Trading in the realities of today: what is it in simple words, how to become a trader and earn money – strategies and psychology for successful trading on the stock exchange. For ordinary people, a trader is an ordinary employee on the stock exchange, who, in an incomprehensible way, makes huge profits. That is why many people do not understand what the job of a trader really is. But in fact, understanding what trading is is quite simple.

- What is trading in an understandable language for beginners in the subject

- Trading Psychology

- Understanding fear

- Overcoming Greed

- Directions of modern trading

- Categories of traders

- How to become a trader

- Qualities of a successful trader

- Risks of the profession – is it possible to make money by trading?

- Trader’s earnings

What is trading in an understandable language for beginners in the subject

In simple words, trading is a way to make a profit through trading in financial or stock markets. The following items can be used as goods:

- stock indices.

- Stock.

- Futures.

- currency pairs.

- Energy resources.

- Precious metals and more.

These are the main assets with which the trader makes a profit. His job is to buy and sell securities or currencies for speculative gain. Trading on stock exchanges is available to absolutely any user who has access to the Internet and has opened a trading account with a brokerage company. https://articles.opexflow.com/brokers/brokerskij-schet.htm However, not all people have the same rights in this area, so traders are usually divided into two categories. Official traders have a special license that allows them to trade through the exchange. Thus, they buy or sell assets on their own behalf, or on behalf of the company. Official traders usually manage the capital of bank employees, financial institutions or investment funds. Such people are fluent in the skills of technical market analysis and professionally assess the fundamental factors that affect market quotes. https://articles.opexflow.com/strategies/fundamental-analysis.htm Private traders speculate solely in their own interests and they need an intermediary in the form of a broker to work. They are not responsible for the accounts of other users and trading is an additional source of income for them, or the trader incurs the loss of his initial deposit. Note! Private traders can trade without obtaining a license through one of the brokers. It is enough for them to master the basic knowledge of market processes and understand the rules for concluding transactions on a demo account. com/strategies/fundamental-analysis.htm Private traders conduct speculation solely in their own interests and they need an intermediary in the form of a broker to work. They are not responsible for the accounts of other users and trading is an additional source of income for them, or the trader incurs the loss of his initial deposit. Note! Private traders can trade without obtaining a license through one of the brokers. It is enough for them to master the basic knowledge of market processes and understand the rules for concluding transactions on a demo account. com/strategies/fundamental-analysis.htm Private traders conduct speculation solely in their own interests and they need an intermediary in the form of a broker to work. They are not responsible for the accounts of other users and trading is an additional source of income for them, or the trader incurs the loss of his initial deposit. Note! Private traders can trade without obtaining a license through one of the brokers. It is enough for them to master the basic knowledge of market processes and understand the rules for concluding transactions on a demo account. or the trader bears the loss of his initial deposit. Note! Private traders can trade without obtaining a license through one of the brokers. It is enough for them to master the basic knowledge of market processes and understand the rules for concluding transactions on a demo account. or the trader bears the loss of his initial deposit. Note! Private traders can trade without obtaining a license through one of the brokers. It is enough for them to master the basic knowledge of market processes and understand the rules for concluding transactions on a demo account.

Trading Psychology

Successful trading in the financial markets requires many skills. These include the ability to evaluate a company’s fundamentals and determine the direction of a stock’s price trend. But none of these technical skills are as important as a trader’s mindset. Holding back emotions, thinking fast, and exercising discipline are the components of what we might call the psychology of trading. There are two main emotions to understand and control: fear and greed.

Note! Traders often have to think fast and make quick decisions, getting into and out of positions in the shortest amount of time. This requires a certain presence of awareness and discipline.

Understanding fear

When novice traders receive bad news about certain stocks, or about the economy as a whole, they naturally panic, and as a result, they may overreact and feel compelled to liquidate their holdings and sit on cash, refraining from taking further risks. If they do, they may avoid certain losses, but they may also miss out on the chance to profit on further swings. New traders should understand that such fear is a natural response to a perceived threat. In this case, it is a threat to their profit potential.

Overcoming Greed

There’s an old saying on Wall Street that “pigs are killed.” This refers to the habit of greedy investors to hold on to a winning position too long to get every last tick up in price. Sooner or later the trend changes and the greedy will be caught.

Interesting! Greed is not easy to overcome. This is often based on an instinct to do better, to get a little more. A trader must learn to recognize this instinct and develop a trading plan based on rational thinking, not whims or instincts.

Directions of modern trading

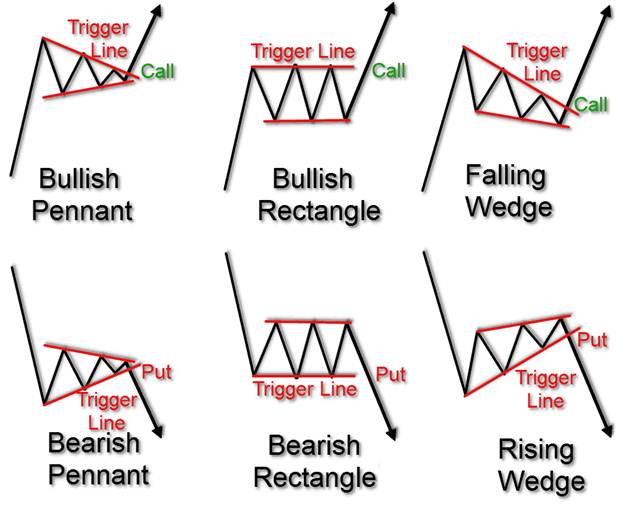

In order to successfully trade in the stock market, traders need to use different trading methods. They may have the following orientation:

- scalping . The category of intensive trading, which involves a quick analysis of the market in the shortest periods. Such traders hold positions for several minutes or even seconds, and then close them with the help of special trading robots for scalping . This approach involves making a small profit from one position at the same time with a large number of them.

- Day trading . Intraday trading, which involves transactions during one trading session. Such traders open positions in the morning and close in the evening, trading intraday.

- Positional . A long-term strategy used primarily by professionals. They analyze the state of the market and open a position for a specific event. At the same time, the global trend of the asset change, ascending or descending, is determined.

- Algorithmic trading, when all the work is done by a special robot advisor . You can read more in this article and in this one .

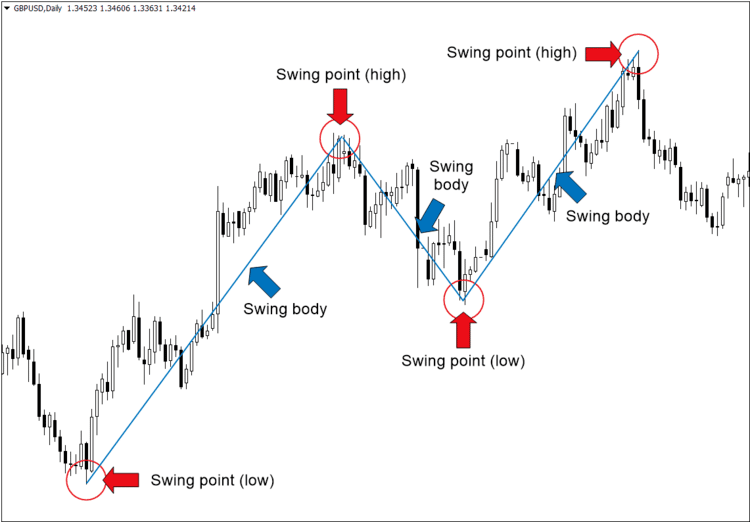

- Swing-treading . This direction speculates on a wave-like change in the value of assets, when, after reaching peak values, they move back. The trader tries to determine the moment of the price rollback and make a deal with the trend in the conditions of the rebound of the price from specific levels. This usually involves closing the position in a few days.

Categories of traders

The financiers came up with a simple scheme that allows you to quickly determine the trader’s strategy based on his actions in the market. Such a scheme quickly took root in narrow circles and was subsequently installed in the form of monuments on the New York and Shanghai stock exchanges. Thus, several images of traders stand out:

- Bull . It analyzes the growth in the value of an asset and opens a long-term trade, playing for an increase. They buy currencies in large volumes, expecting profits to come from skyrocketing prices.

- Bear . Their activity is aimed at the expectation of lower prices. They usually borrow assets from the company and then immediately sell them at an inflated price. After that, the trader expects a fall in prices in order to give back the borrowed assets at a lower cost.

How to become a trader

Many famous traders have different success stories. This is due to the fact that everyone has a unique character and principle of thinking. There are three types of markets:

- Stock.

- Currency.

- Commodity.

Beginners often start with currency. Here you can learn the principles of currency trading. After a complete study of the foreign exchange market, it is desirable to switch to the stock and commodity. In addition to the above, there are many courses for learning from scratch and advanced training. Do not forget about literature with examples from the life of great specialists in this field. In modern times, there is a lot of information in the public domain that can be used. https://articles.opexflow.com/trading-training/knigi-po-algotrajdingu.htm After mastering the basics, an important step to trading on the stock exchange is to find the right broker. This is a legal entity that performs intermediary functions in the purchase and sale of shares. In most cases, it is brokers who provide training opportunities for clients. https://articles.opexflow.com/brokers/kak-vybrat.htm

Additional Information! An important nuance in our country is the license of the Central Bank of Russia for a broker. In the case of cooperation with various companies in the field of brokerage or development courses, an appropriate license must be present.

When mastering a new strategy, you should fix the result in different conditions, and then move on to learning a new one. You should also be aware of the existence of a demonstrative account. With the help of virtual money, a beginner can clearly see how the trading system works. This feature is present on most types of exchanges. Thus, the whole process of becoming a trader can be divided into several main stages. These include the following:

- Choose the right platform .

- Find the right training materials and a broker.

- See the scheme of the exchange thanks to the demo account .

- Open a real trading account.

After the above points, you can start trading. However, it should be remembered that you need to constantly learn and move forward. The world is extremely dynamic and does not tolerate stagnation.

Important! To gain basic knowledge about trading, you should join various specialized telegram channels.

Trading for Dummies – all novice traders will find it useful to watch: https://youtu.be/0wmE_csJrJc

Qualities of a successful trader

It is not enough to master only technical and fundamental knowledge to conduct successful transactions in the market. Each trader must have several personal qualities that allow him to work confidently in stressful conditions:

- Discipline . A key trait that every trader should have. It is necessary for the correct distribution of time when analyzing the market, self-education, pre-market transactions or trading. This is especially important when there is no leading person nearby who can push for action.

- Patience . This quality is lacking for many beginners who come into trading. But it should be remembered that a quick profit is only a short-term luck. When conducting speculation, you must patiently wait for the moment of success.

- Flexibility . A successful trader differs from a beginner in that he is able to apply a trading strategy in various market conditions. There is no perfect pattern and setup because market volatility is constantly changing. That is why it is so important to have mental flexibility, which will allow you to correctly apply the knowledge gained.

- Awareness . The market is a place of concentration of stress, so a trader must monitor his emotional state and be able to control it. Only a cool-headed approach can bring winning profits and save a person’s nerves.

Risks of the profession – is it possible to make money by trading?

Trading is one of the most difficult and unpredictable professions. Considering the fact that it takes many years to master a specialty. There are many factors that can threaten successful transactions. These include the consequences of mistakes a trader can make. Among others:

- Excitement associated with self-confidence . There are many examples where a trader makes a successful trade based on intuition. Especially when it comes to large sums. In this case, you may get the impression that money is earned easily and quickly. Most often, such an event causes a lot of emotions and does not allow you to think with a cold head. The trader starts to make mistakes, and after that he wants to recoup. Under a similar scheme, many people have lost a large financial investment, as well as interest in this profession.

- Increasing risk and earning potential . There are times when a trader is very confident in his choice. This encourages you to risk a large percentage of the total amount of money, and sometimes the entire amount. According to the principle of many experienced traders, this is a mistake. In most cases, professionals allocate no more than 5% of the total amount per transaction, which provides some kind of insurance.

- Loans . A huge mistake can be the desire to use the money that is borrowed for trading. The fact is that it can put a strong pressure on the emotional state of a person. In trading, one of the main principles is to be calm and relaxed. Stress due to credit can greatly affect work decisions during the opening of positions.

There are risks that are almost impossible to foresee. Usually they are associated with a market crash and other costs. However, if you follow the rules, be careful and properly manage your finances, you can protect yourself from big losses. First of all, to prevent risks, you should choose the most proven strategies with predictable results. At the same time, it is advisable not to start working with a large amount of money, since at the beginning of the journey, the trader must learn to determine the patterns of the market, and not chase the jackpot.

Trader’s earnings

How much money does a regular trader make? This question is impossible to answer. Few traders disclose their results to anyone, so accurate earnings statistics are very difficult to determine. However, there is great potential in this area, especially if a person enters the market with a ready-made financial cushion. So, when investing $1,000 with the right strategy, an experienced trader can easily raise this money to $14,000, especially if he trades in foreign markets. However, it is not necessary to save such amounts to get started. It is enough to invest a little money and slowly analyze the actions of the market. But it is important to consider that the earning potential will increase significantly from investing large amounts. https://articles.opexflow.com/trading-training/skolko-zarabatyvayut-trajdery.htm In order to start earning, just follow four simple steps.

- Find a stock broker . Opening an exchange account is possible only through the participation of an online broker.

- Open a trading account. The broker must send a link to fill out an online form, where the basic data of the future trader is entered.

- Login to your account and deposit money . After registration, the user can start exploring the platform and deposit money from their bank account

- Analyze detailed information about the shares and start trading, initially on a demo account . Market prices are always available to any trading account user.

Online trading has become an absolutely popular form of earning, initially it is worth finding a qualified broker before starting work, open a demo account and try several trading strategies on a demo account. And only then try to trade on a real account.

Uzbek

Керемет. Жаксы лекция болды. Тек арасында кателери коп екен

Узб

Min hali yangi tiredirman

Men bunga qiziqib qoldim shogirtlikga olish uchun ustozlar bormi