ThinkOrSwim (TOS) – an overview of the investment and trading platform. Thinkorswim is a fully functional investment platform with desktop, web and mobile versions. Desktop software can be downloaded, mobile apps are available for iPhone, Android, tablets and smart watches. The versions offer slightly different options, but in general, all major asset classes can be traded on Thinkorswim – stocks, mutual funds,

ETFs (exchange-traded funds), options, futures, bonds, CDs (certificates of deposit) and forex (foreign exchange).

- A detailed overview of the ThinkOrSwim platform

- Description, functionality, ToS interface

- Tools – indicators, strategies, terminals, robots

- Registering an account in the Russian Federation – what is the difficulty

- Brokerage services

- Thinkorswim® web – installation, configuration, interface, tools, trading

- Thinkorswim® Desktop – installation, configuration, interface, tools, trading

- Thinkorswim® mobile – installation, configuration, interface, tools, trading

- Pros and cons of TOS platforms

A detailed overview of the ThinkOrSwim platform

Thinkorswim provides access to professional-grade trading tools that help you quickly react and manage risk. The platform has a wide range of technical features and trading tools, is very detailed, which allows trading both at a basic level and for experienced traders. ToS is known for its thoughtful and customizable interface, filled with technical analysis and charting tools, as well as software features that help improve the efficiency of the trader. This is a platform where searching for a stock shows not only its price, but also the spread between bid and offer, the option chain and the OCO order.

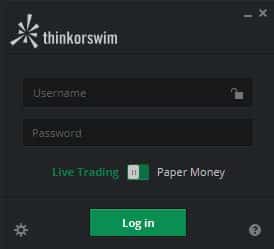

- Paper Money is a demo version with data delay and limited filter settings.

- Live Trading works in real time.

In terms of security, according to the financial industry regulator (FINRA), TD Ameritrade is both a brokerage firm and an investment advisor. She is also a member of the Securities Investor Protection Corporation (SIPC), which protects clients from losing cash and securities up to $500,000 in the event of a brokerage firm going bankrupt. TD Ameritrade has an asset protection guarantee and promises to refund clients if they lose cash or securities due to fraud.

Description, functionality, ToS interface

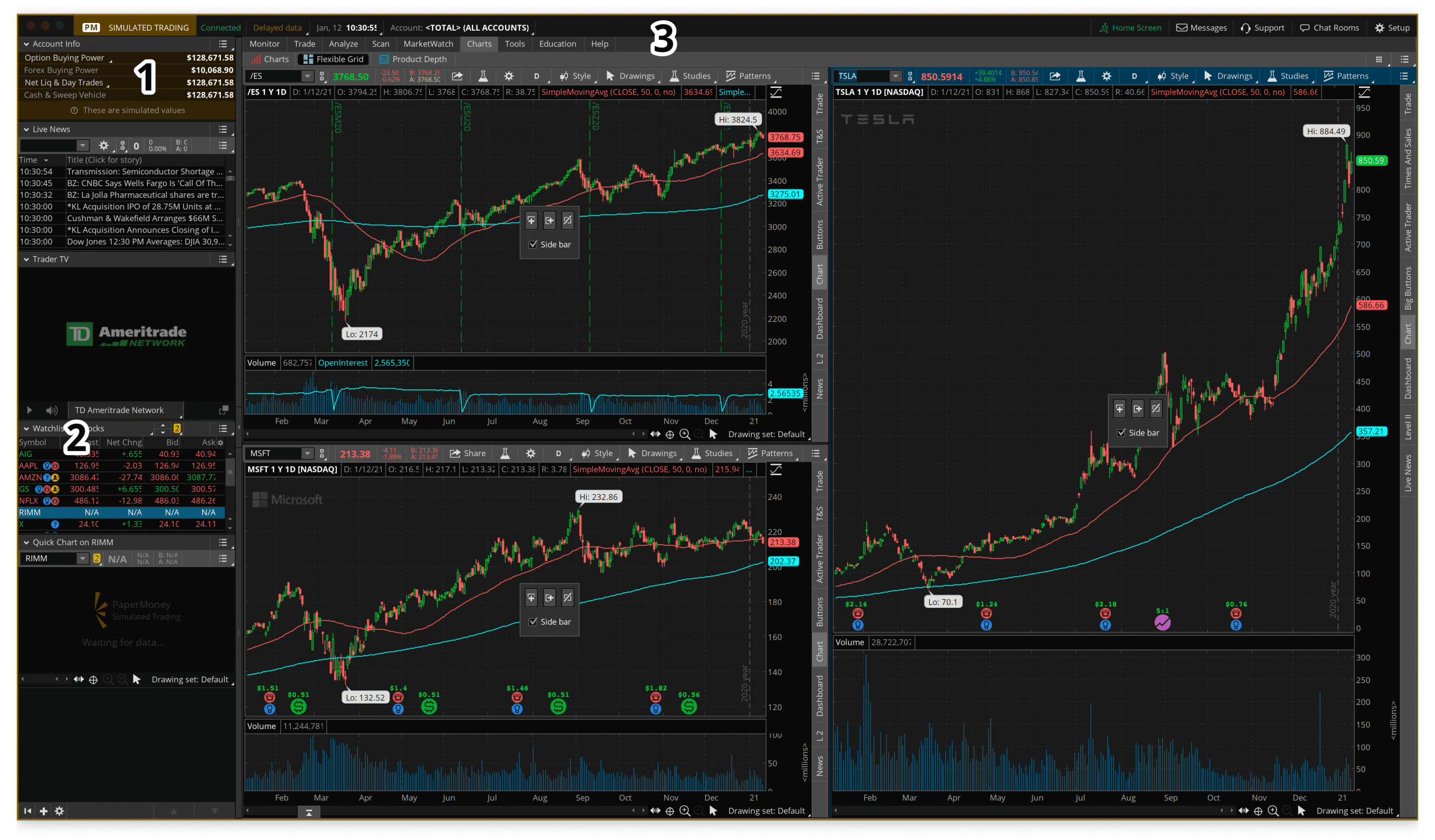

First of all, it is important to learn how to use Thinkorswim, starting with the layout and settings of the platform, different tabs and interfaces. After the Thinkorswim software is downloaded and installed, you need to open it and log in. The workspace can be divided into two parts – the left sidebar and the main window.

- The left sidebar is where the gadgets you need to work are stored.

- The main window includes nine tabs with different functions, each of which has sub-tabs dedicated to specific functions.

- ” Monitoring ” tracks trading activity and includes data such as orders, positions, trading account status, and the like.

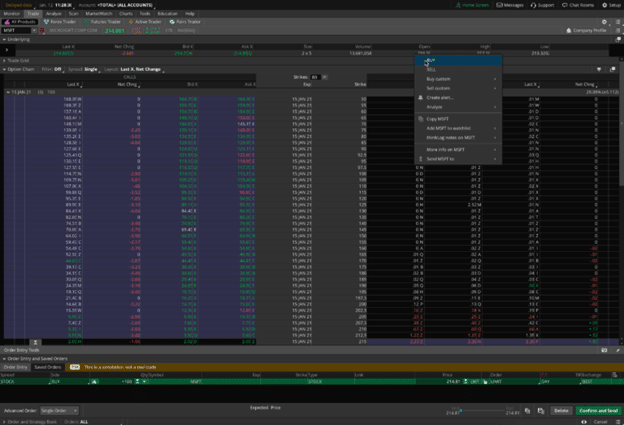

- ” Trading ” includes “All Products”, “Forex Trader”, “Futures Trader”, “Pairs Trader” and “Active Trader”.

- ” Analysis ” offers different methods of analysis (volatility and probability, databases of indicators of economic data and testing of options on historical data), both for real and hypothetical transactions, including scenario modeling “what if”. The Probability Analysis tool helps you determine if a stock will move in the future (which can also be done by expanding the charts). Active traders can use the thinkScript programming language to create their own research, trading strategies, alerts and more.

- ” Scan ” allows you to filter available stock options, futures, forex products based on personal interests.

- ” Market Watch ” is a variety of market data and methods that help to process them. The tab has several tabs – “Quotes”, “Alerts”, “Visualization”, “Funding Rates” and “Calendar”.

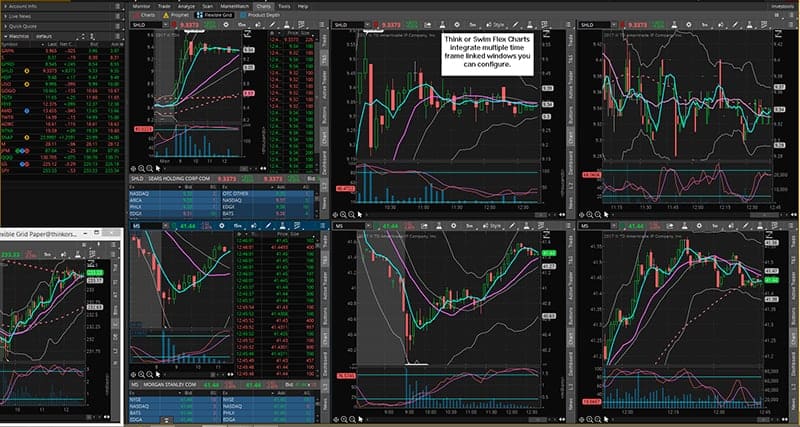

- ” Charts ” – a graphical interface of real-time market data with a wide range of technical analysis tools.

- ” Tools ” includes a number of handy features – thinkLog, Videos and Shared Items.

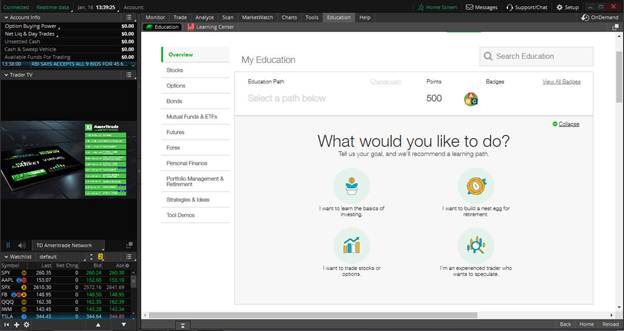

- “Tutorial” and “Help” are self-explanatory. By clicking on the Learn tab, thinkorswim com takes you to a learning center that has tutorials on everything from platform layout to entry and exit strategies to the Forex Trader interface. A range of financial literacy education programs are available in a variety of interactive forms, including instructor-led synchronous and asynchronous online courses, face-to-face workshops, online coaching programs, phone and online chats, and email support. The Learning Center offers educational webcasts on how to trade futures and how to use the “Calendar” interface that includes earnings reports, conference calls and the like.

Tools – indicators, strategies, terminals, robots

What the thinkorswim platform is famous for is indicators. It has hundreds of preloaded studies and strategies. Charts also offer extensive customization options. You can change the chart type from Candlestick, Bar, Line, Equivolume, Heikin Ashi.

- There is a small box in the center of each chart. This is because flexible mesh editing is enabled. This small box allows you to add and remove charts in a flexible grid. To access it, click on the 9 dots icon in the upper right corner of the application and select “Set Up Grid”.

- To add moving averages and patterns to a grid, right-click on any grid and select any of the styles, patterns, or studies. At the top of each grid, there is an icon marked “D” that allows you to quickly change the time frame of the grid.

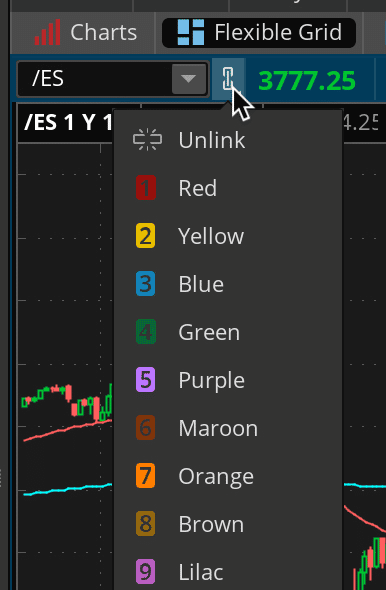

- Each mesh is independent. However, you can link grids and even watchlists to them by clicking on the chain icon next to the symbol field in the upper left corner of the grid.

- Choose a color that matches the color of the watchlist (possibly red). When you click on a watchlist symbol/stock, it populates the grid with that stock. Thus, it is possible to link two grids for multiple timeframes or studies.

Registering an account in the Russian Federation – what is the difficulty

It is not possible to register and get a real account on Thinkorswim for non-US residents. TD Ameritrade is actively blocking Thinkorswim accounts outside of the US. For many years, TD Ameritrade has banned TOS Realtime in many countries, making registration with real-time quotes problematic. At first, it was still possible to find ways to get around the ban. Thinkorswim Infinity worked, it was possible to register with only an email address. The user received a login and password for a demo account, in which there was a real-time mode. But TDA removed realtime in demos. In addition, there was a bug for several months, when entering a login with a capital letter, the system mistakenly started up in real time. Thinkorswim has fixed this bug by making it even more difficult to sign up for a TOS account. In this way, possibilities are almost exhausted. But not everything is so hopeless and there are options for how to register thinkorswim, moreover, official ones:

- If there is someone from acquaintances, friends or relatives, it is possible to open an account for a US citizen, of course, provided that this someone agrees to open a tos thinkorswim account in real time in their name. It’s pretty formal and stretched out over time. You need to draw up, print out a lot of documents, sign them, send them by mail, wait another two months for verification. And no one guarantees anything. In the case of the implementation of such a plan, according to the new server policy, the company closes accounts older than six months with a zero balance in the account. Therefore, in order to protect your account from blocking, losing settings, indicators and recovery time, you need to replenish your account with a minimum amount.

- You need to contact TDA and solve the thinkorswim realtime for russian problem through the rental service. The server offers platform rental for a period of 6 to 12 months with a 100% money back guarantee within 48 hours after payment, if the quality of the service is not satisfactory. The prices are optimal!

Brokerage services

Generally, there are four types of fees to look out for when choosing a trading platform and when evaluating any investment or trading service:

- Any fixed fees charged per transaction. This can be a fixed fee or what is known as a “spread” (a fee to a broker based on the difference between the buying and selling price of an asset).

- Trading commissions, where the broker charges a percentage based on the volume or value of each trade.

- Inactivity fees that a broker charges for a user not trading (inactive), such as keeping money in a brokerage account.

- Another form of platform trading fees. For example, a brokerage company may charge fees for making deposits into, withdrawing money from, or subscribing to additional services.

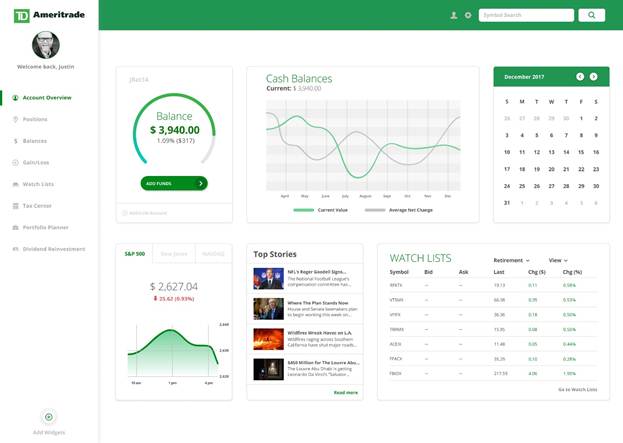

TD Ameritrade’s Thinkorswim pricing models are in line with most of the market. TD Ameritrade does not charge for the Thinkorswim terminal or data. For online stocks listed on US stock exchanges, US and Canadian ETFs and options, there is no commission and options cost $0.65 per contract. Most bonds cost $1, while mutual funds not included in TD Ameritrade’s extensive list of free investments cost $50. Futures contracts can cost up to $5 per trade. Forex trades are based on the bid/ask spread between individual currencies, and foreign stocks are subject to a $6.95 commission. Unlike many complex platforms, there is no minimum balance to use Thinkorswim, although margin traders will need to maintain it. TD Ameritrade supports short selling and margin orders and interest rates start at 9, 5% depending on the account balance. Trading with a broker is available for $25 per trade. The platform does not charge fees for most standard transactions such as depositing or withdrawing money. However, depending on specific transactions, some niche fees may apply.

Thinkorswim® web – installation, configuration, interface, tools, trading

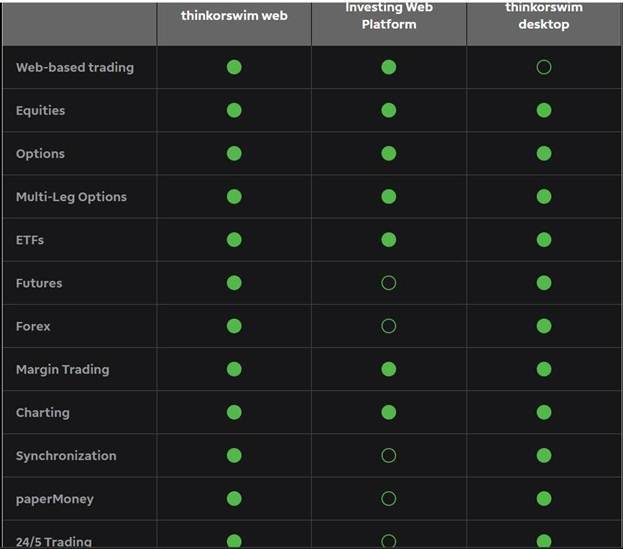

Thinkorswim web is a simple platform with no download required. Uses core Thinkorswim tools:

- An intuitive interface that puts the most important tools in the foreground.

- You can log in anywhere with an internet connection using web access and use pre-configured strategies to set up orders with one click.

- In addition to stocks, options and ETFs, Thinkorswim Web provides access to futures and forex for advanced trading.

Thinkorswim® Desktop – installation, configuration, interface, tools, trading

You can download Thinkorswim for free on the official TD Ameritrade website. Before using the program, you need to create an account with a broker – TD Ameritrade. Open an account and download the installer. A wizard will appear to help you install thinkorswim appropriate for your operating system. Downloading can take from a couple of minutes to half an hour, depending on the speed of the Internet connection. Once the download is complete, the installation wizard should start automatically.

- The download for Windows includes a Java virtual machine. If you upgrade from a 32-bit installation to a 64-bit installation, the installer will automatically detect the old installation and keep the existing settings.

- Mac users require OS X 10.11 or later.

- Thinkorswim for Linux requires Zulu OpenJDK 11 (general installation instructions can be found on the Zulu website).

- For Unix or Unix-like operating systems, Java 11 must be installed (Azul’s Zulu OpenJDK 11 is preferred).

Thinkorswim® Desktop provides access to trading tools and a platform backed by insights, training and dedicated service. Using a tool such as thinkorswim scripts, you can create your own order fulfillment algorithms and strategic testing.

Thinkorswim® mobile – installation, configuration, interface, tools, trading

The mobile application mirrors the functionality of the desktop computer, offering almost all the tools and options available in the browser version.

- Thinkorswim download from the App Store https://apps.apple.com/app/apple-store/id299366785

- Thinkorswim free download on Google Play https://play.google.com/store/apps/details?id=com.devexperts.tdmobile.platform.android.thinkorswim

Pros and cons of TOS platforms

The range of tools offered by the software is dizzying. These are hundreds of discrete technical indicators and a piece of tracking data. It offers over 4,000 different data points from banks and the Federal Reserve. Desktop version – almost endless customization options. The platform itself is simple. While it doesn’t offer the lightning-fast speed or macro-intensive use of other platforms built specifically for intraday traders, it is a responsive system that lets you create a variety of windows and widgets. On the other hand, searching for even a single asset can mean digging through multiple menu layers. While looking for data for this asset means looking for even more. The tools are hidden at the top of the screen, in three menu layers, inside the left widget, right toolbar and so on. Thinkorswim offers some of the highest levels of data and options of any high-tech trading platform on the market today. This is an extensive and extremely complex program, so even the most sophisticated traders should expect a long learning curve. Despite long training, once the system is mastered, it becomes easier to work with it. And while TOS often requires many more clicks per action than competitors, customization options mitigate this problem. You can customize the trading screen to your preferred instruments and data. therefore, even the most sophisticated traders should expect a long learning curve. Despite long training, once the system is mastered, it becomes easier to work with it. And while TOS often requires many more clicks per action than competitors, customization options mitigate this problem. You can customize the trading screen to your preferred instruments and data. therefore, even the most sophisticated traders should expect a long learning curve. Despite long training, once the system is mastered, it becomes easier to work with it. And while TOS often requires many more clicks per action than competitors, customization options mitigate this problem. You can customize the trading screen to your preferred instruments and data.