Overview of the Tradematic Trader platform: features, interface, algorithmic trading. Trading on the real Forex market is carried out independently or with the help

of a trading robot . If an independent platform involves an independent analysis of the market, then a trading robot can significantly simplify the process. The best option for beginners can be the Tradematic platform.

- What is the Tradematic Trader platform

- Capabilities

- Application of different versions of the program

- The standard version of the Tradematic platform is installed

- Parking

- Entering an application manually, canceling an application

- How it works

- Overview of Solutions for Traders

- For developers

- For managers

- For investment business

- Tradematic Trader personal account, registration

- Practical use

- Trading robot constructor

- Pros and cons of the Tradematic Trader platform for automated trading

- Price

What is the Tradematic Trader platform

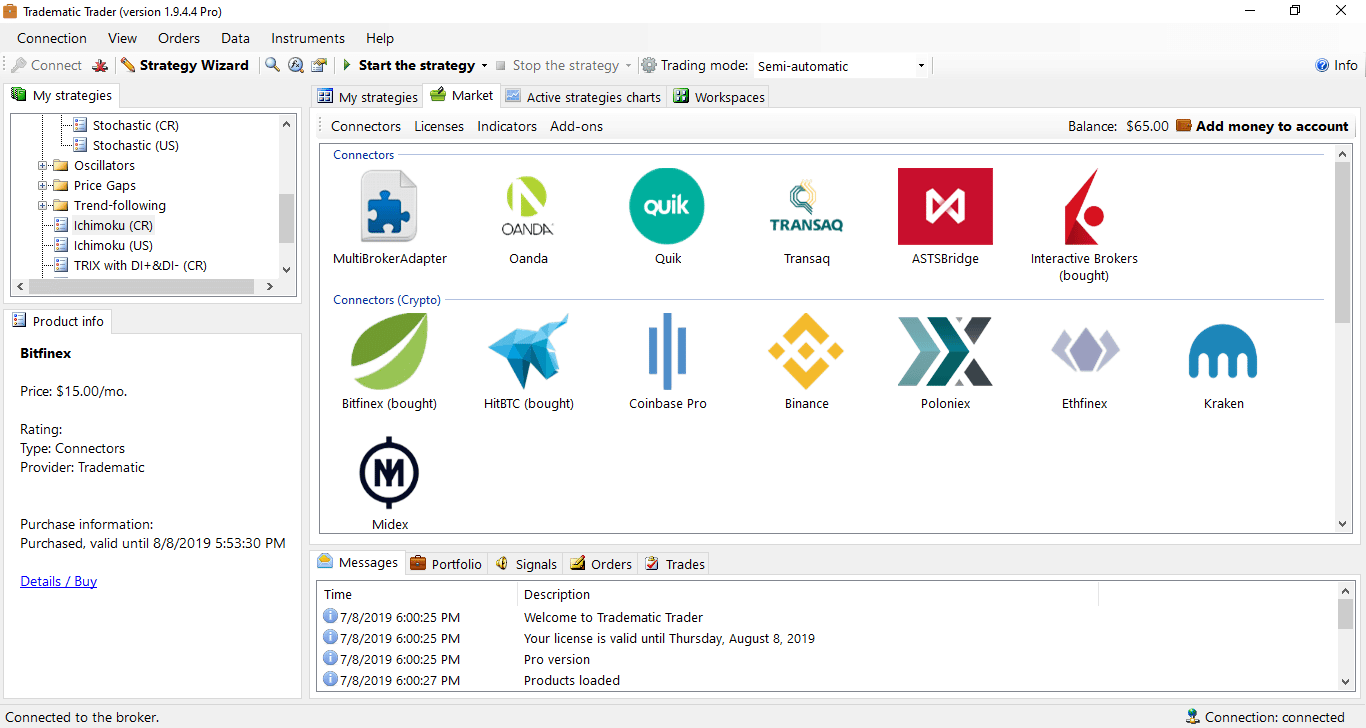

So what is the Tradematic Trader platform? Tradematic is a software platform designed for

algorithmic trading in the stock markets and creating trading strategies. The platform provides access to sites such as MOEX, as well as cryptocurrency exchanges. Internal algorithms automate the trading process as much as possible due to ready-to-use strategies. The strategy is called an algorithm, ready-made algorithms are used, but if you wish, you can develop your own strategy, and programming skills are not necessary. Trading is carried out through such terminals as

QUIK ,

Transaq and others. Cryptocurrency trading takes place on platforms such as Binance, Bitfinex and others.

- Ability to develop your own strategy (algorithm) . Programming experts can use adapted and flexible strategy script editors. It is also possible to use a lightweight strategy wizard, which consists of many rules and prepared indicators for technical market analysis.

- The platform supports a whole list of programming languages Visual Basic, JScript, and so on .

- All proposed strategies were written by professionals, tested on real trading . Strategies lead to the optimal profit indicator, taking into account the existing risks.

You can learn more about the platform on the official website https://tradematic.com/ru/

Capabilities

The main purpose of Tradematic is the construction

of trading robots , which is based on the Microsoft.NET platform. If desired, each strategy can be supplemented or modernized. For this, the C# code editor is used. Also, if you have knowledge, you can create your own strategy from absolute scratch.

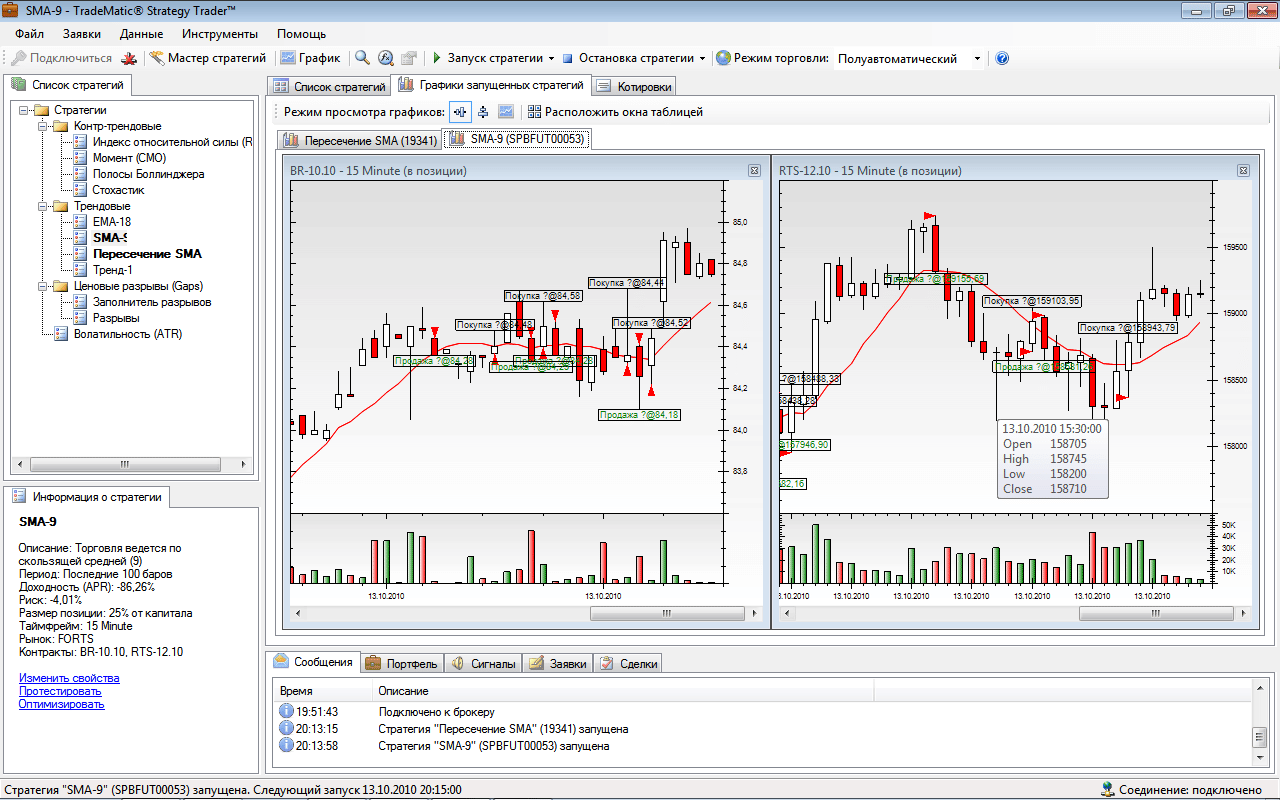

- Convenient introduction to the available strategies that can be arranged in the form of a tree, tables, lists. Each strategy is accompanied by a graph with performance over the past period. When you select a specific strategy, a detailed description of it appears.

- Ability to write a new strategy or upgrade a finished strategy.

- The ability to create a secure strategy, namely a container, for exchange between users.

- Three trading modes are available – fully automatic, semi-automatic and manual trading.

- A full-fledged terminal has all the quotes, a glass of orders. Application can be entered manually. It is convenient to view price charts, apply indicators and use a full set of tools.

- It is possible to try the algorithm on historical parameters, to get acquainted with the statistical data.

- The strategy is easily optimized for a whole set of parameters.

- It is easy to control the status of the trading account.

- The list of signals, orders for a specific strategy is easily accessible.

Application of different versions of the program

The developers provide 2 versions – standard and PRO. Based on the name, the PRO version is aimed at professional participants, including managers. This version has a number of distinctive features:

- Special optimization designed to run more than one strategy.

- Grouping of accounts, simultaneous launch of several strategies and release of several orders.

- Local data server.

- There are no limiting restrictions for running instances concurrently.

- It is possible to run more than 3 strategies simultaneously. So, the regular version limits the simultaneous launch, no more than 3x.

- When the need to update the version approaches, the wishes of users will not be left without attention.

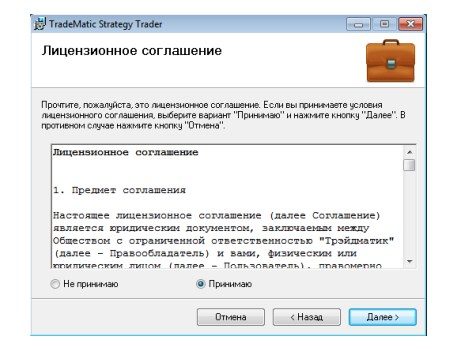

The standard version of the Tradematic platform is installed

With the help of the Qiwi service, the license of the version without commission is paid. The version is paid for 3 and a half months, or for 12 months. If you have problems connecting the version, you should write to support, where employees will quickly solve all the problems that have arisen.

Parking

The “Parking” service is an opportunity to launch your tradematic strategy or manager’s strategy on a separate reliable dedicated server with access from anywhere in the world!

If you have already developed your strategy, or use one of the strategies of managers, then you probably began to think that a trader should not work at home (or at work). An unreliable communication channel, equipment not designed for continuous operation, lack of control over trading from other places are factors that do not contribute to the quality of signal execution, and as a result, lead to a loss of profit, and sometimes loss. The platform offers rental of a virtual dedicated server located in a modern data center, where TradeMatic and Quik will be constantly running. You will have full access to the server – ie. in fact, it is your second computer. Advantages of the new service:

- Offline work .

- Access to the server from anywhere in the world (from home, from work, from a business trip or from a hotel, etc.).

- Work with the tradematic on the server via mobile devices – iPhone, iPad, smartphones with Android OS (using third-party programs for these OS, compatible with the Remote Desktop protocol).

- Several parallel Internet channels .

- Cloud fault-tolerant architecture (i.e. the processor will not overheat, the hard drive will not fail).

- Cooling and fire extinguishing system .

- Optimal server configuration , optimized for working with the tradematic.

- Close proximity to data servers (which means minimal delays in receiving data).

- Savings on licenses (you can work with the tradematic from home, work or any other place under one license).

- Due to the powerful server configuration, it is possible to test on historical parameters and optimize at a much higher speed.

Monthly cost – 3000 rubles, when paying through the Qiwi system, no commission is required.

Entering an application manually, canceling an application

“Order” is a list of orders that have been submitted to the exchange. There are two ways to enter an application:

- the order came from a trading strategy, when the automatic trading mode is activated;

- entering the application manually.

Orders that were not automatically executed are highlighted. In order to manually create an application, in the main menu you need to select “Applications” and click “new application”. Then you need to perform the following procedure:

- the contract is indicated;

- the preferred number of lots for the application is selected;

- the price is indicated;

- one of three types of orders is selected (choice between limit, market, conditional);

- then a command to buy or sell is entered.

The application is considered entered, after that it will be displayed in the general list of applications. If a deal is made on the created order, it will be moved to the “Deals” section. If you need to cancel an active order, then you need to move the cursor over it, hold down the right mouse button and select “cancel”.

How it works

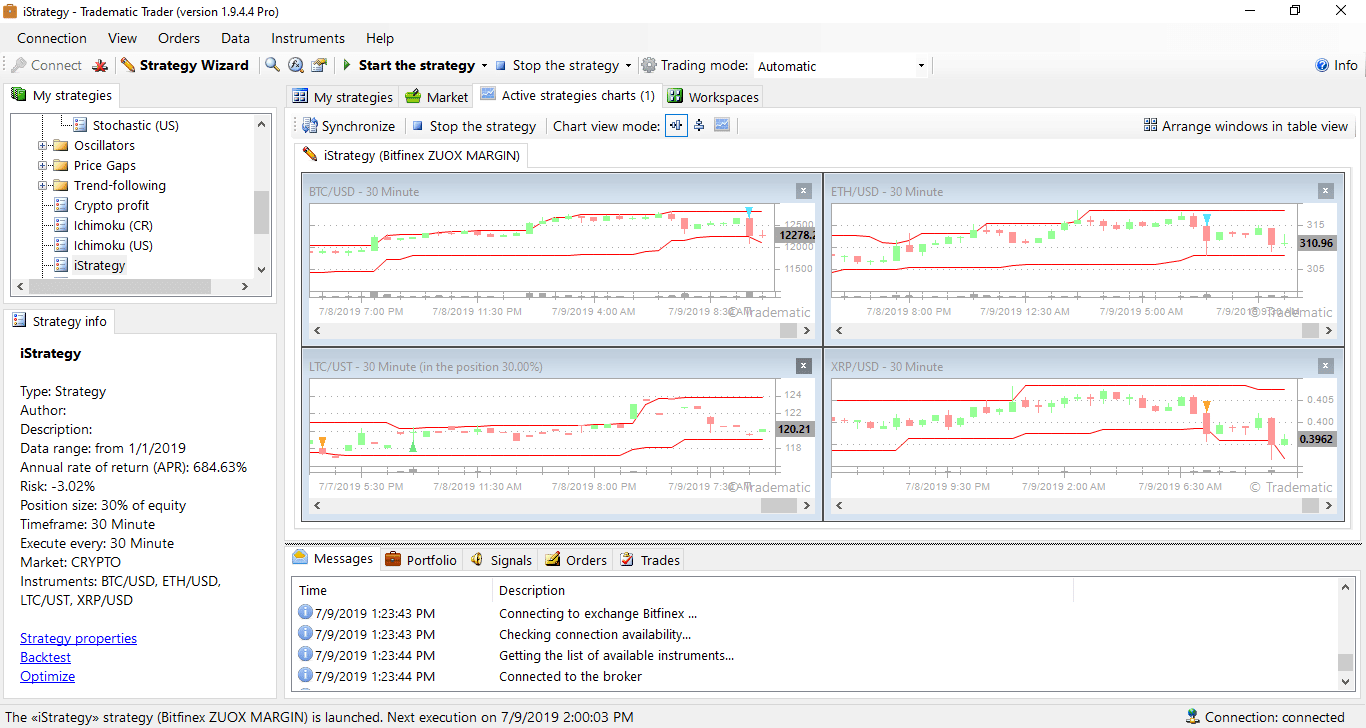

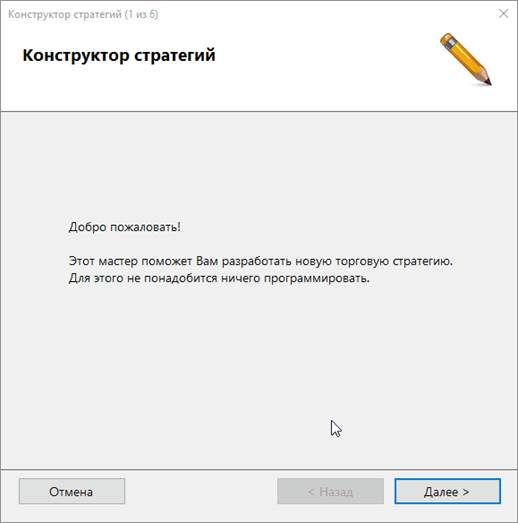

TradeMatic Trader allows you to develop mechanical automatic trading systems, test the result on the data already available in the system. To create your own “trading robot”, you can use the easy-to-use strategy builder and you don’t need to be able to program for this! If you have not yet developed your own algorithm, but want to effectively manage your account right now, then you can use the trading algorithms developed by professionals and trade them automatically, or use these algorithms as basic ones for developing your own strategy. The platform is user-oriented, simplified navigation and ease of management. The interface has been translated into Russian, despite its simplicity, the functionality is at a high level, which is comparable to professional platforms

.After loading the platform and moving it to the main screen, it will automatically connect to the previously specified QUIK. All settings will automatically adjust to the desired format of work. Further work will only consist in developing a unique strategy or applying existing options. Overview webinar on Tradematic Trader (25 minutes): https://youtu.be/HWkKhabYTXU

Before operating, be sure to read the user manual. This will help you start working effectively in the shortest possible time.

So, the Tradematic Trader platform is an all-in-one system in which you can create a trading strategy, test and optimize it, and then trade, including in a fully automatic mode, i.e. only track the execution of signals according to the strategy. There is no longer a need to trade using various complex bundles of technical analysis packages, adapters and trading terminals – all the functionality is implemented in the form of an easy-to-use, but incredibly flexible and powerful automated trading platform – Tradematic Trader. Typical path when using the program:

- The idea of a trading system.

- Writing a trading system (either using the strategy wizard or using the strategy source code editor)

- Trading system testing, analysis of results. It is possible to make changes to the strategy algorithm and/or its parameters.

- Trading system optimization, results analysis. It is possible to change the parameters.

- Strategy work.

Development of profitable strategies in Tradematic Trader: https://youtu.be/hqEzsuqLEVw

Overview of Solutions for Traders

For traders, the main interest is trading strategies. Interestingly, each strategy can be tested both on the real market and on historical charts. A trader can use ready-made algorithms and create strategies manually, actively using automated processes. It is possible to trade on the MOEX sections, as well as trade cryptocurrency on the relevant exchanges. The most popular Moscow Exchange is connected through almost all major Russian brokers. A portfolio management system has been introduced to quickly monitor and control capital. Money can be divided into assets and strategies. The platform offers arbitrage, trend and counter-trend trading strategies. https://articles.opexflow.com/strategies/kontrtrend-v-tradinge. htm The chart shows all completed orders for a particular instrument in line with the chosen strategy. The user can set up a standard schedule, as well as an income and drawdown schedule.

For developers

Tradematic trader makes it possible to use about 150 developed indicators for technical and static analysis. If ready-made indicators are not enough, it is possible to write your own indicator in a convenient editor. The platform leaks a huge amount of market information. According to the developers, the volume of data exceeds the exchanges. To use third-party applications, the connection must be made through the API. Trading strategies are written through the microsoft.NET platform. On the platform, the use of the main group of programming languages is available, which includes Visual Basic, J#, JScript, etc. Visual designers are responsible for developing strategies, programming languages mainly serve to complement them.

For managers

The ability to manage assets is required to work on the platform. To facilitate the work of users, the developers have provided ready-made solutions aimed at automating the management process, as well as hanging protection against various kinds of risks. The company broadcasts a call to streamline the process of solving operating rooms without much effort. Benefits for managers:

- Portfolio and indices – it is possible to create profile strategies for money management, as well as individual indices.

- A Lite version for the client base is provided – the ability to supply Tradematic Lite clients for the convenience of repeating signals. It is convenient for clients to keep track of all events, there is no need to disturb managers on every issue.

- Absolute control – the exchange contains all the necessary control modules. It is possible to track applications, manage risks.

- Liver strategies and account groups – the manager can control client accounts and group them for convenience.

- Transparent reporting system – the platform contains many types of reporting, while it is possible to extract data and transfer it to the client.

- Ease of scaling – the user can simultaneously use multiple accounts and use multiple exchanges. If desired, you can make the simultaneous launch of several strategies. Scaling is possible up to the enterprise level.

For investment business

If the user is a representative of an investment company, then an individual automated trading solution is the best option. The platform infrastructure is ideal for businesses. The server infrastructure includes terminals and server-side execution of account clients, Quik and the ability to connect to trading platforms. Fast implementation of given solutions. All commands follow directly, without bureaucracy. The platform highlights the following advantages:

- Cloud system + API.

- Scalability, risk minimization, minimum failure rate, easy to integrate.

- Total support.

- Fast support, high-quality training, the possibility of corrections and improvements.

- Flexibility for business.

- A clear monitoring and control system.

- A separate system for tracking the infrastructure and the nature of the implementation of signals on customer accounts.

Tradematic Trader personal account, registration

To register on Tradematic Trader, you need to go to the official website ( https://www.tradematic.com/cabinet/?lang=ru& ) in the “new user registration” section. A field appears in front of the user that must be completely filled out:

- email;

- create a password (minimum 8 characters);

- choose the currency of the account;

- agree to the privacy policy.

Practical use

Tradematic trader has more than 10 partner brokers, the platform provides access to more than 12 trading platforms. In over 12 years on the market, the company has achieved phenomenal results that expand the overall understanding of automated trading:

- Service strategies execute signals through the activities of professional managers.

- Protected strategies – creation of containers for exchange between users.

- Testing strategies in real time and on historical intervals.

- Trading is accompanied by graphical visualization and statistical data.

- The ability to optimize trading on a whole list of built-in parameters.

- It is convenient to analyze the results, which contributes to stable trading.

- Possibility of fully automated trading, semi-automatic or manual.

- Built-in trading terminal that provides comprehensive indicators – quotes, order book, etc.

- Convenient system for monitoring and tracking the execution of applications.

- Minimization of the influence of the human factor.

Trading robot constructor

Peculiarities:

- Trading in the market takes place in the system.

- Automated trading is suitable for both beginners and professionals in trading.

- You can use a strategy using algorithms in the Exchange Trainer service.

The platform works in conjunction with Quik to create robots.

A trading strategy is created in just a few clicks, since you can easily combine ready-made rules. The sequence is detailed in the video. https://youtu.be/bx7Q3m1Yh-E

Pros and cons of the Tradematic Trader platform for automated trading

Since the 1990s, when automated trading began to develop rapidly, millions of traders have gained access to the Internet. The most powerful artificial intelligence, which is able to accurately analyze the market based on risks, apply proven indicators and perform the most difficult mathematical calculations in a matter of seconds, attracts more and more people. To the advantages of automatic trading on Tradematic Trader:

- the ability to find a suitable robot among the mass of options;

- high speed of calculations, accurate technical analysis;

- the platform works around the clock, supports several markets;

- the probability of robot error is minimized.

However, despite the perfection of the algorithms, there are some disadvantages:

- automatic trading practically does not use fundamental analysis;

- it is not possible to 100% predict the market movement, so the same strategy cannot guarantee a profit.

- if a trader does not have a clear understanding of trading, it will be difficult to make a profit.

Price

The platform developers provide two options for working, depending on the chosen tariff: Standard tariff and Pro. The cost of each tariff is 900 and 1900 rubles per month, respectively. It is worth noting that there is no trial period, that is, it will not work to test the capabilities of the platform for free. You can start getting acquainted with the platform only after subscribing and paying. If the user understands that the platform does not suit him, then within 2 weeks from the date of payment, he can withdraw back. The question arises as to the differences between the proposed tariffs. The Pro version implies the presence of risk, the user chooses between arbitrage trading or the creation of encrypted containers. A complete list of the features of both versions can be found on the tradematic trader website. In this way, Tradematic Trader is the optimal platform for making money both for beginners in algorithmic trading and for professionals. It should be noted that the platforms of this direction are not suitable for absolute beginners in trading. Successful earnings require knowledge of the basics of trading and an understanding of algorithmic trading. To profit from constructing robots, even through a simplified version of the constructor, a minimum base is required.