The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. So he is a successful trader, what qualities distinguish him, thinking, lifestyle and how to become a successful trader personally for you you you you and you . Well, at the end of the article, we will sketch out interesting facts about famous and successful (sometimes, but not always) traders in the world and Russia. Go!

- Portrait of an ideal trader, but does he exist?

- Let’s look at the experience of successful

- Patience and patience and patience and something else

- Eat, learn, trade. Trader’s routine on trading day

- How investors/traders and successful people sleep

- A good trader understands that the desire to control everything is tantamount to tilting at windmills

- About fear of losses: how should those who want to become a successful trader approach this?

- What to do: theory and practice

- Practical advice for beginners who dream of becoming successful from the real world :

- How to become a successful trader

- The best traders in the world and Russia, their stories of success and failure (success)

- Jim Simons

- Richard Denis

Portrait of an ideal trader, but does he exist?

The ideal trader – who is he and what does he look like? Spoiler: yes

. Not the one who knows everything – he only thinks he knows! And those who control their emotions are already 80% successful. And only the remaining 20% is the system, analysis, work, charts, indicators… The lower the emotionality, the higher the efficiency on the stock exchange. A Taoist monk would be the most successful person in trading, but he doesn’t need money. The ideal option in front of you is the robot Nut .

. Not the one who knows everything – he only thinks he knows! And those who control their emotions are already 80% successful. And only the remaining 20% is the system, analysis, work, charts, indicators… The lower the emotionality, the higher the efficiency on the stock exchange. A Taoist monk would be the most successful person in trading, but he doesn’t need money. The ideal option in front of you is the robot Nut .  I trade without emotions, analyze data, know trading systems, build charts and use indicators.

I trade without emotions, analyze data, know trading systems, build charts and use indicators.

Let’s look at the experience of successful

“I haven’t noticed much correlation between good trading and intelligence. The emotional component is much more important.” William Eckhardt, one of the founding fathers of foreign exchange trading. “In the world of money…no one has the slightest idea what will happen in the future.” Linda Raschke, one of the most successful female traders. “I often hear, “I just lost money, now I have to do something to get it back.” No. You have to sit patiently and wait until you find the next opportunity.” Jim Rogers, American millionaire investor

Patience and patience and patience and something else

A good trader has critical thinking, patience and the ability and desire to test strategies. It follows that he makes mistakes and is not afraid to make them. Always responsible for his results, does not blame the broker, the market, or colleagues. Has a clear, non-illusory goal. A good trader is always ready to test hundreds of strategies over a long period, discarding unsuccessful ones one by one. A bad trader believes that he can hack the market with the first strategy he comes across within a couple of months.

Eat, learn, trade. Trader’s routine on trading day

Breakfast before the start of the trading session, at the kitchen table, not at the workplace. Lightweight so that there is no burden on housing and communal services and all the blood is in the head and does not go to the stomach. Eggs, fish, celery. Drink: water, juice, tea. Complete 20 minutes before trading. For example, trading on the Moex stock market from 09:50. During bidding, do not chew anything, you can drink. Turn off notifications. Lunch at 13-14 o’clock, when the market is quiet. Do a warm-up, don’t read the news before eating, so as not to get twisted intestines. It’s better to watch something motivating. Light soup, poultry, oatmeal, cheese, apple, artichoke. Heavier food for steelworkers. Dinner– after the close of trading. If you are not trading in the evening and at profit, you can allow 50 cold, or 500 dark. Crayfish, fish, crawfish and lobster are encouraged. You can read something light, for example, us in TG .

The most important advice: never trade while hungover and read books before going to bed.

How investors/traders and successful people sleep

Warren Buffett : “I like to sleep. So I usually sleep 8 hours at night.” Bill Gates: “I like to sleep 7 hours.” Businessman Mark Cuban sleeps 6 to 7 hours a night. Virgin Group founder Richard Branson : “I sleep about 6 hours, wake up at 5 am.” Investor show host Jim Cramer sleeps from 11:30 pm to 3:45 am. By the way, according to Rafael Badziaga, on average billionaires get up at 5:30, and getting up early has proven to be extremely important to their success – it makes them more productive and energetic.

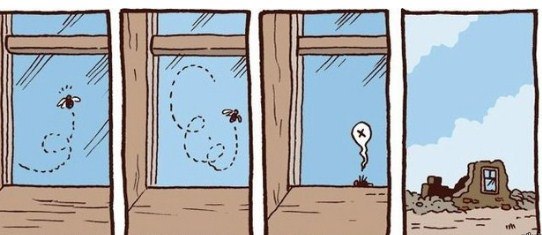

A good trader understands that the desire to control everything is tantamount to tilting at windmills

In short, it’s impossible. Let go and do what you have to do. Let’s go our separate ways. Okay, let’s talk a little. Trying to foresee everything and take into account possible risks is fighting with windmills. Have you seen how a fly hits the window without seeing the open window? It seems to the fly that it sees/knows everything, but it looks narrowly. How can you control something you don’t even know about? Expand the boundaries? Fine. But having just studied one window, she doesn’t even know that there are 8 more windows in the house. And next to the house there is a house and a street with houses… Or it’s just a window without a house.  Planning and taking into account risks is good. Trading strategy, following a plan – excellent. Profit over a “long” period is magical! It’s just not enough. The fact is that the market generates so many random events over the long term that no one is able to study it thoroughly. And that means control too.

Planning and taking into account risks is good. Trading strategy, following a plan – excellent. Profit over a “long” period is magical! It’s just not enough. The fact is that the market generates so many random events over the long term that no one is able to study it thoroughly. And that means control too.

What should I do? Study, plan, get into money and risk management, improve your emotional intelligence. And also accepting that often the trader/investor does not even control himself, not like the market.

But on the other side of the scale: “total control”, inevitable emotional burnout, collapse and depression.

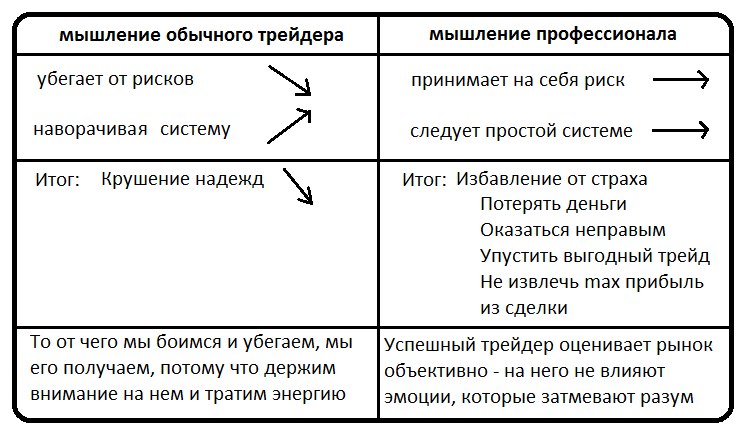

About fear of losses: how should those who want to become a successful trader approach this?

“Fear of losses” – realize, study, win.

The fear of losses affects both those who have already entered the market and those who are still struggling with a demo account. This is normal and not scary. This is an emotional trap. You need to give yours right now! And will there be a profit?

What to do: theory and practice

You can continue to chicken out for a couple hundred bucks. The bad news is that you can’t get new results without taking new actions. There is good news. This fear can really be overcome. Forward thinking will help. Risk in trading is just part of a process that, if done correctly, ultimately results in profit.

Practical advice for beginners who dream of becoming successful from the real world :

- Study the materiel.

- Run the demo for a couple of days.

- Count, analyze and record all transactions.

- Trade at micro percentages from the deposit (1-2%).

- Place limiting orders.

- Don’t quit your day job.

- Tune in to positive scenarios.

- But work through the negative ones. Your first deposit may expire, take it now.

- Split the deposit amount into several starts/accounts.

- Build a trading system on a large number of small transactions.

- Start with low-profit, but low-risk trading schemes.

- Find your comfortable level of risk.

- Don’t kill yourself for unprofitable trades, draw conclusions, adjust the system. Test the new one.

- Emotional swings begin, has rationality left the chat? Close the terminal.

- Upgrade your emotional intelligence.

Trade only with free money. No loans . Trading is not a last chance, but a worthy job with all that it entails. All famous traders have gone through hardships to the stars. There are no perfect success stories.

The difference between a successful trader and a loser is only one thing: the first one got up after the blow, and the second one crawled.

One of the main principles of a successful trader is consistency, dedication and willingness to fail. But not all this: excellent monitors, purchased data sources and terminals, charts, indexes, a lot of time and studied literature… A blow to the gut – the approach doesn’t work, the bank is drained, you are not the hero of her novel. Jack Schwager said: “Good trading should be simple.” Opexbot comments: “It’s even easier when a robot trades for you.”

Are you a good trader or can you become one? Go in the comments?

How to become a successful trader

The question is not simple. Some estimates and suggestions have been given below. Some tips from the best traders will be below. But we take a comprehensive look at the path to successful trading in the telegram channel and on the website . For starters, I recommend: What is trading, how to become a trader and make money in 2023 The main indicators of technical analysis in trading and their use on the stock exchange Why are you poor – psychology, resources and habits Psychology of poverty: beggars pray that their poverty is guaranteed Platform for trading OpexBot. Step-by-step instruction. And many many others. Author’s view, developments and thoughts

The best traders in the world and Russia, their stories of success and failure (success)

Every professional trader was once an amateur. Who refused to give up. They didn’t give up:

- Eric Nyman, a domestic trader, started with failure. Now a millionaire, founder of the robo-advisor HUGʼs, author of popular books on trading.

- Vladimir Gapay , a domestic trader, started with unsuccessful business ideas. Now a successful trader and a sought-after investment consultant and analyst.

- Paul Tudor Jones . I started with monotonous, low-profit trading in cotton futures. Now one of the world’s best traders, a master of money management.

- Larry Williams once said, “It doesn’t take much skill in the market. All you need is the desire to wait patiently for deals and the courage to conclude them.”

Jim Simons

Jim Simons is a mathematician who doesn’t lose money even during crises, a man who figured out the market, the smartest billionaire on Wall Street. The goal of his work was to invent a mathematical model and use it as a basis for inference to be right, not always, but often enough. He wins by creating order in chaos. “ Previously, I often fell into the trap of trying to create something perfect, I always wanted to be right. But in reality, you don’t need to always be right, or rather, it’s not necessary. It’s okay to make mistakes, it’s experience. But to make mistakes systematically is already a failure.” The main principle of Jim Simons cannot be imagined without mathematics:

- We are right 50.75% of the time.

- And in these cases we are already 100% sure.

- This can be used to make billions.

The principles of his Medallion Fund:

- Find a pattern that appears to be an anomaly.

- There is no better information than more information.

- Don’t ask why, just follow the forecast.

Richard Denis

“Leader of the Turtles”, “Prince of the Pit”, who has proven from his own experience the harm of emotions in trading. The approach to trading is faith in technical analysis, systematicity, learning ability, harm of emotions. Born in Chicago in January 1949. First experience was lumpy. $400 borrowed from my father was successfully “merged” on the stock exchange. Then, at the age of 25, he turned $1.6 thousand into $1 million. He founded the Drexel Fund, by the beginning of 1980 he earned $100 million. In an argument with a friend, what is more important in trading: training and system, or emotions and innate abilities, he proved the first. His “turtles,” novice traders, brought in a profit of $175 million in a year. In 1987, after Black Monday, he lost 50% of his and his clients’ assets. Admitted that he deviated from his own strategy and made several emotional transactions. Left the market “forever”. In 1994 he returned, in 1995-96 trading robots brought +108% and +112%. Richard Denis on the right[/caption] Called them “the only way to win in the futures market.” Died in 2012. His “turtle strategy” motivates and proves that trading is accessible to everyone. Well, a couple of videos, interesting and controversial: Traders who rose from scratch: https://youtu.be/0Bm1uaaUa6U?si=K6LHpJt97e5MgdhI The greatest traders in history: https://youtu.be/cxspPEkuAXU?si=QDaZ3knDLsBqA_dn Exhale and continue in comments.

Richard Denis on the right[/caption] Called them “the only way to win in the futures market.” Died in 2012. His “turtle strategy” motivates and proves that trading is accessible to everyone. Well, a couple of videos, interesting and controversial: Traders who rose from scratch: https://youtu.be/0Bm1uaaUa6U?si=K6LHpJt97e5MgdhI The greatest traders in history: https://youtu.be/cxspPEkuAXU?si=QDaZ3knDLsBqA_dn Exhale and continue in comments.