Traders who trade stocks, futures and bonds on stock exchanges spend a lot of time studying the market. To make the workflow a little easier, users can connect to a

trading robot . Using the program will not only save time spent on work, but also avoid the wrong steps that are often made by a trader subject to emotions. Bots will collect profits around the clock, while observing a certain algorithm. Below you can find a description of the best robots for trading on the stock market in the Russian Federation.

How to choose a trading robot for trading on the Russian stock exchange – the best bots for automated trading

The bots presented below for trading stocks and bonds on stock exchanges in the Russian Federation will delight you with their reliability and user-friendly interface.

Tinkoff robot

Tinkoff is a trading bot that is popular with both beginners and more experienced traders. Users can place orders from the general list / order book, or through an automatic planning system. Traders have the opportunity to get acquainted with a detailed overview of the sales plan and their full volume. In the Lite version, sales can be systematized according to simple rules in automatic mode. The strengths of the Tinkoff bot include:

- intuitive interface;

- wide functionality;

- reliability;

- high speed of work.

VTB robot

VTB robot is considered one of the most reliable bots, which pleases with profitable commissions with a turnover of more than 1 million rubles per day. If you have any questions regarding the operation of the program, the technical support specialists will quickly provide assistance. Additional services are simple and conservative. The advantages of a VTB robot include:

- ease of use;

- reliability;

- the ability to withdraw funds from the IIS to the card;

- intuitive interface;

- availability of profitable bonuses for loyalty programs.

Alpha robot

Alpha robot is a special program that automates stock trading. The bot is able to track a number of indicators in order to make trading decisions. After analyzing the market situation, the program module proceeds to the transaction. In this case, the given trading strategy is taken into account. The advantages of the Alpha Robot include:

- reliability;

- intuitive interface;

- trading according to a clear algorithm;

- rich functionality;

- excellent work of the technical support service.

Judging by the feedback from traders, no significant flaws were found in this bot.

Bond scalper

Bond Scalper is a popular bot that, if properly configured and followed by recommendations, will help you avoid losing trades. The interface is intuitive, the process of use is simple, there are no Internet requirements, which is considered the main advantage of the bot. If the program crashes, nothing will happen to the user’s position. However, the bot also has disadvantages. Traders note that a more adaptive trailing stop is lacking to work effectively

Note! Experts advise to constantly monitor and analyze the order book throughout the entire operation time. Therefore, the use of the Bond Scalper robot will help significantly save a trader’s time.

GerchikBot

GerchikBot is a semi-automated bot that greatly facilitates the process of trading stocks in the stock markets. GerchikBot does not deviate from the specified strategy and automatically sets stop losses. The advantages of a trading robot include:

- systemic conclusion of transactions;

- exact adherence to the trading algorithm;

- execution of transactions at a given price;

- risk control for each of the positions;

- automatic calculation of Take Profit and closing positions.

It should be borne in mind that the program independently adjusts the stop loss after the price and conducts a large number of transactions at the same time. There were no significant drawbacks in the course of using GerchikBot.

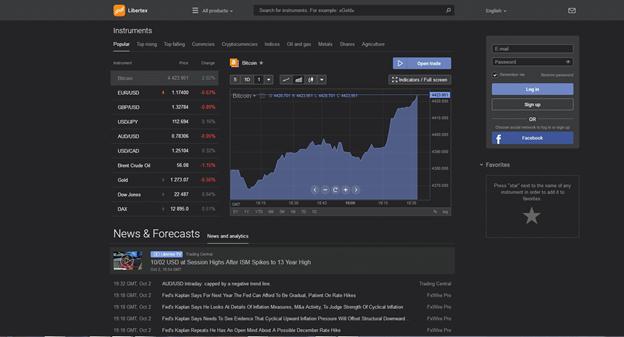

Libertex

Libertex is considered one of the best trading bots. The program can be used by both beginners and professionals. The bot interface is self-explanatory. The developers have made sure that novice traders can be trained. The site contains more than 30 video tutorials on working with the terminal. The quotes chart presented on the Libertex platform includes timeframes, as well as a convenient scaling function. There is a convenient service that allows you to change the display format of the asset value. It can be a line or Japanese candlesticks. The Libertex trading platform is regularly updated. Withdrawals are standard: e-wallets, bank accounts and cards. This bot is compatible with devices running such operating systems as Android and iOS, macOS and Windows. Transaction fees are fixed. There is only one type of account – “Classic”,and the starting amount starts from 100 euros.

Beginners can use a demo account, which will provide an opportunity to get acquainted with the nuances of the site and the market in general.

The following features are available on your Libertex account:

- account replenishment / money transfer;

- viewing statistics on shares;

- transaction history;

- customer service;

- selection of a trading instrument;

- analytics;

- quotes;

- news / economic calendar.

The advantages of the bot for trading Libertex stocks and bonds, traders include:

- instant registration, allowing you to access your account;

- the convenience of use;

- clear interface;

- reliability;

- availability of popular trading instruments on one platform;

- tight spreads.

A little upsetting can only be that the developer offers only 2 types of accounts – training (Demo) and Standard (analogue of the Classic). There is no central account, like the Pro version.

Note! Most traders use a demo account to test the effectiveness of their strategies.

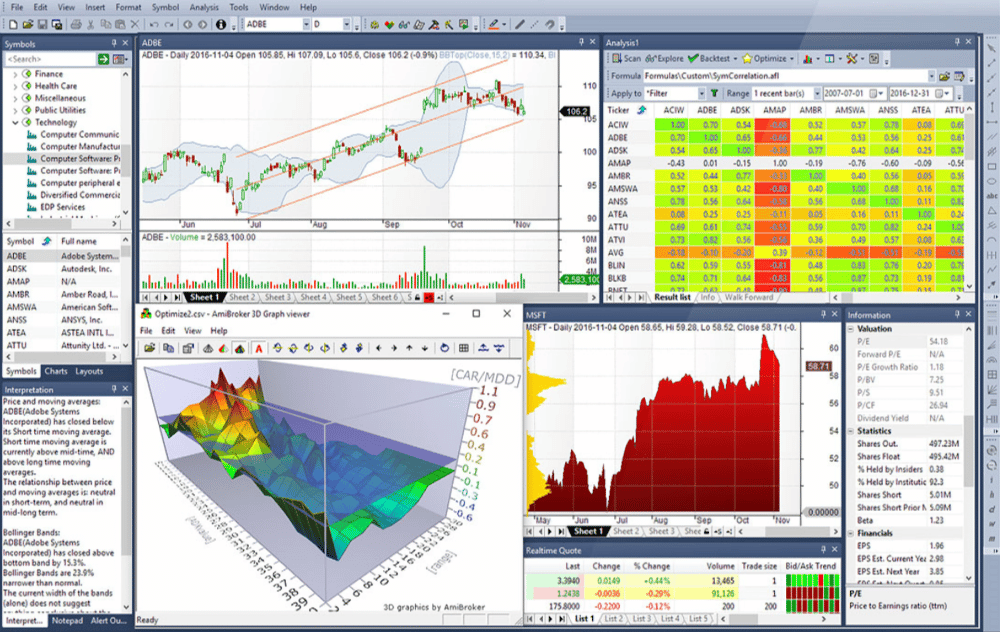

MetaStock

MetaStock is a popular bot that is most suitable for experienced traders who need quality technical analysis. If you encounter any problem related to the operation of the program, the technical support service is ready to help you and recommend the most effective ways to eliminate the problem. MetaStock D / C provides end-of-day exchange data and MetaStock R / T adds real-time intraday Refinitiv data. The strengths of the robot for trading stocks and bonds MetaStock include:

- reliability;

- excellent deep backtesting;

- price forecast for unique shares;

- a large library of additional professional strategies;

- the ability to work in the program not only online, but also offline;

- excellent work of the technical support service.

For your information! System backtesting is excellent because it allows the trader to check if the strategy has worked in the past.

TradeMiner

TradeMiner is a popular trading robot that will delight you with an intuitive interface and extensive functionality. The program contains the following functions: a chart analyzer, trade alerts, educational support. Thanks to the various charts included in the bot, traders can view:

- results of transactions over several years;

- detailed trade logs of trends in recent years;

- the level of profit versus risk.

TradeMiner users receive email alerts that their chosen seasonal trading is about to begin. In the “Settings” tab, traders have the ability to filter the number and types of shares. TradeMiner offers excellent videos to help newbies figure out how to properly operate the program. You can also use webinars and audio materials for training. TradeMiner works great on PC, Linux or Mac, as well as futures, stocks or Forex markets.

- clear interface;

- reliability;

- quick sorting and analysis of data;

- the convenience of use.

Note! When you double-click on a stock, a diagram opens immediately, which can also be attributed to advantages.

TradeMiner does not cover all stocks, but mainly only those included in the DJIA, S&P 500 and NASDAQ 100 indices.

This is considered the main disadvantage of this bot.

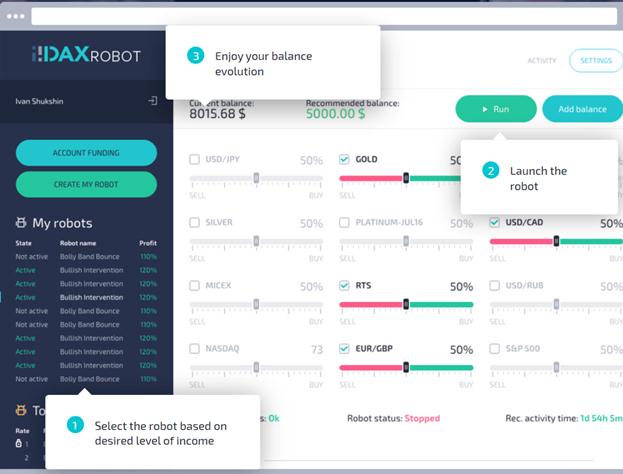

DaxRobot

Users who have installed DaxRobot can use a trial version with a demo account, which will allow them to understand how the program works and which strategy to choose. The initial deposit is $ 250. DAXrobot is software that does not need to be downloaded to the user’s computer. A 24-hour support service with video assistance options is available to the trader. There is also a chat system, which will be needed in case the visitor wants to ask any questions. The withdrawal process is carried out within 60 minutes.

- clear interface;

- a trial version with a demo account;

- reliability.

However, traders who have chosen DaxRobot have no less reasons for frustration: there are no confirmed back-testing results, and the initial deposit amount is quite high.

BlackBoxStocks

BlackBoxStocks is a bot that allows traders to set up automated trades. Using this program, users can trade stocks / bonds / options. Traders can easily make difficult decisions without opening multiple windows. BlackBoxStocks is great for both beginners and more experienced traders. Users of this bot receive push notifications when a stock is sold above or below a certain price. It is also possible to set up individual trading alerts for specific stocks, in accordance with your own strategy with one-click access from the buy / sell window.

Interesting to know! Traders using the BlackBoxStocks bot have the ability to customize and manage all aspects of trading signals from sounds to pop-ups in one place.

Thanks to the “Alert Log” option, traders will never miss a single important notification. Users will be able to view all their messages in one place. The alert log stores everything from price surges / rapid declines / active promotions alerts in the hours after go to market to alerts on market data of the trading day for the user. If necessary, you can use the stock symbol search tool in the stock scanner. This will make it possible to quickly and easily identify and compare stocks. Using real-time information directly from the charts, traders can create their own strategies. The advantages of the BlackBoxStocks bot include:

- access to an unlimited number of basic stock trading strategies;

- reliability;

- convenient user interface;

- the ability to communicate with other traders in an active chat room 24/7;

- availability of its own volatility indicator.

Slightly frustrating is the minimal amount of educational materials for beginners.

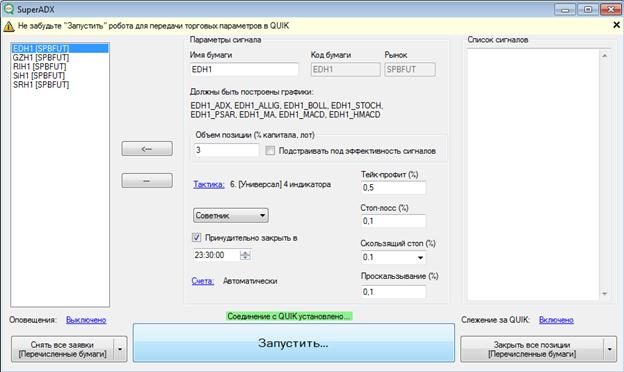

SuperADX

SuperADX is a unique trading bot that is popular among traders in the Russian Federation. To start trading stocks and bonds, you will need:

- choose an exchange and a trading pair;

- create a virtual wallet;

- choose a suitable algorithm of work and set the bot settings;

- launch SuperADX and start tracking income.

The strengths of the SuperADX robot include:

- the ability to manually configure the bot;

- clear interface;

- termination of trading and liquidation of all positions when the balance reaches a predetermined threshold;

- the ability to independently move stop orders that are placed by the robot;

- reliability.

Judging by the feedback from traders, this bot has no drawbacks.

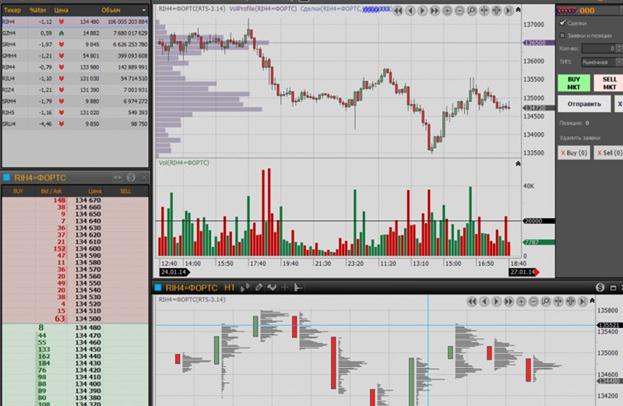

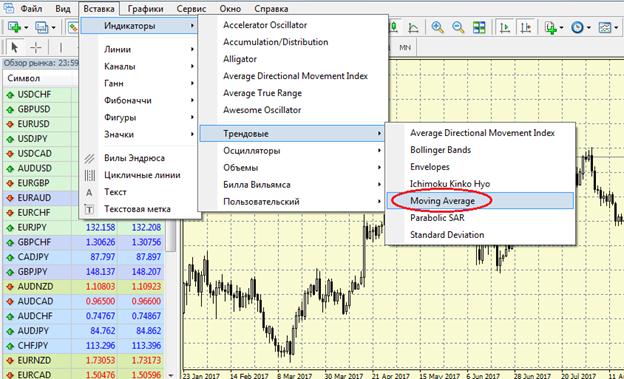

QuikFan

QuikFan is a popular bot that works according to a specific algorithm. Traders using this program can trade simultaneously on 14 different timeframes. The presence of various settings allows you to filter lateral movement. This trading robot is used in conjunction with the Quik platform. QuikFan benefits:

- intuitive interface;

- the ability to trade on 14 timeframes;

- a large number of settings;

- no interruptions in work;

- reliability.

https://articles.opexflow.com/software-trading/torgovyj-terminal-quik.htm Only the absence of trailing stops is a little upsetting. However, the developers are working on improving the bot, therefore, it is possible that this shortcoming will be eliminated soon.

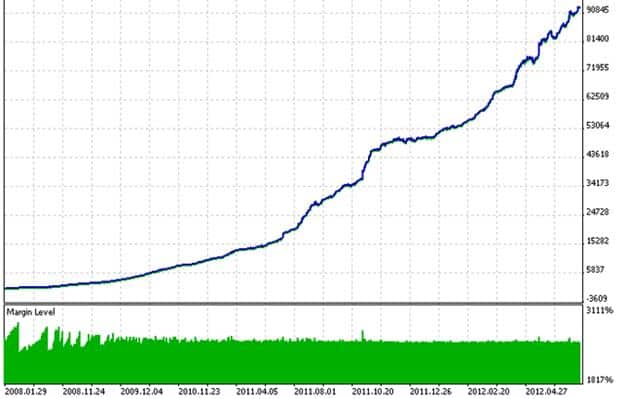

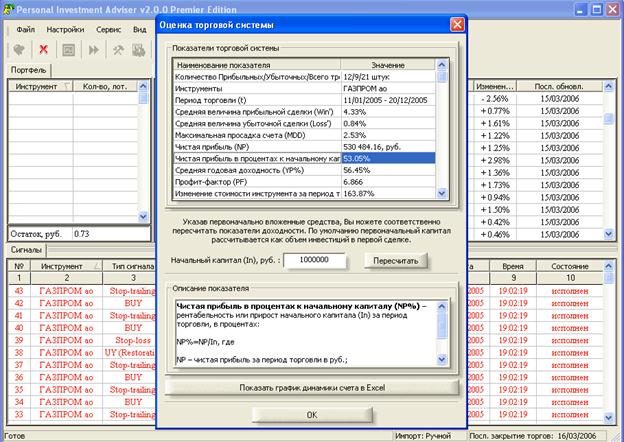

Personal Investment Adviser

Personal Investment Adviser is a bot that RF traders can use to trade stocks / bonds / futures / commodities / ADRs. Personal Investment Adviser already has a ready-made and proven trading algorithm based on two basic trading principles: channel and trend following models.

Interesting to know! The bot’s trading algorithms are subject to the golden rule of trading – allow profits to grow and fix losses at a low level.

The advantages of the Personal Investment Adviser program, traders include:

- a significant reduction in the likelihood of large capital losses;

- reliability;

- immediate receipt of information about the issuer;

- the ability to track prevailing market trends, their dynamics, “strong” and “weak” instruments.

The interface for novice traders is a little complicated. This is the main disadvantage of the Personal Investment Adviser.

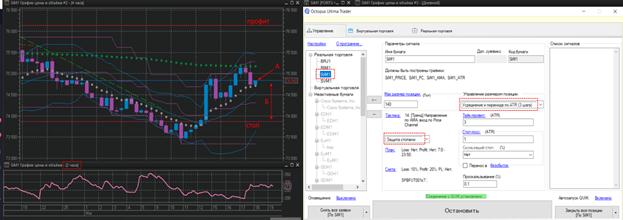

Octopus Trader

Octopus Trader is a bot that can trade several instruments simultaneously using the same or different tactics. Users can choose the direction of trade either manually or automatically. The trailing stop is used in 6 variations. By opening positions manually, traders can use stop protection. To test the work of various strategies, you should use a virtual account. It is possible to set a stop loss and take profit based on the ATR indicator. Octopus Trader advantages:

- intuitive interface;

- reliability;

- trading according to a clear algorithm;

- rich functionality;

- risk control and loss limitation;

- availability of 23 strategies that can be used in trading;

- the ability to adjust stop orders in real time, including with an open position.

The only drawback is considered only that the use of the robot is possible only on a paid basis.

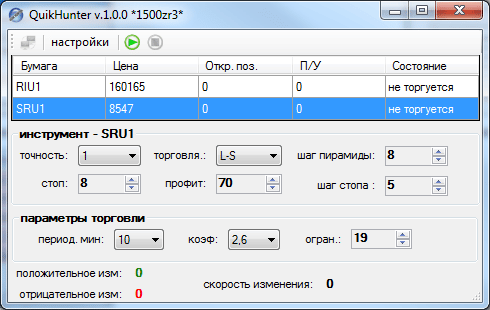

QuikHunter

QuickHunter is a bot, the use of which will allow a trader to succeed in trading stocks and bonds. However, it is very important to take care of the correct selection of parameters. Experienced traders are advised to additionally use information with WebPIAdviser, which will make it possible to make informed decisions. The strengths of the program include:

- simple interface;

- high speed of work;

- clear settings;

- reliability.