Menene maki Pivot (maganin juyi) ko Pivot Points a cikin kalmomi masu sauƙi, yadda ake ƙididdigewa, yadda ake ginawa, ainihin ma’anar Pivot Points, yadda ake amfani da mai nuna alama. Pivot Points, ko na gargajiya Pivot Points, kayan aiki ne da ƙwararrun yan kasuwa ke amfani da su a duk kasuwannin kuɗi. Yana nuna maki pivot kuma yana ba ku damar gina

layin tallafi da juriya . Wannan hanyar tana ba da sigina masu inganci. Hakanan yana da sauƙi kuma mai sauƙin amfani har ma ga novice yan kasuwa.

Menene Pivot Points

Mahimman bayanai, a sanya shi a sauƙaƙe, wurare ne masu jujjuyawa akan ginshiƙi farashin. Wannan shi ne matsakaicin adadi na babba, ƙanana, da farashin rufe wani kadara a ranar ciniki da ta gabata. ‘Yan kasuwa suna ƙayyade motsin farashi na gaba kuma suna kafa tsarin kasuwancin su a wani ɓangare akan waɗannan mahimman abubuwan.

Henry Chase ne ya kirkiro wannan hanya a cikin 1930s. Ya ƙididdige ma’anar pivot ta amfani da dabarar da ta haɗa da babba, ƙarami, da ƙimar rufewa na ranar da ta gabata. A lokacin, ana yin lissafin da hannu, kuma ’yan kasuwa suna yin ciniki ba tare da taimakon kwamfuta ba.

Tsarin yana ƙididdige maƙasudin farashin, gwargwadon abin da aka zana matakan. An ɗauka cewa farashin zai shiga ta cikin su, ko canza alkibla. Yanzu ba kwa buƙatar yin lissafin da kanku. Akwai algorithms da ayyuka da yawa waɗanda ke yin wannan. Wani muhimmin fasali na wannan hanya shine cewa ba shi da mahimmanci. Kowane mutum yana nuna daidaitaccen tallafi da juriya bisa ga nasu dokokin. Ko da yake akwai ma’aunin tantancewa gaba ɗaya, ma’anarsu ta bambanta daga mutum zuwa mutum. Ana iya ƙididdige pivots ta amfani da dabara kuma iri ɗaya ne ga kowa da kowa. Don haka, manyan masu shiga kasuwa ke amfani da su kamar bankuna, masu yin kasuwa da sauransu.

Yaya ake ƙididdige maki pivot?

‘Yan kasuwa sun kasance suna ƙoƙari su inganta a kan tsofaffin hanyoyin. A sakamakon haka, a yau akwai da dama dabaru:

- Na gargajiya . Hanya ta farko ita ce mafi sauƙi.

- Classic . Dan bambanta, amma yana da irin wannan aikace-aikacen.

- Woody . Farashin rufewa shine mafi mahimmanci a cikin wannan fasaha.

- Camarilla . An yi amfani da shi don ƙayyade tasha asara da kuma ɗaukar riba.

- Fibonacci . Lissafin yana amfani da ma’aunin gyaran Fibonacci.

- DeMark . Hasashen matsanancin yankuna.

Hanyar lissafin gargajiya yana da sauqi qwarai: ƙara ƙananan ƙima, babba da kusa. Raba sakamakon da aka samu da 3: (high + low + close): 3 = Pivot. Wannan darajar ita ce babba. Sauran layukan ana ƙididdige su akan haka:

- 3 sanduna sama da tsaka-tsaki – juriya.

- Layi 3 da ke ƙasa da cibiyar – tallafi.

Ana lissafta kowane nau’i daban. Idan ya cancanta, zaku iya lissafin waɗannan ƙimar da kanku, amma ba a ba da shawarar yin wannan da hannu ba. Yana da kyau a yi amfani da fasaha na musamman. Ana iya aiwatar da kowane irin waɗannan nau’ikan. Yawancin lokaci, mutane da yawa suna farawa da zaɓi na gargajiya kuma sun gamsu da shi gaba ɗaya. Hakanan ana gwada su ta hanyar gwaji don tantance mafi kyawun zaɓi na wani nau’in kuɗi na musamman. Tom DeMark ya haɓaka tsarin lissafin layi ɗaya kamar yadda aka nuna a teburin da ke ƙasa.

| Jiha | Formula | Makin na yau |

| Idan jiya ta bude> jiya ta rufe | P = (Mai girma na Jiya x 2) + Ƙarƙashin Jiya + Ƙarshen Jiya | Low = P/2 – Babban Jiya na Jiya = P/2 – Ƙananan Jiya |

| Idan jiya ta bude < jiya ta kusa | P = (Ƙasashen Jiya x 2) + Babban Jiya + Ƙarshen Jiya | Low = P/2 – Babban Jiya na Jiya = P/2 – Ƙananan Jiya |

| Idan jiya ta bude = jiya ta kusa | P = (Karshen Jiya x 2) + Ƙarƙashin Jiya + Ƙarshen Jiya | Low = P/2 – Babban Jiya na Jiya = P/2 – Ƙananan Jiya |

Wasu manazarta kuma suna amfani da buɗaɗɗen farashin yau ga ma’auni don ƙididdige matsakaicin farko. [taken magana id = “abin da aka makala_16017” align = “aligncenter” nisa = “866”]

Menene Matsayin Pivot?

Alamar Pivot Point ta dogara ne akan ra’ayin cewa kasuwa yana ƙidaya komai kuma tarihin yana maimaita kansa. Wannan shine ka’idar mai nuna alama: ana iya amfani da farashin rufewa da buɗewa na kyandir azaman tallafi da matakan juriya a nan gaba. Don haka, ‘yan kasuwa suna amfani da babban lokaci don saita matakan sa’an nan kuma amfani da su a cikin kasuwancin su. Bari mu ce ana ƙididdige matakan a kan ginshiƙi D1 da sama, kuma ana sanya ciniki a kan ginshiƙi na ɗan gajeren lokaci, misali, M30 da ƙasa.

Yana da mahimmanci a lura cewa matakan Pivot ba sa wakiltar takamaiman lamba ko farashi akan ginshiƙi: suna wakiltar kewayon da farashin zai iya tsayawa a cikin wani ɗan lokaci.

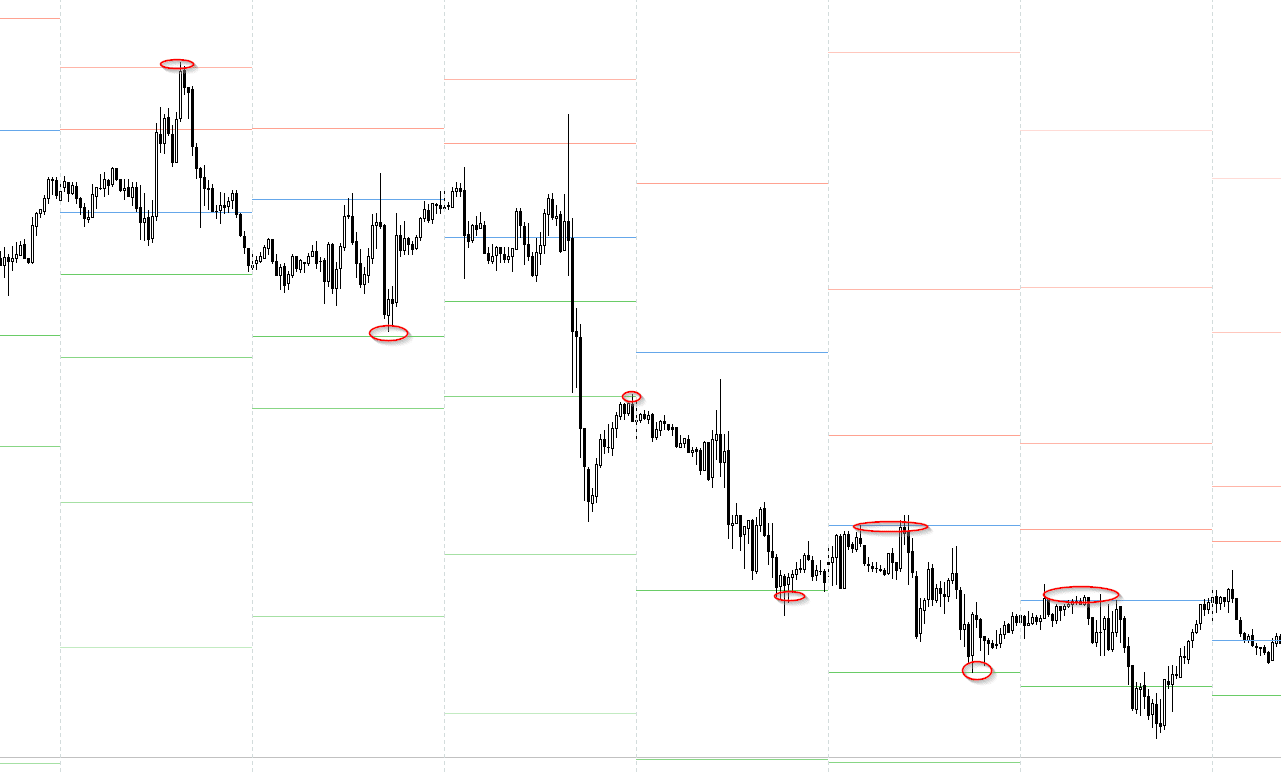

Yadda Pivot ke kallon ginshiƙi

Ana nuna matakan pivot akan ginshiƙi a matsayin layi na kwance, yayin da aka nuna matakin tsakiya, kuma matakan tallafi da juriya sun lalace ta hanyar tsoho (za’a iya canza launi da salon layin matakin a cikin saitunan kamar yadda ake so).

Dabarun ciniki

Akwai manyan dabaru masu zuwa don kasuwancin pivot points:

- Buɗe gajerun wurare lokacin da farashin ke ƙasa da babban madaidaicin maɓallin.

- Buɗe dogayen matsayi lokacin da farashin ya ke sama da babban maƙallin tuƙi.

- Kasance cikin dogon matsayi lokacin da farashin ke motsawa daga S1, S2 ko S3.

- Don zama takaice idan farashin ya motsa daga R1, R2 ko R3.

Waɗannan su ne manyan dabarun ciniki da ake amfani da su tare da Pivot Points:

- Idan aikin farashin ya canza kuma ya yi bounces kafin isa matakin pivot, shigar da cinikin a cikin hanyar billa. Idan ana gwada ciniki tare da farashi sama da layin pivot kuma farashin yana gabatowa layin pivot kuma yana komawa sama, yakamata a shiga kasuwanci mai tsayi. A gefe guda, idan ana gwada layin pivot na ƙasa kuma farashin ya dawo ƙasa bayan buga maƙasudin pivot, sayar da gajere. Asara tasha don ciniki yana sama da layin pivot idan cinikin ya kasance gajere kuma ƙasa da layin pivot idan cinikin ya yi tsayi.

- Lokacin da farashin farashin ya karye ta hanyar layin pivot, to, cinikin ya kamata ya ci gaba a cikin hanyar fashewa. Don tashin hankali, cinikin dole ne ya yi tsayi.

https://articles.opexflow.com/analysis-methods-and-tools/podderzhki-i-soprotivleniya-v-tradinge.htm

Misalin ciniki ta maki da matakan Pivot

‘Yan kasuwa sau da yawa ba sa zaɓar tun da wuri abin da za su yi ciniki a yau. Suna kallon kasuwa kuma suna zabar dabaru bisa abin da ke faruwa. Bari mu kalli misalin yadda zaku iya aiwatar da Pivot Points a cikin ayyukanku na yau da kullun. Bari mu buɗe nau’in kuɗi kuma mu yi amfani da maki Pivot zuwa gare ta. Wannan misalin yana amfani da Algorithm na Pivot Points All-In-One, wanda ke da yawa kuma yana iya amfani da dabaru daban-daban. Ana nuna hanyar gargajiya bisa madaidaicin hanya. Biyu Currency – EURUSD, tazarar lokaci – M30. Da farko kuna buƙatar ƙayyade yanayin halin yanzu. Akwai ka’ida ta gaba ɗaya wacce ke nuna jagorar masu zuba jari. Lokacin da ranar ta buɗe sama da babban matakin, za a yi la’akari da sayan matsayi. Idan ya yi ƙasa, za su nemi shigarwar siyarwa. Babban layin yana da shuɗi, kuma idan ranar buɗewa tana sama da shi.

- Ana sanya asarar tsayawa a bayan layi.

- Cin riba – a layi mafi kusa.

Ribobi da fursunoni na Pivot Points mai nuna alama

Abubuwan amfani sun haɗa da:

- Sauƙin amfani.

- Yana ba da ra’ayi na yuwuwar motsin farashi.

- Lissafin lissafi bisa takamaiman ƙididdiga.

- Ana iya amfani da shi zuwa tazarar lokaci daban-daban.

- Kuna iya kasuwanci tare da oda masu jiran aiki.

Alamar Matsayin Matsakaicin Babu shakka kayan aikin bincike ne mai ƙarfi sosai kuma, idan aka yi amfani da shi daidai, zai iya zama da amfani sosai ga masu farawa da ƙwararrun yan kasuwa a cikin kasuwancin kasuwannin kuɗi. Ba kamar sauran kayan aikin ciniki waɗanda ke amfani da dogon lokaci ba, alamar Biya tana karɓar bayanai daga rana ɗaya ta ciniki. Hasashen yuwuwar matakin tallafi da juriya yana buƙatar ƙima, ƙanana da farashin kusa daga ranar da ta gabata. Rashin hasara na mai nuna alama sun haɗa da zaɓuɓɓukan lissafin da yawa, wanda ke haifar da rudani game da wanene ya fi kyau, mafi daidai ko mafi daidai. Idan kun yi amfani da lissafin D1 index, bayanan na yanzu na iya zama mara amfani don zaman ciniki na gaba. Mai nuna alamar Pivot shine kayan aiki mai sauƙin amfani wanda aka haɗa cikin dandamalin ciniki.

Просто и доходчиво изложен материал.