The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. TOP popular and very dangerous mistakes made by beginner and not-so-novice traders, which will lead to failure and loss of deposit. Trader mistakes in trading, psychology, risks and how a trader can correct his mistakes. Know the enemy by sight (in the terminal)!

- It took 35 cups of coffee to analyze the results for the queries “main mistakes of novice traders” and “mistakes in stock trading”

- It took 4 hours to analyze the video, with experienced traders sharing their experiences about mistakes in trading in the stock market.

This is the story. And generally speaking:

Who are traders to make trading mistakes?

In a large community of traders I came across a survey: “What was the main mistake you made when you started trading?” The publication has currently been viewed by 52k followers. Here are the TOP 15 most liked comments:

- Psychology, both on the first day and today

- Go all in

- Averaging a losing trade, no matter how much it goes against you

- An attempt to get rich quickly and thus trade for large amounts compared to the size of the deposit

- Trying to recover the loss from the next candle

- I didn’t know the difference between an analyst and a trader.

- Overload

- Trading without a plan and greed

- Thought it would be easy

- Trading too often and using leverage

- Overtrading, or overtrading

- Trying to make money before learning to trade

- Firstly, greed, secondly, fear… lost the first deposit

- Constantly think about profit

- Failure to apply risk management. Risk management and discipline – failure without them

And a comment with more than 1k likes:

Random trading without a plan. This caused great losses. Trading in revenge on the market for a large part of the deposit. From the second round, an attempt to find a 100% strategy. Running for indicators. After thoughtlessly using indicators, the depot was reset to zero. Now I trade through studying price, supply and demand, liquidity, market structure, discipline.

Your most dangerous enemy on the stock exchange, or the conscious cycle of the trader

Variant of the cycle (mechanism) according to Ray Dalio

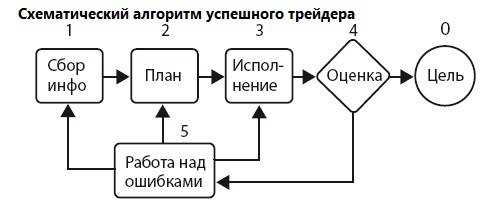

Allows you to achieve results in anything, including trading:

- Setting a goal.

- Collection of information.

- Planning.

- Performance.

- Failure.

- Feedback: evaluating the result and working on mistakes.

- Education.

- Adjusting the plan and improving the principles based on experience gained

- Restart.

The cycle of a successful trader:

The cycle of a “regular” trader:

- Temporary normal trading until the first mistake.

- The first blow and an instant desire to win back.

- Makes your wish come true. Enters new positions without analysis, increases entry percentage, leverage and risks.

- Collapse, deposit lost. He perceives the moon in Capricorn and the machinations of the broker as an accident. Go to point one.

What is the main mistake of almost all traders?

Lack of understanding of crowd psychology, own overestimation and underestimation of the market. What else will I highlight? 1. Insufficient study of the market and trading instruments : An unsystematic approach to trading without proper study of the market and the selected instrument can lead to undesirable results. It is necessary to conduct market analysis and learn the basics of trading before starting real trading. 2. Improper risk management : Failure to follow a risk management strategy can lead to significant losses. Traders should limit their losses and set stop losses to minimize losses in the event of unfavorable market movements. 3. Frequent trading operations: Constantly opening and closing positions can lead to excessive commissions and wasted time analyzing the market. It is important to select trading opportunities with caution and make decisions based on fundamental and technical analysis. 4. Emotional Reactions : Reacting to emotions such as fear or greed can lead to unwise decisions. It is important to remain calm and restrained, stick to your trading strategy, and not let your emotions influence your decision-making. 5. Lack of a plan : Traders must have a clear trading plan that includes entry and exit criteria, risk management strategy and time limits. Not having a plan can lead to random trading and unjustified decisions. 6. Insufficient recording and analysis of results: Traders should keep a log of their trades and analyze their results to evaluate the effectiveness of their strategies. Without regular analysis of results, traders will not be able to improve their skills and correct mistakes in their trading.

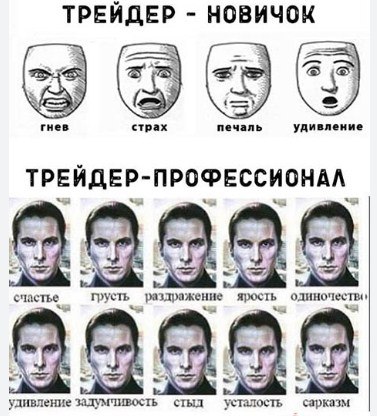

The main problem of human traders is the lack of emotional intelligence, which prevents them from adequately responding to market movements. The crowd on the stock exchange is an emotional monster, it is predictable and very vulnerable. Well, the critical mistake in the market is panic, which is necessarily followed by unfounded mistakes.