Overview of the cTrader trading terminal – platform installation, advantages and disadvantages.

About the cTrader platform

cTrader is a trading terminal founded in 2011 by Spotware. The cTrader platform is an actively developing

terminal designed for ECN trading, it provides direct STP access to the international currency market, which means no dealers, as well as instant order placement and execution of trade orders. Due to the fact that cTrader was created in 2011 and has been actively developed based on the positive and negative aspects of its competitors, it is now one of the best trading tools in the industry.

Installing the cTrader terminal

You can download cTrader on the official website or on the broker’s website. Brokers working with the cTrader platform:

- Fibo Group.

- trade view.

- RoboForex.

- Alpari.

- Alpha Forex.

- FxPro and others.

cTrader is distributed absolutely free of charge, in 14 languages and is available on most OCs (Windows, macOS, Linux). There is also a browser version and a mobile version https://play.google.com/store/apps/details?id=com. spotware.ct&hl=ru&gl=US. It is also worth mentioning the version of cTrader copy for PAMM trading.

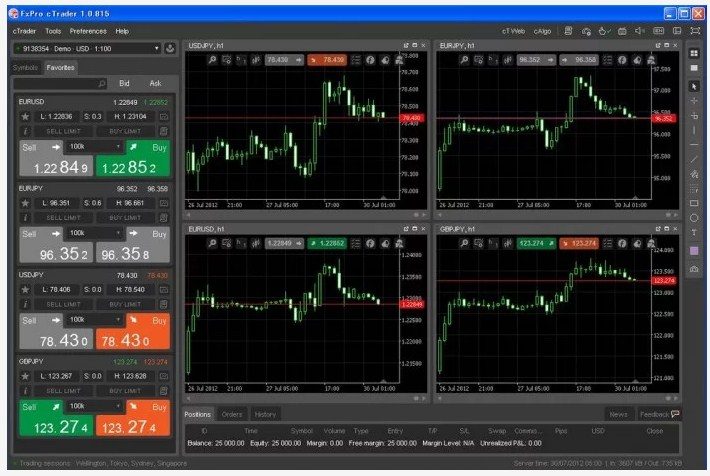

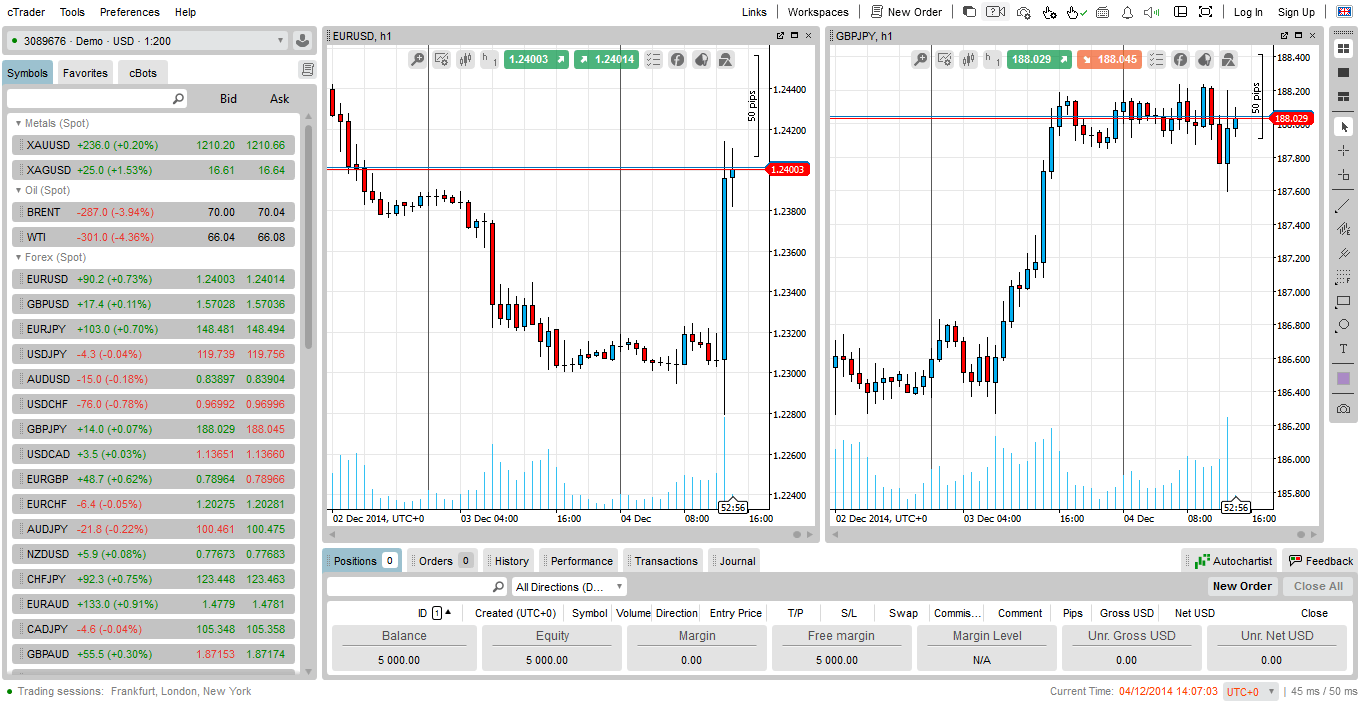

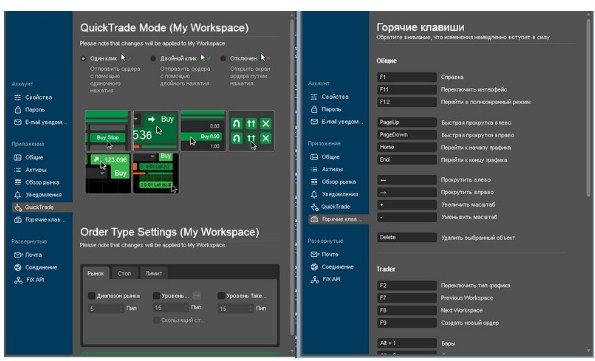

Setting up the cTrader platform

One of the main advantages of cTrader is the program’s intuitive interface. This is partly facilitated by the minimalist design of the program. A new user will not hesitate to customize the program for himself, especially when working with other trading terminals.

- Interested timeframes.

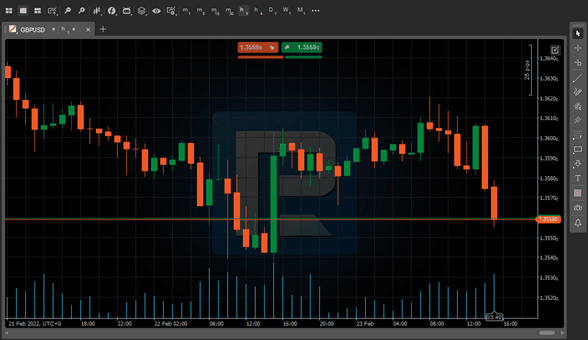

- Chart types – in addition to the classic chart, the program supports tick and range charts, as well as the Renko chart.

- Trading tool.

- The number of graphs displayed on the screen.

- Chart display type – bars, candles, line or dots.

- Connect or remove indicators, or a trading robot.

In addition, in the settings of the terminal itself, you can change notifications, asset units, and security settings.

The terminal is also suitable for those who use multiple monitors in trading, cTrader has the ability to distribute windows at the discretion of the user without being tied to a specific desktop.

Trading in the trading terminal

Tools

Despite the fact that the terminal was originally designed for trading on the Forex market, trading on indices and the commodity market is also available on it. Available

leverage depends on the broker, but averages 1:500. Available Markets by Tradeview:

| Forex | Commodity market | Indices | Crypto |

| EURUSD | XAUUSD | Australia 200 | BTC/USD |

| GBPUSD | Europe 50 | ||

| USDCHF | XAGUSD | France 40 | ETH/USD |

| USD/JPY | Germany 30 | ||

| AUDUSD | NGAS | Japan 255 | LTC/USD |

| USDCAD | Spain 35 | ||

| HZDUSD | XTI/USD | UK 100 | XBN/USD |

| USDRUB | US SPX 500 | ||

| USDMXN | |||

| USDCNH | XBR/USD | US TECH 100 | XRP/USD |

| USDPLN | Wall Street 30 | ||

| And many other currency pairs |

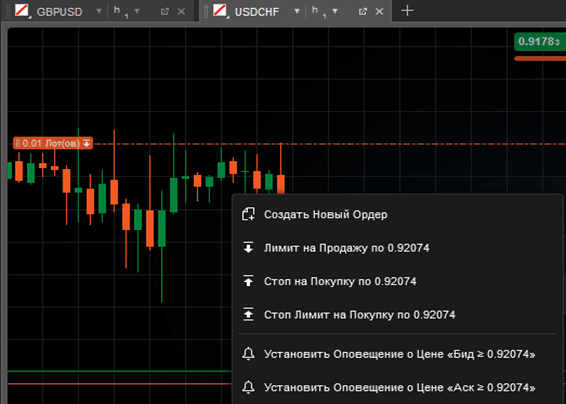

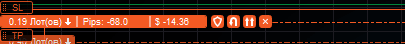

Opening a deal

Thanks to the ECN system, the terminal provides the ability to instantly create a market or limit order. You can enter a position by clicking on the chart window, placing a market order or a limit order at a given price. After placing a limit order, you can change it or set a stop loss / take profit simply by moving the line on the chart. Price alerts can be set in the same way. In addition, the terminal has a quick buy function that allows you to enter a position in a couple of clicks.

Analysis

The Depth of Market (DoM) is available in the terminal with several types of information display. In addition, there is a news calendar for each instrument, indicating the volatility of the news. More than 50 of the most popular technical indicators are integrated into cTrader for technical analysis. They are divided into 6 categories:

- Trend (Different types of moving average , supertrend, ASI, parabolic SAR).

- Oscillators (Awesome oscillator, stochastic, momentum, RSI , MACD, Price).

- Volatility (True range, Bollinger bands, Chaikin).

- Volume (Chaikin Money Flow, money flow index, on balance volume).

- Others (Alligato, Fractals, Ichimoku Kinki Hyo).

- Custom indicators – (indicators downloaded by the user from the official site or written on their own).

It is possible to completely clear the chart from indicators in a couple of clicks or save the indicators to a template.

In addition to indicators in cTrader, there are many graphical tools for analysis:

- Simple – geometric shapes, vertical and horizontal lines and trend lines.

- Fibonacci – levels, fan and Fibonacci expansion.

- Channel with equidistant price.

- Andrews pitchfork.

I would like to emphasize that cTrader significantly surpasses many terminals in terms of ease of use of graphical tools, especially MetaTrader. Any figures, arrows, etc. are set in one click and are easily configured right on the chart. CTrader – an overview of the trading terminal: https://youtu.be/WG5cqohqc7o

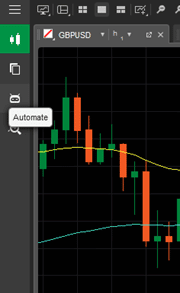

Automated trading in the cTrader terminal

To use

trading robots , the platform user needs to switch to Automate mode. A relative advantage of the terminal is the use of the C# language for creating robots and indicators; if the user knows this language, he can write a trading algorithm/indicator and test it on the selected instrument.

Statistics

CTrader allows the user to get wide statistics for a certain period in one click. To do this, switch to the Analyze tab in the panel on the left.

- Total earnings – profit, profit factor, percentage of profitability, maximum balance drawdown.

- Chart of account balance, deposits and withdrawals.

- The number of losing and profitable trades, as well as the number of sell and buy trades.

- Traded volume on different instruments for specified periods.

- The amount of profit and the total number of profitable and losing trades for different currency pairs/markets.

Using this feature of the program, you can quickly track the history of transactions and identify shortcomings in your strategy. The only disadvantage of statistics in cTrader is the lack of the ability to automatically format it into a separate file.

Using this feature of the program, you can quickly track the history of transactions and identify shortcomings in your strategy. The only disadvantage of statistics in cTrader is the lack of the ability to automatically format it into a separate file.

Platform Community

cTrader has a relatively active user community. On the official website of cTrader there is:

- A forum where you can chat with users or ask a question to technical support.

- Indicators and trading robots, most of which are distributed free of charge.

- Guides for creators of robots and indicators with a detailed description of the API.

- Jobs – a list of orders for freelancers, most often writing or editing code for a particular trading robot.

- VPS is a virtual dedicated server for automatic trading, which the user can rent from various providers.

CTrader is one of the best free terminals for trading today. When compared to its closest and more well-known MetaTrader 5 competitor, cTrader clearly wins in:

- Convenience.

- Design.

- Speeds.

- Workspace setup.

- Lack of a large number of indicators.

- Support for a limited number of brokers and markets.

However, cTrader is actively developed. If this development continues, these problems will resolve themselves over time.