How much traders earn on the US stock market, Russia, in the world and on cryptocurrency per month, year, and what the earnings depend on. In the modern world, there are many ways to legally earn money. You can improve your financial position by choosing trading for this. Before investing, it is recommended to carefully study the issue of how much a trader earns in the stock market per month / year. Here you need to take into account that the data must be taken not only for a particular country, but also for the world as a whole, then you can get a real idea of u200bu200bprofit and income in different pages.

Nuances of upcoming work

For those who are just starting to study the topic of trading in the stock market, it is interesting to know how much a trader earns per month. It is impossible to name an exact fixed amount here, since a lot depends on the state of affairs in the world economy and in the country where the person intends to work. You need to take into account official information, study reports for a certain period of time in order to always stay up to date with current events.

According to available information, the volume of trading in global terms in the foreign exchange market for the period 2019-2020 amounted to more than 6.5 trillion dollars.

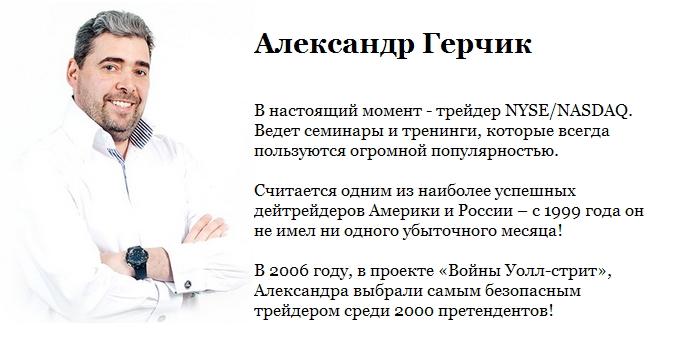

It’s no secret that every profession has its own nuances, which some call “pitfalls”. Knowing these features will help to bypass them and thereby eliminate the likelihood of errors. Many of them list the active trader’s course, which is called Buy Sell Earn, the author of which is one of the most successful and famous people in this profession – Alexander Gerchik. One of the nuances is the fact that it is impossible to know exactly how much a trader earns per day. A similar feature is associated with a pronounced individuality in the selected segment of business activity.

For new people who are just discovering ways to make money trading securities, you need to remember one, but very important recommendation – you need to focus on successful representatives of the segment, but make calculations according to average indicators. It is also impossible to focus only on certain countries – it is necessary to assess the situation and prospects taking into account global trends, since they are all interconnected.

Another nuance that you need to know when choosing the path of a trader as a source of income: no one can say with accuracy how much a trader earns per month. Also, this information is individual, since the exact amount of income depends on the methods, methods and skills that are used by businessmen in the process of work. You can only roughly calculate the average trader’s earnings, since in this case you can take the values shown by different people over several years. It is better to look at the data in the middle segment or focus on those financial values that are shown for the same period by people who have been working as traders for 1-2 years. Given all these nuances, you can guarantee yourself a successful start and the opportunity to succeed in the chosen direction.

Important success factors

Studying the material on how, on what and how much traders earn cannot be superficial. At this stage, you need to understand what social, economic and personal factors lead a person to success. On trading, as a full-fledged business element, you can really make money. In order to reach new heights and rise in your career, you need to know how to invest and trade, while receiving the greatest possible return. A trader must have a number of features that will help him in his work:

- Well-developed intuition, not foresight, but analysis, which is carried out by comparing events taking place in the economy and in the whole segment.

- Ability to analyze and compare.

- The desire not only to conduct many and successfully transactions on various platforms, but also to predict.

- Experience broker reputation – you should work in trading for at least a year to understand all its features.

- Suggested rate.

- Third-party commissions (in this case, brokers will need to pay).

https://articles.opexflow.com/brokers/kak-vybrat.htm Before entering serious trades, you need to learn the basic rules that work and allow you to increase your capital (for this purpose, you can use simulators offered by brokers) . As a result, already in the first months, you can return the starting funds and reach a tangible “plus”.

It is important to know: at the very beginning of your activity, you need to create a so-called trial demo account (it is used at the start of a career or for training on trading floors) and choose the simplest and most profitable strategy available. This will help to understand the initial principles of trading. Then you need to get acquainted with the state of affairs in the market – to study the indicators of the “behavior” of currencies, stocks and bonds of large companies and corporations. Then you need to open a trading account and pay the first deposit.

The beginning of trading occurs with the acquisition of one lot (if there is a loss, it will not hit the finances much). How much do traders earn, a stereotypical opinion about investments, should a trader be rich: https://youtu.be/SSiJvHPhUxY Studying the nuances of how and how much and for how long traders earn their first serious money cannot do without understanding what factors lead a person to financial success. You can make money in trading if you approach the matter with maximum concentration and attention. It is important to know the following points in advance: how to invest and trade with the greatest financial benefit, in what directions and areas to develop, where to look for a broker. In addition, a person who has chosen trading for himself must have a number of features in behavior and character, which will help him in his future work. So the main components will be:

- The ability to analyze and compare the information that is available with the situation taking place on the sites right now. This applies to all factors that are associated with trading. It is recommended to include here the situation in foreign and domestic policy, since it contributes to the rise or fall in prices for securities, shares and other components included in the auction.

- The desire not only to trade successfully and a lot, but also to make accurate forecasts.

A trader who has set himself the goal of achieving success, becoming a leader or repeating the path of those who eventually became a millionaire, must understand that his main task in this case will be the ability to quickly find what is commonly called repetitive situations. You also need to be able to understand the psychology of personality in order to avoid deception from brokers or competitors. You should constantly train to make a forecast in a timely manner. First of all, it should be directed to the state of the markets. At the beginning of the journey, this can be done without financial investments, so as not to burn out and not go into the red.

What does earnings depend on?

The choice of the direction of activity depends on how much traders in Russia, the world or the USA earn. The following factors influence income indicators:

- Initial financial investment.

- Intellectual capital – knowledge and skills, the desire to develop.

- Selected working strategies that are used to increase capital inflows.

- Is capital borrowed from outside organizations used, for example, a cash loan (if there is a loan, then part of the profit will go to repay it).

- Markets selected for trading.

In the expenditure side, you must immediately include not only the payment of taxes, but also commissions – the remuneration to the broker. When entering global markets, it will be possible to save a little, as it is known that some brokers do not charge for transactions not only with shares, but also with exchange-traded funds that operate on the territory of countries such as the United States and Canada. For other transactions, including international ones, the commission is about $5. Commissions are necessary so that specialists can choose the best tactics for opening and closing transactions, studying the situation on the markets. The rules of successful traders indicate that it is necessary to constantly develop analytical skills. If you can quickly respond to ongoing changes in the financial market, you can get the maximum profit. To increase profits, you need to train concentration. It is important to be able to withstand stressful situations in order to calmly respond to any changes. It is also recommended to train accuracy in yourself, as you need to be able to record, record and save all the results of transactions. Over time, to increase earnings, you need to try different strategies and stick to the most successful one. It is necessary to understand that traders call a certain percentage of the invested deposit as income. In order to increase profits, you need to develop a plan and stick to it. We must not forget that in order to increase income, you must constantly supplement your knowledge in the field of trading. Information that will become important and interesting for everyone who wants to test themselves in this direction: you need to consider the positions that the stock market shows. The volume of trading on the stock market for the period 2019-2020 increased by 6.4% and amounted to 4.5 billion rubles. One-day bonds were not included in the calculations. The volume of trading in corporate, regional and government bonds amounted to approximately 1.5 billion rubles for the period under review. We need to look at the components in more detail. Comparison is with September 2020:

- The derivatives market is another component, having studied which you can roughly imagine your future earnings. In this direction, the trading volume amounted to 13 trillion rubles (it should be taken into account that the value of 13 trillion rubles was relevant in September 2020), or 171.5 million contracts (187 million contracts earlier). The average daily trading volume amounted to 580.5 billion rubles (593 billion rubles is given for comparison). The volume of trading in futures contracts (future orders and contracts) amounted to about 167 million contracts, while in options contracts – 4.6 million.

The volume of open positions presented on the derivatives market, according to data relevant as of the end of September 2021, increased by 15.8%. The indicator increased to 805.4 billion rubles (it showed 695.6 billion rubles in September 2020).

- The foreign exchange market is an equally important element that determines the indicator of future or current earnings. The volume of trading in the foreign exchange market in the period under review amounted to 25 trillion rubles (against 30 trillion rubles, which was achieved earlier). About 7 trillion rubles fell on trading in spot instruments, about 18.5 trillion rubles were shown on swap and forward transactions.

- The money market is an equally important component that any trader should consider when choosing a successful strategy. The trading volume here also grew to 46.3 trillion rubles (against 39 trillion rubles in 2020).

Examples of a trader’s earnings – how much did the “sharks” of trading in financial stock markets earn?

In order to have an incentive to work, you need to focus on real examples of successful activities related to trading. Among the most notable examples of advancement in this profession is the trader Alexander Gerchik (USA).

If we take a closer look at the global situation on the market in numbers, we can note that 9 out of 10 traders completely drain the amount that is on their account in the first year. About a third (30-35% according to various sources) of them eventually refuse to earn money in the future by trading or to make it their main profession.

A small number of newcomers to this business (about 10%) eventually reach a level where they can boast their first significant profit. Another story of successful earnings is dedicated to Rainer Theo. He achieved success not only in the profession, but also in running his own YouTube channel. Here he tells what to do for beginners so as not to lose their own funds and increase investments. Subscribers exceed the number of 100.000 people. Another example of success and the fact that anyone who shows patience and interest in business can get high income is the story of a simple American, whose name is Ronald Reed. Before starting his successful trading path, he also led a modest life.

- Download special software – terminal.

- Select an item to trade. It can be currency (any), bonds or stocks.

- Set buy or sell position.

- Select lot size.

This can be done using tables or graphs that will be displayed on the monitor screen. In order for a transaction to be considered open and involved in trading, you need to create an order for a certain time (for example, a day). You can also open a current order. At the next stage, the moment of closing the transaction is selected and fixed. After that, the profit is fixed.