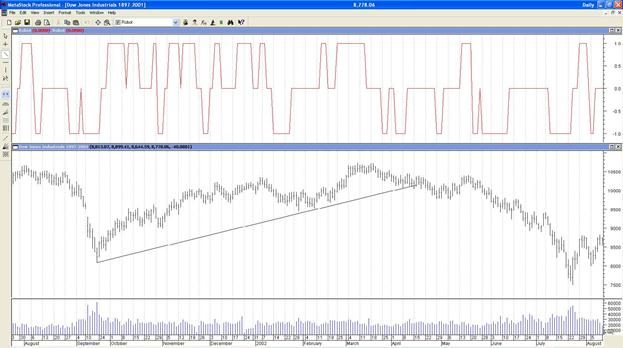

MetaStock

MetaStock is a robot ideal for both novice traders and experienced traders. The technical support service helps to quickly solve the problems that have arisen. MetaStock has industry-leading stock testing and prediction capabilities and charts stocks, ETFs, indices, bonds and currencies around the world. The bot is the leader in technical analysis of charts. The program offers over 300 price and volume indicators including Darvas Box, Gann, Fibonacci and Ichimoku Cloud. If desired, users can develop their own indicators based on the MetaStock coding system. MetaStock is one of the few companies that takes forecasting seriously enough. System backtesting is excellent because it allows traders to test if a theory / idea has worked in the past.Forecasting takes the process of trading stocks and bonds to a whole new level. By playing back test it can be seen how successful a chosen strategy can be under certain circumstances.

- excellent deep backtesting;

- the most accurate forecast of prices for unique shares;

- open access to training materials;

- the ability to build charts / indicators in real time;

- reliability;

- good technical support work.

Market data coverage is global. The data transfer rate is excellent. Only the old-school design of Windows applications and the long period of getting used to the program is a little frustrating.

Note! Using MetaStock, traders can trade not only stocks but also vehicles, ETFs, options, Forex futures and bonds.

Using robots to trade stocks and bonds allows traders to delegate their responsibilities to an intelligent assistant. However, the process of choosing a bot should be taken especially seriously. Don’t be tempted to buy the cheapest software. It is better to thoroughly study the reviews of merchants who have already managed to assess the advantages and disadvantages of the robot. It is important to remember that in the event of a loss, the trader will lose money from his wallet, and not from someone else’s. Therefore, it will not be superfluous to double-check how reliable the chosen bot is considered. The rating offered in the article will help both beginners and more experienced traders choose the most suitable option for themselves for trading stocks and bonds in the United States.