The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. The psychology of poverty, why the problem arises and how it is solved, so why are you poor, haven’t you thought? Financial literacy lesson.

- You are poor because you are not using these resources correctly.

- Lack of competence?

- What about the expenses?

- Education and profession

- The impact of education on financial success

- The Role of Personal Financial Habits in Building Wealth

- The influence of social environment on financial situation

- The Importance of Managing Debt to Avoid Poverty

- How does a psychological factor affect financial stability?

You are poor because you are not using these resources correctly.

Four resource pillars on which success is built: youth, time, energy, knowledge . Only then comes money, acquaintances, wings of luck… I repeat, time is your greatest asset. Delegate, eliminate, or automate all unimportant tasks. Knowledge is an asset that is always with you. Pump up – this is important. Youth and its inherent energy

Everyone regrets what they didn’t do, about missed opportunities.

No time? Remove those very useless 80% of actions that just devour priceless minutes. Remove everything unnecessary and toxic from your life. People who drag you down – why do you need them? Buy a bike, sell a TV, set up time tracking, delete social networks.

Lack of competence?

Invest in yourself. Convert your freed up time and energy into your skill. Sign up for courses, read a useful book, improve an existing skill through communication with colleagues. Subscribe to this channel and blog. No money? Start the chain again, iteration by iteration, improving your result at each link in this chain. And after the first free money appears, do not spend it on tinsel. Invest, take smart risks, continue to upgrade yourself and everyone around you. Do what you have long dreamed of. Obviously there is something that can be done right now? That’s why you’re poor: https://youtu.be/g6m9qADnO9A

What about the expenses?

Many people are faced with the problem of poverty and cannot understand why they find themselves in this situation. They may have a job, an income, but they still have to live from paycheck to paycheck. Why is this happening? In this article, we will look at several factors that may be contributing to your financial confusion and will help you understand why you are poor. The first and most obvious factor is cost. Many people spend more money than they earn. They buy things they don’t need or can’t afford. They live on credit cards and loans, which only worsens their financial situation. If you want to avoid poverty, it is important to learn to control your spending and make smart purchases.

Education and profession

The second factor is education and profession. Some people end up poor because they lack a good education or have low-paying jobs. If you don’t have the skills and education that are in demand in the job market, your chances of getting a high salary and financial stability will be extremely low. Therefore, it is important to invest in your education and professional skills development. In this article, we will also look at other factors such as lack of financial planning and management, unwise investments and debt. By understanding the reasons for your poverty, you can take the necessary steps to change your financial situation and achieve financial well-being. Next, we will analyze each of these factors in detail and offer practical recommendations to improve your situation.

The impact of education on financial success

Education plays a key role in determining a person’s financial success. Research shows that people with higher levels of education have more opportunities for high-paying jobs and career advancement. Higher education also equips people with the necessary skills and knowledge to manage their finances effectively. For example, financial literacy training, often included in higher education, helps people develop skills in budgeting, investing, and debt management. These skills can be crucial to achieving material well-being. In addition, higher education provides access to better career opportunities and higher salaries. People with a bachelor’s or master’s degree often have a better chance of getting jobs with high salaries and prestigious positions. A career in science, technology, engineering or business can be key to increasing your income and achieving financial stability.

However, it should be noted that education in itself is not a guarantee of financial success.

The Role of Personal Financial Habits in Building Wealth

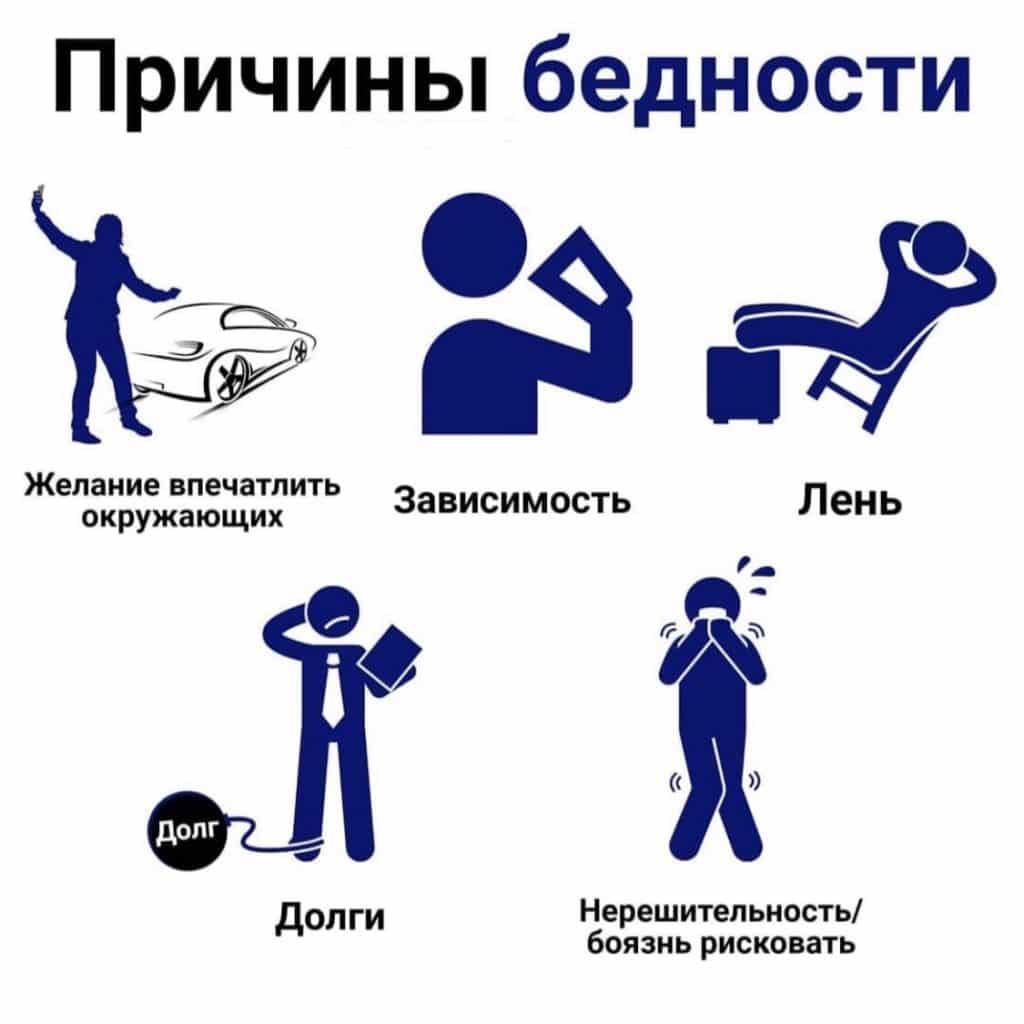

Personal financial habits play an important role in the formation of wealth or, conversely, poverty. People often don’t realize that their day-to-day financial actions and decisions can have long-term effects on their financial situation. One of the main habits that can lead to poverty is poor income management. Many people live by the “earn and spend” principle, without thinking about how they could save or invest their money. Failure to plan for spending and saving for the future jeopardizes achieving financial stability. Another common habit that can cause poverty is excessive use of credit. Most people are dependent on borrowed funds to purchase goods or services, without thinking about interest and commissions, which you have to pay to use the loan. This can lead to an accumulation of debt that becomes too much to pay off. Also, bad financial habits can include frequent and careless spending on unnecessary items or entertainment.

The influence of social environment on financial situation

One of the reasons why many people end up in poverty is the influence of their social environment on their financial situation. In modern society, there is often pressure to follow certain consumption standards and show one’s social status through spending. People with wealthier friends or colleagues may feel pressure to maintain the same level of consumption. This can lead to excessive spending and poor financial management. For example, people may take out loans or use credit cards to purchase luxury items they cannot afford. In addition, environment can also influence career choice and income level. If most people around you have low-paying jobs or have low levels of education, then the likelihood of getting a high-paying job or developing in your career decreases. It is important to realize that the influence of the social environment should not become an excuse for one’s poverty. Every person has the opportunity to make their own decisions and manage their finances.

The Importance of Managing Debt to Avoid Poverty

Managing debt plays an important role in preventing poverty. Unwise use of loans and accumulation of debt obligations can lead to financial difficulties and deprive a person of the opportunity to improve their financial situation. First, loan payments may be too high for a low-income person, resulting in delayed or inability to pay. This may lead to penalties and interest charges, which will further worsen the financial situation. Secondly, having large amounts of debt makes it difficult to budget and save money. Regular loan payments mean that a significant portion of your income is already obligated to go towards this purpose, leaving less room for saving or investing. Besides, High debts can have a negative impact on a person’s credit history. This may make it more difficult to obtain new loans or mortgages and may affect your ability to rent or find employment. Proper debt management includes using credit responsibly, making on-time payments, and setting financial priorities.

How does a psychological factor affect financial stability?

One of the reasons for poverty is the influence of psychological factors on financial stability. Our attitude towards money and our ability to manage it can significantly influence our financial situation. Often people who suffer from low income or are unable to save enough money have certain psychological barriers. They may experience feelings of helplessness, low self-esteem, or fear of money. These emotional states can interfere with sound financial management and lead to ineffective decisions. In addition, poor financial habits can be caused by psychological factors. For example, we may be prone to consumer behavior and a desire for instant gratification, which can lead to unnecessary spending and debt. Also, Frequent dependence on credit cards or borrowed funds may indicate low financial literacy and a lack of understanding of how to manage your money. It is important to understand that psychological factors can be overcome and changed.