Trading terminal for the stock market – we analyze, select and compare popular platforms for trading and investment. Today, the bulk of trading operations are carried out using special terminals. Thanks to the efforts of the developers, there is no shortage of software. And if experienced traders can easily find a suitable terminal for themselves, then beginners are often lost in the abundance of options. Below you can find in more detail information on the features of the choice of software and the rating of the best terminals. Having studied this information, traders can easily choose the most suitable option for themselves.

- Trading terminal: what it is and why such platforms are needed

- How the trading platform works

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Stage 5

- Stage 6

- Types of trading terminals

- How to choose a trading terminal, what to look for

- Popular trading terminals – rating 2022

- Terminals for trading in the world

- Metatrader 4 – MT4

- ActTrader

- CQG Trader

- QUIK

- Trading terminals for trading on the US stock exchanges

- Fusion

- IB Trader Workstation

- Thinkorswim (TOS)

- OEC Trader

- Ninja trader

- Omega TradeStation

- Terminals for trading in the Russian Federation and in the CIS countries

- Bloomberg Terminal

- Thomson Reuters Eikon

- MetaStock

- SMARTx

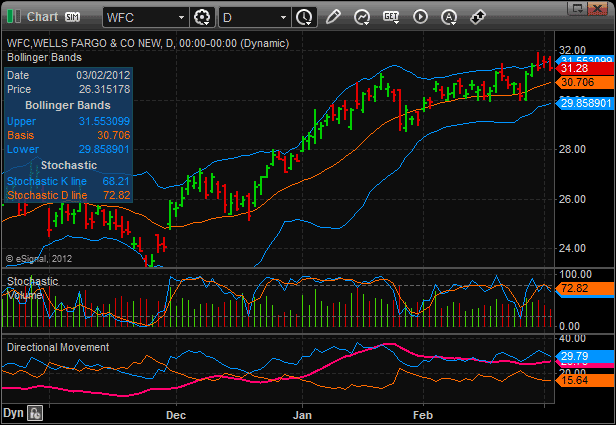

- E-signal

- Tinkoff

- VTB terminal

- Alfa Bank

- BKS TERMINAL

- Terminal Vinance

- Sberbank Investor

- MTS investments

- Questions and answers

Trading terminal: what it is and why such platforms are needed

A trading terminal is the software used to carry out transactions on the stock exchange. Interaction between a trader and a broker at the time of trading / non-trading operations occurs through the terminal. The simple platform will run through a web browser and will not require software to be installed on a computer.

Note! The trading terminal is quite sensitive as it contains all the information about the trader’s trading account. To ensure proper security, brokers usually follow a strict login process. The process includes entering a password and responding to a secret 6-digit PIN for two-factor authentication. Alternatively, you can install T-OTP to improve security.

How the trading platform works

Most novice traders do not understand how the trading terminal works. Below you can see a conditional diagram that shows the most fundamental steps.

Stage 1

First of all, liquidity providers provide brokers with market quotes. The data that is transmitted to companies turns into a continuous stream, because the supply / demand parameters are in constant dynamics.

Stage 2

After the data arrives at the broker’s server (via secure gateways), the aggregation of the price stream will begin. The use of special software allows you to start the process of comparing prices from different liquidity providers. Then the most favorable offer for the transaction is selected. Now the broker can include in the price the amount of remuneration for the provision of services.

Stage 3

The data is transferred to the trading platform servers (after the completion of the aggregation). The data flow is structured in a sequence that is understandable for the trading terminal. At the next stage, it is broadcast to client programs that have been authorized in the system.

Stage 4

After the quotes get into the trading terminal, they will be displayed on its screen.

Stage 5

As soon as a specialist in the field of trading opens a deal at the current value, the corresponding requests will be sent to the broker’s servers. However, until the data is checked for security, it will not end up in the processing queue. The request is then assigned an identifier and will be sent back to the supplier for execution.

Stage 6

The execution of an order to open / change / close an order is carried out by the liquidity provider. The clearing system receives data on the current state of the transaction and on the operations that have been performed. A number of static and changing characteristics will be assigned to an open position. This data is transmitted to brokers and trading terminals. The software screen will display data notifying about the current profit / trade volume / loss size and other parameters. https://articles.opexflow.com/software-trading/torgovyj-terminal-quik.htm

Note! The trading terminal is based on certain settings related to buying and selling in the financial markets. The software receives a statistical analysis of a number of transactions and contains past results that have made a profit. It allows you to place buy / sell orders, stop loss / take profit orders. Developers equip the software with the tools necessary for technical analysis of charts.

Types of trading terminals

There are 2 types of TT (trading terminals): WEB-terminal and TT, installed on the trader’s laptop / smartphone in the form of a program. The first type is similar to the second. The only difference is the fact that the terminal is installed on a public server on the Internet. This allows traders to avoid installing software on their PC. To use the WEB terminal, users follow the URL.

- Fibonacci levels ;

- trend lines;

- support and resistance lines, etc.

Analysis in the desktop version is performed directly on the displayed charts. Such terminals contain a strategy tester that allows you to run any built-in action algorithms. The mobile version will not please with wide functionality. However, it is this terminal version that allows you to urgently make some changes, view the price chart, open / close a position.

Advice! Experts recommend using desktop versions of terminals for basic work.

How to choose a trading terminal, what to look for

Novice traders are often interested in what to look for when choosing a trading terminal. Experts recommend taking into account:

- Convenience of the interface . It will be nice if the interface is customizable and user-friendly. The ability to connect an additional desktop, activate a dark theme, a quotes plugin is considered a significant advantage. These options will undoubtedly be necessary for a trader in his work.

- Risk management functions that allow you to keep risks under control, minimize possible losses and reliably fix profits on transactions. It should be borne in mind that to protect open positions, in the event that the price drops sharply, it is necessary to use orders of the type of stop loss / take profit / trailing stop orders. These positions must be included in the terminal functionality.

- Performance . It is important that the program can work well at the time of hundreds of transactions per day, not only on new laptops, but also on old PCs. An insufficiently optimized program freezes at the most crucial moments, which often leads to losses.

It is important that the software does an excellent job with all cases. Therefore, experts advise to take care of increasing the productivity and speed of the terminal.

Note! Trading terminals must be reliably protected from all malicious programs. No information should be available to other sources.

Popular trading terminals – rating 2022

Below you can find a description of the most popular trading terminals.

Terminals for trading in the world

The most popular programs that are willingly used by traders around the world to trade stocks, bonds and futures are: Metatrader 4 – MT4, ActTrader and CQG Trader.

Metatrader 4 – MT4

MT4 is popular with both beginners and experienced traders for its user-friendly interface. Traders can easily navigate the program, access fundamental and technical analysis data to make informed decisions. Customizable charts are also available that novice traders can use to identify patterns in the market. The sheer volume of information available on the platform greatly simplifies strategy development.

- the ability to use automated trading;

- reliability;

- clear interface;

- wide functionality.

The lack of an automated feature for the web platform is the only downside to MT4.

ActTrader

ActTrader is considered to be a popular fully functional terminal that can be used to trade CFDs, ETFs, Forex, Stocks, Forwards and Options. Loading all functions at startup is very fast. Requotes are extremely rare. Placing an order is simple. The trading system responds very well to any command or action. The advantages of the program include: the ability to track actions, wide functionality, reliability, intuitive interface. A bit frustrating is the lack of any financial control.

CQG Trader

CQG Trader is a popular futures and bond trading platform that offers DOM (Depth Of Market) execution. CQG Trader includes Quote Board, Work Order, Open Positions, Buy and Sell / Account Summary. Accounting for the summary of the account balance is fairly accurate. Users can customize functions by type:

- placing orders and positions;

- display configuration (display of order placement / order and item settings);

- placing orders (DOM Trader / placing orders);

- the style of presentation of the quote;

- notifications (order sounds: filled, confirmed, rejected).

Disadvantages: The platform does not contain charts or a global button to cancel all open orders for all

futures contracts . It is recommended to cancel open orders by placing one futures order at a time.

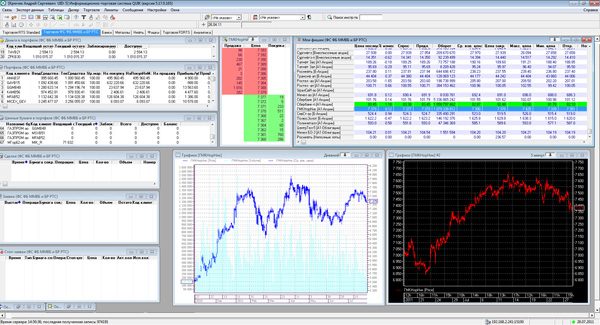

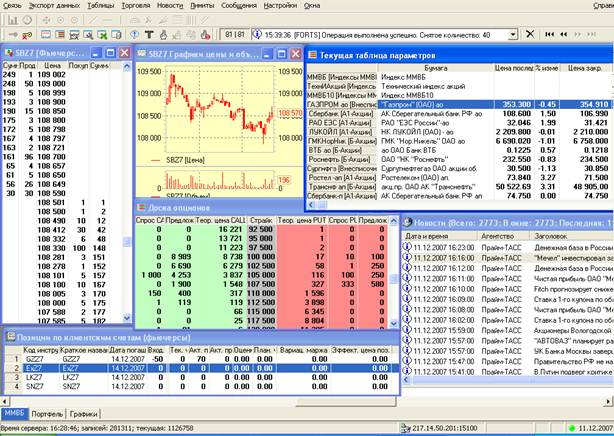

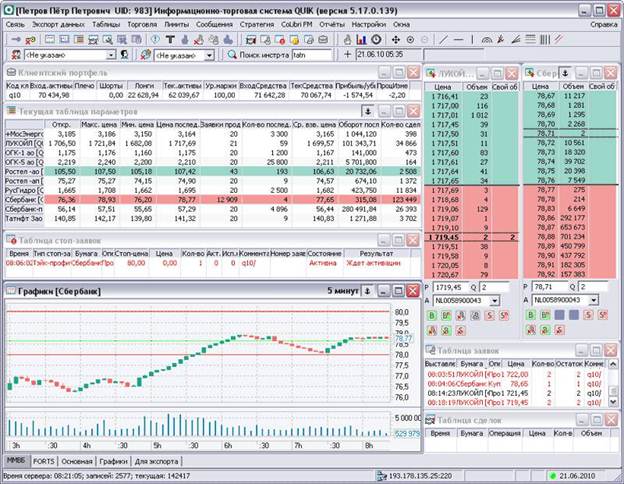

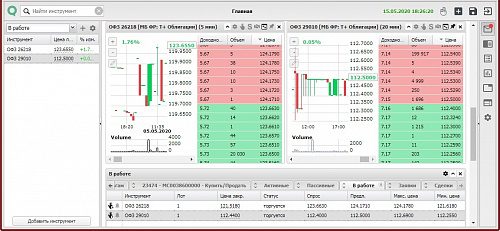

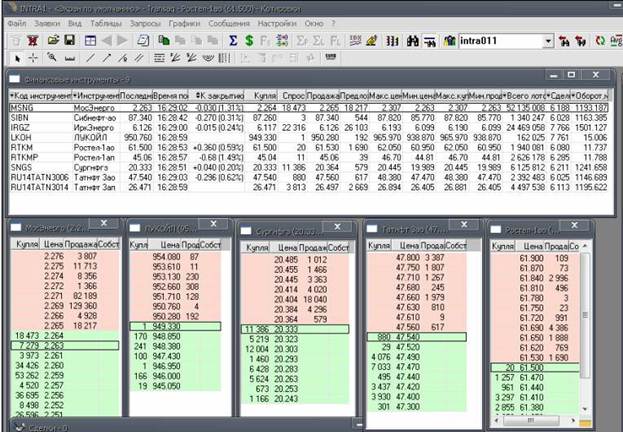

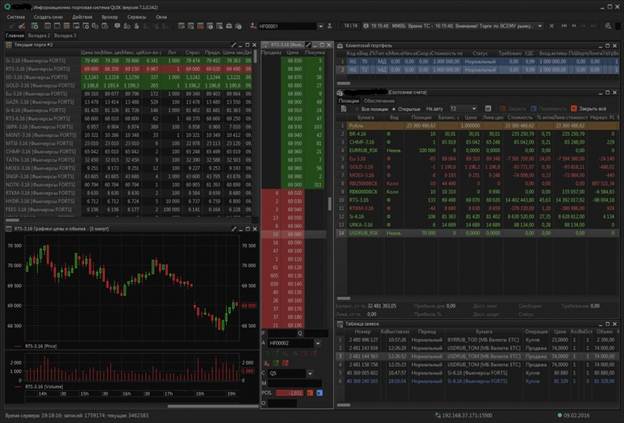

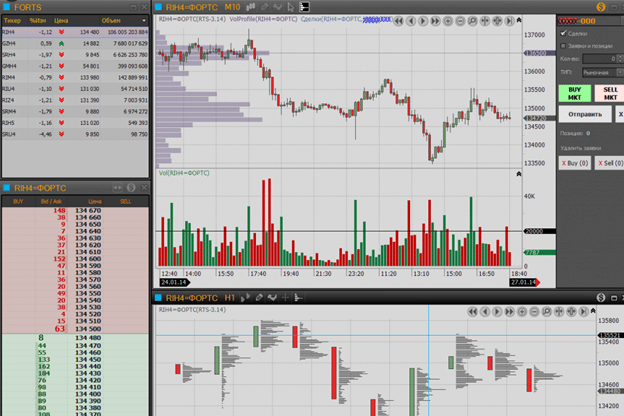

QUIK

QUIK is a terminal that includes the main set of tools for a trader. Users can create any type of tickets. The program is able not only to analyze the state of the portfolio, but also to monitor the quotes and the market. Graphs displaying changes by parameters are very comfortable to work with. Also, traders can use the system of bookmarks and digital signatures. The first 30 days you can use the terminal free of charge. The speed of execution of transactions, the convenience of creating positions and reliable protection of personal information of clients can be attributed to the advantages of the program. A little upsetting is the lack of archives on past transactions for 24 hours.

Trading terminals for trading on the US stock exchanges

The listed trading terminals provide direct access to the largest US stock exchanges (NYSE / AMEX / NASDAQ). They are suitable not only for experienced traders, but also for beginners in the field of trading.

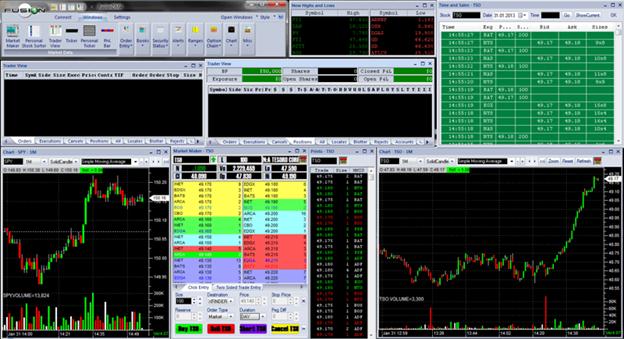

Fusion

Fusion is the ideal trading platform for the intraday trader. The terminal pleases with unpretentiousness to the speed of the Internet connection and the technical characteristics of the PC. TT Fusion has the largest shortlist and the ability to trade baskets. The filtration system is convenient, the list of settings is flexible. The strengths of Fusion are considered to be:

- availability of the possibility of direct withdrawal of transactions to the exchange;

- impressive shortlist;

- no requirements for the speed of the Internet connection;

- displaying the entire “order book”

- the ability to use the demo version;

- reliability;

- wide functionality.

Disadvantages of the terminal: there is no educational information and author’s analytics on the broker’s website.

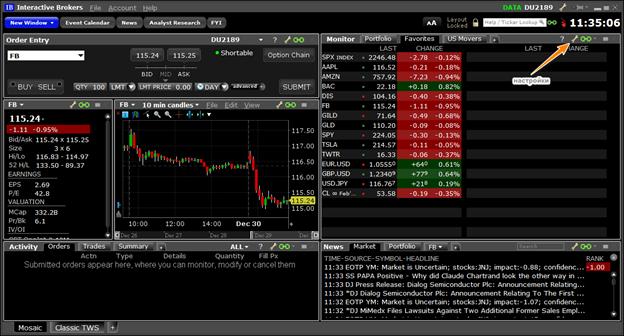

IB Trader Workstation

Interactive Brokers is a popular terminal among US traders. With one account, it can be used to trade various types of securities, including options, stocks, futures, Forex and bonds. One of the advantages of the program is the ability to trade a wide range of goods. When you enter a company name or ticker in the order entry field, a drop-down window with a selection range opens. Depending on the security, they can include stocks, options, futures or CFDs (Contract for Difference). Clicking on any of these elements opens the corresponding trading instrument for the desired security. The advantages of the terminal include:

- flexibility of settings;

- the ability to create orders with one click on the bid / ask prices;

- availability of open access to news services;

- the ability to study market data on individual exchanges of the world;

- the presence of a built-in calendar of events.

A significant drawback of IB Trader Workstation is the system freezing when a trader opens more than 5-6 charts.

Thinkorswim (TOS)

Thinkorswim (TOS) offers robust trading tools, many free educational resources, and a convenient format for investors of all levels. Yes, it is only available to TD Ameritrade clients, however, since none of them require an account, traders can register with TD Ameritrade solely to access Thinkorswim. The strengths of the trading terminal are:

- the ability to trade shares / options with a commission of 0%;

- provision of training materials;

- the possibility of round-the-clock trading.

A bit frustrating is the high inactivity fee of $ 13.90.

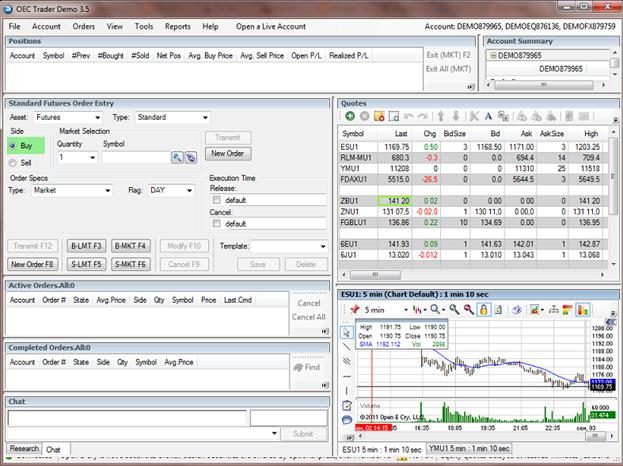

OEC Trader

OEC Trader is a trading terminal with a charting system that includes more than 100 indicators. A bunch of objects and indicators in the chart through orders is allowed. The presence of the “Market Replay” function for recording the trading screen, the excellent work of the technical support service and the ability to monitor risks with the “Alerts-Signal” option are significant advantages of OEC Trader. It is also allowed to export data to Excel via the DDE (Dynamic Data Exchange) interface. Judging by the reviews of traders, the trading terminal has no significant drawbacks.

Note! To obtain demo access to the OEC Trader trading terminal, you need to go to the page: http://tradeinwest.ru/index.php/ru/live/demo-versiya and, using the instructions, order a demo version.

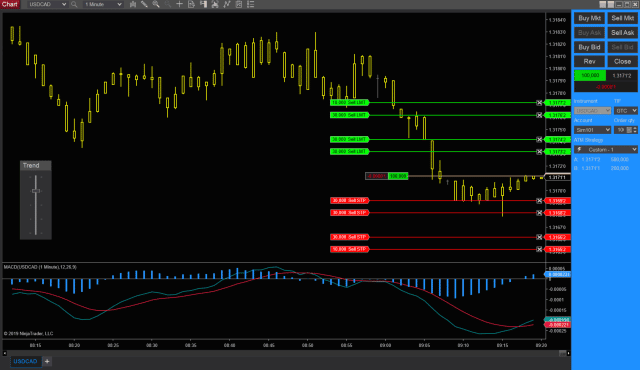

Ninja trader

Ninja Trader is a popular trading terminal that provides a stream of quotes. Users using the program can create their own algorithmic strategies. The software is paid, however, the developers have provided an opportunity to test Ninja Trader in demo mode.

In order to open an account, you will need to deposit at least $ 1000.

The process of trading directly from the chart is allowed, due to which it will be convenient to track the sizes of open positions / orders and stops. The SuperDOM marketplace is quite advanced. The trading program provides its own automation platform. The strengths of Ninja Trader include:

- ease of use;

- clear interface;

- low commissions;

- the ability to program algorithmic scripts.

A number of indicators are provided in the open form, and for some you have to pay extra. This is the disadvantage of the trading terminal.

Omega TradeStation

Omega TradeStation is a popular trading terminal that offers a wide variety of line instruments and technical indicators. Users have the ability to change the properties of tools and terminal settings. Omega TradeStation is suitable for both experienced traders and beginners. The advantages of the trading terminal include:

- open access to various tools;

- clear interface;

- ease of use;

- availability of quotes in real time;

- the ability to receive reports on accounts;

- creation of various charts;

- changing the properties of instruments;

- lack of requotes.

However, despite the huge number of advantages, it should be borne in mind that in the case of using a wireless connection, the operation of the trading terminal will be less efficient.

Terminals for trading in the Russian Federation and in the CIS countries

The terminals listed below are suitable for traders in Russia and the CIS countries. These programs will delight you with a user-friendly interface and wide functionality.

Bloomberg Terminal

Bloomberg Terminal is a popular software used by professional traders. Users can place trades and track financial market data in real time. Bloomberg Terminal is considered by many to be the gold standard in the financial industry.

Keep in mind, however, that it is the most expensive option at $ 24,000 per year. For those who don’t want to pay the high price, there are many free and more economical alternatives to choose from.

Bloomberg’s strengths include:

- reliability;

- wide functionality;

- providing users with a large amount of data.

It can be frustrating if the interface is not entirely clear and the cost is too expensive.

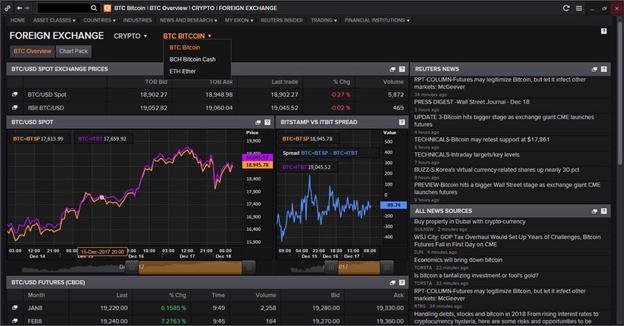

Thomson Reuters Eikon

Thomson Reuters Eikon is a professional system for monitoring and analyzing financial information. The built-in analysis of traders’ sentiment is a very interesting feature. In addition, the system is capable of analyzing Twitter posts. Taking into account the information received, Thomson Reuters Eikon builds hypotheses about further movements in the stock market. An accessible interface, wide functionality and reliability are the main advantages of the terminal. The only thing that can be a little frustrating is the high cost of the software.

Note! Depending on the set of functions, the cost of the terminal will depend (basic version – from $ 3600, full version – $ 22,000).

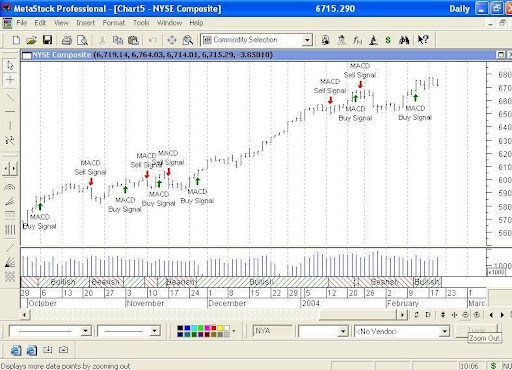

MetaStock

MetaStock is a legendary terminal that successfully analyzes the market situation. This program is suitable not only for experienced traders, but also for beginners in the field of trading. The cost of the basic version reaches $ 499, the PRO version – $ 1395. The strength of MetaStock is not only reliability, but also the availability of graphical components for drawing charts. There are many system elements in the terminal that can be purchased separately. The downside to MetaStock is the overpricing.

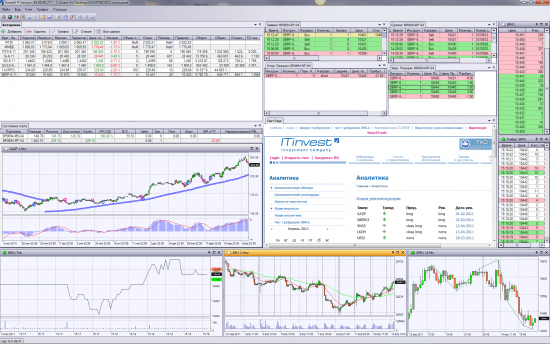

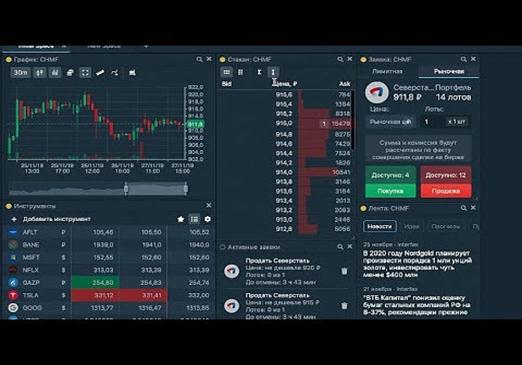

SMARTx

SMARTx is a trading terminal, the functionality of which is divided into main and additional. The latter can be installed at the request of users. Fast tick charts and the window for entering trade orders belong to the main functionality. The developers also made sure that orders, deals and positions for different markets are displayed simultaneously. The trading terminal has a built-in risk management system. The advantages of SMARTx include:

- clear interface;

- the presence of a built-in risk management system;

- constant expansion of functionality;

- unlimited access to the demo version.

The inability to manually position the chart in the window vertically and disable auto-centering is considered the main disadvantage of SMARTx.

E-signal

E-signal is a terminal with stable and smooth graphics, flexible scaling. Charts contain an extensive library of advanced and basic technical indicators. Buy / Sell orders are issued from the platform. You can create a portfolio of symbols in E-signal only once. For further analysis, the already created portfolio is used. The advantages of this trading terminal include:

- the ability to write trading strategies and indicators using a scripting language;

- creation of your own analysis technique;

- the ability to use various charts (histograms / points / lines / Japanese candlesticks, etc.);

- the presence of drawing tools and built-in indicators.

There are no significant drawbacks, however, some beginners find the interface complicated.

Tinkoff

Tinkoff is a trading terminal that pleases with a fairly simple and intuitive interface. However, the program is still damp. The terminal often freezes for a couple of minutes. In this case, deals may not be displayed in the “Events”, which is a significant drawback. Tinkoff’s strengths include:

- the ability to purchase currency from $ 1, and not only in lots from $ 1000;

- no commission for maintaining depository accounts;

- the ability to withdraw funds 24/7;

- availability of access to the premarket / postmarket of American stocks.

Note! The minimum purchase price for American ETFs starts at $ 3000.

VTB terminal

VTB is one of the most reliable trading terminals in the Russian Federation. If you encounter any problem related to the program, the technical support staff will quickly help you resolve the issues. Access to international markets is fine-tuned, but it should be borne in mind that the size of commissions is significant. The advantages of the VTB trading terminal include:

- reliability;

- simple interface;

- the ability to withdraw funds from the IIS to the card;

- profitable bonuses for loyalty programs.

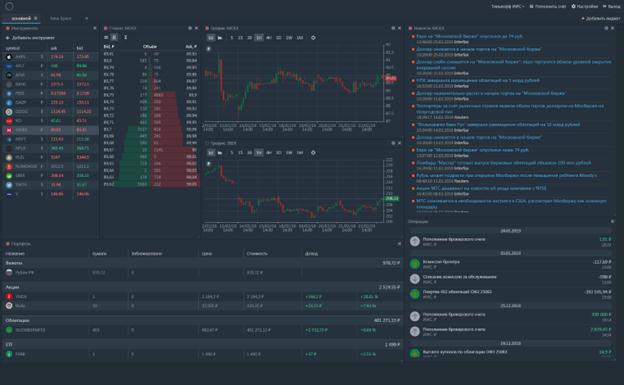

Alfa Bank

Alfabank is a trading terminal in which users can independently customize the main screen and add tools that are necessary for their work. To study statistics on payments / transactions and analytics for individual assets, you will need to go to the “Portfolio”. You can view the depth of market for stocks in real time. The advantages of the Alfabank terminal include:

- the ability to replenish the account for any amount;

- no commission for replenishment / withdrawal of funds;

- open access to educational materials collected on the official website;

- reliability;

- excellent work of the technical support service.

Weaknesses:

- systematic malfunctions of the program;

- high commission.

For your information! To explore tips and investment ideas for newbies, you should go to the Predictions category.

BKS TERMINAL

BCS is a popular terminal that provides reliable and fault-tolerant access to all popular markets and instruments. The size of the commissions is average on the market. Access to demanded markets and tools for BCS users is always open. Strengths of the program:

- the ability to withdraw funds from the IIS;

- availability of a mobile application;

- reliability;

- free consultations of a personal manager;

- foreign shares on IIA.

A little upsetting is the too high minimum amount on the account, which is 100,000 rubles. It is also worth considering that monthly reporting will not be operational.

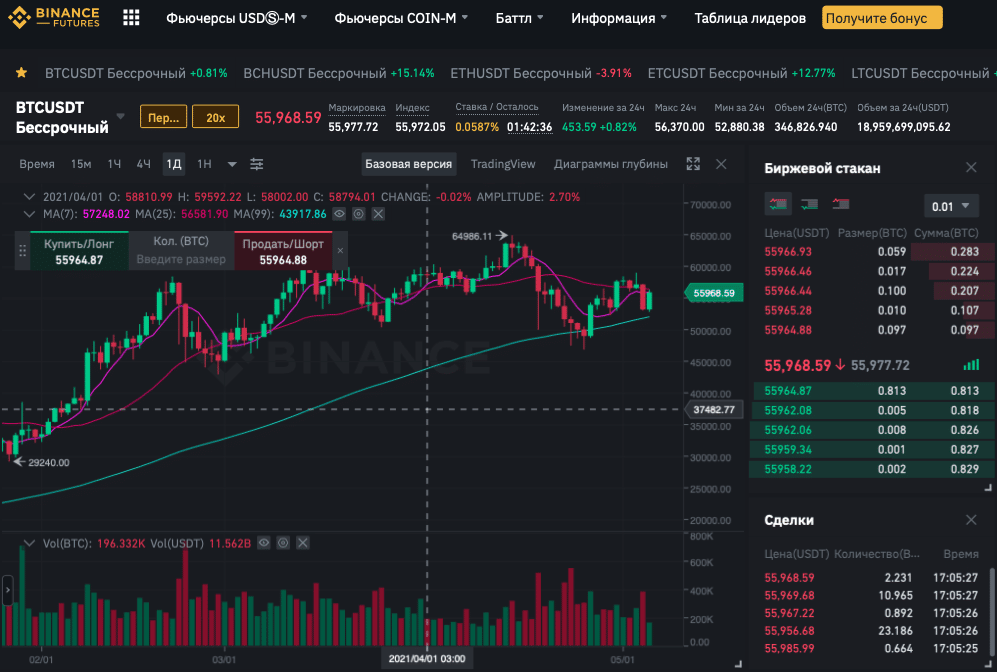

Terminal Vinance

Users have access to different versions of the Vinance terminal, designed for Windows / MacOS / Linux or for IOS / Android. The developers have provided free access to the program and its tools. The trader’s deposit is under insurance. The advantages of Vinance include:

- availability of access to spots / futures / options in one terminal;

- reliability;

- the presence of two types of trade orders.

Judging by the feedback from the users of the program, no significant shortcomings have been identified.

Sberbank Investor

Sberbank Investor is considered one of the most reliable terminals with a fairly low commission. Using this program, users will be able to invest in shares of foreign companies. Applications for the purchase / sale of securities are accepted over the telephone. The stocks are categorized by risk levels, which is undoubtedly an advantage. Among the disadvantages of this terminal, it is worth highlighting: a limited choice of currencies (euros / dollars), the absence of an order book, a complex interface.

MTS investments

MTS Investments is a terminal with an intuitive interface. It is easy to use even for beginners. The window displays the main and most popular promotions (prices available for the majority of the Russian population). The user is selected the strategy that is best suited for investing. The advantages of the program include:

- profit growth;

- reliability;

- intuitive interface;

- low threshold for buying.

The only thing that can be a little upsetting is that profits are growing rather slowly.

Questions and answers

Below you can find frequently asked questions about trading terminals and the answers to them.

Are trading terminals free or paid? Some terminals require a fee. However, there are programs that can be installed absolutely free. In order to decide which terminal to give preference to, you should test the options you like using the demo version.

What are the additional features of trading terminals? Trading terminals provide users with additional options, namely, advanced ordering tools, the ability to filter the news feed, advanced research tools (historical income / company size / financial matrices, etc.).

Can I use the POS terminal on my Android phone? All a trader needs is a smartphone with an Internet connection, be it Android or iOS, and a trading account with a specific broker. Technology has reached its zenith and mobile trading has made the stock market extremely accessible to traders, even in small towns. Choosing a terminal for trading stocks, bonds and futures is far from the easiest process. It is important to take a responsible approach to the selection process and pay attention to especially significant criteria, which you could familiarize yourself with in the article. Such a responsible approach will allow traders to avoid mistakes and achieve success in their activities.