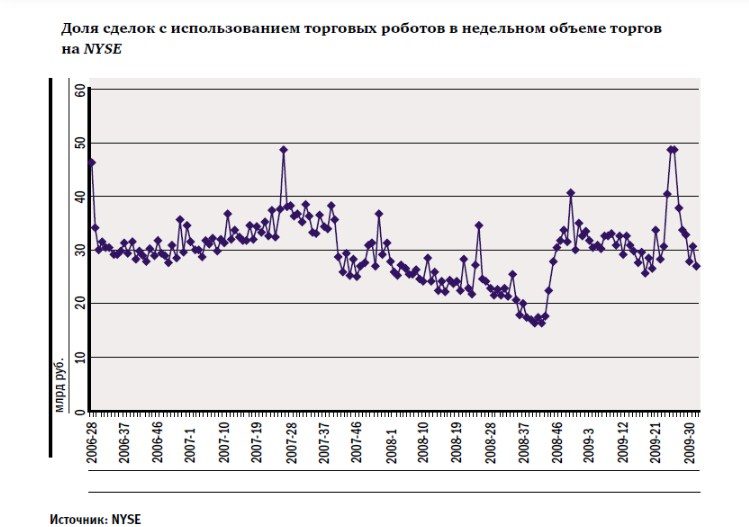

Today it is difficult to find a trader who would not use a robot for trading in his activities

. Such programs allow users to gain an advantage over their competitors, because high-frequency trading works at an incredible speed. Trading robots do not succumb to emotions and are able to quickly analyze data. However, not every program is reliable and easy to use. In order not to be mistaken when choosing, you should familiarize yourself with the rating of the best bots designed for trading on the stock market in Europe.

Review of trading for trading on the stock exchange in Europe – trading bots for the European stock market

After examining the descriptions of the most popular robots for trading stocks and bonds in Europe, each user will be able to choose the most suitable option for himself.

Trading bot SuperADX – intraday trading stock bot

SuperADX is a popular robot that performs automatic intraday

trading of stocks,

futures and bonds. It is important for a trader to take care of the correct choice of tactics for the dynamic nature of the market. Then the deals will definitely be successful. The higher the skill level of the trader, the better he will be able to use the robot in his trading. The bot is quickly reconfigurable, which makes it flexible enough to manage. The setup process is simple. As soon as the balance of the trading account reaches the specified threshold, the trade will be completed and all positions are liquidated. At the end of the trading day, the user can close positions. The robot can also be used as an advisor. If a crash occurs, the program will automatically restart and start.

Note! The robot provides 12 trading tactics and a new strategy from BCS-Expert.

The strengths of the robot include:

- reliability;

- accessible interface;

- ease of use;

- the ability to independently move stop orders that the bot places;

- timely solution of the arisen problems by the technical support service;

- regulation of the size of protective orders;

- the ability to set the start / end time for trading.

The only drawback is considered too high cost. Users have the ability to independently customize SuperADX based on trading preferences / personal risks and in accordance with the market situation.

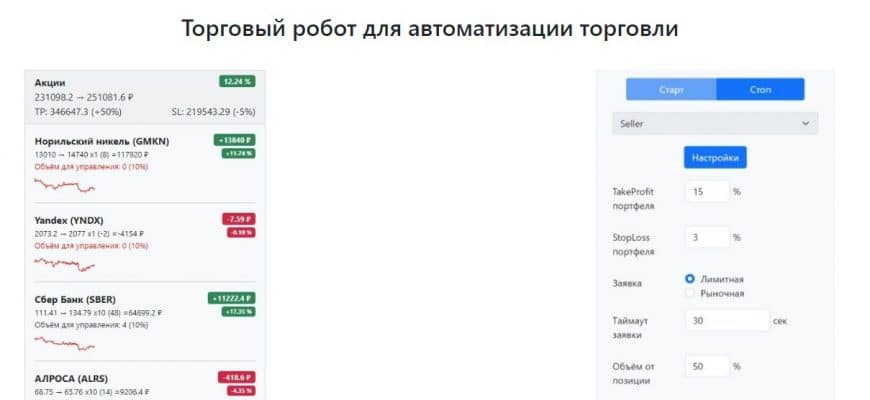

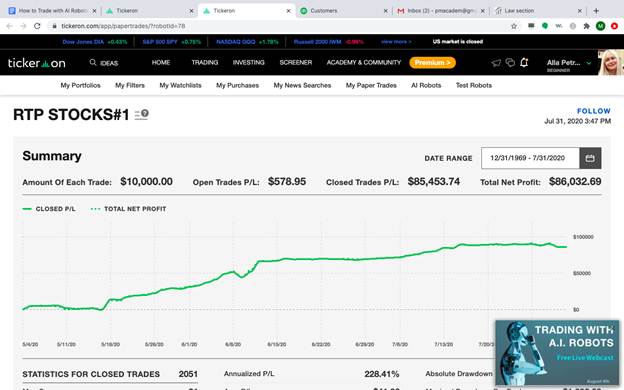

Exchange robot Tickeron

Tickeron is a reliable platform for trading and investment services. The bot conducts scans based on various fundamental, AI, and Human Intelligence (HI), which makes it possible to quickly find suitable options for a deal. Traders can use the trial version of the bot, which lasts for 14 days. When this period ends, the trader will be required to make a monthly payment of $ 20. Tickeron provides users with free self-study tutorials, videos, articles and webcasts that can be accessed through the Academies section. Studying this content will help traders to adapt to the software and explore different price patterns, settings, triggers. The strengths of the Tickeron stock and bond trading robot include:

- the presence of a scanner based on artificial intelligence;

- a large number of training materials;

- reliability;

- providing a trial period for an extended period.

The only thing that can be a little frustrating is that the interface is not entirely clear to beginners. However, after reading the training materials, you can quickly understand what’s what.

Libertex

Libertex is a stock and bond trading robot that is popular among European traders. A trader can count on 24/7 support available via email, phone and live chat. Libertex is regulated by the Cypriot financial supervisory authority, so there is no doubt about the reliability of the program. For beginners, you can use a demo account to understand how the bot works. The strengths of this robot are:

- regulation of activities by the Cypriot financial supervisory authority;

- large selection of CFDs on stocks;

- clear interface;

- reliability;

- availability of a free demo version.

The limited selection of stocks and the small selection of educational materials are considered to be the main disadvantages of Libertex.

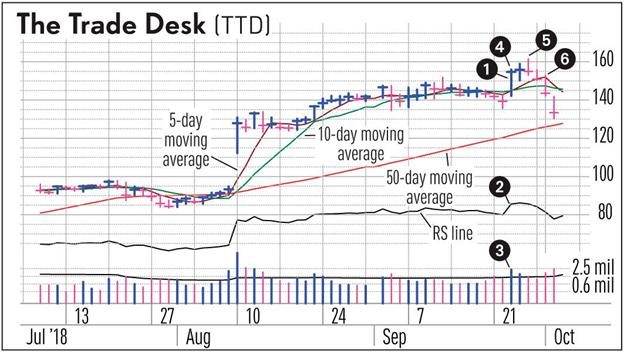

StocksToTrade

StocksToTrade is a popular robot used by European traders for market analysis, charting and stock trading. StocksToTrade is great for both beginners and seasoned traders. The software reduces the time and effort of the trader. StocksToTrade provides traders with powerful market scanning and screening tools. A trading algorithm called ORACLE warns users about entering / exiting trades in the most favorable conditions. Software built for Windows and macOS is not available for smartphones or tablets. To use the StocksToTrade software, you need to take care of purchasing a subscription that costs $ 179.95 per month.

- the presence of a powerful ORACLE trading algorithm;

- an extensive line of charts with many built-in popular technical analysts;

- stock summary, watch lists and news presented along with trading charts;

- reliability;

- user-friendly interface.

The bot is not available on mobile, which is the main drawback of StocksToTrade.

SwingTradeBot

SwingTradeBot is a popular bot that differentiates itself from other variants in its many technical stock screens. Scanners cover a huge number of technical patterns and signal combinations. The user can merge multiple screens together and add additional custom filters, which is a significant advantage. This bot is more suitable for beginners, because you will not be able to create your own screen if you have an individual trading strategy. The strengths of SwingTradeBot are:

- the ability to simultaneously combine 2-3 technical screens;

- relatively modest cost;

- reliability;

- user-friendly interface.

The only thing that can be frustrating is the impossibility of creating your own screen.

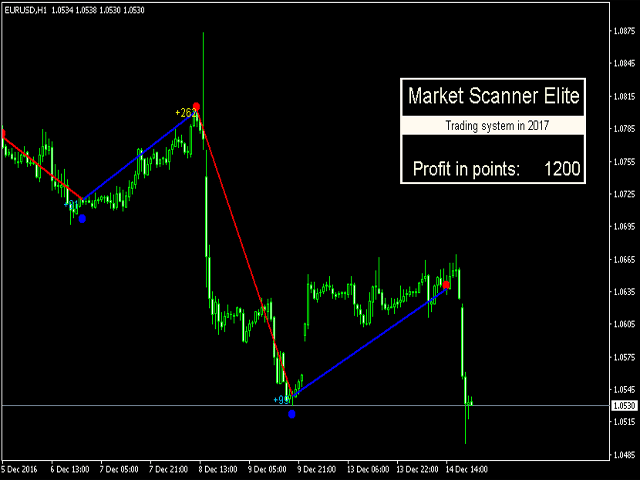

Robot for trading TrendSpider

TrendSpider is considered a powerful tool for charting and analyzing stock market trends. However, the system will only work effectively if the user knows how to use it. Professional and experienced stock traders will appreciate TrendSpider’s capabilities and easy-to-understand guides. For beginners in the field of trading, it is recommended to use the training materials that the developer carefully provides. The software includes a multi-timeframe analysis feature that allows you to overlay multiple timeframes on a single chart to see how long-term indicators and price levels interact with short-term price action.

Note! The program will show the trader the moments that he missed. This will improve your analytical skills.

The strengths of the TrendSpider program include:

- a huge number of automatic technical analysis tools;

- providing free individual lessons for users;

- the ability to use high-quality training materials.

- learning curve for new users;

- the ability to use only one browser at a time;

- no desktop platform option.

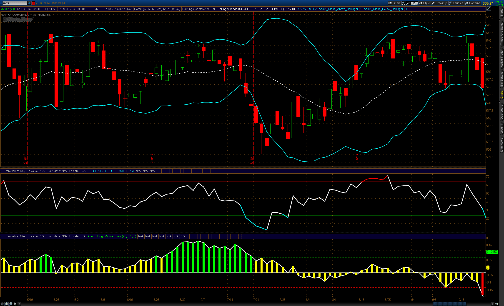

MetaStock

MetaStock is a powerful technical analysis charting service with a huge selection of indicators for stocks / ETFs / bonds and Forex. MetaStock offers excellent testing and forecasting tools as well as the market for trading systems. By adding Refinitiv Xenith, users will be able to view the market situation in real time. The program is easy to use because MetaStock focuses on making the merchant’s workflow convenient. The software is available on all devices, from PCs to smartphones / TVs. MetaStock uses a huge number of built-in systems to help the novice / intermediate trader understand and benefit from technical analysis models and well-studied systems.

- excellent deep backtesting;

- price forecast for unique shares;

- open access to a large library of additional professional strategies;

- timely solution of emerging issues by the technical support service and systematic training webinars;

- the ability to work online and offline.

The old school design of the Windows program is the only drawback of MetaStock.

TradeMiner

TradeMiner is a bot that provides a trader with ideas that can help him make practical investment decisions. The software is compatible with all major operating systems including macOS, Linux and Windows. The bot automatically starts scanning the markets and providing detailed trend reports. Thanks to such an assistant, the trader has more free time to focus on developing a good strategy. The advantages of a robot for trading stocks, futures and bonds on the stock market in Europe include:

- ease of use and installation of the system;

- affordable price;

- simple and intuitive interface;

- analytical system based on data;

- reliability.

Traders are a little frustrated by the fact that the developers do not attach much importance to the need for one-to-one mentoring.

Note! Users only need to pay an annual fee. There are no monthly payments, which is a significant advantage.

TradeMiner may be far from perfect, but it is definitely worth taking a closer look at. The software is suitable for both novice traders and experienced traders.

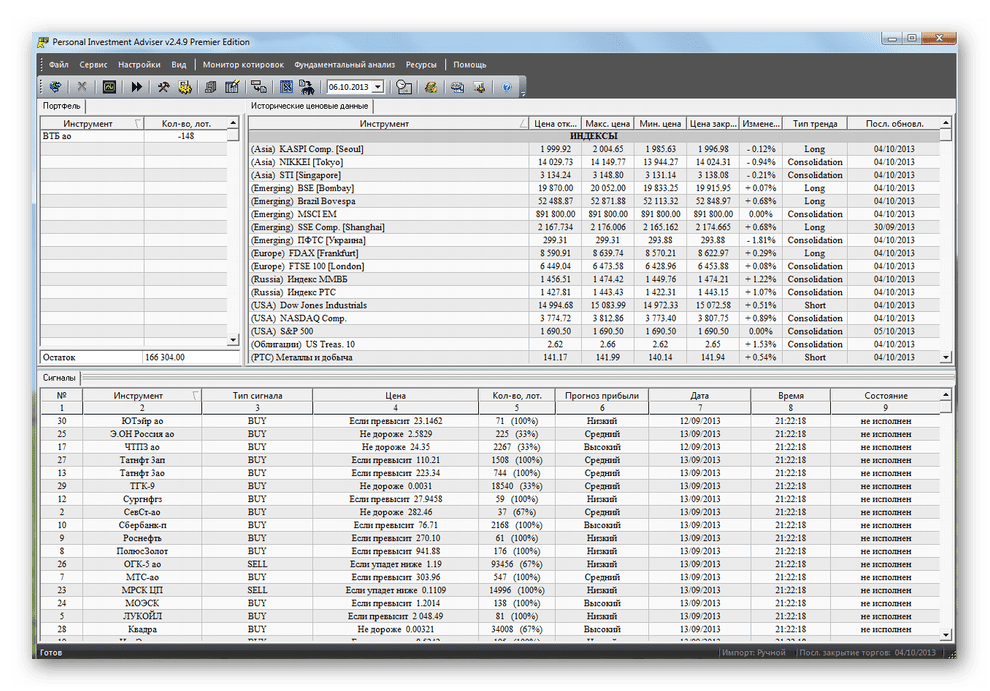

PIAdviser

PIAdviser is a popular bot used by European traders to trade stocks and bonds. The system analyzes the Russian and European stock markets. PIAdviser is able to determine the dynamics of the market as accurately as possible. The user receives a notification about the market situation with some recommendations. The trader can choose the classic, premium or web version. The presence of a Russian-language interface, reliability and ease of use are the main advantages of the bot. Judging by the reviews of traders, no significant shortcomings were found in this robot.

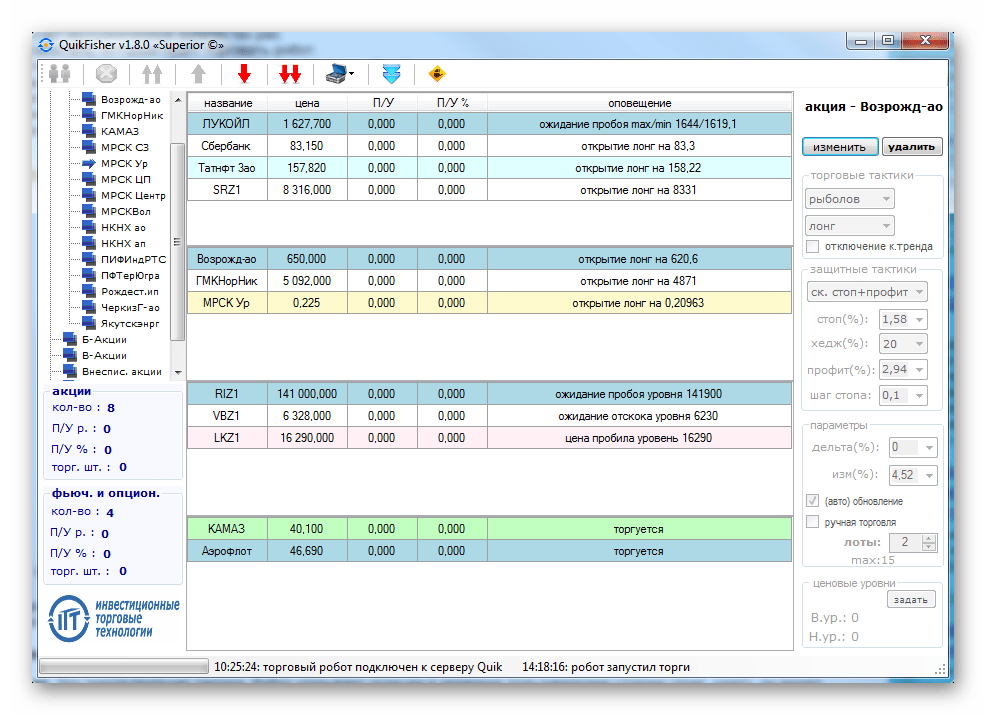

QuikFisher

QuikFisher is a versatile robot that allows users to trade futures and stocks of different liquidity levels. The program performs in-depth analysis and calculations to determine the most profitable transactions. The trader can only set the appropriate parameters and entrust the trading process to the bot. QuikFisher supports work with the QUIK complex. Traders can use 6 strategies. A timer is provided for automatic shutdown after a specified period. The advantages of a bot include:

- availability of a Russian-language version;

- in-depth analysis to determine the most profitable transactions;

- reliability;

- clear interface.