The emergence of robots for trading foreign exchange is the result of the rapid development of technology and the transfer of all routine trading functions to reliable assistant programs. They help traders follow the algorithms precisely, bringing money to their owners even while they sleep.

- Features of Free Trading Robot

- Forex and Binary Options Warning

- Work principles

- When is a trading robot useful?

- How popular and safe are trading robots?

- Pros and cons of automated trading

- Why are robots made available freely?

- Types of trading robots

- Strategies for trading robots

- Scalping

- Trend

- Mesh

- All in

- Martingale

- Strategy based on the Parabolic SAR indicator

- Moving average crossover

- Crossing 2 lines of indicators

- Choosing a free trading robot

- Installing and connecting a trading robot

- Reviews of traders

Features of Free Trading Robot

A trading robot is a special additional program with certain functions that simplify the trading process. Such a robot can independently execute transactions and send signals to traders about when to complete the transaction. Trading robots have been used by both private traders and professionals for more than a year. But the existence of trading robots does not guarantee that you will always make a profit.

Forex and Binary Options Warning

Any trading in financial markets, including Forex and binary options, carries risks. Robots cannot guarantee you a profitable trade. It is only a tool thanks to which you can trade in accordance with the parameters set by you. Using a robot, like trading on your own, can lead to partial or complete loss of funds on your trading account. And this must be clearly understood. The developer of the program does not bear any responsibility for the losses incurred by you.

Work principles

The principle of operation is different. Let’s talk about the most common among free robots – indicator. The robots are based on an algorithm based on moving average indicators that allow them to “see” the direction of the trend. When the average price of an asset rises, the robot buys it. If the price starts to fall, then the robot can make a profit before completing the transaction.

Moving Average is a technical indicator based on the analysis of quotes behavior. It is one of the oldest and most common trend indicators in technical analysis.

Apart from moving averages, such a free robot can also have a built-in Martingale algorithm. This strategy is very popular with the players. Its essence is that after each unprofitable contract you need to double the amount. In theory, in this way, the trader will return the funds lost as a result of an unsuccessful transaction. If the next contract is successful, a profit will be made. In practice, this strategy is not so smooth. She has more negative reviews – the strategy often leads to a complete drain.

When is a trading robot useful?

The robot can be useful to you and simplify the process if you decide to buy securities yourself and build your portfolio. The amount also matters here. If the investment starts from 1 million rubles, then it makes sense to trade using this algorithm, if, for example, from 100 thousand rubles, then no. This is because the robot needs somewhere to turn around. It is more difficult to manage the risks of a small investment portfolio than a large one.

How popular and safe are trading robots?

Robot trading is very popular. According to the Central Bank of the Russian Federation, as of April 2018, up to half of transactions on the Moscow Exchange were carried out using robotic programs. This trading volume is carried out by professional robots. They were created by a group of highly professional programmers. Free bots are not always safe and reliable. These are most often primary developments.

Pros and cons of automated trading

The advantages of using trading robots are clear – their judicious use helps to increase income from binary trading. At the same time, you can not understand much about the intricacies of these same trading operations. Also among the pluses:

- strict adherence to the system, because the robot is not able to miss a deal or succumb to a fleeting emotion;

- the robot quickly analyzes the data, which is especially valuable if you need to process large amounts of information in a short time period, or make quick transactions;

- it is possible to trade several instruments at the same time, which is very time consuming to do manually (you can easily miss something or just get confused);

- it is possible to implement several trading systems at once – it is useful when, for example, trading according to his usual system, a person understands that other assets will receive interesting signals – simple, but rare, and it is impossible to use the strategy for them as the main one.

Disadvantages of using:

- the program works according to the algorithms incorporated in it, and cannot analyze the non-standard situations that have arisen;

- the programmer does not always correctly understand the task of the trader, and the result of his work may not be as he would like;

- regular use of robots unnecessarily loads the platform, which may result in a delay in data updates and lead to losses;

- trading robots do not work very well in news trading and do not always accurately and correctly understand fixed indicators, because they analyze external sources to find them.

Why are robots made available freely?

It’s not a secret for anyone that now you can win on the stock exchange only with the help of robots. Experts estimate that 50% to 80% of all transactions are performed using these automated programs owned by professionals.

The purpose of providing such robots for free is to show the convenience and comfort of trading with them.

Of course, free software is unlikely to bring you extra profits. The performance of free robots is not as good as that of more advanced, paid counterparts, which is quite logical. However, when configured correctly, many traders use them successfully.

Types of trading robots

Such robots can be classified according to several criteria. By the level of automation, there are robots:

- Automatic. Here, trade is carried out completely without human participation.

- Semi-automatic. Such systems give a signal to the trader when a suitable deal appears on the horizon, but the person makes the final decision.

According to the principle of work, there are such robots:

- Indicator. They work on the basis of one or several indicators at once.

- Indicator-free. Such systems carry out trader transactions by levels, candlestick patterns and chart patterns. This trading principle is suitable for those who already have experience.

- Mesh robots. They place orders with fixed price change intervals and close the trade with an overall positive result. Judging by the reviews, these are the most popular robots.

- Trendy. Trend lines are plotted using the moving averages method, along which trading is carried out. This type shows good results with one-sided price changes.

- Scalping. Robots carry out transactions with high regularity. The goal is to take several pips at once (percentage points, which represent the smallest price variation on the Forex exchange).

- News. The robot works by relying on events from the news feed. But the program will not be able to track the calendar itself, so the trader will need to choose the appropriate time intervals.

- Duct. Robots trade in the channel, on the rebound and breakout of its boundaries. They are made on the basis of the Elliott wave theory (this is a theory about the process of changing financial markets in the form of recognizable patterns).

- Self-learning bots. These are robots using neural networks.

- Arbitration. Robots use the difference in quotes from different brokers. Naturally, for your own benefit. The trader acts on the slightest fluctuations in quotes.

According to the control principle, robots are as follows:

- using a fixed lot for trading;

- calculating the number of lots for each transaction by% of the deposit;

- trading on the Martigale system, in the event of a losing trade, they open the next transaction with an increased lot amount;

- increasing the number of transactions in the direction of the trend as capital increases.

Strategies for trading robots

There are dozens of different trading strategies on the stock market today. Brokers provide ready-made free tactics suitable for newbies. Traders who already have experience in this area prefer to independently develop individual work plans.

Scalping

Short-term trading takes place during the best trading hours when prices fluctuate a lot. The process itself:

- Place an order for a specific currency pair, set stop loss and take profit. The duration of a trading session usually does not exceed 30 minutes.

- The rate moves away from the channel border, the system fixes and opens an order.

- The price closes in a few pips.

This method is usually based on the Bollinger indicator, also called the “Bollinger Bands”.

Bollinger Bands are a tool used to analyze the financial market that reflects current price fluctuations. The indicator is calculated based on the deviation from the moving average. Usually displayed at the top of the price chart.

Trend

The system is applicable to any asset, it is best to trade on long intervals. The user is not protected from losing, so the bet is accepted by min value. The principle of constructing a trend line is based on a moving average. When the price goes to profit / loss, the trade will be opened. This strategy is universal for a wide variety of indicator types.

The more indicators are involved in the analysis, the more accurate the forecast and the more likely it is to make a profit.

Mesh

Trading is based on placing a pending order at the same distance in the upward and downward directions from the price. As a result, a kind of mesh is formed. Stop loss and take profit will be an additional guarantee.

Take profit is a pending order. When the price reaches a certain mark, the robot automatically closes the trade and makes a profit.

In case of sharp fluctuations in the trend, the grid strategy gives a positive effect. Many brokers and trading terminals do not support the function of opening multidirectional orders.

Flat (Flat) is when the price does not rise and fall within a certain period of time. Usually this time period is referred to as a correction or a sideways trend.

All in

This long-term strategy is one of the most risky. It does not use indicators, and trading is carried out on an intuitive level and based on basic technical calculations. The main idea of the strategy is to calculate long-term big moves and place orders on potential pullbacks. Trades are usually made on Monday when the likelihood of a reversal is highest. Situational analysis is based on price charts. In most cases, strategic signals are processed by taking profit. A unique feature of robots with this strategy is that they do not need to be installed on the trading platform.

Martingale

The principle of the strategy is to calculate a losing position and form a two-stage position in one direction. The risk of such transactions is too great, but you can compensate yourself for the losses of the previous batch. The development of a universal advisor takes into account the possibility of market volatility in order to minimize risks. The subtlety of trading using this method is the rejection of the stop loss.

Strategy based on the Parabolic SAR indicator

The work of the technical advisor is aimed at reducing the delay in the response of the trading platform. Such a system can be used if the trend in market prices is evident. In flat, such a robot will be ineffective. The robot helps traders find the optimal profit and stop loss values.

Moving average crossover

The system is based on moving average indicators, easy to understand and use. The robot is suitable for any currency pair on different timeframes. The program has many inter-level price differences, price types, stop loss and profit settings. When the first moving average crossover occurs, an order is opened and then closed when the operation is repeated. In order for the robot to be able to pick up all the signals, it must be ensured continuous operation.

Crossing 2 lines of indicators

This strategy involves opening orders when an indicator line is applied to a price line or other index chart. Provided that the signal line is below the main line, it is profitable to sell, and vice versa. The robot allows you to trade using trend, reversal or price channels.

Choosing a free trading robot

If you are just starting to try to conduct transactions on the exchange and you do not have enough time to fully understand trading and conduct transactions on your own, use free currency exchange robots. When choosing, check the profitability of the program in the past, the level of risk and the openness of the system itself. If some of this is not announced, it is better to refuse to use such a robot. Also, when choosing, it is important to remember the importance of minimizing risks. It’s great if several robots are connected to the account at once using different strategies. Rating of the best free robots:

- Wall Street Forex Robot. The robot appeared back in 2011 and has been successfully operating to this day. The principle of trading with it is very simple – entering along a trend on corrections (this is a change in the rate in the direction opposite to the trend). The downside is that the stop loss is several times higher than the profit.

- Forex Hacked Pro. You can work with several currency pairs at the same time. The downside is the presence of Martingale, which is why the robot needs to provide a deposit of $ 100 for a cent account, and $ 10,000 for a regular one. A VPS is required for continuous operation. This is a virtual dedicated server.

- Generic and Generic 14. This is the same robot, except that an order grid was added in version 14. He uses the strategy of night scalping, which has already become a classic. It is extremely problematic to trade without the help of a robot using this strategy.

- Setka Project. This is a rather complex program. To work with this robot, you will have to deeply study and delve into the topic. If you do not understand anything at all about this, you will not be able to use it. In fact, it is the most advanced mesh robot available for free.

- VelociGrid. The multicurrency Expert Advisor uses the Martingale trading system with average parameters. To open a working position, a grid with trade orders will be created on the price chart.

- Golden ducat. Long Term Stable Gold Trading Robot (XAUUSD). Without using the Martingale system (although, if necessary, you can enable it in the settings).

- Survivor. A sophisticated indicator-based Expert Advisor. The transaction is carried out in the channel. If the price is against the position, a small grid of orders will be set. The robot has also been successfully operating for several years.

A stop loss is an order (order) that limits your losses and closes automatically when the price reaches a certain level.

Here are some more robots with good reviews:

- Big Dog;

- Momentum Elder;

- Yellow Free;

- Turtle Soup;

- Night-Fractal;

- PZ Suoer Trend.

Installing and connecting a trading robot

Since the robot for trading based on trading is a software algorithm, it is very important to install it correctly. You need to do this as follows:

- Download the file with the robot from the website of its creator. The downloaded file should contain the robot itself, settings for it and an archive with additional indicators.

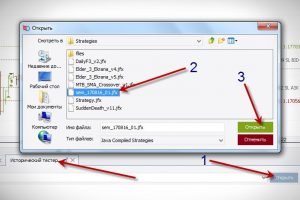

- Unpack the file and install it on the trading platform. To do this, copy all the file components and place them in the appropriate folders on the site. After completing these operations, the robot will be integrated into the platform, but not activated.

- Connect to the schedule. In order for the program to start analyzing the chart, check the box to enable automatic trading via the site. Then, using the navigator panel, drag the robot onto the chart using the mouse.

- Before you start trading, adapt the system for active strategies. To do this, configure the program. Load the input parameters of the robot if necessary. In order for it to react correctly to all changes in the foreign exchange market, the strategy will need to be regularly adjusted.

- After all the installation and configuration steps are completed correctly, you will find a robot icon and a smiley face in the upper right corner. The program will not start trading immediately after you install it, it must take some time for all the specified trading parameters to match.

The robot trades only when the terminal is active. When the user turns off the computer, work will stop.

Reviews of traders

Alexander Ignatov, 31 years old. Wall Street Forex Robot is an excellent bot, but I do not recommend putting it on Forex. Best of all, it beats off profit by indices. Or you can try on quiet stocks.

Yuri Mikov, 36 years old. I am currently using Survivor. The program works well and smoothly, but it is not an easy one. For beginners, I would recommend Wall Street Forex Robot or VelociGrid. They are easier to learn from. Trading robots are an excellent tool for increasing your trading profits in the Forex market. They perform transactions automatically and greatly facilitate the work of traders: they save your energy, time and money. Any strategy can be implemented on the basis of robots.