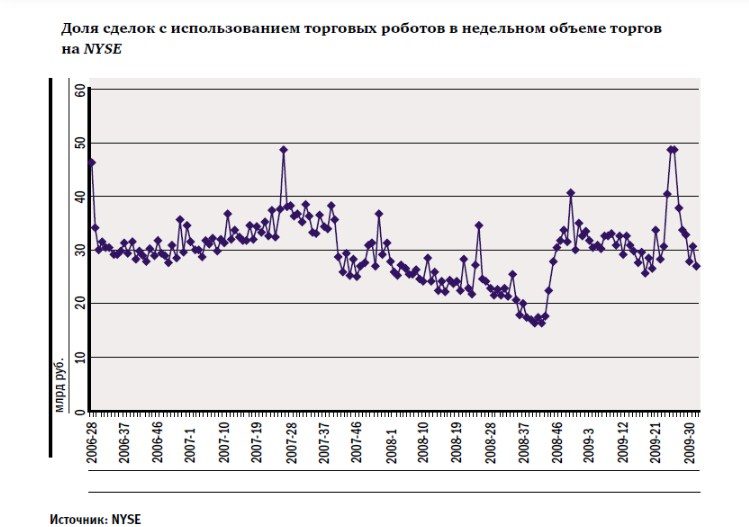

Today it is difficult to meet a trader who would not use a

trading robot in his activity . Such programs give users the opportunity to gain an advantage over their competitors, because high-frequency trading works at an incredible speed. Trading robots do not give in to emotions and are able to quickly analyze data. However, not every program is reliable and easy to use. In order not to make a mistake when choosing, you should familiarize yourself with the rating of the best bots designed for trading on the stock market in Europe.

Overview of trading for trading on the stock exchange in Europe – trading bots for the European stock market

Having studied the descriptions of the most popular robots for trading stocks and bonds in Europe, each user will be able to choose the most suitable option for himself.

Trading bot SuperADX – intraday stock trading bot

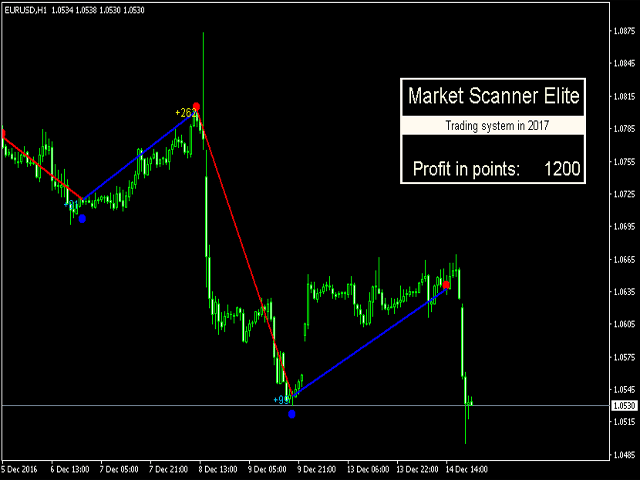

SuperADX is a popular robot that performs automatic intraday

trading in stocks,

futures and bonds. It is important for a trader to take care of the right choice of tactics for the dynamic nature of the market. Then the transactions will definitely be successful. The higher the skill level of a trader, the better he will be able to use the robot in his trading. The bot is quickly reconfigured, which makes it flexible enough to manage. The setup process is simple. As soon as the balance of the trading account reaches the specified threshold, the trade will be completed and all positions will be liquidated. At the end of the trading day, the user can close positions. The robot can also be used as an advisor. In case of failures, the program will automatically reboot and start.

Note! The robot provides 12 trading tactics and a new strategy from BCS-Expert.

The strengths of the robot include:

- reliability;

- accessible interface;

- ease of use;

- the possibility of independent movement of stop orders placed by the bot;

- timely resolution of emerging problems by the technical support service;

- regulation of the size of protective orders;

- the ability to set the start / end time of trading.

The only drawback is considered too high cost. Users have the ability to customize SuperADX based on their trading preferences/personal risks and market conditions.

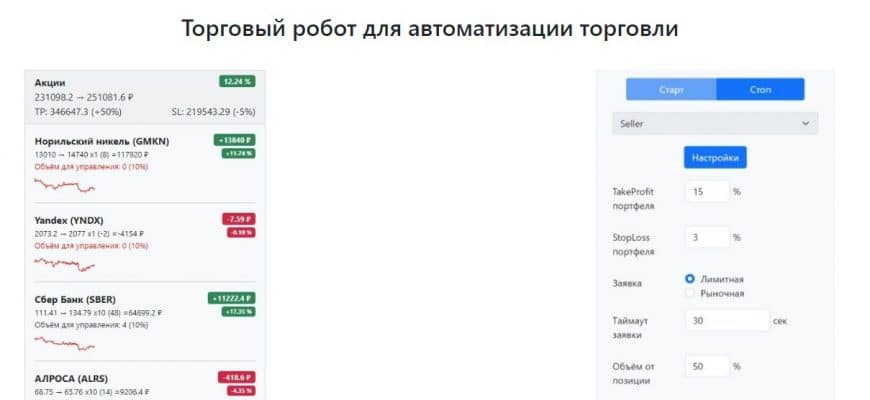

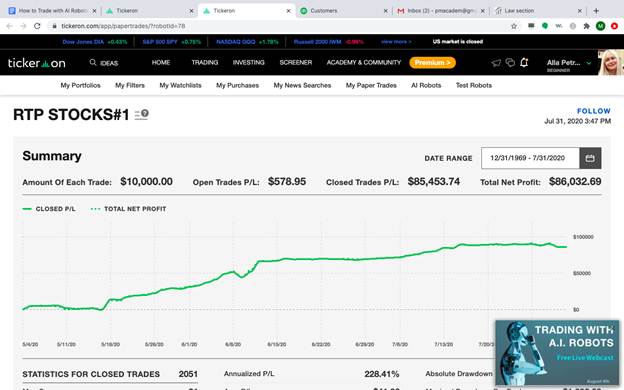

Stock tickeron robot

Tickeron is a trusted platform for trading and investment services. The bot scans based on various fundamental, AI, and Human Intelligence (HI), which makes it possible to quickly find suitable options for a trade. Merchants can use the trial version of the bot, the duration of which is 14 days. When this period ends, the trader will be required to pay a monthly fee of $20. Tickeron provides users with free self-paced learning materials, videos, articles and webcasts through the Academy section. Studying this content will help traders to adapt to the software and learn about different price patterns, settings, triggers. The strengths of the Tickeron stock and bond trading robot include:

- the presence of a scanner based on artificial intelligence;

- a large number of educational materials;

- reliability;

- provision of a trial period for an extended period.

The only thing that can upset a little is that the interface is not entirely clear to beginners. However, after reading the training materials, you can quickly understand what’s what.

Libertex

Libertex is a robot for trading stocks and bonds, which is popular among traders in Europe. A trader can count on 24/7 support available via email, phone and live chat. The activity of Libertex is regulated by the Cypriot Financial Supervisory Authority, so there is no doubt about the reliability of the program. Beginners can use a demo account to understand how the bot works. The strengths of this robot are:

- regulation of the activities of the Cypriot financial supervisory authority;

- a large selection of CFDs on shares;

- clear interface;

- reliability;

- availability of a free demo version.

A limited selection of stocks and a small selection of educational materials are considered the main disadvantages of Libertex.

StocksToTrade

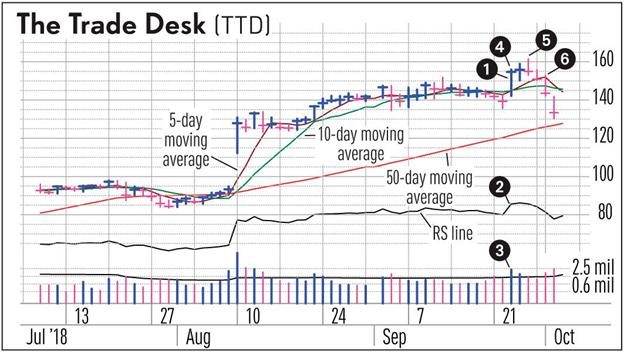

StocksToTrade is a popular robot used by traders in Europe for market analysis, charting and stock trading. StocksToTrade is great for both beginners and experienced traders. The software reduces the time and effort of the trading specialist. StocksToTrade provides traders with powerful market scanning and screening tools. A trading algorithm called ORACLE warns users about entering / exiting trades in the most favorable conditions. Software created for Windows and macOS is not available for smartphones or tablets. To use the StocksToTrade software, you need to take care of purchasing a subscription, which costs $179.95 per month.

- the presence of a powerful trading algorithm ORACLE;

- an extensive line of charts with many built-in popular technical analysts;

- stock summary, watch lists and news presented along with trading charts;

- reliability;

- user-friendly interface.

The bot is not available on mobile devices, which is the main disadvantage of StocksToTrade.

SwingTradeBot

SwingTradeBot is a popular bot that stands out from other options with its many technical stock screens. Scanners cover a huge number of technical patterns and combinations of signals. The user can combine several screens together and add additional custom filters, which is a significant advantage. This bot is more suitable for beginners, because creating your own screen with an individual trading strategy will not work. The strengths of SwingTradeBot are:

- the ability to simultaneously combine 2-3 technical screens;

- relatively modest cost;

- reliability;

- user-friendly interface.

Only the impossibility of creating your own screen can upset you.

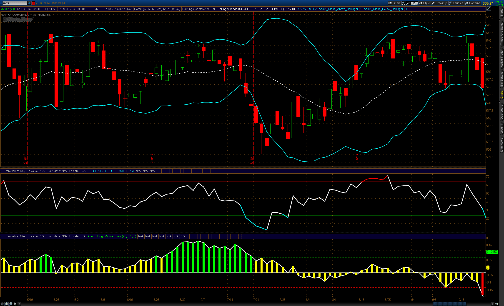

Robot for trading TrendSpider

TrendSpider is considered a powerful tool for charting and analyzing stock market trends. However, the system will only work effectively if the user knows how to use it. Professional and experienced stock traders will appreciate TrendSpider’s features and clear guides. For beginners in the field of trading, it is recommended to use the training materials that the developer carefully provides. The software contains a multi-timeframe analysis feature, which gives you the ability to overlay multiple timeframes on a single chart to see how long-term indicators and price levels interact with short-term price action.

Note! The program will show the trader the moments that he missed. This will improve your analytical skills.

The strengths of the TrendSpider program include:

- a huge number of automatic technical analysis tools;

- providing free individual lessons for users;

- access to high quality teaching materials.

- learning curve for new users;

- the ability to use only one browser at a time;

- no desktop platform option.

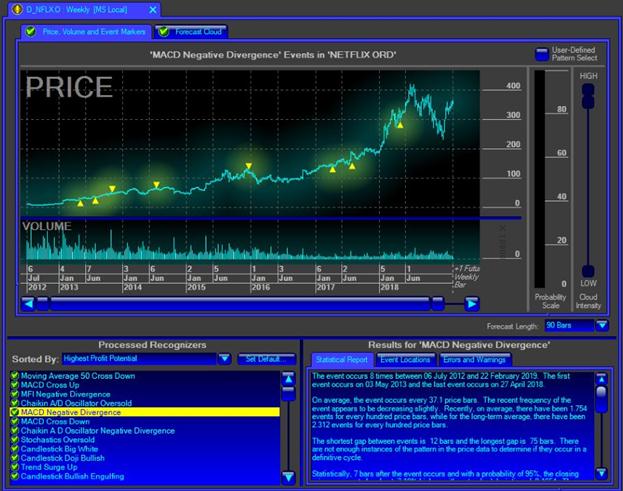

MetaStock

MetaStock is a powerful technical analysis charting service with a huge selection of stock/ETF/bond and Forex indicators. MetaStock offers excellent testing and forecasting tools, as well as a trading systems market. By adding Refinitiv Xenith, users will be able to view the real-time market situation. The program is easy to use as MetaStock focuses on making the merchant’s workflow convenient. The software is available on all devices, from PCs to smartphones/TVs. MetaStock uses a huge number of built-in systems to help the novice/intermediate trader understand and benefit from technical analysis patterns and well-researched systems.

- excellent deep backtesting;

- price forecast for unique shares;

- open access to a large library of additional professional strategies;

- timely resolution of emerging issues by the technical support service and the systematic conduct of training webinars;

- Ability to work online and offline.

The old-school design of the Windows program is the only drawback of MetaStock.

TradeMiner

TradeMiner is a bot that provides the trader with insights that can help him make practical investment decisions. The software is compatible with all major operating systems including MacOS, Linux and Windows. The bot automatically starts scanning the markets and provides detailed trend reports. Thanks to such an assistant, the trader has more free time to focus on developing a good strategy. The advantages of a robot for trading stocks, futures and bonds on the stock market in Europe include:

- ease of use and installation of the system;

- affordable price;

- simple and intuitive interface;

- analytical system based on data;

- reliability.

Traders are a little frustrated by the fact that the developers do not attach much importance to the need for individual mentoring.

Note! Users only need to pay an annual fee. There are no monthly payments, which is a significant advantage.

TradeMiner may be far from perfect, but it’s definitely worth taking a look at. The software is suitable for both novice traders and experienced traders.

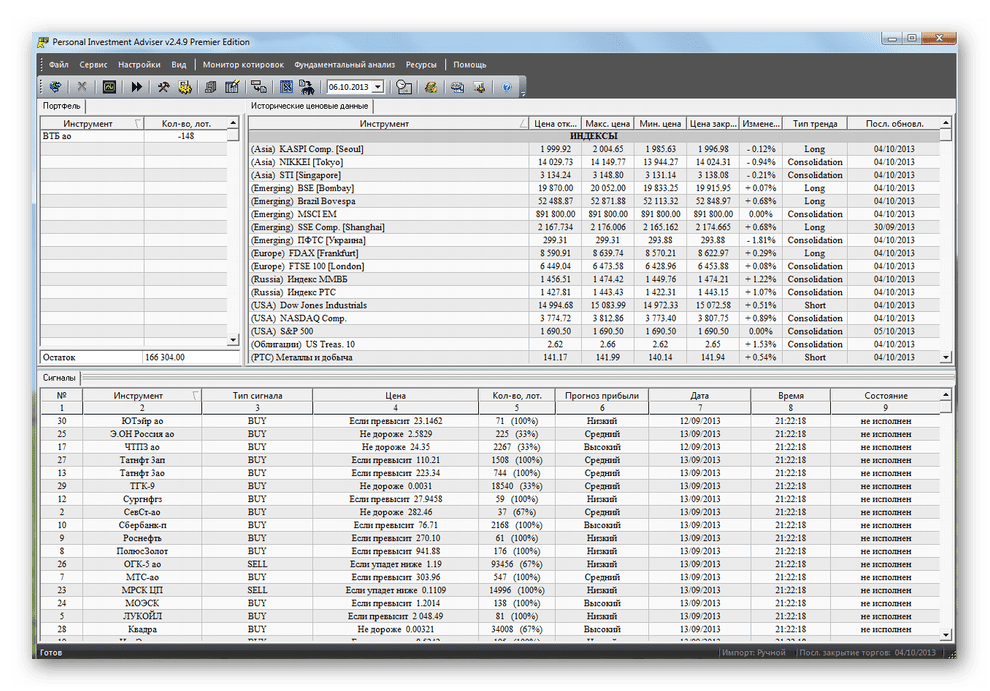

PIAdviser

PIAdviser is a popular bot used by European traders to trade stocks and bonds. The system analyzes Russian and European stock markets. PIAdviser is able to determine the market dynamics as accurately as possible. The user receives a notification about the situation on the market with some recommendations. A trader can choose a classic, premium or web version. The presence of a Russian-language interface, reliability and ease of use are the main advantages of the bot. Judging by the reviews of traders, there were no significant shortcomings in this robot.

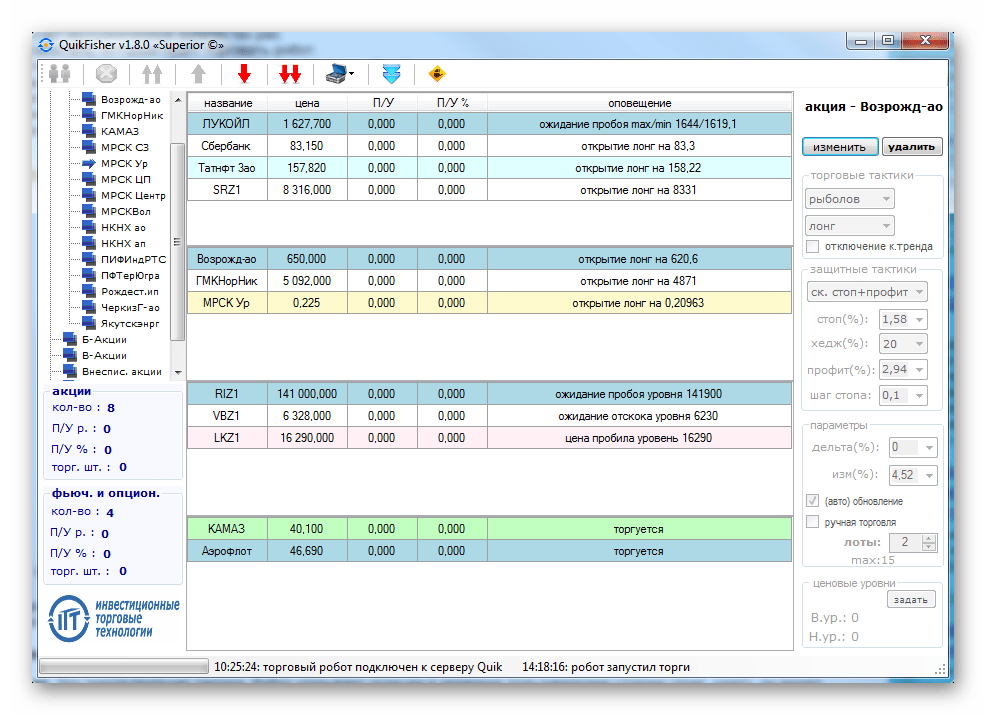

QuikFisher

QuikFisher is a versatile robot that allows users to trade futures and stocks of various levels of liquidity. The program performs deep analysis and performs calculations to determine the most profitable transactions. The trader only needs to set the appropriate parameters and entrust the trading process to the bot. QuikFisher supports work with the QUIK complex. Traders can use 6 strategies. A timer is provided for automatic shutdown after a specified period. Bot benefits include:

- the presence of a Russian version;

- conducting an in-depth analysis in order to determine the most profitable transactions;

- reliability;

- clear interface.