The cryptocurrency market is in demand today. Many people want to make money by initially investing in virtual currency, and then concluding profitable deals. According to the current rules, a trader cannot open more than 10 positions per hour. This is enough for an average income, but if you need more, then you will have to look for workarounds. A robot for cryptocurrency exchanges will help you to conclude 2-3 thousand transactions in 60 minutes. This development has already been tested by tens of thousands of investors, and many of them were satisfied. The program will be able to analyze large amounts of information around the clock and increase earnings.

- What is a program for trading on a cryptocurrency exchange?

- What is a robot for?

- More about the types of cryptobots

- TOP-20 cryptobots for trading on crypto-exchanges that you need to know about

- Advantages and disadvantages of cryptobots

- How to use robots: tips from experts

- How to install a robot for a cryptocurrency exchange

What is a program for trading on a cryptocurrency exchange?

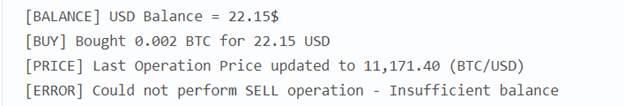

In trading, a trading robot is understood as a special platform, which is distinguished by the presence of its own operation algorithm. You can connect this add-on to your personal exchange account, but only if the platform you work on officially provides an API. In automatic mode, a trading bot for cryptocurrency collects, analyzes information and creates orders. The

Note! The above shows what issues and tasks the standard cryptocurrency bot primarily focuses on. He can either reject or accept offers – it all depends on the situation. The system may not analyze itself.

A programmer who develops an algorithm of actions usually sharpens a robot either for a universal or for a specific strategy, but there are certain nuances that cannot be dealt with. For example, software can make a decision based solely on indicators, prices, charts and other statistics. Such a program still does not work well with new conditions, since it can operate exclusively according to the established algorithm. When developing or buying a bot, it is important to keep this point in mind. The principle of the bot operation consists of the following elements:

- technical analysis;

- implementation of a certain scenario.

There are also some risks. Software can face fraudsters because it lacks emotional perception, critical thinking. If the program makes a deal with cybercriminals a couple of times, the investor will suffer losses. The robot does not always manage to accumulate income, so no one can guarantee that the income will grow with each month of using the bot. It is also worth noting that the program uses only technical analysis, it does not watch news, which can also affect the fall or rise of bitcoin.

What is a robot for?

Cryptocurrency trading robots are designed to save traders’ time. If a trader adheres to a working and simple strategy, then he will quickly be able to integrate and automate all transactions.

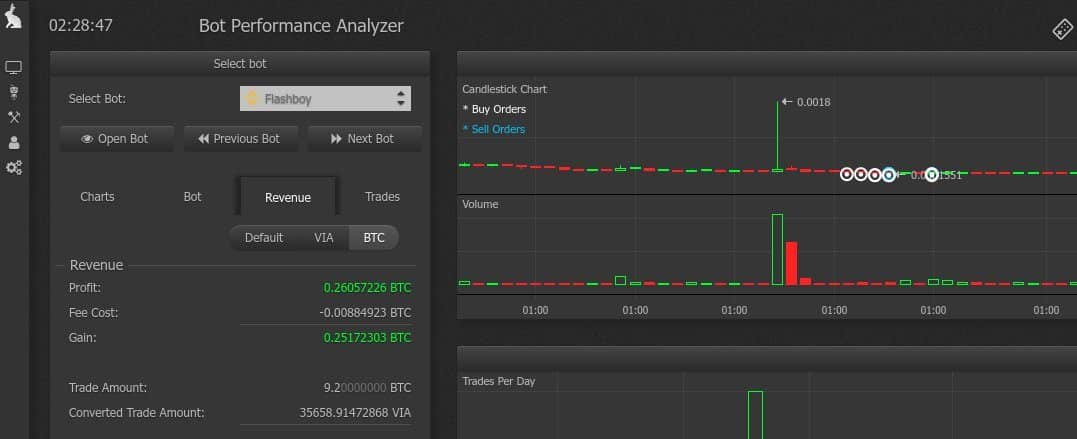

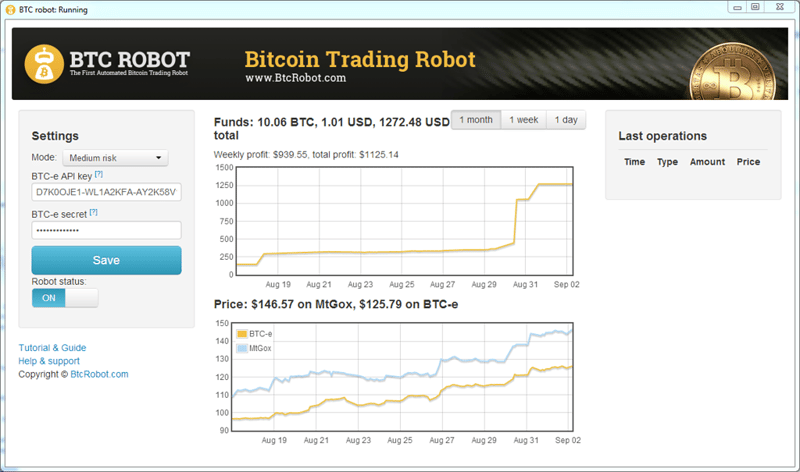

Important! Above is an example of how profitability might change according to market analysis. All this was done precisely with the help of a special trading robot.

Also, such an application is often used to diversify risks. In this case, the capital is divided into two accounts. One belongs to the program and the other belongs to the person. The software covers several times more trading pairs when it analyzes, and in the best case scenario, it will turn out to conclude more positive trades.

More about the types of cryptobots

Modern algorithms adapt to almost any strategy. As a rule, trading bots for crypto exchanges work almost around the clock, and below is a combination that activates the functionality with minimal “rest”.

- trend;

- indicator;

- indicatorless;

- scalping;

- arbitration;

- flat.

It is worth talking about each of these types in more detail. Trending programs are based on sharpening medium-term strategies. They constantly change the algorithm of actions, as they adjust to current trends. It has been proven that within 1-2 weeks the value of the asset increases significantly and along with this algorithm the user receives additional funds. Moving averages are applied to activate.

Interesting fact! When the lines manage to cross each other, the program receives a signal that it is time to sell or buy virtual currency.

Indicator robots are ideal for technical analysis. They collect information from indicators, analyze it and carry out operations. Typically, the system uses up to five instruments at a time. Indicatorless bots also carry out technical analysis, but they work exclusively with simple scenarios. For example, buying a currency is possible if the rate falls by 10% in less than 4 hours, and selling is possible if it increases by at least 5%. Scalping bots allow the user to earn money through minor fluctuations. Simple indicators are analyzed for forecasting. For example, the system can be guided by Bollinger Bands. Felt robots function on certain values. Only according to them the system will be able to decide whether it is necessary to buy a crypt or not. Indicators are manually adjusted by humans.Arbitration robots allow transactions to be carried out automatically and increase the percentage of profits. The software will allow you to earn more, since it is very difficult to carry out all this manually.

TOP-20 cryptobots for trading on crypto-exchanges that you need to know about

There are hundreds of different bots on the market now that allow traders and other investors to increase profits in the cryptocurrency market. Many of them managed to positively recommend themselves, so you can choose any of these twenty in order to automate work processes and not harm your own financial situation.

| Name | Description |

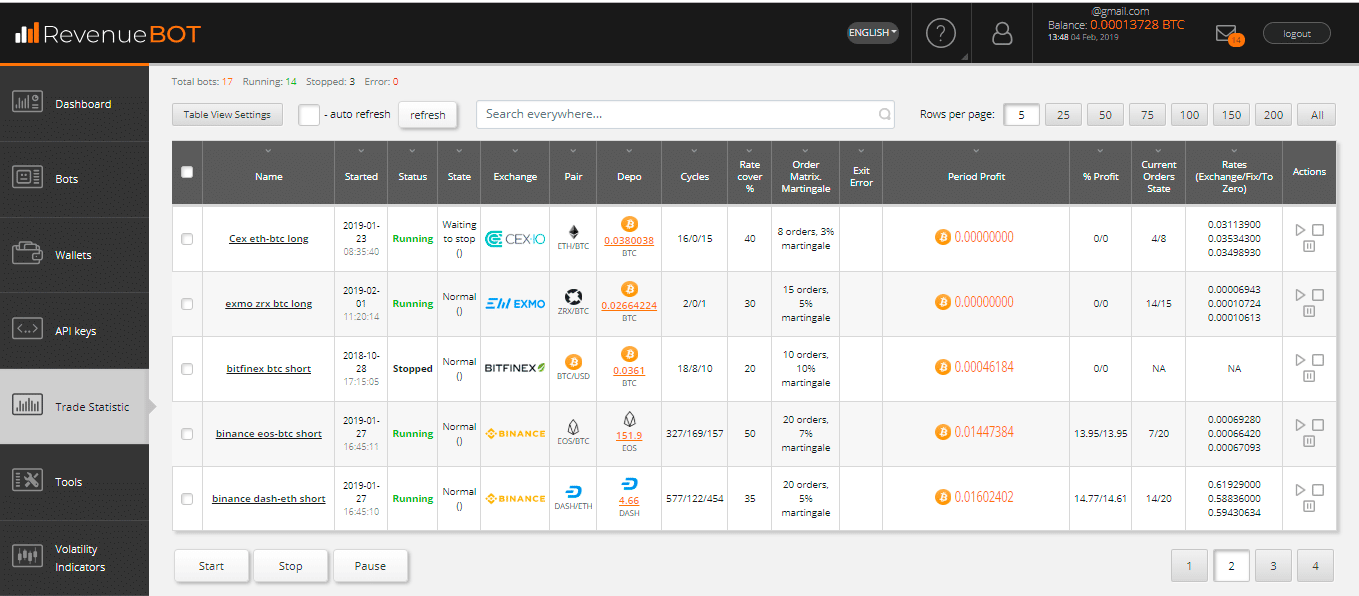

| RevenueBot | Offers free software and customization. You can set your own limits on income and loss. |

| Cryptorg | Another well-known cryptocurrency broker. With this program, you can simultaneously trade on several exchanges at once. |

| 3Commas | Quite a popular bot that allows you to buy and sell coins in one window, trade 24/7 and copy the settings of other bots in just one click. |

| Stratum bot | Provides prompt conclusion of deals 24/7 in automatic mode, but does not analyze news. |

| Zignaly | Quite popular cloud trading software that provides users with not only a bot, but also a whole platform for work absolutely free. |

| Botee trade | This software is quite flexible as it adapts to many popular strategies. The program is paid, but you can download a demo version and test it without any investment for 7 days. |

| Apitrade | Works only if there are ready-made strategies. You can purchase an entry-level or a professional bot level for a fixed price. |

| ByBit | It functions with such basic strategies as short, long and scalping. This program is not suitable for copyright work. |

| FTX | A cloud bot that does not require prior installation on a PC. The program is paid, you can buy it on the official website. |

| Stacked | Automatically buys currency at a low price and then sells it several times more expensive when a favorable rate appears. |

| Pionex | Provides more than 10 absolutely free robots that are suitable for retail earnings on cryptocurrency. |

| Quadency | It easily adapts to the wishes of the user, provides an automatic set of instruments, features extended charts and offers several types of trading at once. |

| Bitsgap | This is another popular bot that is used to manage crypto assets. It checks the settings before investing and can be used online without installing on a PC. |

| Mudrex | The program has an intuitive interface, always increases income, allows you to make a rational choice between risks and rewards. |

| Coinrule | Fully automated bot that works on all popular exchanges. It serves in real time, tests the system, analyzes the data collection. |

| HaasOnline | On this platform, you can connect 15 bots at once, which increases the user’s potential earnings. Proposed means of protection, insurance, 50 indicators for daily use. |

| Shrimpy | Another free bot that makes crypto trading easy. It improves productivity and minimizes the risk of losing your portfolio and all funds. With it, you can implement copyright strategies. |

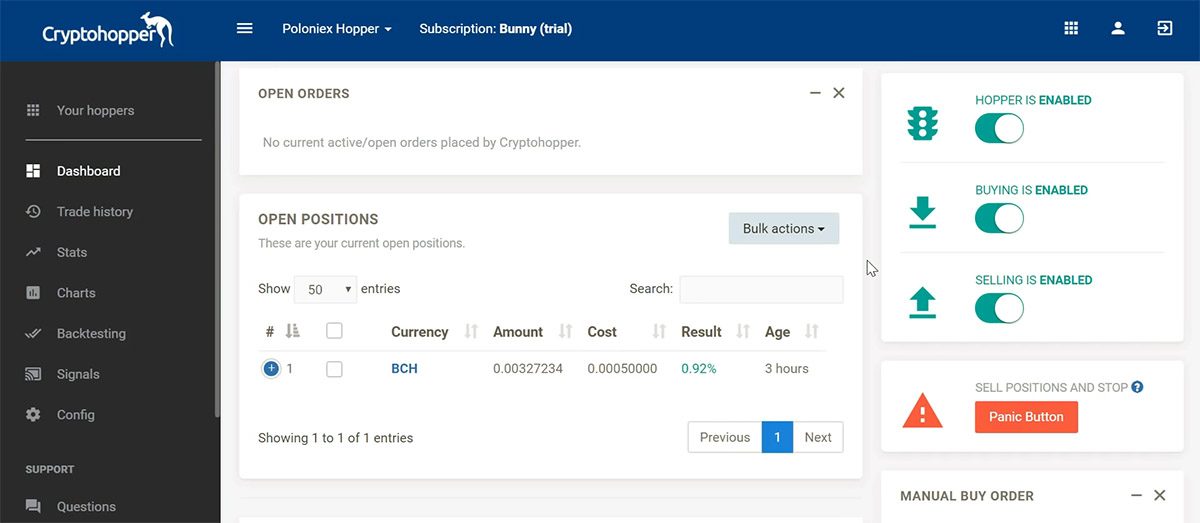

| Cryptohopper | With the help of this bot, it is possible to automatically manage all accounts in one place, carry out individual technical analysis and secure protocols. |

| Tradesanta | This is a free and practical bot that will allow the user to work with crypt practically without risks, choose the appropriate strategy and set a certain amount for urgent withdrawal of money to the account. |

| NapBots | Suitable for short and long trades, guarantees round the clock support, offers a large selection of templates that were preinstalled on the PC along with the program. |

Advantages and disadvantages of cryptobots

Of course, robots for trading on a cryptocurrency exchange cannot replace a trader by 100%, but this is an excellent assistant that can automate most of the work processes.

| Advantages | disadvantages |

| Good scalability | Takes 50% of the profits |

| High level of software accuracy | There are unprofitable risks |

| Automatic conclusion of transactions | You will have to pay a commission for using a bot developed by a programmer |

| There is no emotional pressure | The strategy stops working with a large number of losing trades |

| There is practically no chance of missing a great offer | Minimum percentage of working robots |

| Getting regular passive income | No assessment of news and market trends |

| Minimal time expenditures for registration of transactions and market analysis | Algorithm testing takes a long time |

Each potential user of the program must personally decide for himself whether a bot is suitable for him or whether it is better to do without automation so as not to overpay. There is no one-size-fits-all answer. You should conduct an analysis of the market, your own needs, in order to understand which option will be more profitable.

How to use robots: tips from experts

You can create a trading robot yourself for the cryptocurrency exchange or buy a ready-made one. There are also free options on the market for newbies. Programs are being implemented on exchanges according to the following algorithms:

- promised profitability;

- deposit protection system;

- the cost of the advisor;

- a liquidity provider;

- functional settings;

- developer promises.

The user can configure the robot to work around the clock or only for certain hours – it all depends on what functionality he wants to get. The bot automatically concludes transactions, transfers funds. You just need to connect it to your account on the exchange with just a few clicks. Bot for trading on the cryptocurrency exchange: pros and cons, peculiarities of trading bots in cryptocurrency: https://youtu.be/og-IrKFstC4

How to install a robot for a cryptocurrency exchange

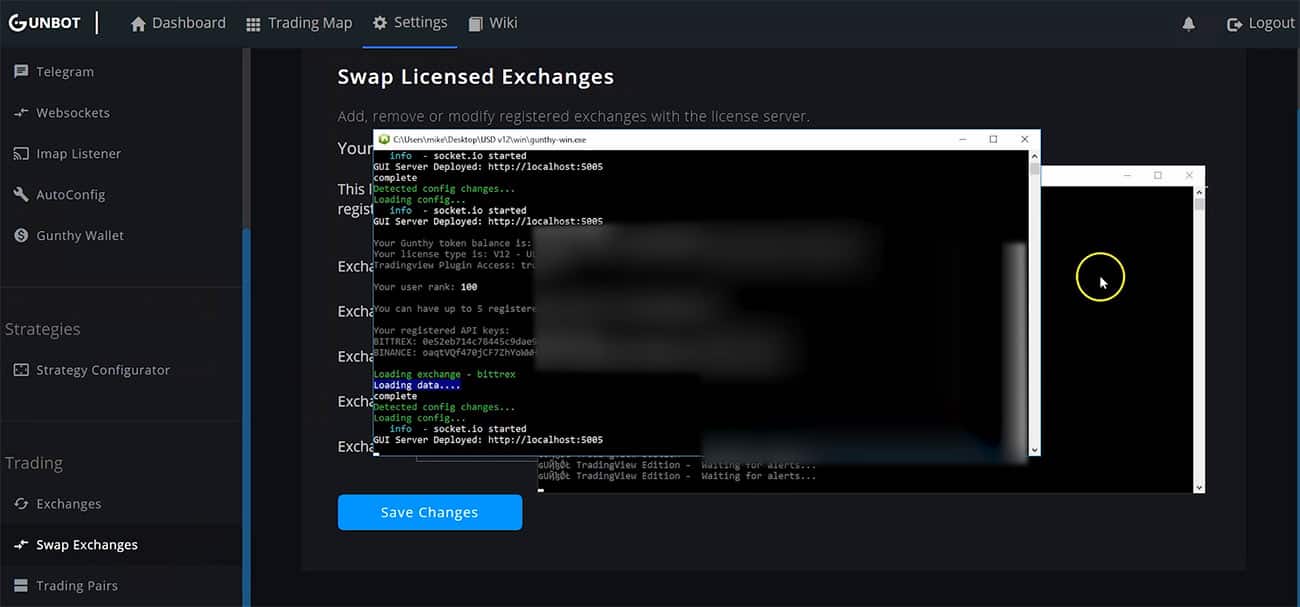

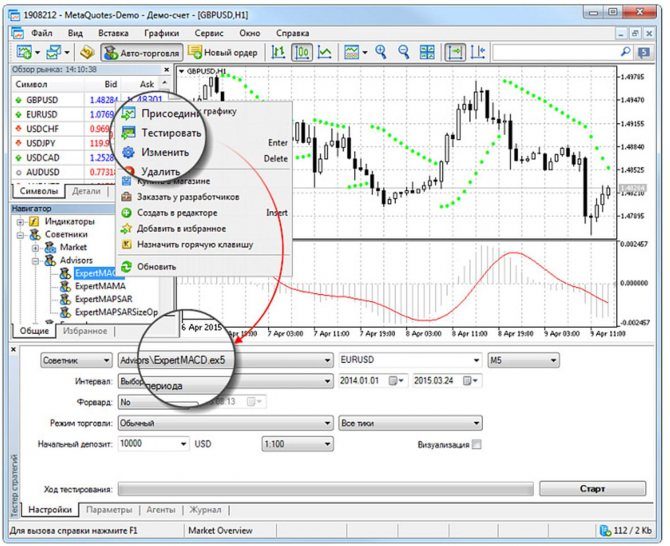

First you need to learn the language of trade. Some bots are universal, while others only use dump, pump or correction. Usually even beginners know all these terms, so it shouldn’t take a lot of time to find the right one. When you decide on a bot, you need to either buy and install it on your PC, or connect it online for free to your account on the exchange where you work. The next step is to configure the cryptorg trading bots.

- DCA level;

- a grid of orders;

- stop loss;

- take profit;

- som.

These are important parameters that can be edited as needed. Paid bots with great functionality offer advanced features. It is important to pay attention to the fact that any software is not trained in fundamental analysis of the market situation. Everything happens only superficially, as the program focuses on technical parameters.