Binciken fasaha ya dogara ne akan ainihin ƙayyadaddun jagorancin farashin farashin, gina matakan mahimmanci da kuma karatun masu nuna alama. Hakanan yana da mahimmanci yadda aka nuna ginshiƙi farashin. Labarin ya bayyana dalla-dalla na Heiken Ashi mai nuna alama azaman kayan aiki na gani na tantance alkiblar kasuwa. Bugu da ƙari, an ba da dabarar ƙididdige ma’aunin Heiken Ashi, dabarun mafi fa’ida dangane da ita.

- Heiken Ashi nuna alama – kayan yau da kullun ga masu farawa

- Ka’idar aiki da lissafin Heiken Ashi

- Dokokin amfani – dabarun da suka danganci Heiken Ashi

- Saita

- Amfani mai amfani na Heiken Ashi – yadda ake amfani da mai nuna alama

- Dabaru 1

- Dabaru 2

- Kuskure da kasada

- Ribobi da rashin amfani

- Aikace-aikace a cikin tashar ciniki

Heiken Ashi nuna alama – kayan yau da kullun ga masu farawa

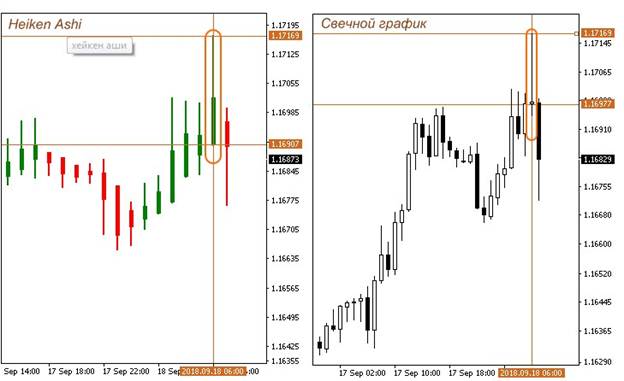

Wannan kayan aiki na gani yana kama da ginshiƙi na yau da kullun wanda ke nuna farashi ta amfani

da sandunan kyandir na Japan . Babban bambanci daga fitulun Jafananci shine nunin santsi na canjin farashi. Hakanan an gina Heiken Ashi a cikin sigar kyandir, amma tare da raguwa. Jinkirin ne ya sa kyandir su zama mafi yawan bayanai.

Ka’idar aiki da lissafin Heiken Ashi

Lokacin amfani da kyandir na Japan na al’ada, mai ciniki yana fuskantar matsalar hayaniyar kasuwa. Wannan juzu’i ce mai yawa wacce ba ta ɗaukar bayanai masu amfani, amma suna tsoma baki sosai tare da tantance mafi fa’ida don shiga kasuwa. Alamar Heiken Ashi tana kawar da hayaniyar kasuwa gwargwadon yadda zai yiwu ta hanyar jera kyandir kawai tare da ƙara mai amfani. Gina kowane kyandir na wannan alamar yana dogara ne akan manyan abubuwa 4:

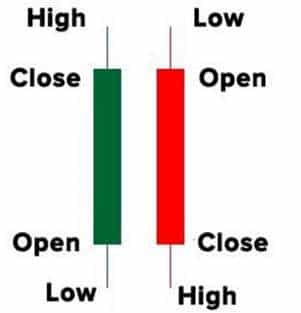

- An yi la’akari da matakin buɗewa.

- Matsayin rufewa na gaba (Close).

- Matsakaicin farashi (Mai girma).

- Mafi ƙarancin farashi (Ƙananan).

- Ana ƙididdige farashin buɗewa, ko Buɗaɗɗen ha daga jimlar buɗewa da rufewar sandar da ta gabata, an raba ta 2- (ha buɗe + ha kusa)/2 .

- Ana ƙididdige farashin rufewa daga jimlar buɗaɗɗen buɗewa, babba, ƙanana da farashin kusa da aka raba ta 4 – (buɗe + high + Low + Close) / 4 .

- Matsakaicin iyakar kyandir ana ƙididdige ƙimar matsakaicin farashin ta hanyar buɗewa da rufewa ha High = max (Buɗe, Close, High).

- Ƙananan shine samfurin ƙananan buɗewa da rufe ƙananan ha Low = min (Buɗe, Rufe, Ƙananan).

Dokokin amfani – dabarun da suka danganci Heiken Ashi

Don yadda ya kamata amfani da alamar Heiken Ashi, akwai wasu dokoki da za a yi la’akari. Manyan su sune kamar haka:

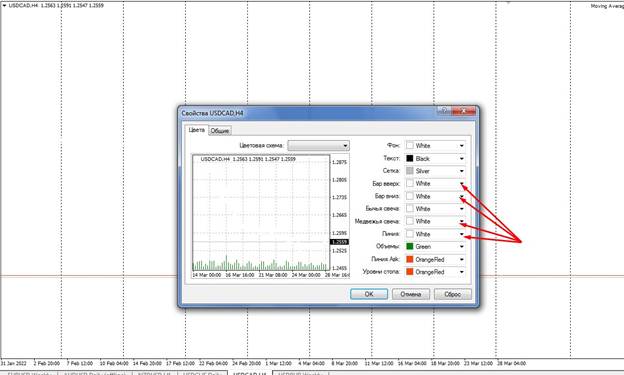

- Sau da yawa a cikin tashoshi, misali, MT4, wannan mai nuna alama yana kan saman manyan kyandir ɗin nunin farashi. A wannan yanayin, yana da daraja rage girman nunin kyandir ɗin Jafananci. Ana yin wannan ta hanyar canza launi daga asali zuwa fari.

- Wannan alamar ita ce mafi ba da labari akan nau’i-nau’i na kuɗi masu saurin canzawa. Yana da kyau a tuna cewa da sauri kasuwa, ƙarancin farashin hayaniya yana cikinta, wanda ke nufin cewa ya ƙunshi ƙarin bayanai masu amfani.

- Ana amfani da mai nuna alama kawai don ciniki na Trend. Wannan kayan aiki yana nuna jagorancin kasuwa sosai.

- Inuwar kyandir. Wajibi ne don saka idanu daidai adadin inuwar fitila da jikin. Idan kawai jikin fitilar ya mamaye kan ginshiƙi, wannan yana nuna ƙarfin mahalarta kasuwar na yanzu. Mahimmancin inuwa yana nuna bayyanar rauni, wanda ke nufin raguwar girma.

- Kayan aiki yana nuna inganci akan lokutan lokaci daga H30 da sama. Ƙananan lokutan lokaci sun ƙunshi hayaniyar kasuwa da yawa da rashin tabbas.

Har ila yau, yana da daraja la’akari da cewa za ku iya fara ciniki ta amfani da wannan alamar kawai bayan bayyanar kyandir 3 na wannan shugabanci.

Heikin-Ashi kyandir nuna alama, Heikin-Ashi dabarun ga sabon shiga: https://youtu.be/ulSacgwzLmk

Saita

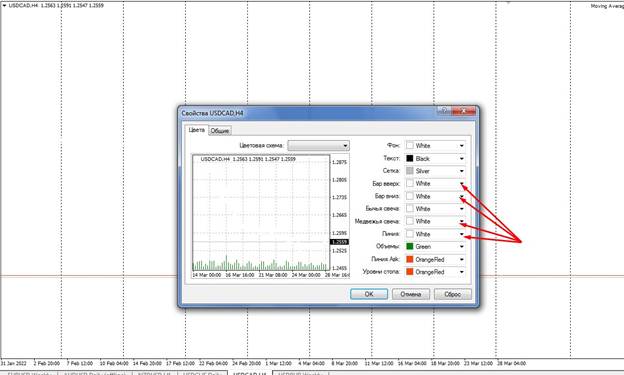

Kafin amfani da alamar Heiken Ashi, dole ne a daidaita shi da kyau. A kan dandalin MT4, ana yin haka kamar haka.

- Buɗe ginshiƙi na nau’i-nau’i na kuɗi mai saurin canzawa, kamar USD/CAD.

- Zaɓi nunin linzamin kwamfuta na jadawali a saman saitunan saitunan.

- Je zuwa kaddarorin ginshiƙi kuma canza launi na nuni na yanzu don dacewa da launin allo. Misali, idan aka nuna layin da baki akan farar bango, dole ne kuma ya zama fari. Don haka, zai yiwu a ɓoye layin nunin farashin gaba ɗaya.

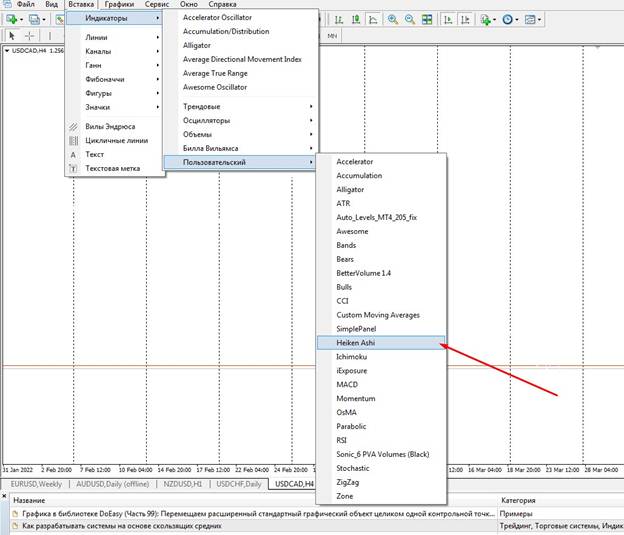

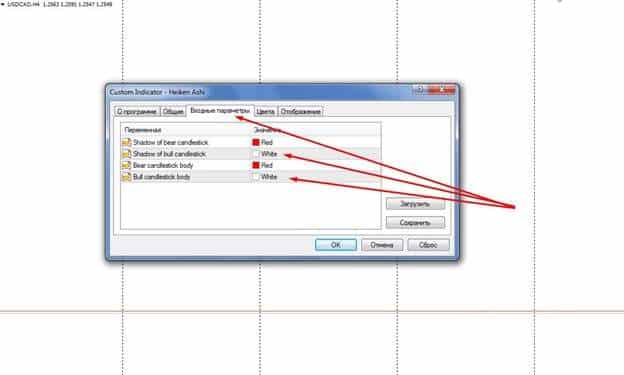

- Na gaba, kuna buƙatar aiwatar da canjin “Saka” – “Masu nuni” – “Custom” – “Heiken Ashi” kuma danna sunan mai nuna alama.

- Bayan haka, taga don saita sigogi masu nuna alama zai bayyana, wanda zaku buƙaci sashin “Input sigogi”.

- A cikin wannan sashe, kuna buƙatar canza launukan nuni na “Shadow of Candlestick” da “Jikin fitilar Bull” daga fari zuwa kore.

- Ajiye saituna.

Komai, mai nuna alama an daidaita shi sosai. Idan kuna amfani da tashar tashar TradingView, kawai kuna buƙatar zuwa zaɓin nunin ginshiƙi kuma zaɓi zaɓin Heiken Ashi. Ba a buƙatar ƙarin saituna.

Amfani mai amfani na Heiken Ashi – yadda ake amfani da mai nuna alama

A cikin ciniki, zaku iya amfani da alamar Heiken Ashi azaman babban kayan aiki ko haɗa tare da ƙarin mai nuna alama. Na gaba, la’akari da dabaru 2 mafi inganci.

Dabaru 1

Wannan tsarin ciniki ya dogara ne akan neman hanyar shiga, a lokacin canji a cikin jagorancin yanayin ko bayan ƙarshen motsi na gyarawa a cikin yanayin:

- Da farko kuna buƙatar sanya alamar Heiken Ashi akan ginshiƙi.

- Na gaba, ya kamata ku zaɓi ƙayyadaddun lokaci tare da mafi bayyanan alkiblar motsin farashi. Wajibi ne a yi la’akari da cewa shugabanci a kan ƙananan lokutan lokaci ya dace da mafi girman lokutan lokaci. Misali, H30, H1, H4 shugabanci – downtrend.

- Na gaba, kuna buƙatar jira canjin yanayi. Za a nuna wannan ta bayyanar kyandir marar tabbas na Doji ko karuwar yawan manyan inuwa.

- Hakanan za’a nuna canjin yanayin daga sama zuwa ƙasa ta bayyanar jajayen kyandir masu saukowa.

- Bayan bayyanar irin waɗannan kyandirori 3, kuna buƙatar shiga kasuwa don faɗuwa.

- An saita hasarar tasha a matakin rufewar kyandir mai saukowa na farko.

- An saita riba kusa da muhimmin matakin.

Wannan dabarar ita ce mafi sauƙi kuma tana buƙatar mafi girman maida hankali. Rashin hasara kawai shine buƙatar ci gaba da bin yanayin, tare da yiwuwar rufe matsayi a kowane lokaci.

Dabaru 2

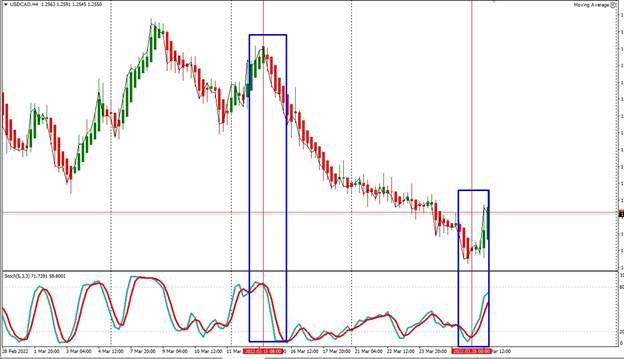

Wannan dabarun yana amfani da Stohastic oscillator tare da daidaitattun saitunan azaman ƙarin kayan aiki:

- Aiwatar da alamar Heiken Ashi zuwa ginshiƙi.

- Shigar da Stohastic Oscillator.

- Jira canji a hanya.

Lokacin da yanayin yanayin ya canza, launi na kyandir na Heiken Ashi zai canza daga kore zuwa ja (farkon raguwa). A lokaci guda, layukan Stohastic oscillator za su kasance a cikin yankin hawan hawan 20, a cikin hanyar hayewa. Ya kamata a buɗe cinikin siyarwa bayan kyandir na uku ya bayyana. A wannan yanayin, an saita matakin asarar tsayawa kusa da farashin rufewar kyandir mai saukowa na farko.

Kuskure da kasada

An riga an faɗi a cikin waɗanne kasuwanni ya dace a yi amfani da alamar Heiken Ashi, wanda ya kamata a yi la’akari da lokutan ginshiƙi. Yanzu bari muyi magana game da kasada.

- Ba a amfani da mai nuna alama don saurin fatar kan mutum akan sassan M1, M5, M15.

- Hakanan akwai babban haɗari na koma baya na ciniki a cikin yanayin.

- An haramta kasuwanci, bisa ga wannan alamar, a lokacin motsin farashin gefe.

- An haramta cinikin kadarori tare da ƙananan saurin motsi. Misali, zinari, agogon crypto, albarkatun kasa.

Har ila yau, mai ciniki ya kamata ya yi la’akari da cewa mafi kyawun tabbatar da canjin yanayi shine lokacin da farashin ke kusa da wani muhimmin mataki kuma ya canza shugabanci a cikin 2-4 kyandirori.

Ribobi da rashin amfani

Kayan aikin Heiken Ashi yana da fa’idodi da rashin amfani da yawa. Daga cikin fa’idodin za a iya gano:

- Karatuttukan jadawali masu laushi.

- Sauƙin gani na ƙayyadaddun alkiblar yanayin.

- Daidaituwar karatu tare da yawancin alamu masu tasowa da oscillators.

Daga cikin gazawar mai nuna alama, mutum zai iya ware kawai jinkiri a cikin alamun yanayin kasuwa na yanzu. Har ila yau, wannan mai nuna alama da ginshiƙi da aka gina bisa tushensa suna da ƙananan ƙididdiga masu ba da labari waɗanda ke nuna canjin yanayi.

Aikace-aikace a cikin tashar ciniki

Daban-daban dandamali na ciniki suna ba ku damar saita Heiken Ashi azaman mai nuna alama, babban hanyar nunin ginshiƙi, ko azaman oscillator “heiken ashi smoothed”.

- A cikin tashar MT4, dole ne a yi amfani da mai nuna alama a kan ginshiƙi, ta yin amfani da shi azaman taimakon gani don sanin alkiblar yanayin.

- Lokacin amfani da heiken ashi smoothed oscillator, shi ma yana kan ginshiƙi, amma ya bambanta da cewa yana gina alkibla bisa ga matsakaicin matsakaicin ƙa’ida.

- A kan dandamali na “TradingView”, za ku iya keɓance nunin dukkan ginshiƙi bisa Heiken Ashi. A lokaci guda, kayan aikin yana nuna cikakken jagorar farashin, ba ya zama mai nuni ba.

Ba tare da la’akari da nau’in ba, Heiken Ashi ya ci gaba da sassauta hayaniyar kasuwa, yana taimakawa wajen sanin alkiblar yanayin. Kayan aikin bincike na fasaha na Heiken Ashi yana ba ‘yan kasuwa damar, ba tare da la’akari da matakin su ba, don gano ƙarin ingantattun karukan kasuwa da kwatance. Wannan mai nuna alama zai taimaka wajen gano madaidaicin ma’ana don shiga kasuwa, rage haɗari da ƙimar kasuwancin da ba daidai ba.