Tinkoff Investments is a professional participant in the securities and currency markets. This service is a simplified version of the platform for making transactions in the stock market both in the capital and abroad on New York stock exchanges, including NASDAQ. Recently, the clients of the Tinkoff Investments trading service have access to a trading robot service called a robo-adviser. With its help, users can manage the risks of their investment portfolio. In this article, we will take a closer look at what a trading robot from the Tinkoff Investments service is, what it is for, what capabilities it has, how to install it and how to configure it by connecting the API.

- Robot for trading tibot “Robo-adviser”: what is it

- The main functional features of the robot for trading from Tinkoff

- Obtaining a token at Tinkoff

- OpenApi

- Functional features

- eToken for interacting with the OpenApi HTTP interface

- Token validity period

- Advantages and disadvantages of the Tinkoff Investments trading robot

- The process of launching a robot for trading Tinkoff Investments

- Practical experience of using a robo-adviser: real facts about the Tinkoff Investments bot

Robot for trading tibot “Robo-adviser”: what is it

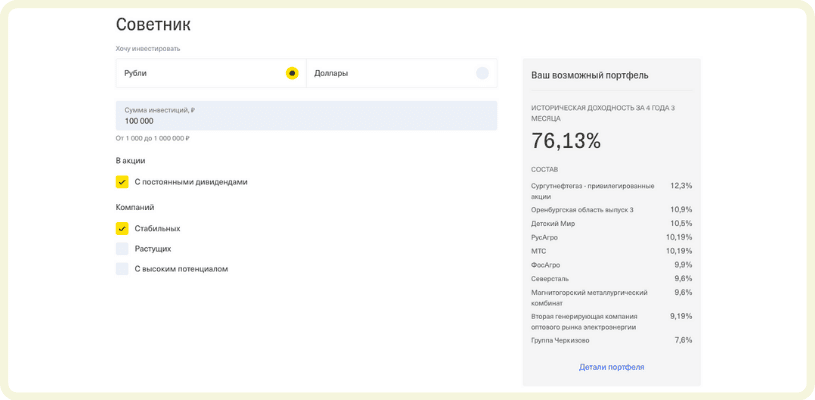

The “Tinkoff Robo-Advisor” robot is a systemic set of programs that automatically create a diversified investment portfolio based on specified conditions when a stock trader performs a certain action pattern. The investor decides whether or not to enter into a transaction with currencies, stocks, bonds and other securities within the limits of his account opened with a broker. Also, the trader is independently responsible for the risk of losses.

The main functional features of the robot for trading from Tinkoff

Clients can connect to the investment system “Robo-adviser” only through the api – Tinkoff OpenApi – link for installation https://www.tinkoff.ru/invest/open-api/.

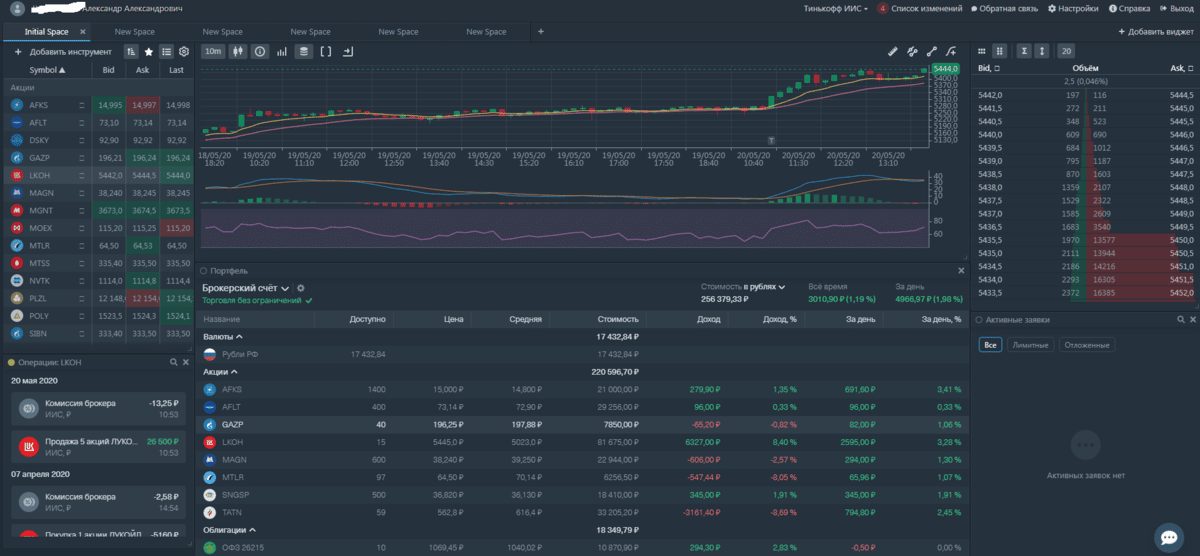

- Review of the sales plan and their full volume for the last and forthcoming periods.

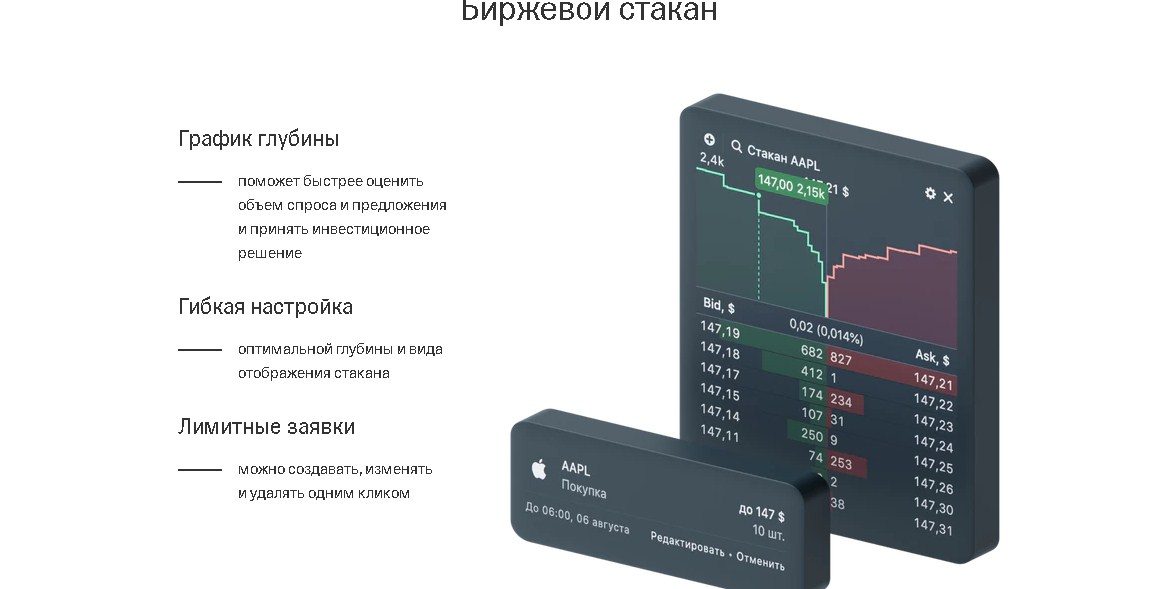

- An overview of the order book, where you can also see the total number of prices you have set for the sale or purchase of securities.

- Review of data on a brokerage account, finance and set prices for the purchase / sale of securities.

- Placing orders can be carried out from their general list, from the order book, through an automatic scheduling system or from system assistants in the form of robots.

- Review of information by sections, selection of instruments that are suitable for work at the moment and plotting a chart as a percentage of the rise / fall of the results for the selected instruments.

- In the process of buying / selling securities or currencies at the value you specified, a limit order can be canceled by a quick command or its parameters can be changed. The service will automatically send a command to cancel the previous limit order, after which the updated value will be set.

- In the Lite version of the Robo-Advisor, you can organize sales according to simple rules in automatic mode.

- In the Pro version, the system makes it possible to set up sales rules using mathematical and logical laws, as well as by entering variables. All edits can be saved to a separate file.

- The robot uploads items to the purchase planning section for which the cost should be monitored.

- In the “Alerts” section, you can find the maximum allowable price size, upon fulfillment of which, the system will inform the investor, when the platform is minimized, about the achievement of the value for the elements.

- In the “History of Transactions” section, the user can find the history of income and expenses made for a certain period, as well as the results of transactions, including the commission charged by the broker.

- Applied configuration objects. They indicate: the best sellers in terms of growth or decline in value, as well as the number of securities or currencies sold. Trade sheet – acquisitions, sales, commissions, company profits, etc. Report on investor finance at the moment with detailed charts in securities currencies and rubles with full results.

- In the “Trading tasks” section, the investor can create goals that will not be transferred as limit orders, but will be saved as personal tasks of the user. When the value is reached, its rise or fall, depending on the goal, the purchase or sale of securities or currency is carried out. Once the goal is achieved, it is automatically deleted from the list. If the building is in the nature of alternation with other tasks, then the type changes each time a transaction is made to “buy” or “sell”, depending on the action being taken.

- In the “Trade tasks” section, you can control the placed limit order and change the status of the “alternate” tasks after the value set by the investor is reached. The flag is specified when configuring the section.

- In the settings, the investor can configure the functionality of all sections of the robot intended for trading: charts, planning, order book, etc.

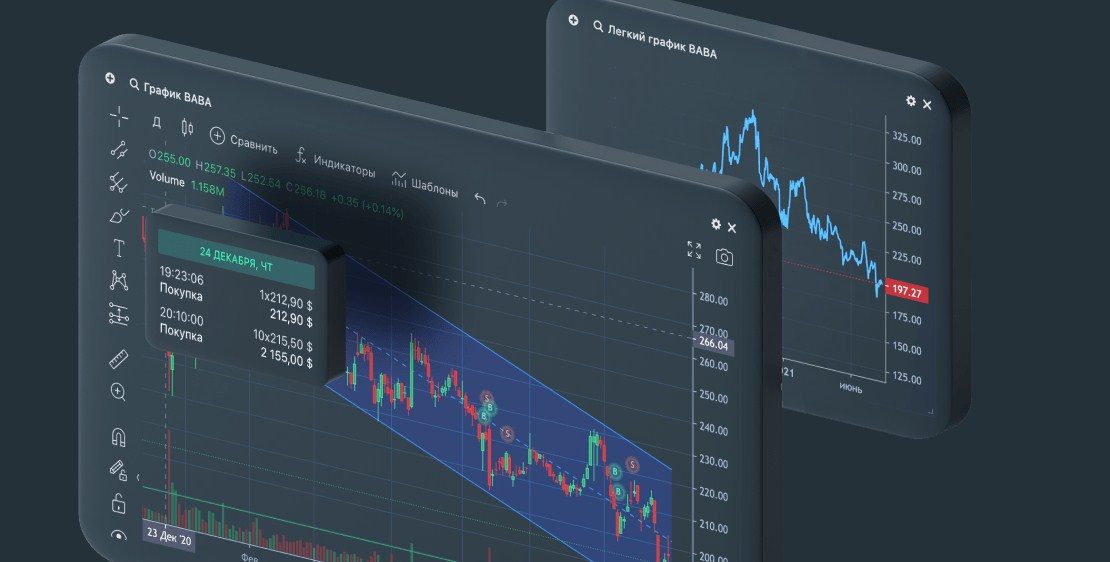

- The robo-adviser includes a built-in system for informing the user about the latest news on the instrument, active links to the tradingview.com and marketwatch.com platforms, as well as to the official Tinkoff Investments page with automatic transition to the page for the current item.

Important! The investor himself is responsible for the results of transactions. What is directly indicated on the corresponding page https://www.tinkoff.ru/invest/disclaimers/advisor/

Obtaining a token at Tinkoff

The use of the robot for trading is available only to those users who have an eToken – token and an investor account with a broker. How to get a token:

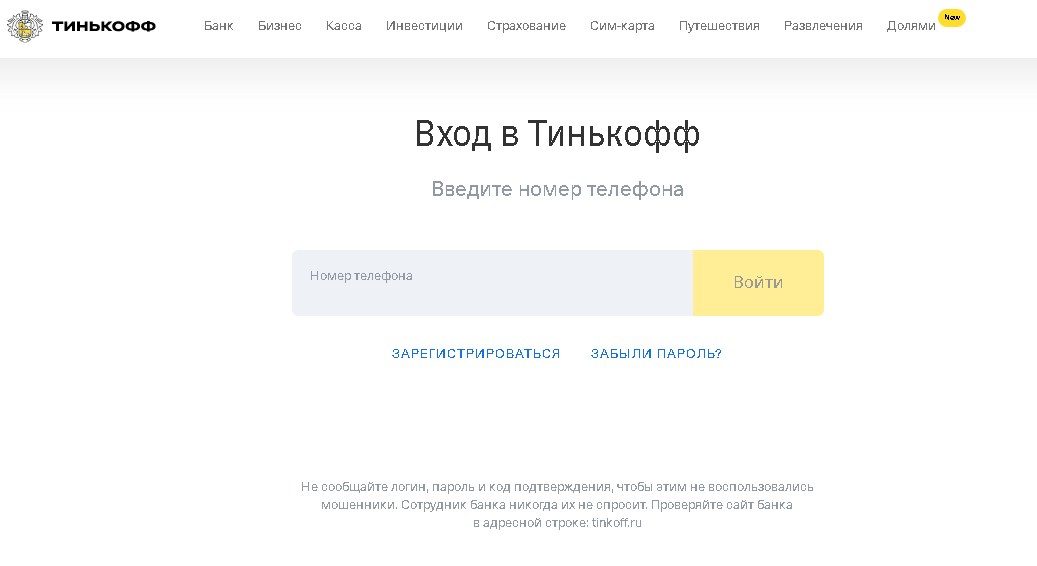

- Log into your personal account on the official Tinkoff website (https://www.tinkoff.ru/login/?redirectTo=/terminal/).

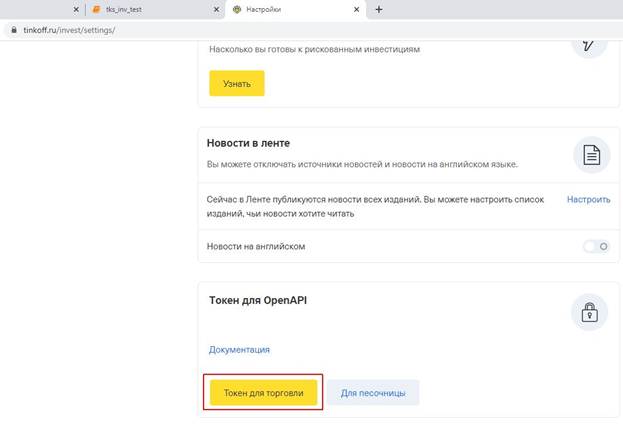

- Go to the “Investments” section, from where go to the “Settings” tab.

- The command “Confirm trades by code” must be disabled.

- Apply for eToken OpenApi for the order book. The platform may repeatedly ask you to enter your personal account, do not worry, this is a necessary step to connect the robo-adviser to the trading platform.

- Copy the eToken and save it, as you won’t be able to find it in the future, the token is displayed only once.

Note! Despite the fact that the token disappears after leaving the page and cannot be viewed again, the user can issue an unlimited number of tokens for the robot.

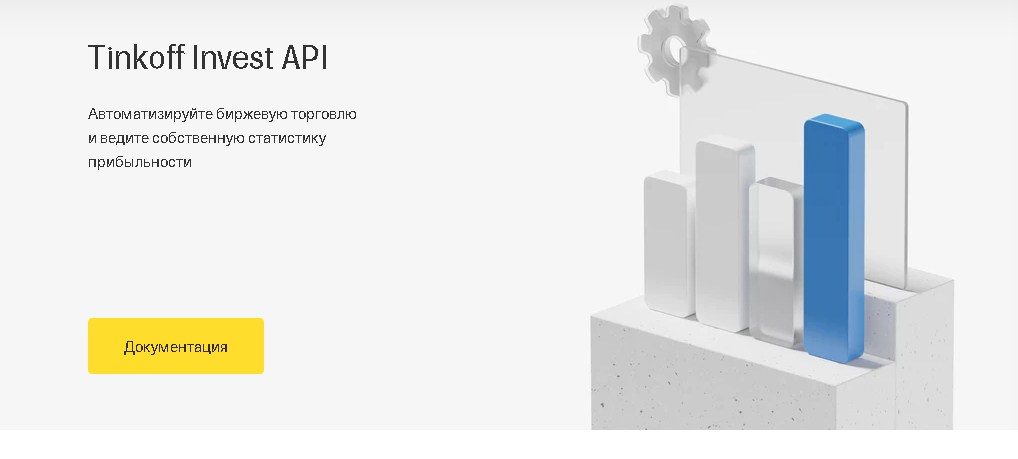

OpenApi

OpenApi is a web interface for investor communication with the Tinkoff Investments trading platform.

Functional features

The main features of the OpenApi HTTP interface are the following functional features:

- setting a limit for trading tasks;

- setting trading tasks within the framework of the stock exchange;

- collection of information data from the stock exchange, including historical information;

- collection of information data on investor finances and recent earnings;

- testing the trading algorithm on historical materials (a step-by-step plan for testing theories is developed by the investor independently, based on his needs).

eToken for interacting with the OpenApi HTTP interface

A token is a specially selected set of elements, which is encrypted data about an investor and information related to the registration procedure in OpenApi.

There are two types of tokens:

- numeric encryption for interacting with the sandbox;

- a set of numbers representing an encrypted code for full-fledged work with the Tinkoff Investments service.

Token validity period

Despite the fact that a large number of tokens can be created, they all have a limited validity period. The token is functional for ninety days from the date of the last application.

Advantages and disadvantages of the Tinkoff Investments trading robot

Among the advantages, users highlight:

- Convenient service with simple and straightforward functionality. Opening an investment account with a broker does not take more than 20 minutes, including transferring funds to it.

- The speed of entry into trading is faster than on cryptocurrency exchanges. If the user already has plastic, then starting a trade is a trifling matter, which takes no more than 10-15 minutes.

- The Robo Advisor takes on a good part of the job, having a lot of necessary functions that help a newbie quickly get into the topic of trading.

There are also “pitfalls” here:

- A large number of transactions are prohibited.

- You cannot sell anything on the order books.

- There are no direct access services.

- The api are poorly developed and almost in no way meets the requirements of the exchange.

The process of launching a robot for trading Tinkoff Investments

- The first step is to download the robot constructor from any available, but verified site.

Note! Some web resources from which various files are installed, including constructors, pose a threat to your device. Often, along with the file, virus programs are installed on the PC that disrupt the proper operation of all services. Therefore, before downloading the robot builder, make sure that the site does not pose any threat.

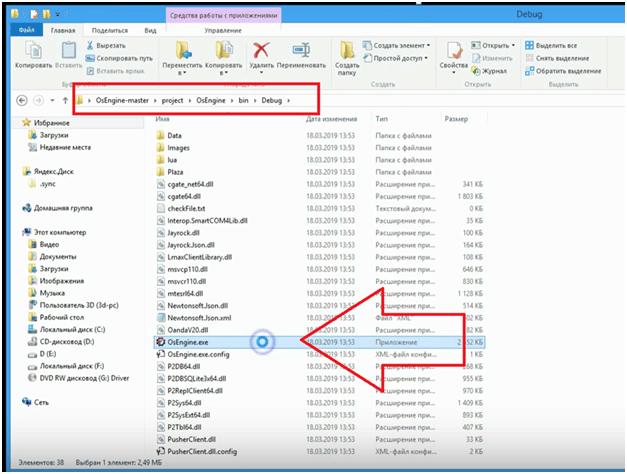

- Download Zip to your personal computer, then open the zipped file and transfer it to the “exe” format as shown in the screenshot.

- We launch the platform as administrator.

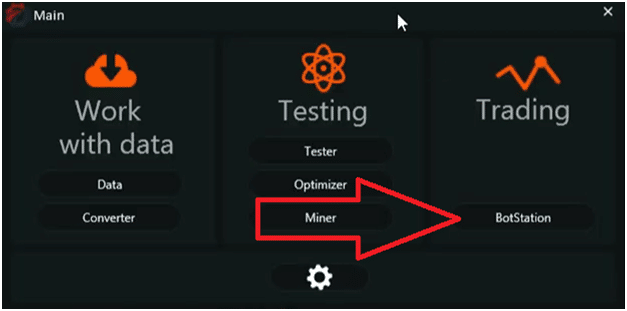

- We go to the bot station, as shown in the picture.

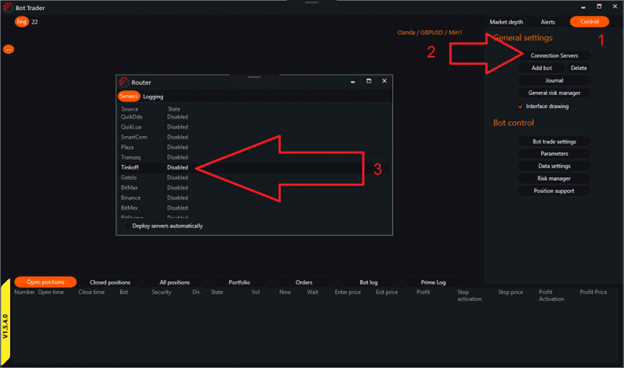

- Then go to the connection settings section.

- Press the “Control” key on me on the right.

- Next, go to Connection Servers.

- In it we scroll to the very end of our program and find “Tinkoff”.

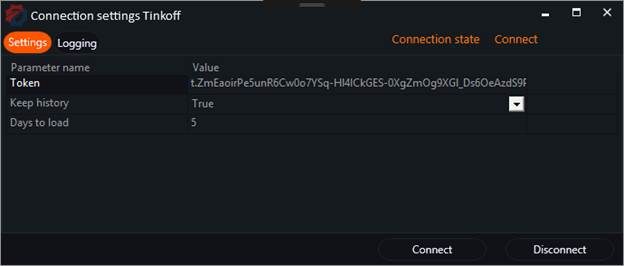

- We double-click on this line, after which a line opens in front of us for entering a token, which must be generated, saved and copied in advance.

- In the input line, we indicate the eToken generated in the personal account of the broker.

- After the completed operation, we can create an assistant robot and everything that we need for work.

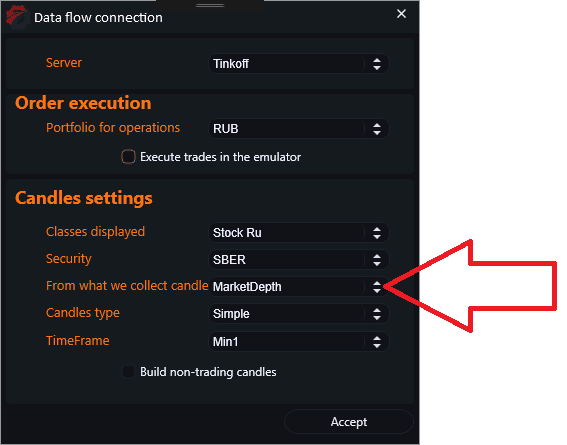

Important! Due to the unstable operation of the service, we did not connect it, so the user will have to set up the candles from the order book on their own.

Practical experience of using a robo-adviser: real facts about the Tinkoff Investments bot

Most of the users who have tried the trading robot from Tinkoff Investments, first of all, note that the Api web interface is poorly executed and almost does not meet the requirements of the trading platform. Streaming data is a complete mess. There is no order to a broker to buy / sell a certain number of financial elements, there is no history of individually performed operations, as well as a feed of transactions. There are only order books available, the installation of which is limited to six pieces. In general, the idea is not bad, but Api at Tinkoff Investments is not a well-thought-out story at all. The disadvantages include the inability to trade a large number of instruments at once. On the other hand, a trading advisor robot with wide functional features,available to every user absolutely free. To connect it to work, you need to have OpenApi, for which you must first unload the token through your personal account on the official website of Tinkoff Investments, after which you can start writing a bot. The process does not take as much time as it might seem, and investors can check their developed plans on a specially created demo account, which does not in any way affect the official brokerage account, so there is no risk of losing money.and investors can check their developed plans on a specially created demo account, which does not in any way affect the official brokerage account, so there is no risk of losing money.and investors can check their developed plans on a specially created demo account, which does not in any way affect the official brokerage account, so there is no risk of losing money.