VTB Capital Investments – brokerage services, mobile application – terminal and robot connection, tariffs for 2022. VTB Capital Investments is a strategic direction under the control of a broker, through the service of which the financial organization VTB PJSC provides investment services to clients regarding various aspects of investment activities on various stock exchanges.

- Official website of VTB Investments: interface and basic information

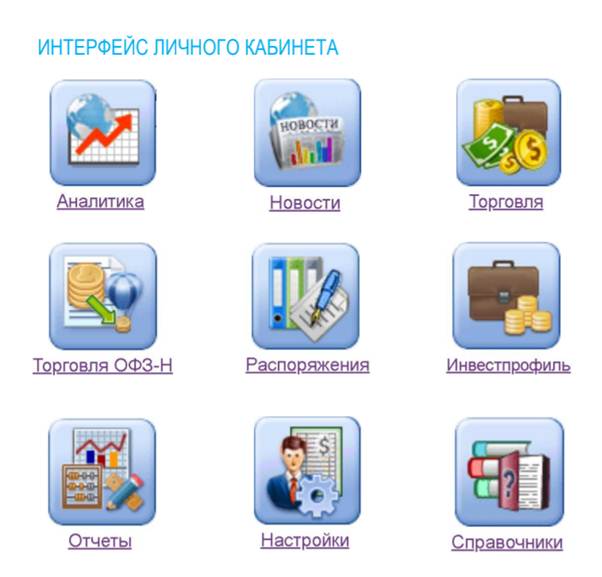

- Platform Interface

- The main functionality of the mobile application “VTB My Investments”

- Benefits of the VTB My Investments mobile app

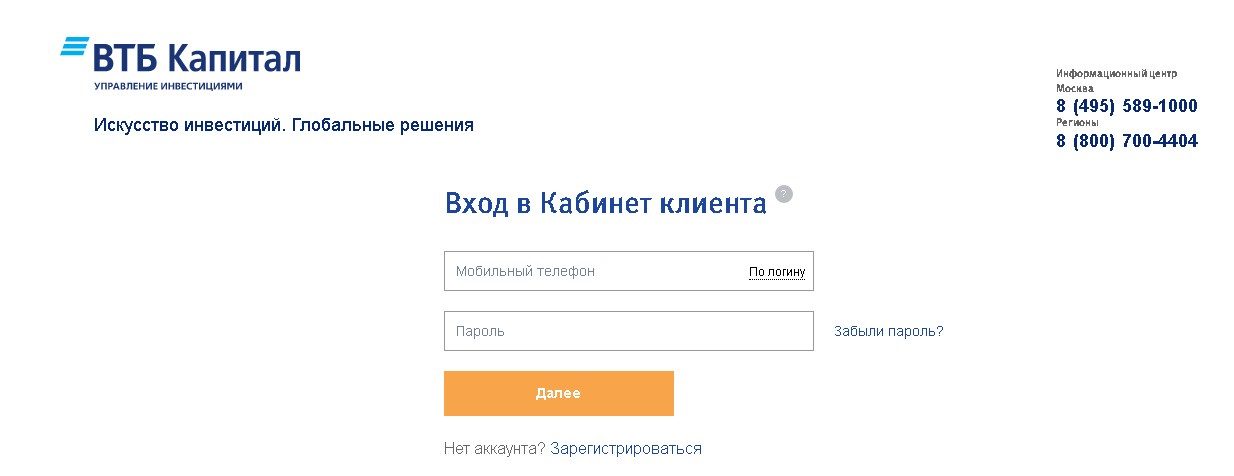

- Personal account: how to register in the system and create a profile

- Tariff programs at VTB Investments – how much does brokerage service cost

- General conditions for tariff plans

- QUIK trading terminal on the VTB investment platform

- Trading robot-adviser VTB Investments: what is it and what is it for

- Questions and answers to frequently asked questions about VTB Investments

Official website of VTB Investments: interface and basic information

Since the organization “VTB Bank” is one of the largest financial and credit companies in the Russian Federation, the institution makes every effort to ensure that customers are satisfied with the services provided. All the basic and necessary information for users is located on the official platform of the organization https://www.vtbcapital.ru/investments/. Not so long ago it was replenished with a new section – investment. Here is collected information on the main conditions for the placement of capital for the purpose of making a profit by individuals.

Platform Interface

- The site was developed by professionals and has convenient and practical navigation through sections. The interface is bright, but unobtrusive, intuitive. Several main sections and tabs are devoted to the activities and functioning of the bank, from which you can learn the history of the company and what is the specifics of its work.

- Clients cooperating with VTB Bank to carry out investment activities should pay attention to the section that contains a list of investment services provided by the bank. It details in detail what services the financial and credit organization is ready to offer to the client, what documents will be required for registration and what are their benefits. In addition, here the user will be able to figure out what mutual funds are, what is their meaning, and also why this is the most profitable option for investing capital.

- For novice investors, the platform regularly holds lectures and training seminars, the schedule of which can also be found on the official platform.

Note! Each user can undergo training, even if he is not going to engage in investment activities.

VTB Bank offers its clients a convenient format for investment activities – a mobile online application – you can download it at https://www.vtb.ru/personal/investicii/#onboarding. Login to the personal account of VTB my investments at the link https://online.vtb.ru/login:

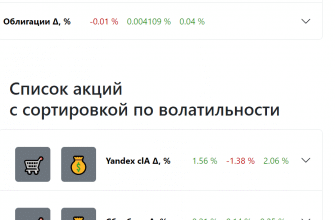

The main functionality of the mobile application “VTB My Investments”

A larger number of VTB Bank clients manage their investments and, in principle, engage in investment activities through a mobile exchange trading terminal. It is affordable and practical, as the device is always at hand.

- Main page . The landing page contains the total value of a set of financial instruments, a list of open accounts and the current price of the main assets. At the bottom of the display is a section with current news and analytical data regarding the investment environment.

- Trade equipment . Here are some interesting ideas that can be applied in the process of planning the purchase of a new financial asset. For greater practicality, ideas are categorized, and the user can additionally sort them by date and level of possible income.

- Virtual interlocutor . This is a robotic technical support that will help find answers to customer questions.

- financial market . The main section of the mobile application, where all work with capital, investments and other financial instruments takes place. In it you can find the name of financial assets, their current price at the moment, the current exchange rate and other important information for work, which can be opened in an additional separate tab – charts, history of financial transactions, number of trades, etc., so as not to block the main data.

- Other . Last but not least section. It contains all information about the client, namely full name, consent number, notifications and basic settings.

Benefits of the VTB My Investments mobile app

The mobile program “VTB My Investments” is much more convenient to use than a personal account on the official website of the company. The smartphone is always at hand, one click – and you are on the main screen of your profile. However, the application has some differences from the official site, which concern not only the interface and design.

Consider the strengths of the mobile program:

- The mobile app is open 24/7. If the official site can sometimes go for technical checks and improvements, then access to your personal account in the mobile program is available at any time. All you need is a stable internet connection and an updated version of the app. Note! If the program requires an update, install it as soon as possible. The outdated version may freeze and crash when you try to perform some action.

- The mobile app interface is simple and intuitive. All sections are in sight and collected in a convenient place.

- The developers have implemented a system of protection and security in the program. Now the user can protect his profile and information by setting a fingerprint, password or Face ID, which the system will require when entering the platform.

- Every day, the latest news in the investment world and its analytics are updated and appear in the appropriate section.

- The mobile application “VTB My Investments” contains an interesting section – investor ideas. After reading them, the user can take into account the opinion of experienced professionals and apply new knowledge in practice.

The mobile service has been installed by active users over 60,000 times. The program is really convenient and practical for investment activities, because it is available at any time of the day and is always at hand. The developers, in turn, regularly update it, fixing the bugs of previous versions and implementing the functions desired by users. However, in order to start investing, investing money or trading in financial instruments, the user must go through the registration procedure in the VTB Investments personal account. VTB Investments: Overview of the VTB broker, open an account or not: https://youtu.be/klRa8cLXrdo

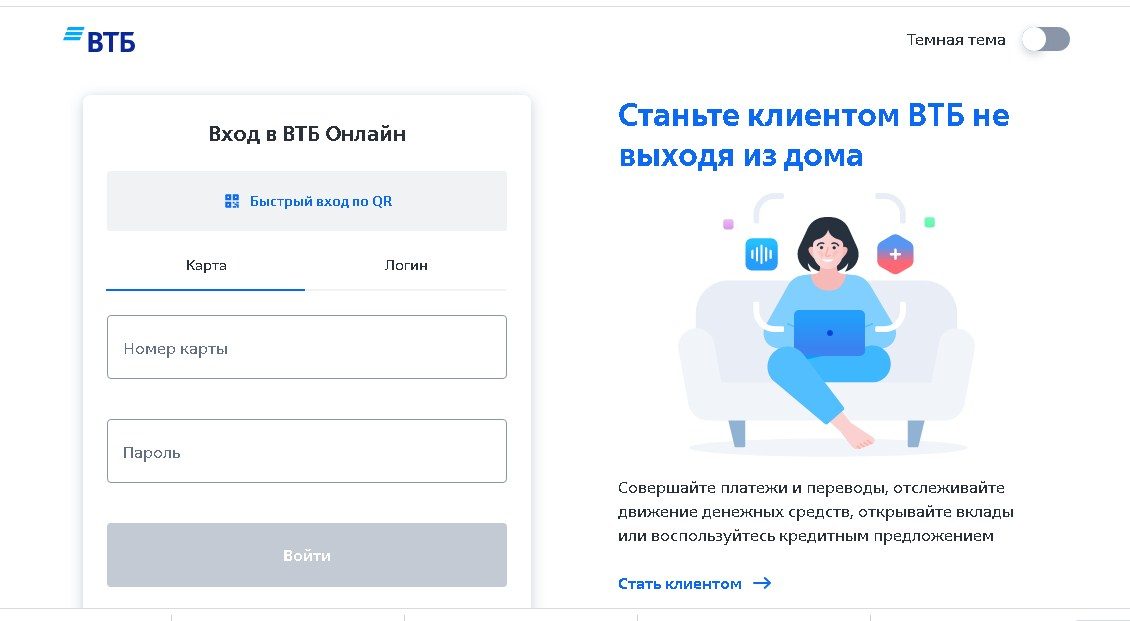

Personal account: how to register in the system and create a profile

VTB Investments personal account is an exchange trading terminal through which investors and financial market participants can interact with the stock exchange. Access to your personal account can be obtained both through the official website of VTB Bank, having a stable connection point to the network, and in a mobile application, having installed it on a smartphone in advance through the appropriate game store – App Store for iPhone users or Google Play for users of OS-led devices Android. The application is compatible with both operating systems. All financial transactions carried out in the account take place in real time. But before starting investment activity, it is necessary to go through the registration procedure in the system. You can log in and set up a client profile in the VTB Investments system as follows:

- Go to the official website of VTB Investments and find the section for registering your personal account https://online.vtbcapital-am.ru/auth/ or, if you decide to use the mobile application, install it on your smartphone in advance and log in to register.

- Fill out the form with the required information:

- surname, name and patronymic;

- individual taxpayer number;

- basic passport data;

- date of birth;

- mobile phone number and e-mail address;

- passphrase.

- Click on the “Register” button. In a moment, the platform will open your new profile, which will be easy to set up. It is enough to go to the “Settings” section and go through the available tabs, adjusting the necessary parameters.

Tariff programs at VTB Investments – how much does brokerage service cost

If a client opened an account with a broker or an individual investment account with VTB Investments after July 1, 2019, the system will automatically assign the My Online tariff plan to him. If one of the accounts is opened after August 9, 2021 through the VTB My Investments mobile application or through the official website of VTB-Online, the tariffs are distributed as follows:

- If one of the privileged tariffs (“Privilege”, “Privilege NEW” or “Privilege-Multicard”) is activated, the “My Online Privilege” program is automatically activated.

- If one of the Prime tariffs (“Prime”, “Prime NEW”, “Prime Plus”) is connected, the “My Online Prime” tariff plan is automatically connected.

General conditions for tariff plans

The broker of the financial company VTB (https://broker.vtb.ru/) has three brokerage service packages available, each of which contains two programs – one for beginners, the other for professional investors. The conditions for brokerage services at VTB Bank are the same for all tariff programs:

| Parameter | Condition |

| 1 ruble per contract | Payment to the exchange assistant for services in the course of operations on the derivatives exchange |

| From 0.15% of total capital | The program applies to transactions outside of exchange trading |

| Replenishment of brokerage and investment individual accounts | Free of charge if the VTB account is replenished not from payment plastic instruments of other banking organizations |

| Withdrawal of funds | Free, no commission fee |

| Platform fee for transactions with securities | From 0.01% of the total transaction amount |

| Exchange commission for currency transactions | From 1 to 50 rubles per transaction |

https://youtu.be/Cnc7rhojgWw

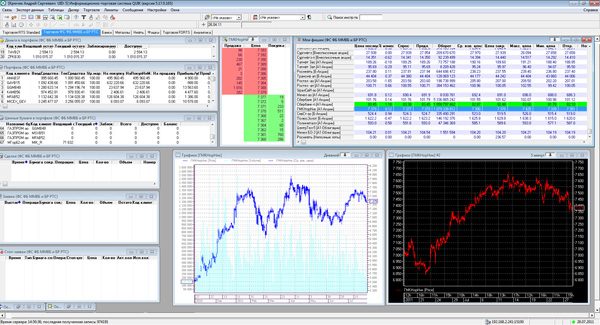

QUIK trading terminal on the VTB investment platform

The VTB broker allows clients to carry out transactions and financial transactions on the stock exchange through the trading terminal – QUIK_VTB. This is a multifunctional platform, which is significantly different from the mobile application “VTB My Investments” and is more suitable for active experienced investors who have access to numerous stock exchanges of the Russian Federation.

- access to trading on the stock exchange and derivatives market is carried out through the CAM module (conditional access module);

- the terminal cooperates with technical analysis, numerous databases and has access to expert systems and accounting systems;

- Client requests are fulfilled in accordance with all conditions in the shortest possible time.

Access to this trading exchange terminal is provided to the client free of charge.

Interesting! The platform processes up to 3 cash transactions per second.

To start trading through the QUIK exchange terminal provided by VTB Bank:

- sign the consent to the brokerage service;

- install the QUIK trading exchange terminal on your device;

- run the distribution;

- install the file on your computer, go through the procedure of generating access keys, and then save them in the bank.

https://articles.opexflow.com/software-trading/torgovyj-terminal-quik.htm New investors will find it more convenient to conduct their investment activities through a mobile-friendly service than through a professional exchange brokerage terminal. However, if your task is to study the topic of investment as deeply and fully as possible, then the QUIK platform will be an excellent assistant in this matter.

Trading robot-adviser VTB Investments: what is it and what is it for

The robotic bank assistant of the VTB banking organization is available to all customers of the company, regardless of the chosen tariff program. The services of a robo-advisor are obligatory and free of charge in the investment activity of each trader and participant in exchange trading.

investment portfolio at the first stages, and will also give useful advice on actions in the management of financial instruments. After the investment profile is set and formalized, determine the purpose for which the portfolio will be formed:

- large-scale purchase;

- financial airbag;

- pension;

- investing as gaining new knowledge and additional occupation.

Based on your goal, the robot will make a list of recommendations for managing securities and other financial instruments.

Note! It is not necessary to follow the recommendations of the robotic assistant. You can reject all or part of the offers and follow your own planned plan.

The adviser controls the state of financial investment instruments and the portfolio and will periodically give practical advice on what to do with securities. For example, to acquire additional assets or, conversely, to sell them. In addition, the platform has a convenient function – the choice of strategy. The client passes a test to determine the investment portfolio, after which the advisor robot offers to choose one of the five available strategies:

- conservative – work with bonds;

- standard – 70% bonds, 30% shares;

- balanced – work with stocks and bonds is divided equally;

- strong – 70% stocks, 30% bonds;

- to the maximum – work only with shares.

Investment portfolios that were formed based on the recommendations of the robotic system show an average return of up to 20% per annum.

Note! It is important to understand that previous returns do not guarantee that the next returns will be the same. The higher you want to raise your income, the higher the risk of a drawdown in your investment portfolio.

Questions and answers to frequently asked questions about VTB Investments

How to get access to a personal account of a VTB Investment client? Each user can go through the registration procedure by choosing one of the most convenient options:

- through the mobile application “VTB My Investments” or the official website;

- in the agents department;

- VTB Capital Pension Reserve branch.

The personal account is open to all clients and work in it is free.

What is required to purchase shares? To purchase shares, you must specify:

- number and date of the executed application for the purchase of the fund;

- information about the selected fund.

What is the commission fee for investing in an open-end mutual fund? When investing in a mutual fund, the following commissions are charged:

- premium – a fee that increases the price of a share upon acquisition;

- discount – a commission that reduces the price of a share upon redemption.

It is important to note that there is no commission fee when exchanging shares.