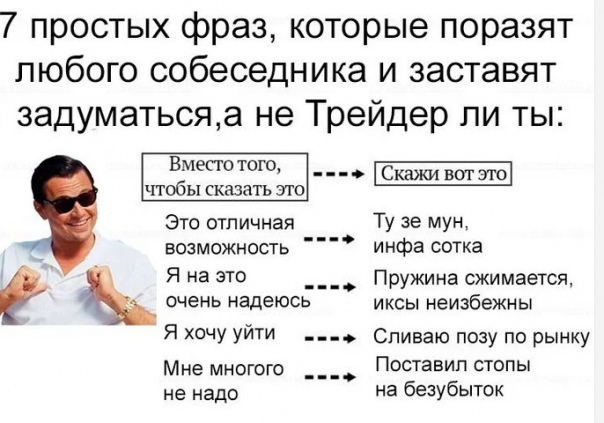

The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. A non-boring trader’s dictionary, basic exchange terms and concepts, terminology and decoding of their designations. How to drive a non-trader’s interlocutor into a dead end. Several “funny” stock exchange terms. Who can decipher the maximum without “G” or “I” and without reading the rest of the article? Byzedip, highball, unpriced, Uncle Kolya, sit on the fence, dolls, native, buy on high. Go in the comments?!

10 seconds of seriousness: analysis of vocabulary based on in-depth interviews with real practicing traders allows us to conclude that the semantic field of expert traders is richer compared to beginners (specific words, terminology).

Trader’s Dictionary in simple words

Trader’s vocabulary and stock terminology includes many terms and concepts that are used in the financial industry and stock markets. They help traders and investors understand and describe various aspects of trading, analysis and risk management. Some of the key terms in a trader’s vocabulary include:

- Shares : shares of companies that are traded on a stock exchange.

- Dividends : Payments companies make to their shareholders from their profits.

- Bonds : Debt instruments that companies or governments issue to raise additional funds.

- Derivatives : financial instruments created on the basis of an underlying asset such as shares, currencies or commodities.

- Lots : units in which financial instruments are traded on an exchange.

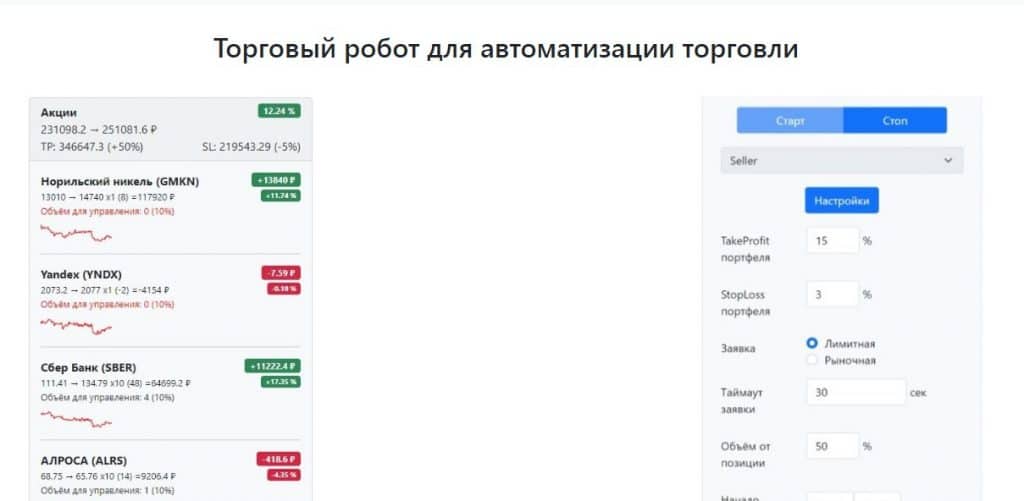

- Stop Loss : An order that is used to limit losses in the event of an adverse price movement of an asset.

- Take Profit : An order that is used to take profit when the price of an asset reaches a certain level.

Exchange terminology includes terms related to various order types, asset price movements, chart analysis, and technical indicators. For example:

- Limit Order : An order that sets a maximum price to buy or a minimum price to sell an asset.

- Market Order : An order that requires immediate execution and buys or sells an asset at the current market price.

- Candlestick Chart : A type of chart that displays price data in the form of candlesticks and allows traders to analyze trends and price behavior.

- Support and Resistance : Price levels at which assets tend to slow down or change direction in price movement.

- RSI (Relative Strength Index) : A technical indicator that shows the relative strength or weakness of an asset and helps identify overbought and oversold levels.

These are just some examples of what can be found in a trader’s dictionary and stock market terminology. It is important to remember that these terms and concepts continue to evolve over time, and traders must stay abreast of new trends and changes in the industry.

These are just some examples of what can be found in a trader’s dictionary and stock market terminology. It is important to remember that these terms and concepts continue to evolve over time, and traders must stay abreast of new trends and changes in the industry.

What was OpexBot muttering about terms and concepts?

Who could not restrain themselves and decided to find out what these abstruse stock exchange terms and concepts mean? Buy the dip (buy the dip) – buying shares during a drawdown – a sharp drop in price. Highball is an attempt to sell an asset at an unreasonably high price; the term is especially popular among crypto traders. And underprice is an unreasonably low price compared to the actual cost of the property. Uncle Kolya (Kolyan, margin call, Margin Call, walrus Kolya) – a warning from the broker that the trader is doing poorly. If nothing is done, Stop Out will occur. Sitting on the fence means going out to cash and looking at stock trading from the sidelines. Doll (puppeteer)is a major player in the market whose actions push the price of an asset in any direction. Tuzemun (to the Moon, flight to the Moon) – a sharp increase in the rate of an asset, for example, a crypt. Buy on highs – buy an asset at its peak price. OpexBot is a quickseller and quickbuyer.

Here is such a boring trader’s dictionary. It is useful and interesting to know.

Baareche Gorsaa keessaanitti gammadeef