What applications / platforms should be used in 2021-2022 for trading in the world – we are considering popular exchange platforms for trading and investments. In the modern world, traders are increasingly using applications and platforms in their activities that can be installed on PCs and mobile devices.

The abundance of trading software is often confusing. It is especially difficult for beginners who are just mastering the process of trading stocks and bonds on the exchange and find it difficult to choose a reliable platform. Below you can see the features of the most popular trading applications that are popular with stock and bond traders around the world.

- Review of the best platforms and stock market trading platforms in the world – Best Trading Platforms 2021-2022

- Fidelity Marketplace

- Olymp Trade

- Step-by-step process of installing and configuring the application

- Charles schwab

- IBKR is a trading platform for trading and investment

- Webull

- SoFi

- Tastyworks – trading platform for experienced

- Ally

- Capital.com

- Tinkoff Investments

- What trading platforms can be installed on the phone – which is suitable for Android and iPhone

Review of the best platforms and stock market trading platforms in the world – Best Trading Platforms 2021-2022

The platforms listed below are popular with traders all over the world. These programs delight with a clear interface, reliability and wide functionality.

Fidelity Marketplace

Fidelity is a secure platform regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). There is no account maintenance fee. At the same time, the margin rates are quite high. Fidelity allows investors to trade stocks and bonds. However, the company does not offer

futures , forex or cryptocurrencies.

- shares of the USA and other countries;

- accessible interface;

- reliability;

Only the slow work of the technical support service can be a little frustrating. Otherwise, the Fidelity platform suits both experienced and novice traders. After installing the application, the trader will need to make sure that the Fidelity account is working. To do this, you will need to enter personal information, namely:

- social Security number;

- employer’s name and address;

- information about the bank account to fund the account.

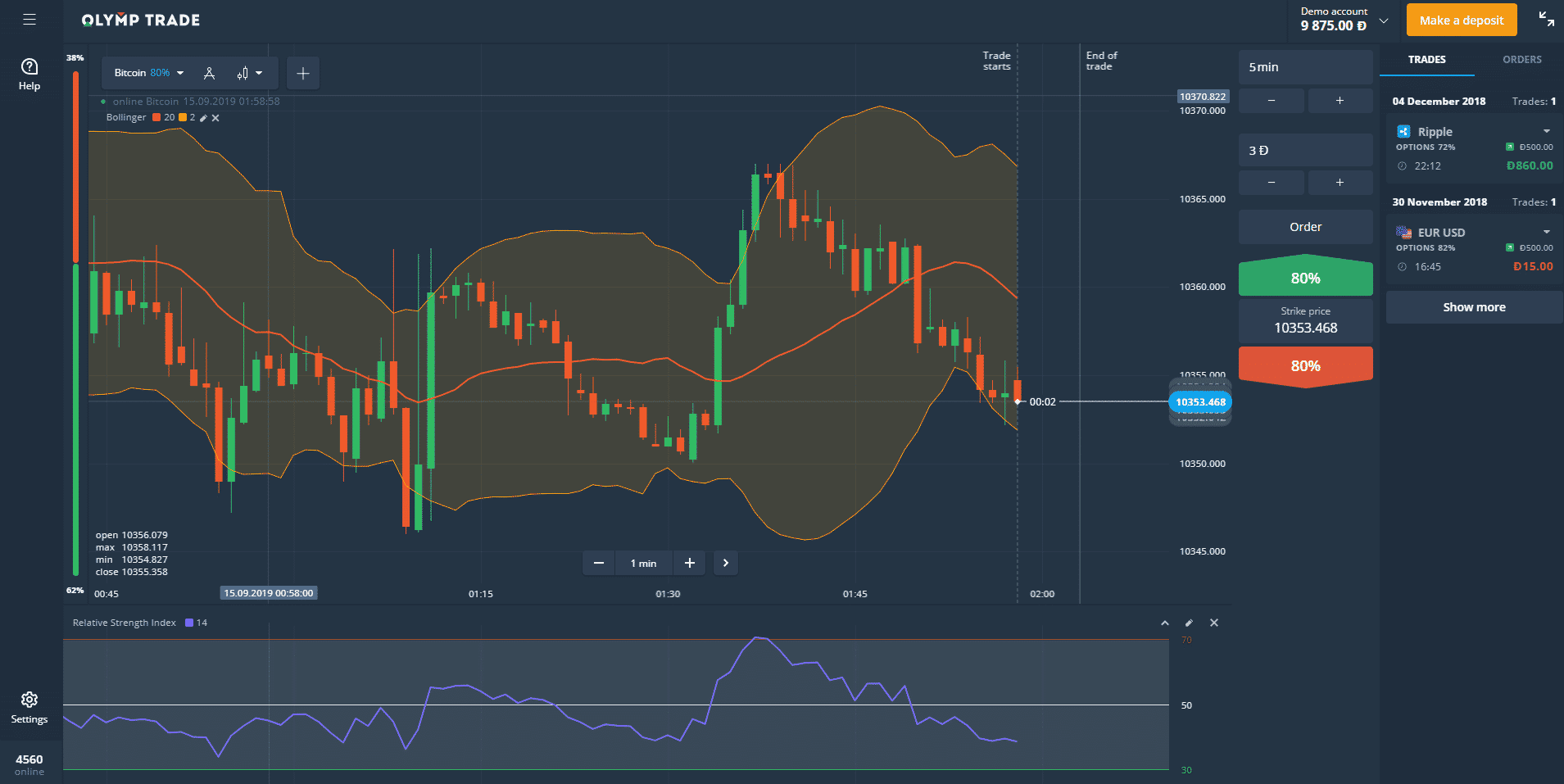

Olymp Trade

The Olymp Trade platform is certified by the International Financial Commission (FinaCom) as a Category A member. The Financial Commission provides traders with up to $ 20,000 of protection for their account if the dispute between the trader and OlympTrade is resolved in favor of the trader (under the terms set by FinaCom). The platform is very simple and intuitive because it was designed for those who are just learning to trade and for traders who prefer easy, simple and intuitive trading in stocks and bonds.

- the minimum deposit is only $ 10;

- minimum trade – $ 1;

- free demo account for $ 10,000;

- the ability to choose a trader’s own expiration time instead of the usual expiration time;

- withdrawal of funds without commission;

- free and exclusive training programs;

- support for more than 12 languages;

- deposit Bonus up to 100%.

The disadvantages of Olymp Trade include:

- not a large selection of assets;

- access only to classic Call / Put deals;

- lack of training videos and webinars in all languages.

Note! The Olymp Trade trading app can be downloaded on IOS and Android.

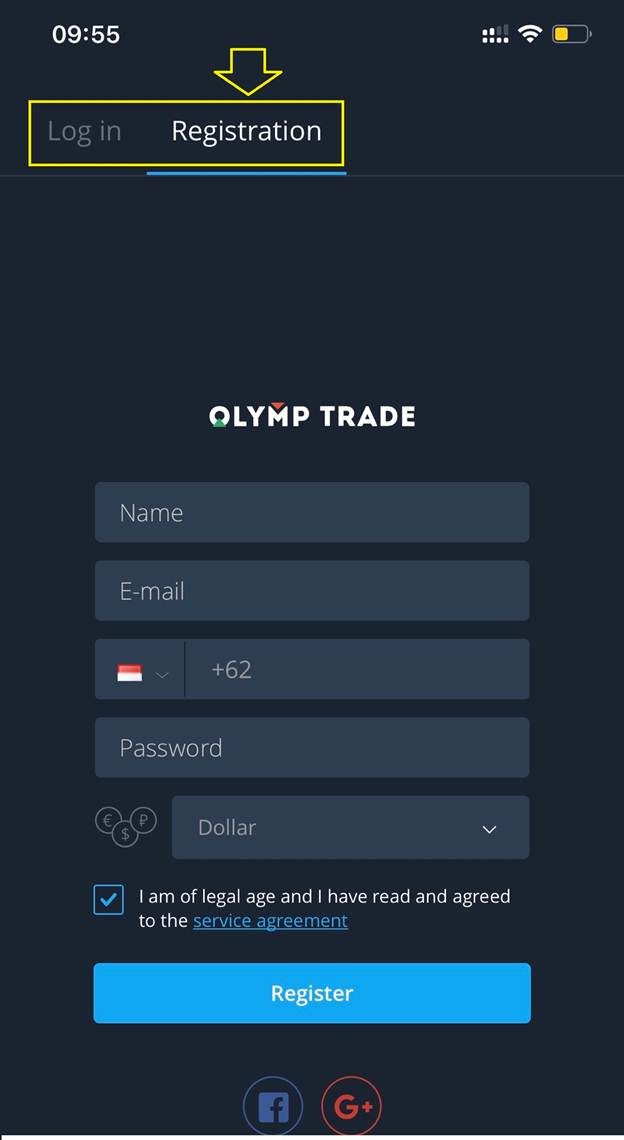

Step-by-step process of installing and configuring the application

Novice traders find it difficult to change the parameters of a stock trading application. Below you can find a step-by-step process of installing and configuring the Olymp Trade platform, which will help beginners avoid mistakes. Stage 1 First of all, users download the application to their smartphone. After starting the program, they log in or register an account.

- demo account and real account at Olymp Trade;

- selection of a pair of products and key indicators;

- selection of the preferred chart: area / heiken-ashi / Japanese candlesticks or histograms;

- history of trade;

- choosing a timeframe for a deal / candle;

- selection of investments for each transaction.

For your information! To replenish your account, you will need to click the “Deposit” button.

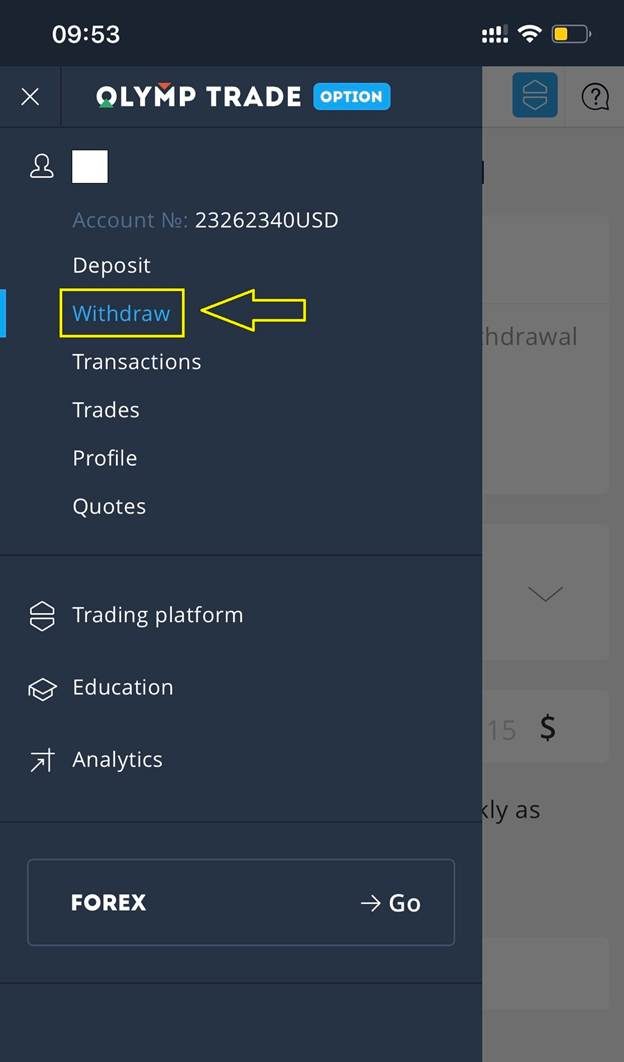

Stage 5 After the trader has managed to master the trading of stocks and bonds in Olymp Trade in the demo version, it is possible to replenish the account and proceed to real trading. To withdraw funds, click on the section “withdrawal and selection of the amount that you want to withdraw”. After that, the user selects his account, sends a request and photographs the receipt.

Note! In cases where the Wi-Fi or 4G connection is not stable, trading at Olymp Trade will fail.

Charles schwab

Charles Schwab is the trusted app for trading stocks and bonds on the world’s stock exchanges. Quality customer service (24/7 by phone or chat). The mobile investment app is available on iOS and Android. Charles Schwab has a wide range of investments, from stocks to margin loans and money market funds. The main advantages of the popular platform include:

- no commissions for opening and maintaining an account for brokerage or trading services;

- no minimum deposit;

- a wide range of investment instruments;

- providing quality educational resources;

- access to in-depth market research.

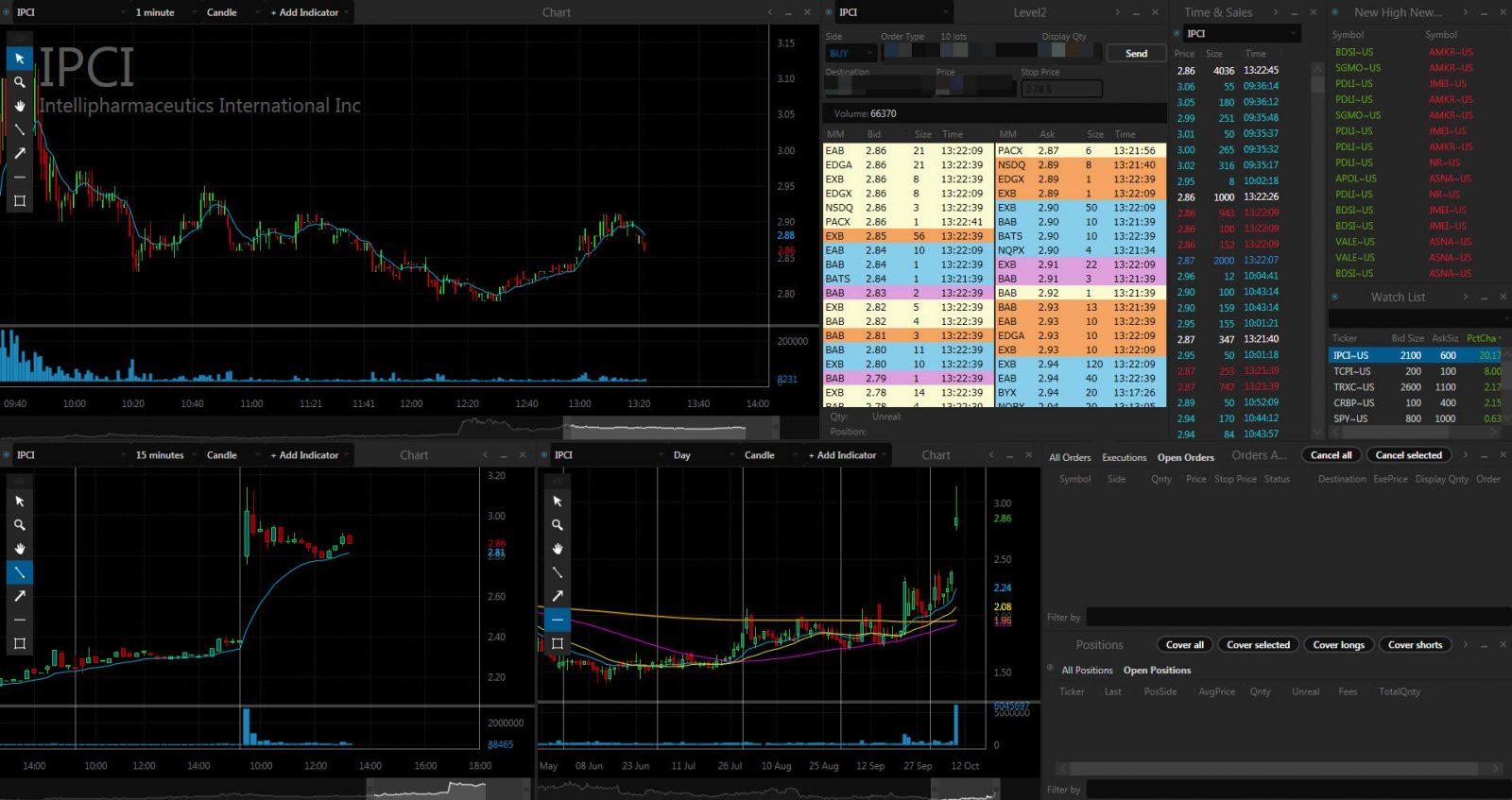

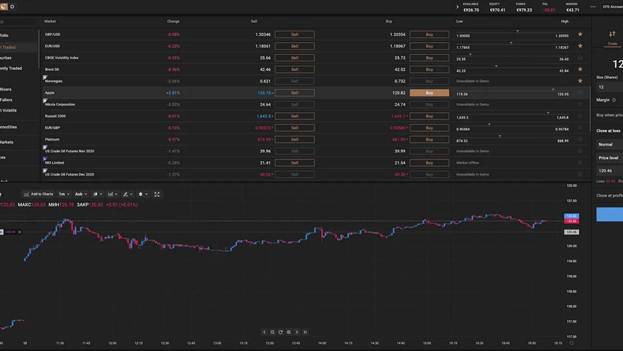

IBKR is a trading platform for trading and investment

IBKR is a trading platform that caters to the needs of both casual investors and serious active traders. As challenging as a trader’s trading and investment goals are, IBKR features help you succeed. Licensed by multiple top-tier regulators, you have complete confidence in Interactive Brokers’ security. The company publicly discloses financial information, which has a positive effect on its reputation. Interactive Brokers offers reasonably low trading commissions in the market. In addition, IBKR provides many useful research tools.

- low trading commission;

- wide functionality;

- a large number of research tools.

The slow work of the support service and the complicated process of opening an account are a little frustrating.

Webull

The commission for trading with Webull is low. The structure of commission fees is transparent and understandable. The platform offers users to trade stocks and ETFs for free. The company is regulated by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), as well as the Hong Kong Securities and Futures Commission (SFC). Therefore, there is no need to doubt the reliability of the platform. Even a beginner can easily cope with the process of opening an account. The trading platform is well structured and user-friendly with different types of orders. You can replenish your account / withdraw earned funds using a bank transfer. The advantages of the Webull platform, traders include:

- the possibility of free trading in shares;

- user-friendly interface;

- wide functionality;

- reliability;

- the ability to quickly open an account.

The disadvantages of the trading application are the limited portfolio of products and the lack of a live chat.

SoFi

SoFi Invest is a popular platform that is ideal for newcomers to the trading field to trade stocks. The platform provides its users with access to financial advisors. There is no account maintenance fee. SoFi is not suitable for active investors and those who prefer a sophisticated trading platform, asset verification tools, and detailed research reports. The company offers a targeted set of financial assets. The strengths of the platform include:

- providing access to financial advisors;

- no account maintenance fees;

- reliability;

- accessible interface.

Note! SoFi is not suitable for seasoned investors, but most investors will find whatever they need.

Tastyworks – trading platform for experienced

Tastyworks is a popular platform for experienced traders. The application has functionality and accuracy, which is especially important for complex transactions and strategies. The Tastyworks terminal allows you to trade stocks and ETFs. Trading commissions are low. Users who have opened an account can use educational and research materials to aid in training and trading performance. The strengths of the application are:

- low trading commission;

- the possibility of using training materials;

- wide functionality;

- reliability.

Important! Tastyworks is aimed at advanced traders who have experience with complex multi-element trades.

Ally

Ally Invest offers competitive pricing, helpful trading tools and an easy-to-use trading platform. Ally Invest is an absolutely safe platform that has been popular with traders for many years. The company’s activities are regulated by top-level financial authorities. Trading fees are low. The account opening process is simple. Users of the application have access to high-quality training tools. The advantages of the Ally Invest platform include:

- low trading and non-trading commissions;

- a simple process of opening an account that even a beginner can handle;

- open access to training materials;

- reliability.

Capital.com

Capital.com is one of the best trading apps for stocks and bonds. The platform is ideal for experienced traders looking to maximize their profits. The functionality of the program is wide. The interface is accessible. The customer support service allows you to quickly resolve issues arising in the course of business. Capital.com does not charge any commission from its users. The spreads offered by the broker are among the best in the industry. The advantages of this platform, traders include:

- systematic real-time updates and price alerts for over 3,700 markets;

- 0% commission and no hidden commissions;

- the best spreads on the market;

- fast order execution;

- free demo account, the validity period of which is not limited;

- low minimum deposit;

- access to training materials, training applications, online courses and trading guides;

- online technical support chat (24/7);

- availability of risk management tools.

There are hardly any downsides to the Capital.com platform. Although one is still there. Traders from the USA cannot trade.

Note! The company has developed a mobile app that uses artificial intelligence (AI) to improve trading conditions. This is one of the few brokers who use this technology to help their traders.

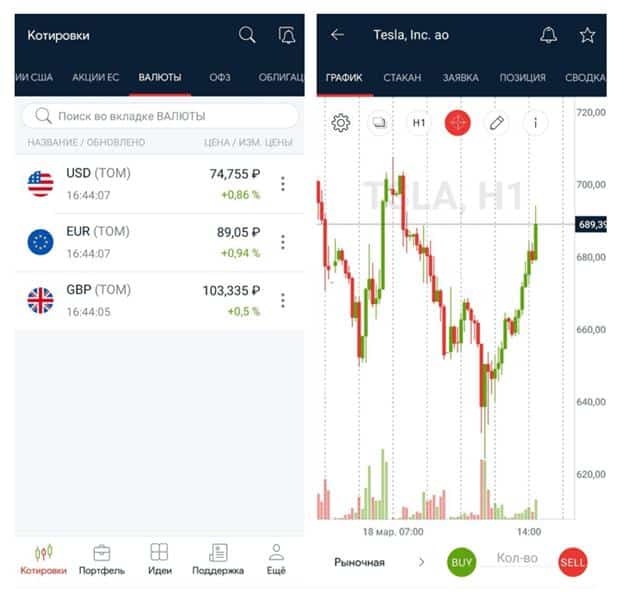

Tinkoff Investments

By installing the program, the trader will be able to trade various financial assets. In order to be able to trade stocks and bonds, you need to open a brokerage account / IIS (individual investment account). After that, the user will receive a link by clicking on which it will be possible to open access to the personal account. Next, you need to replenish your account and start choosing to buy a stock. The main advantages of the Russian trading application, which is actively used all over the world, are:

- fast and round-the-clock technical support;

- accessible interface;

- the presence of a news tab;

- availability of the possibility of using a free tariff package.

- lack of broad functionality;

- lack of a bar chart;

- obligatory registration of a Tinkoff Bank card, which will be required to withdraw funds.

Stock Trading Platforms – Video Review: https://youtu.be/l3ZT7BJfL3g

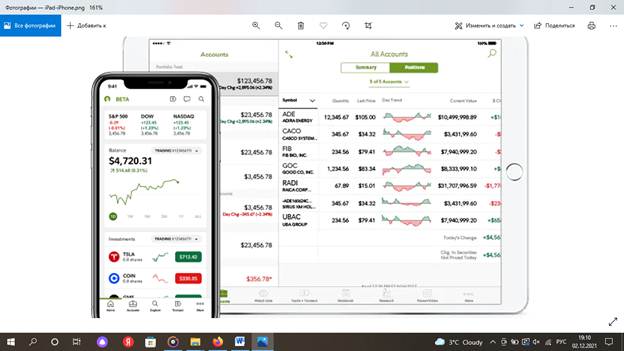

What trading platforms can be installed on the phone – which is suitable for Android and iPhone

Often, traders are interested in whether it is possible to install the trading application they like on their own smartphone. Of course, the developers have tried to ensure that merchants have the opportunity to open platforms from different devices and work in a comfortable environment. The best trading platforms that can be downloaded on Android include:

- Fidelity;

- Charles Schwab;

- Ally;

- IBKR;

- Tastyworks;

- IBKR;

- SoFi;

- com;

- Webull.

Among the most reliable trading applications suitable for iPhone, it is worth highlighting:

- Fidelity;

- Tastyworks;

- Webull;

- Charles Schwab;

- Capital.com.

Top 7 mobile applications for investment and trading – some allow you to trade stocks on stock exchanges around the world: https://youtu.be/EW2O9ExuZCw Modern traders, thanks to the efforts of the developers of trading platforms, have the ability to buy and sell stocks / bonds at the click of a button, while avoiding the large fees charged by financial managers. However, choosing a reliable application is difficult. After reviewing the above ranking of the best platforms, everyone will be able to choose the most suitable option for themselves. In the process of choosing a program, it is important not only to thoroughly study the functionality, but also to get acquainted with the reviews of other traders who have already managed to use the application.