The cryptocurrency market is now in demand. Many want to earn money by initially investing in virtual currency, and then concluding profitable deals. According to the current rules, a trader cannot open more than 10 positions per hour. This is enough for an average income, but if you need more, then you have to look for workarounds. A robot for cryptocurrency exchanges will help you to conclude 2-3 thousand transactions in 60 minutes. This development has already been tested by tens of thousands of investors, and many of them were satisfied. The program will be able to analyze large amounts of information around the clock and increase earnings.

- What is a program for trading on the cryptocurrency exchange?

- What is a robot for?

- More about the types of cryptobots

- TOP 20 crypto bots for trading on crypto exchanges that you need to know about

- Advantages and disadvantages of cryptobots

- How to use robots: tips from experts

- How to install a robot for a cryptocurrency exchange

What is a program for trading on the cryptocurrency exchange?

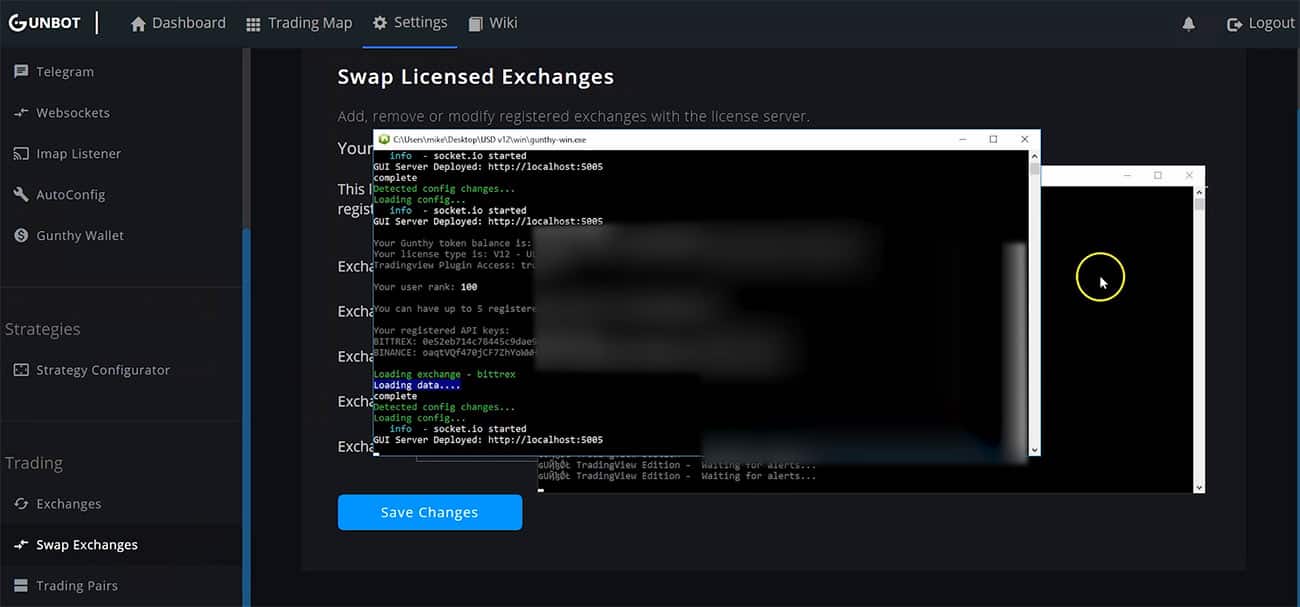

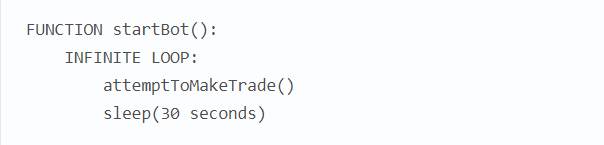

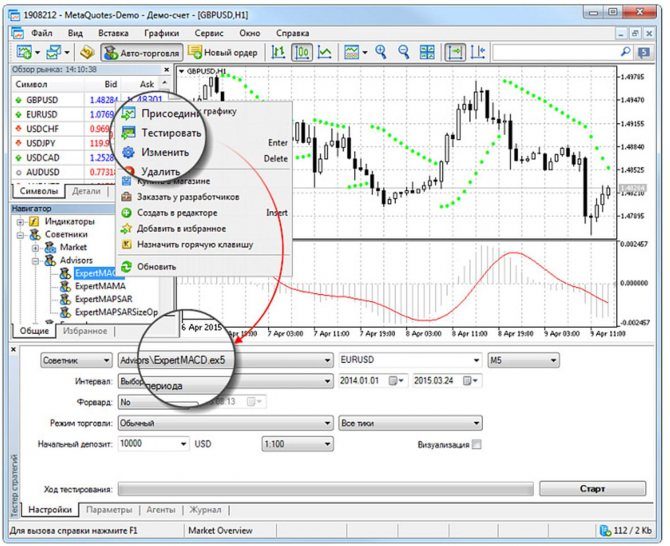

In trading, a trading robot is understood as a special platform, which is distinguished by the presence of its own work algorithm. You can connect this add-on to your personal exchange account, but only if the site you work on officially provides an API. In automatic mode, a cryptocurrency trading bot collects and analyzes information and creates orders.

Note! The above shows what questions and tasks the standard cryptocurrency bot is primarily focused on. He can both reject and accept offers – it all depends on the situation. The system may not analyze itself.

A programmer who develops an action algorithm usually sharpens the robot either for a universal or for a specific strategy, but there are certain nuances that cannot be dealt with. For example, software can make a decision based solely on indicators, prices, charts, and other statistics. Such a program still does not work well with the new conjuncture, since it can only act according to the algorithm laid down. When developing or buying a bot, it is important to consider this point. The principle of operation of the bot consists of the following elements:

- technical analysis;

- implementation of a certain scenario.

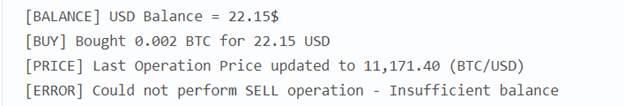

There are also some risks. Software can run into scammers because it does not have emotional perception, critical thinking. If the program makes a deal with the attackers a couple of times, the investor will suffer losses. The robot does not always manage to accumulate income, so no one can guarantee that the income will grow with each month of using the bot. It is also worth noting that the program uses only technical analysis, it does not view the news, which can also affect the fall or rise of bitcoin.

What is a robot for?

Cryptocurrency trading robots are designed to save traders time. If a trader adheres to a working and simple strategy, then he will quickly be able to integrate and automate all transactions.

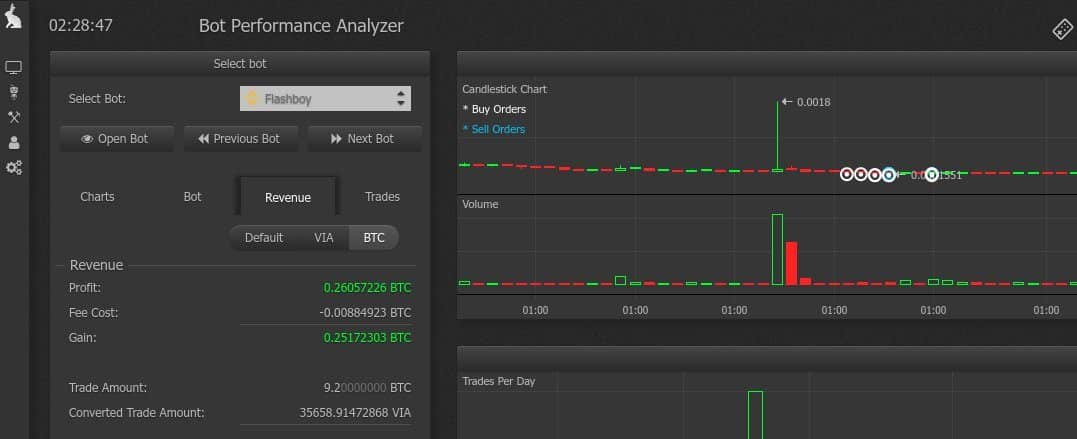

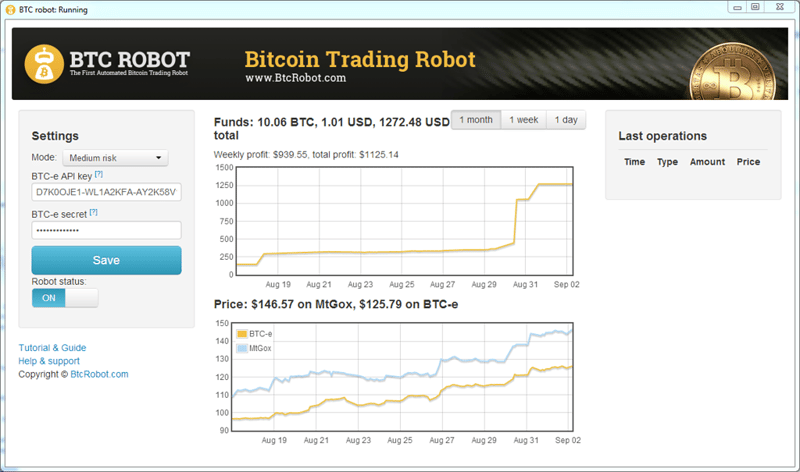

Important! Above is an example of how returns can change according to market analysis. All this was done with the help of a special trading robot.

Also, such an application is often used to diversify risks. The capital in this case is divided into two accounts. One belongs to the program, and the second belongs to the person. The software covers several times more trading pairs when it analyzes, and in the best case, it will be possible to conclude more positive trades.

More about the types of cryptobots

Modern algorithms adapt to almost any strategy. As a rule, crypto exchange trading bots work almost around the clock, and below is a combination that activates the functionality with minimal “rest”.

- trendy;

- indicator;

- non-indicator;

- scalping;

- arbitration;

- flat.

It is worth talking about each of these types in more detail. Trend programs are based on sharpening for medium-term strategies. They constantly change the algorithm of actions, as they adapt to current trends. It has been proven that within 1-2 weeks the value of the asset grows noticeably, and along with this algorithm, the user receives additional funds. Moving averages are applied for activation.

Interesting fact! When the lines manage to cross each other, the program receives a signal that it is time to sell or buy virtual currency.

Indicator robots are ideal for technical analysis. They collect information from indicators, analyze it and carry out operations. Typically, the system uses up to five tools at a time. Non-indicator bots also perform technical analysis, but work exclusively with simple scenarios. For example, buying a currency is possible if the rate falls by 10% in less than 4 hours, and selling is possible if it increases by at least 5%. Scalping bots allow the user to earn through minor fluctuations. Simple indicators are analyzed for forecasting. For example, the system can focus on Bollinger Bands. Felt robots function from certain values. Only by them the system will be able to decide whether to buy a crypt or not. Indicators are manually adjusted by a human. Arbitrage robots allow you to conduct transactions automatically and increase the percentage of profits. The software will allow you to earn more, since it is very difficult to do it all manually.

TOP 20 crypto bots for trading on crypto exchanges that you need to know about

You can now find hundreds of different bots on the market that allow traders and other investors to increase profits in the cryptocurrency market. Many of them have managed to positively recommend themselves, so you can choose any of these twenty in order to automate work processes and not harm your own financial situation.

| Name | Description |

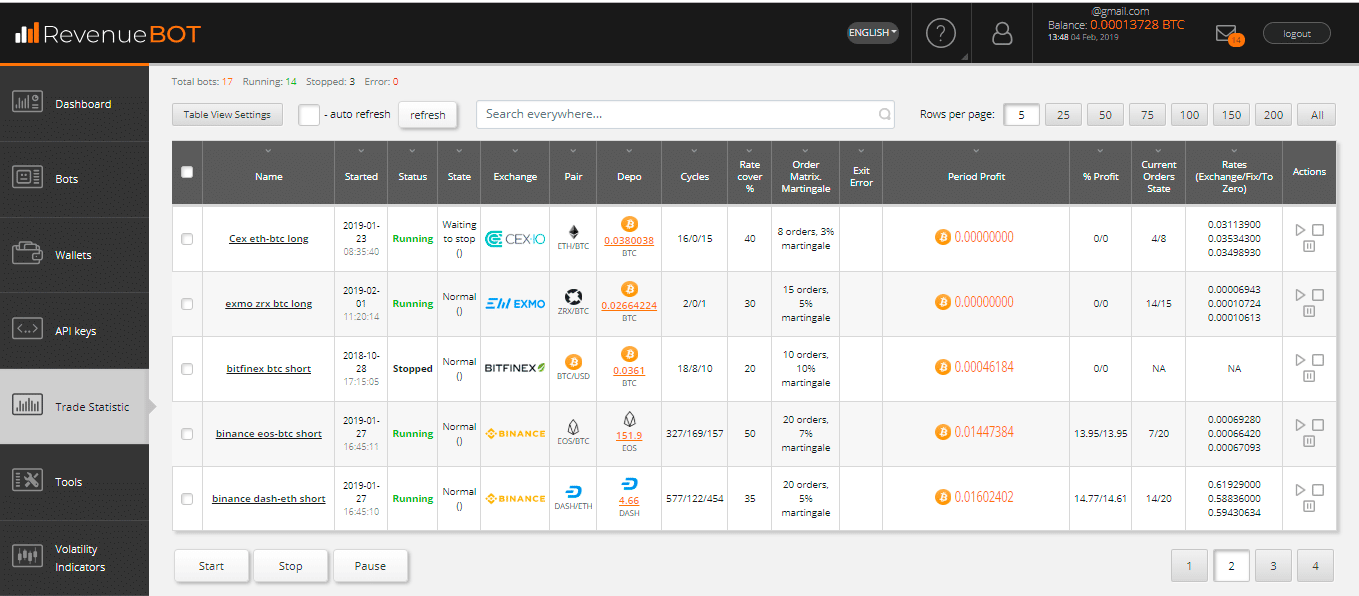

| revenuebot | Offers free software and customization. You can set your own profit and loss limits. |

| Cryptorg | Another well-known cryptocurrency broker. With this program, you can simultaneously trade on several exchanges at once. |

| 3Commas | A fairly popular bot that allows you to sell and buy coins in one window, trade 24/7 and copy the settings of other bots in just one click. |

| Stratum Bot | Provides prompt conclusion of transactions 24/7 in automatic mode, but does not analyze news. |

| Zignaly | A fairly popular cloud trading software that provides users with not only a bot, but also a whole platform to work absolutely free of charge. |

| Bote Trade | This is a fairly flexible software, as it adapts to many popular strategies. The program is paid, but you can download a demo version and test it without any investment for 7 days. |

| apitrade | It works only if there are ready-made strategies. You can purchase an entry-level or professional level bot for a fixed price. |

| ByBit | It works with such basic strategies as short, long and scalping. This program is not suitable for copyright work. |

| FTX | A cloud bot that does not require pre-installation on a PC. The program is paid, you can buy it on the official website. |

| stacked | Automatically buys currency cheaply and then sells it several times more expensive when a favorable rate appears. |

| Pionex | Provides more than 10 absolutely free robots that are suitable for retail earnings on cryptocurrency. |

| Quadency | Easily adapts to the wishes of the user, provides an automatic set of tools, features advanced charts and offers several types of trading at once. |

| Bitsgap | This is another popular bot that is used to manage crypto assets. It checks the settings before starting to invest and can be used online without installing on a PC. |

| Mudrex | The program has an intuitive interface, always increases income, allows you to make a rational choice between risks and rewards. |

| coinrule | Fully automated bot that works on all popular exchanges. It provides real-time service, system testing, data collection analysis. |

| HaasOnline | On this platform, you can connect 15 bots at once, which increases the potential earnings of the user. Proposed means of protection, insurance, 50 indicators for daily use. |

| Shrimpy | Another free bot that makes crypto trading easy. It improves performance and minimizes the risk of losing the portfolio and all funds. With it, you can also implement authoring strategies. |

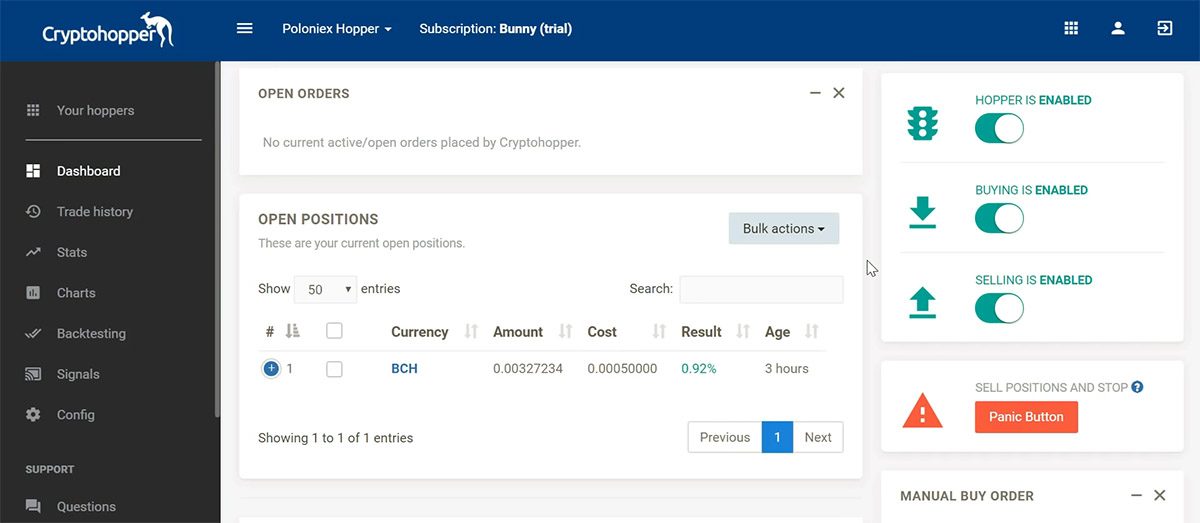

| Cryptohopper | With the help of this bot, it is possible to automatically manage all accounts in one place, conduct individual technical analysis and secure protocols. |

| Tradesanta | This is a free and practical bot that will allow the user to work with crypto with virtually no risk, choose the appropriate strategy and set a certain amount for urgent withdrawal of money to the account. |

| NapBots | Suitable for short and long trades, guarantees round-the-clock support, offers a large selection of templates that were pre-installed on the PC along with the program. |

Advantages and disadvantages of cryptobots

Of course, robots for trading on the cryptocurrency exchange cannot replace a trader 100%, but this is an excellent assistant that can automate most of the work processes.

| Advantages | Flaws |

| Good scalability | Takes 50% of the profit |

| High level of software accuracy | There are downside risks |

| Automatic conclusion of transactions | You will have to pay a commission for using a bot developed by a programmer |

| No emotional pressure | The strategy stops working with a large number of losing trades |

| Virtually no chance of missing out on a great deal | Minimum percentage of working robots |

| Getting regular passive income | No assessment of news and market trends |

| Minimum time spent on transactions and market analysis | It takes a lot of time to test the algorithm |

Each potential user of the program must decide for himself whether the bot suits him or it is better to do without automation so as not to overpay. There is no one universal answer for everyone. You should analyze the market, your own needs, in order to understand which option will be more profitable.

How to use robots: tips from experts

You can create a trading robot yourself for a cryptocurrency exchange or buy a ready-made one. There are also free options on the market for beginners. Programs are implemented on exchanges according to the following algorithms:

- promised return;

- deposit protection system;

- adviser cost;

- liquidity provider;

- settings functionality;

- developer promises.

The user can set the robot to work around the clock or only certain hours – it all depends on what functionality he wants to get. The bot automatically concludes transactions, transfers funds. You just need to connect it to your exchange account in just a few clicks. Bot for trading on the cryptocurrency exchange: pros and cons, features of trading by bots in cryptocurrency: https://youtu.be/og-IrKFstC4

How to install a robot for a cryptocurrency exchange

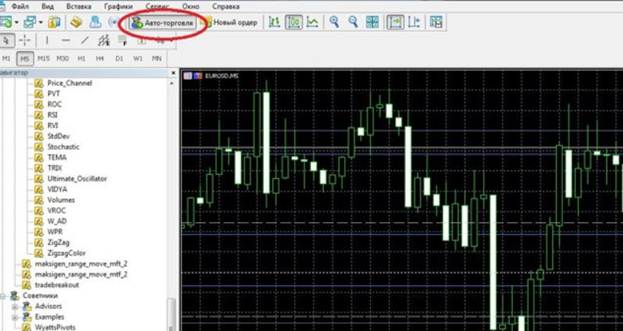

First you need to learn the language of trade. Some bots are universal, while others only use dump, pump or correction. Usually even beginners know all these terms, so it should not take much time to select the right option. When you decide on a bot, you need to either buy it and install it on a PC, or connect it online for free to an account on the exchange where you work. The next step is to set up cryptoorg trading bots.

- DCA level;

- grid of orders;

- stop loss;

- take profit;

- som.

These are important parameters that you can edit if necessary. Paid bots with more functionality offer advanced features. It is important to pay attention to the fact that any software does not learn fundamental analysis of the market situation. Everything happens only superficially, as the program focuses on technical parameters.