The emergence of foreign exchange trading robots is the result of the rapid development of technology and the transfer of all routine trading functions to reliable assistant programs. They help traders to follow the algorithms exactly, bringing money to their owners even while they sleep.

- Features of the free trading robot

- Forex and Binary Options Warning

- Work principles

- When is a trading robot useful?

- How popular and safe are trading robots?

- Pros and cons of automated trading

- Why are robots posted for free?

- Types of trading robots

- Strategies for trading robots

- scalping

- trending

- Grid

- All in

- Martingales

- Strategy based on the Parabolic SAR indicator

- moving average crossover

- Crossing of 2 indicator lines

- Choosing a free trading robot

- Installing and connecting a trading robot

- Trader reviews

Features of the free trading robot

A trading robot is a special additional program with certain functions that simplify the trading process. Such a robot can independently execute transactions and send signals to traders about when to complete a transaction. Robots for trading have been used by both private traders and professionals for more than a year. But the existence of trading robots does not guarantee that you will always make a profit.

Forex and Binary Options Warning

Any trading in financial markets, including Forex and binary options, involves risk. Robots cannot guarantee you profitable trading. It is only a tool through which you can trade in accordance with the parameters you set. Using the robot, as well as independent trading, may lead to partial or complete loss of funds in your trading account. And this must be clearly understood. The developer of the program does not bear any responsibility for the losses incurred by you.

Work principles

The principle of operation is different. Let’s talk about the most common among free robots – indicator. The robots are based on an algorithm built on moving average indicators that allow them to “see” the direction of the trend. When the average price of an asset rises, the robot buys it. If the price starts to fall, then the robot can make a profit before the trade is completed.

A moving average is a technical indicator based on the analysis of quotes behavior. This is one of the oldest and most common trend indicators in technical analysis.

In addition to moving averages, such a free robot can also have a built-in martingale algorithm. This strategy is very popular with players. Its essence is that after each unprofitable contract, you need to double the amount. Theoretically, in this way, the trader will return the funds lost as a result of an unsuccessful transaction. If the next contract is successful, profit will be made. In practice, this strategy is not so smooth. It has more negative reviews – the strategy quite often leads to a complete drain.

When is a trading robot useful?

The robot can be useful to you and will simplify the process if you decide to buy securities yourself and build your portfolio. The amount also matters here. If the investment starts from 1 million rubles, then it makes sense to trade using this algorithm, if, for example, from 100 thousand rubles, then no. This is because the robot needs a place to turn around. Managing the risks of a small investment portfolio is more difficult than managing a large one.

How popular and safe are trading robots?

Robot trading is very popular. According to the Central Bank of the Russian Federation, as of April 2018, up to half of transactions on the Moscow Exchange were carried out using robot programs. This volume of trading is carried out by professional robots. They were created by a group of highly professional programmers. Free bots are not always safe and reliable. These are most often primary developments.

Pros and cons of automated trading

With the advantages of using trading robots, everything is clear – their reasonable use helps to increase the income from binary trading. At the same time, you can not much understand the intricacies of these same trading operations. Also among the pluses:

- strict adherence to the system, because the robot is not able to miss a deal or succumb to a fleeting emotion;

- the robot quickly analyzes data, which is especially valuable if you need to process large amounts of information in a short time period, or make quick transactions;

- it is possible to simultaneously trade several instruments, which is very time consuming to do manually (you can easily miss something, and just get confused);

- it is possible to implement several trading systems at once – it is useful when, for example, trading using his usual system, a person understands that other assets will receive interesting signals – simple, but rare, and it is impossible to use a strategy for them as the main one.

Disadvantages of use:

- the program works according to the algorithms embedded in it, and cannot analyze the non-standard situations that have arisen;

- the programmer does not always correctly understand the task of the trader, and the result of his work may not be as desired;

- regular use of robots unnecessarily loads the platform, which may delay data updates and lead to losses;

- trading robots do not work very well in news trading and do not always accurately and correctly understand fixed indicators, because. they analyze external sources to find them.

Why are robots posted for free?

It’s no secret that now you can win on the stock exchange only with the help of robots. Experts estimate that between 50% and 80% of all transactions are carried out using these automated programs owned by professionals.

The purpose of providing such robots for free is to show the convenience and comfort of trading with them.

Of course, free programs are unlikely to bring you super profits. The performance of free robots is not as good as that of more advanced paid counterparts, which is quite logical. However, when set up correctly, many traders use them successfully.

Types of trading robots

Such robots can be divided according to several criteria. According to the level of automation, there are robots:

- Automatic. Here trade is carried out completely without human participation.

- Semi-automatic. Such systems give a signal to the trader when a suitable trade appears on the horizon, but the final decision is made by a person.

According to the principle of work, there are such robots:

- Indicator. They work on the basis of one or several indicators at once.

- Non-indicator. Such systems carry out trade transactions by levels, candlestick figures and chart patterns. This principle of trading is suitable for those who already have experience with.

- Grid robots. They place orders with fixed price change intervals and close the deal with an overall positive result. Judging by the reviews, these are the most popular robots.

- Trendy. Using the method of moving averages, trend lines are built, along which trading is carried out. This view shows good results with unilateral price changes.

- Scalping. Robots carry out transactions with high regularity. The goal is to take several pips at once (percentage points, which are the smallest price variation on the Forex currency exchange).

- News. The robot performs work, relying on events from the news feed. But the program will not be able to keep track of the calendar itself, so the trader will need to choose the appropriate time intervals.

- Channel. Robots trade in the channel, on the rebound and breakdown of its borders. They are made on the basis of the Elliot wave theory (this is a theory about the process of changing financial markets in the form of recognizable patterns).

- Self-learning bots. These are robots using neural networks.

- Arbitration. Robots use the difference in quotes from different brokers. Of course, for your own benefit. The trader acts on the slightest fluctuations in quotes.

According to the principle of control, robots are as follows:

- using a fixed lot for trading;

- calculating the number of lots for each transaction by % of the deposit;

- trading using the Martigale system, in case of a losing trade, they open the next transaction with an increased lot amount;

- increasing the number of transactions in the direction of the trend as capital increases.

Strategies for trading robots

There are dozens of different trading strategies on the stock market today. Brokers provide ready-made free tactics suitable for beginners. Traders who already have experience in this area prefer to develop individual work plans on their own.

scalping

Short-term trading is carried out during the best trading hours, when quotes fluctuate a lot. The process itself:

- Place an order for a specific currency pair, set a stop loss and take profit. The duration of a trading session usually does not exceed 30 minutes.

- The rate moves away from the border of the channel, the system is fixed and opens an order.

- The price closes in a few points.

This method is usually based on the Bollinger indicator, also known as Bollinger Bands.

Bollinger Bands is a tool used to analyze the financial market, which reflects current price deviations. The indicator is calculated based on the deviation from the moving average. Usually displayed at the top of the price chart.

trending

The system is applicable to any asset, it is best to trade on long intervals. The user is not protected from losing, so the bet is accepted by the min value. The principle of drawing a trend line is based on a moving average. When the price goes to profit/loss, the trade will be opened. This strategy is universal for various types of indicators.

The more indicators involved in the analysis, the more accurate the forecast and the more likely it is to make a profit.

Grid

Trading is based on placing a pending order at the same distance in the ascending and descending directions from the price. As a result, a kind of network is formed. An additional guarantee will be stop loss and take profit.

Take profit is a pending order. When the price reaches a certain mark, the robot automatically closes the deal and makes a profit.

With sharp fluctuations in the trend, the grid strategy gives a positive effect. Many brokers and trading terminals do not support the function of opening bidirectional orders.

Flat is when the price does not rise or fall for a certain period of time. Usually this time period is referred to as a correction or sideways trend.

All in

This long-term strategy is one of the riskiest. It does not use indicators, and trading is carried out on an intuitive level and based on basic technical calculations. The main idea of the strategy is to calculate long-term big moves and place orders on potential pullbacks. Typically, trades are made on Monday, when the likelihood of a reversal is highest. The situational analysis is based on price charts. In most cases, strategic signals are processed by profit taking. The unique feature of robots with this strategy is that they do not need to be installed on the trading platform.

Martingales

The principle of the strategy is to calculate a losing position and form a two-stage position in one direction. The risk of such transactions is too great, but you can recover the losses of the previous batch. The development of a universal advisor takes into account the possibility of market volatility in order to minimize risks. The subtlety of trading using this method is the rejection of the stop loss.

Strategy based on the Parabolic SAR indicator

The work of the technical advisor is aimed at reducing the delay in the response of the trading platform. Such a system may be used if the market price trend is clear. In a flat, such a robot will be ineffective. The robot helps traders find optimal profit and stop loss values.

moving average crossover

The system is based on moving average indicators and is easy to understand and use. The robot is suitable for any currency pair on different timeframes. The program has many inter-level price differences, price types, stop loss and profit settings. When the first crossing of the moving average occurs, the order is opened and then closed when the operation is repeated. In order for the robot to catch all the signals, it is necessary to ensure its continuous operation.

Crossing of 2 indicator lines

This strategy involves opening orders when the indicator line is applied to the price line or another index chart. Provided that the signal line is below the main one, it is profitable to sell, and vice versa. The robot allows you to trade using trend, reversal or price channels.

Choosing a free trading robot

If you are just starting to try to conduct transactions on the stock exchange and you do not have enough time to fully understand trading and conduct transactions on your own, use free currency exchange robots. When choosing, check the profitability of the program in the past, the level of risk and the openness of the system itself. If any of this is not disclosed, it is better to refuse to use such a robot. Also, when choosing, it is important to remember the importance of minimizing risks. It’s great if several robots are connected to the account at once using different strategies. Rating of the best free robots:

- Wall Street Forex Robot. The robot appeared back in 2011 and is still working successfully. The principle of trading with it is very simple – entering the trend on the correction (this is a change in the rate in the direction opposite to the trend). The downside is that the stop loss is several times larger than the profit.

- Forex Hacked Pro. You can work with several currency pairs at the same time. The downside is the presence of Martingale, because of which the robot needs to provide a deposit of $100 for a cent account, and $10,000 for a regular account. A VPS is required for continuous operation. This is a virtual dedicated server.

- Generic and Generic 14. This is the same robot, except that an order grid was added in version 14. He uses the night scalping strategy, which has already become a classic. It is extremely problematic to trade without the help of a robot using this strategy.

- Setka Project. This is a rather complex program. To work with this robot, you will have to deeply study and delve into the topic. If you do not understand anything at all in this, you will not be able to use it. In fact, this is the most advanced grid robot available for free.

- Veloci Grid. The multi-currency Expert Advisor uses the Martingale trading system with medium parameters. To open a working position on the price chart, a grid with trading orders will be created.

- Golden chervonets. Long-term stable gold trading robot (XAUUSD). Without using the Martingale system (although it can be enabled in the settings if necessary).

- Survivor. Sophisticated Expert Advisor based on indicators. The transaction is carried out in a channel. If the price is against the position, a small grid of orders will be set. The robot has also been successfully working for several years.

A stop loss is an order (order) that limits your losses and automatically closes when the price reaches a certain level.

Here are a few more robots with good reviews:

- Big Dog

- Momentum Elder;

- Yellow Free;

- Turtle Soup;

- Night Fractal;

- PZ Suer Trend.

Installing and connecting a trading robot

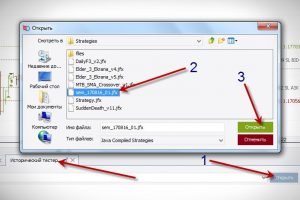

Since the trading robot is a software algorithm, it is very important to install it correctly. You need to do this as follows:

- Download the robot file from its creator’s website. The downloaded file should contain the robot itself, settings for it and an archive with additional indicators.

- Unpack the file and install it on the marketplace. To do this, copy all the components of the file and place them in the appropriate folders on the site. After performing these operations, the robot will be built into the platform, but not activated.

- Connect to the chart. In order for the program to start analyzing the chart, check the box to enable automatic trading through the site. Then, using the navigator panel, drag the robot onto the chart with the mouse.

- Before you start trading, adapt the system to active strategies. To do this, set up the program. If necessary, load the input parameters of the robot. In order for it to correctly respond to all changes in the foreign exchange market, the strategy will need to be regularly adjusted.

- After all the installation and configuration steps are completed correctly, you will find a robot icon and a smiley emoticon in the top right corner. The program will not start trading immediately after you install it, some time must pass for all the specified trading parameters to match.

The robot trades only when the terminal is active. When the user turns off the computer, the operation will stop.

Trader reviews

Alexander Ignatov, 31 years old. Wall Street Forex Robot is a great bot, but I don’t recommend using it on Forex. Best of all beats off the profit on the indices. Or you can try for quiet promotions.

Yuri Mikov, 36 years old. Now I use Survivor. The program clearly and debugged works, but it is not simple. For beginners, I would recommend Wall Street Forex Robot or VelociGrid. They are easier to learn from. Trading robots are an excellent tool for increasing trading profits in the Forex currency market. They perform transactions automatically and greatly facilitate the work of traders: they save your energy, time and money. Any strategy can be implemented on the basis of robots.