The modern economy and trading in the stock market require the use of powerful computers and special algorithms. It will be difficult for a trader to trade stocks and futures without the use

of trading robots . Conditions in the stock market vary from country to country, so a trader should use suitable trading robots when trading securities. This article will present a list of suitable robots for the Chinese stock market, consider promising Chinese exchanges where you can conduct investment activities.

China exchanges for trading and investment

Shanghai Stock Exchange. Founded in 1990. Stock indices – Shanghai Composite, reflecting the aggregate state of all companies on the stock exchange and SSE 50, reflecting the shares of 50

blue chips . You can buy shares of 1334 companies on the stock exchange. Hong Kong Stock Exchange. The year of foundation is 1891. Stock index Hang Seng. 1421 companies have been listed on the stock exchange.

Robots suitable for trading on stock exchanges in China

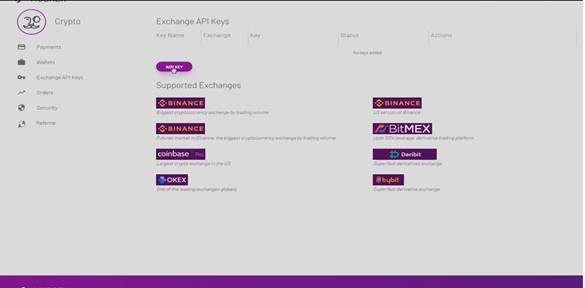

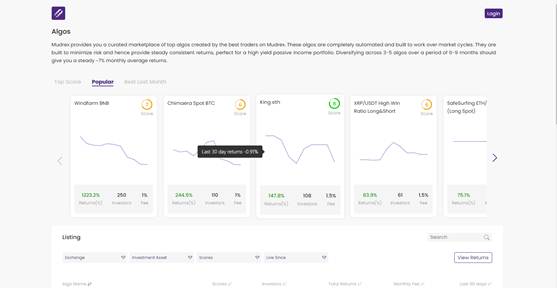

Mudrex platform and trading robots

Online trading platform. It is an Internet site on which the user only needs to register and set the necessary parameters. The resource allows you to invest in stocks, including on Chinese stock exchanges.

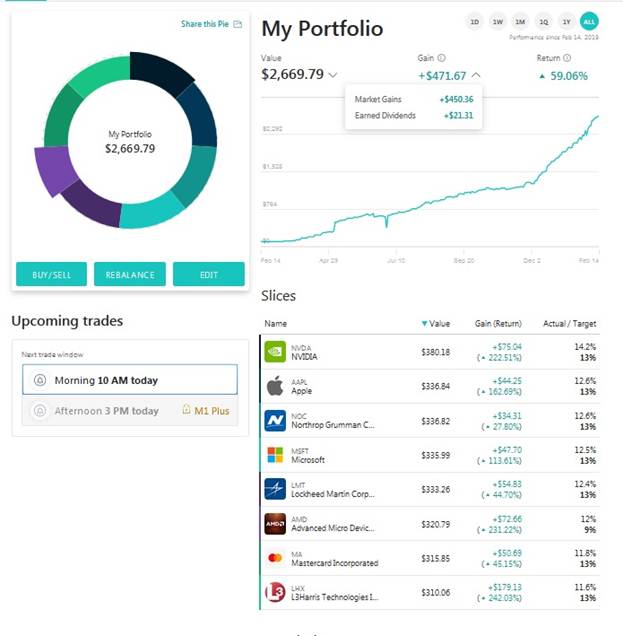

M1 Finance

American stock management system. Available in web form, as well as the application form for iOS and Android. M1 Finance allows you to create your own investment portfolio from ETFs, use shares individually or even fractionally. To start investing using the system, you need to register by setting your username and password.

of an investment portfolio is done in the form of a pie, where the trader determines which stocks and ETFs will be included in it. You can delete, add or edit each “slice” of the investment, set the target weight. This will create a personal pie.

- General investments – creation of an individual investment portfolio.

- Income – a portfolio for earnings and dividends.

- Retirement is a pie for a planned retirement.

- Responsible investment

- Hedge Fund Followers – Portfolios from Established Investors

- Industry – investing in industries that are relevant to the trader.

No commission is charged for buying and selling securities. This is a great benefit of the service. However, the user can choose one of two spending systems: free M1 Standard and M1 Plus, which provides for an annual fee of $100 in the first year and $125 in the next. If a trader does not use the platform for more than 90 days, he will be charged a fine of $ 20. M1 Finance has a support service that will advise on investment issues. At the same time, the service is quite complicated and is not mastered immediately, for this you need to use it for a certain time.

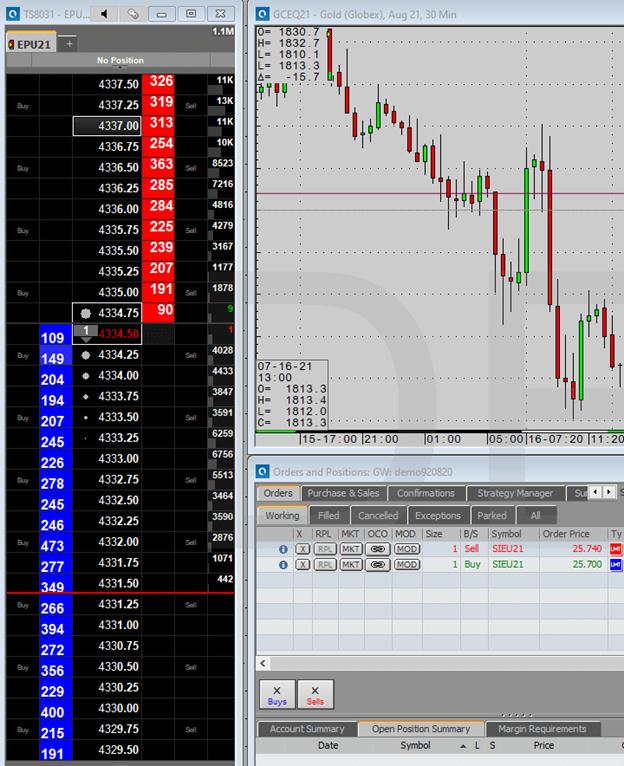

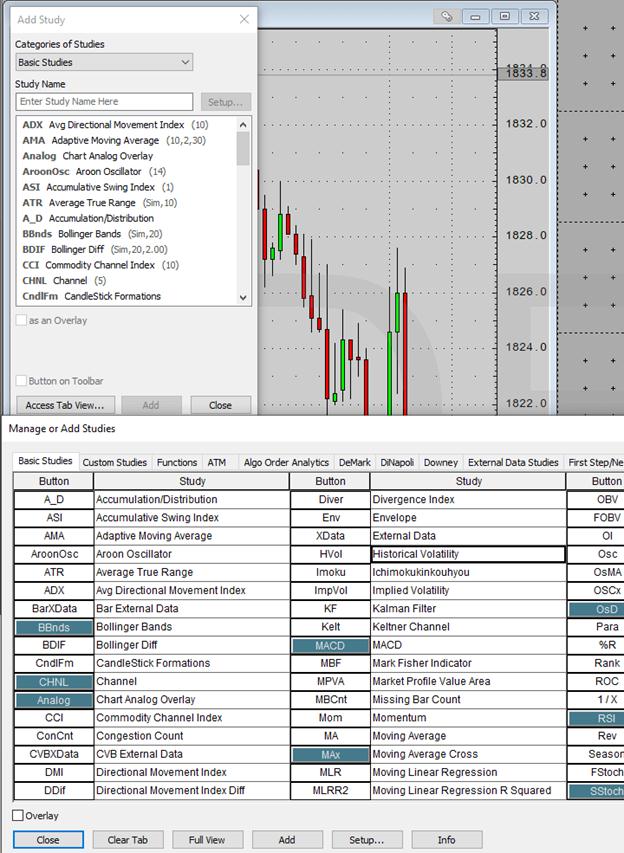

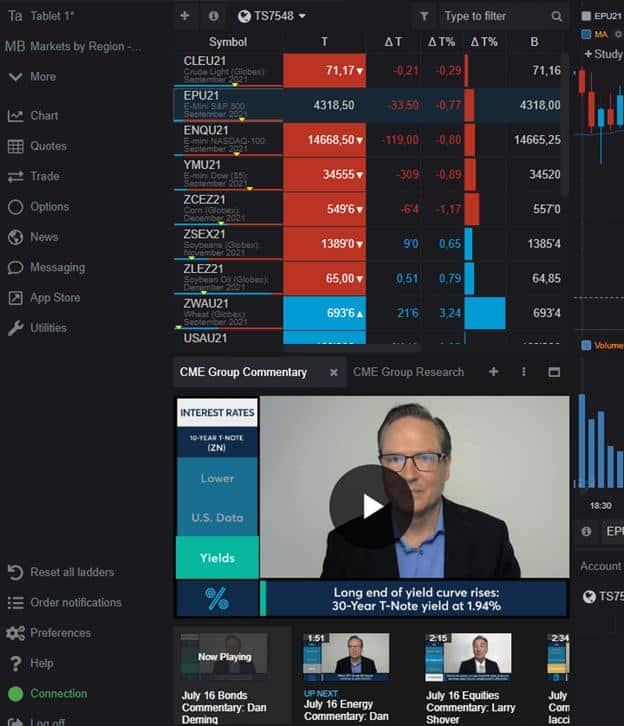

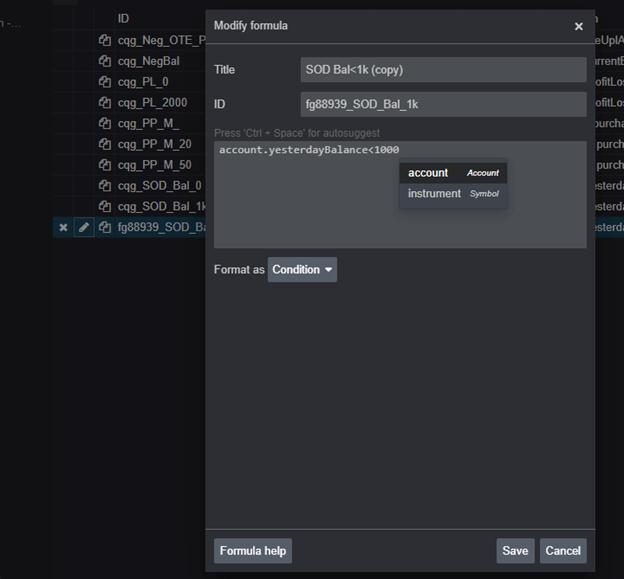

CQG

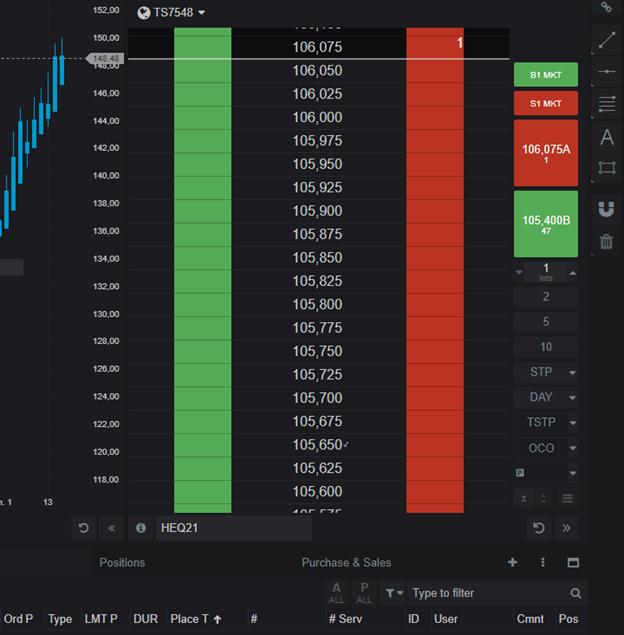

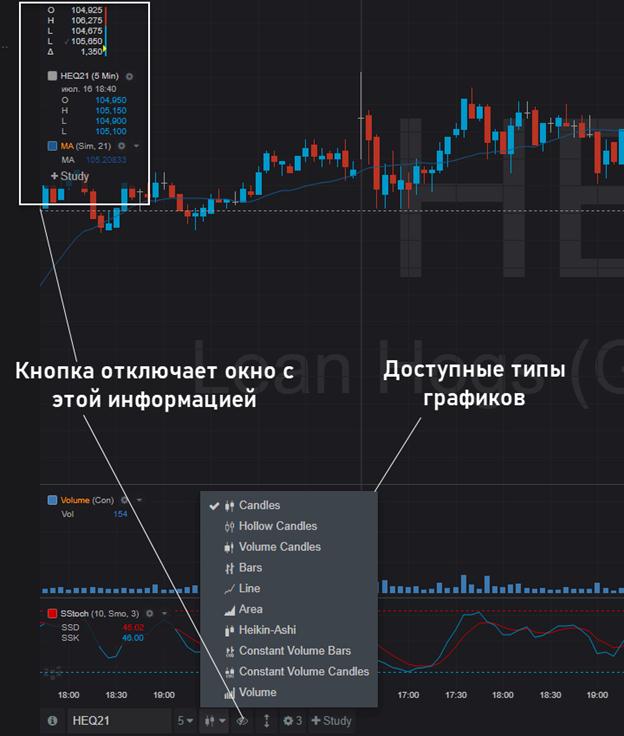

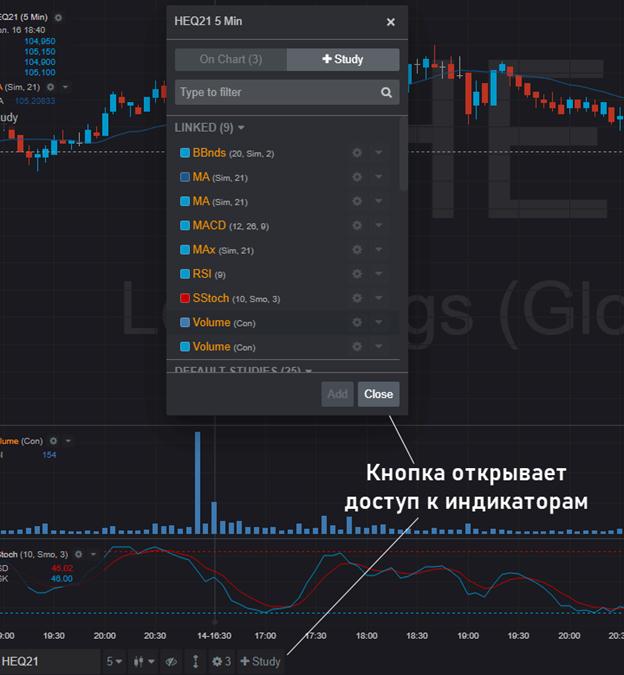

Professional investment management platform. Allows you to trade on European, American and Asian exchanges. A trader can customize the desktop of the program in the form of a glass of an instrument, a chart or a window with account information with tabs, which will display information on open and closed orders. CQG has two versions: the web version of QTrader and the Desktop version for installation on a computer.

- Buying/selling futures – Hedge to arrive and Basic Trade.

- Spreadsheet Trader window. Click the right mouse button and the Buy and Sell items will open.

- Order Ticket window

- Hybrid order ticket section.

- Algo order ticket – for algo trading and automated trading. The method can be applied not in all accounts and all instruments.

QTrader costs $75 per month and the Desktop web version is free. However, the version installed on the computer has more functionality. The advantage of CQG is that professional traders can use the program and perform the most complex tasks with it. However, a beginner is unlikely to be able to use it, he may need time to master it. In general, the web terminal and the computer application are similar to the Tinkoff. Investment service, so there should not be any big difficulties for an experienced trader. Terminal CQG QTRADER: https://youtu.be/HR8DVPRKGng

WaveBasis

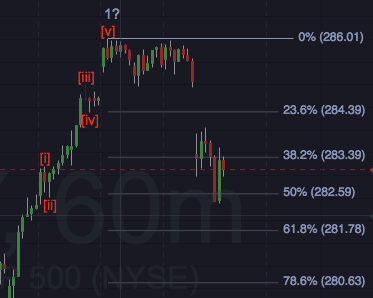

Web platform for technical analysis. Suitable for traders and wave analysts. With WaveBasis, you can get up-to-date information for doing business. The key features of WaveBasis are a wide range of tools (over 100 indicators and 35 tools) including a wave scanner and Elliott wave analysis. The platform supports more chart styles and has multiple chart layouts.

Fibonacci levels, automatic support and resistance zones, automatic wave summation and superimposition, automatic wave counting point are available in WaveBasis.

| Rate | Wave analyzes per month | Simultaneous schedules | Workspaces | Price |

| Random Trader | 250 | 6 | 3 | $49 |

| Trader | 1000 | twenty | 10 | $169 |

| Active trader | 2500 | 40 | twenty | $399 |

What can you invest in?

Before you start trading in China, you need to know which stocks and futures you can invest in. Below are stocks of popular Chinese companies:

| Company name | Listing | Description | share price |

| Alibaba | 9988 (SEHK) | Internet commerce company. Owns online stores taobao.com, Alibaba.com, Aliexpress | $16.52 |

| haier | 600690 (SSE) | Household appliance manufacturer | $4.73 |

| China Life Insurance Company Limited | 601628 (SSE) | Chinese insurance company | $4.79 |

| China Eastern Airlines | 600115 (SSE) | Airline, Shanghai | $0.84 |

| Huaxia Bank | 600015 (SSE) | Commercial Bank, Beijing | $0.89 |

| Bank of China | 3988 (SEHK) | Commercial Bank, Beijing | $0.49 |

| Air China | 3988 (SEHK) | Chinese national airline | $1.48 |

| Aokang | 603001 (SSE) | shoe company | $1.46 |

| Changchong | 8016 (SEHK) | Household appliance manufacturer | $0.53 |

| Lenovo | 0992 (SEHK) | Equipment manufacturer | $1.15 |

| TCL Corp | 000100 (SSE) | Equipment manufacturer | $1.00 |

Trading in China is not much different from that of other countries. Stock exchanges in China – Hong Kong and Shahnai. Of the programs, Mudrex is suitable. M1 Finance, CQG, WaveBasis. Shares of Chinese companies listed on the Shanghai and Hong Kong stock exchanges are not expensive, they are easy to buy, which is important for a novice trader.