Exchange trading looks promising in order to make significant profits. However, to achieve success in this area, it is important to work as efficiently as possible. Choosing the right broker is one of the most important steps for a successful business. The trader does not have the opportunity to directly access the exchange. In order to become a broker yourself, you need to acquire special permits and invest significant funds. Access to trading on the stock exchange is a service that can be obtained by concluding an appropriate agreement with an intermediary.

- What is a brokerage service and what does it include

- Who provides brokerage services in Russia in 2021 – conditions and tariffs of Sberbank, VTB, Tinkoff, Finam, etc.

- BCS Broker

- Tinkoff Investments

- Broker Opening

- Finam

- Sberbank

- Brokerage fees

- How to choose a broker

- Pitfalls and problems

- Confidence in the broker

- Cent accounts

- Accurate trade execution

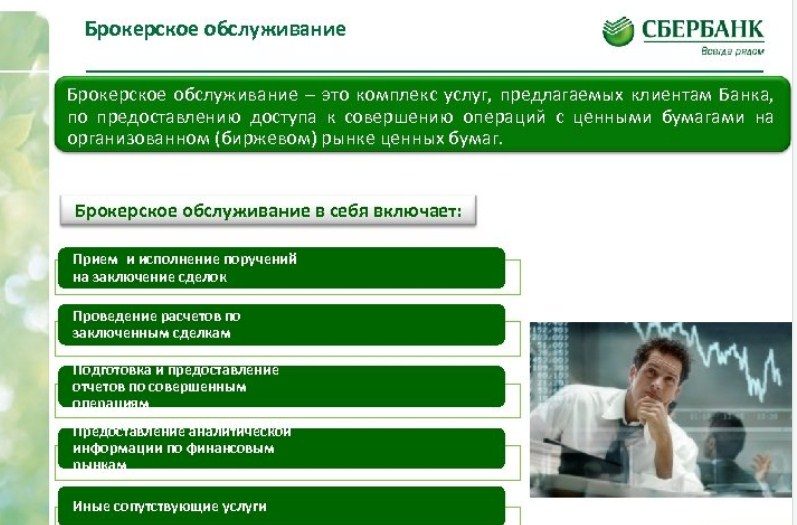

What is a brokerage service and what does it include

When trading on the stock exchange, all activities are carried out through a broker. In particular, he does the following:

- Ensures transactions are carried out in strict accordance with their terms.

- Accepts money to the trading account, keeps records of them and organizes the withdrawal of funds on demand.

- Provides a working terminal that allows a trader to see quote charts, use technical indicators to make decisions.

- Provides leverage for transactions.

Other options are also available:

- Sometimes the broker provides training for beginners and helps experienced traders improve their skills.

- May provide additional bonuses. As an example, we can recall the possibility of no deposit trading. In this case, the trader is transferred to the account the amount sufficient to start trading.

- Trading signals are provided for transactions.

- You can use the services of experienced traders to copy trades. In this case, a beginner can perform actions in the same way as professionals perform them.

- The broker can provide the ability to use special programs – advisors , which make it possible to trade automatically.

- Provides important economic information that may affect the change in stock quotes.

- Often the broker arranges the opportunity to transfer money to the management of experienced professionals for an appropriate fee.

The quality of the support service is important. It helps clients solve problems that have arisen in the course of their activities.

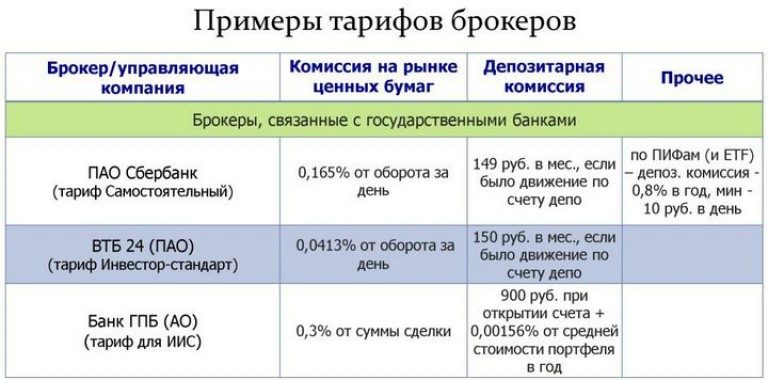

Who provides brokerage services in Russia in 2021 – conditions and tariffs of Sberbank, VTB, Tinkoff, Finam, etc.

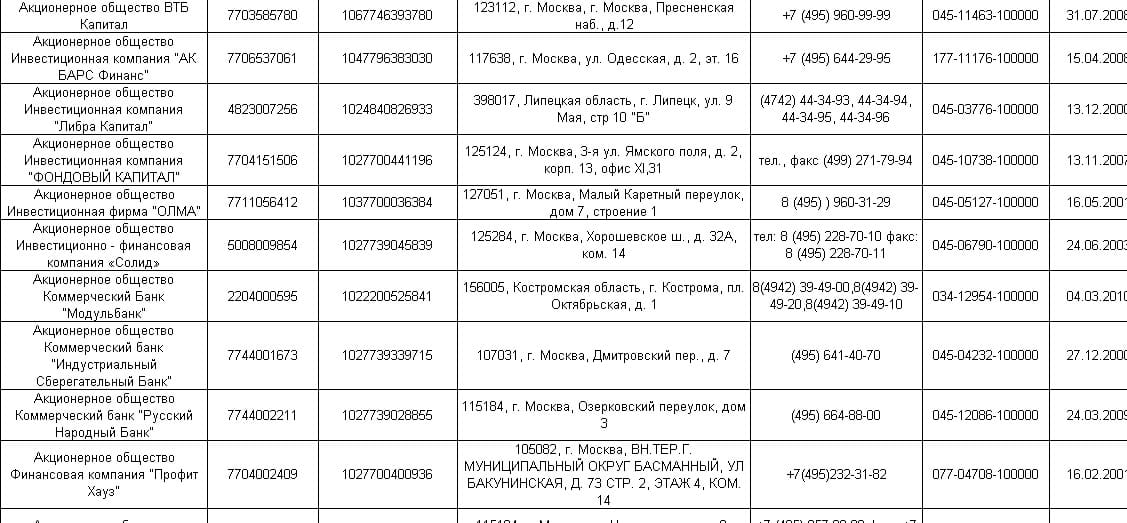

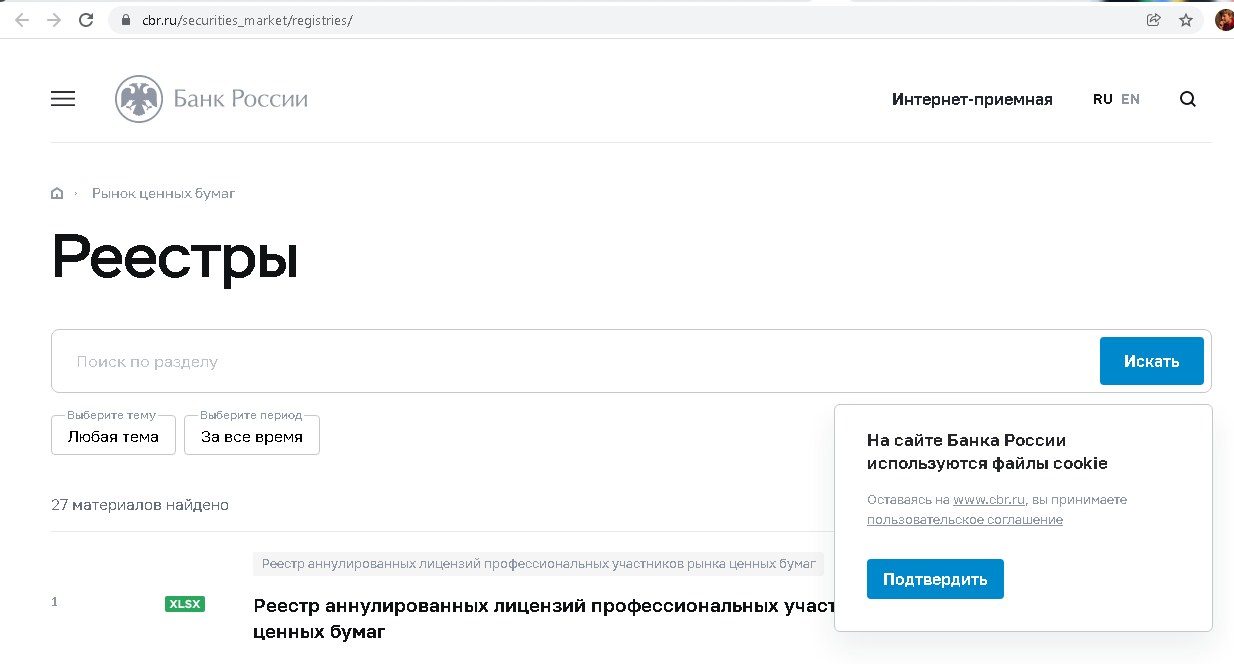

The rights and obligations of brokers are regulated by law. In order to carry out activities in this area, you must obtain a special license. Although often traders work with brokers from their own country, it is possible to conclude contracts with those who belong to exchanges from other countries. When choosing a broker, the rating of the best of them can help. Depending on the criteria used (the volume of transactions, the number of clients, and others), the first places can be distributed in different ways, but the following companies in the list below will definitely be among the leaders. Stock brokers work with exchanges that trade stocks and bonds. In Russia, the largest are the Moscow and St. Petersburg stock exchanges.

Brokers licensed by the Central Bank of the Russian Federation

Cent accounts

In order for a trader to be able to trade with little risk and profit, brokers can provide cent accounts. This is common, for example, when working with currency pairs on the Forex exchange market. At the same time, you need to understand that when a trader makes such transactions, the company does not copy them on the exchange because of their insignificant amounts. In practice, the total value is taken and, in accordance with it, a hedging transaction is made on the exchange. Such transactions can be the initial step for the development of a trader, however, it must be remembered that winning in them represents a loss for the broker. Therefore, in order to receive significant income, you need to switch to transactions that are actually executed on the exchange.

Accurate trade execution

It is generally accepted that the broker will definitely execute the transaction exactly. In fact, this does not always happen. With rapid price changes, a delay in opening or closing a trade can significantly reduce a trader’s profit. Therefore, it is important to choose a broker where these things do not happen. Another example of such a problem can be related to how the stop is closed. A situation is possible when 2-3 points were not enough before it, and then the price turned in the right direction. If, despite the existing gap, the stop has worked, then it will be unprofitable for the trader. Such situations rarely occur, but if the price moves quickly and changes abruptly, then they become real. When a broker executes a deal accurately and as quickly as possible, the success of the trader will depend on him, on his professionalism and luck.