Traders who trade stocks, futures and bonds on stock exchanges spend a lot of time studying the market. To make the workflow a little easier, users can connect to a

trading robot . Using the program will not only save time spent on work, but also avoid wrong steps that are often taken by a trader subject to emotions. Bots will bring profit around the clock, while observing a certain algorithm. Below you can find a description of the best robots for trading on the stock market in the Russian Federation.

How to choose a trading robot for trading on the Russian stock exchange – the best bots for automated trading

The bots presented below for trading stocks and bonds on stock exchanges in the Russian Federation will delight you with their reliability and user-friendly interface.

Tinkoff robot

Tinkoff is a trading bot that is popular with both beginners and more experienced traders. Users can place orders from the general list / stock market glass, or through an automatic planning system. Merchants have the opportunity to get acquainted with a detailed overview of the sales plan and their full volume. The Lite version allows systematization of sales according to simple rules in automatic mode. The strengths of the Tinkoff bot include:

- intuitive interface;

- wide functionality;

- reliability;

- high speed.

VTB robot

VTB robot is considered one of the most reliable bots, which pleases with profitable commissions with a turnover of more than 1 million rubles per day. If you have any questions regarding the operation of the program, technical support specialists will quickly provide assistance. Additional services are simple and conservative. The advantages of the VTB robot include:

- ease of use;

- reliability;

- the possibility of withdrawing funds from the IIS to the card;

- intuitive interface;

- the availability of profitable bonuses for loyalty programs.

Alpha robot

Alpha robot is a special program that automates exchange trading. The bot is able to track a number of indicators in order to make trading decisions. The software module, after analyzing the situation on the market, proceeds to making a deal. At the same time, the given trading strategy is taken into account. The advantages of the Alpha robot include:

- reliability;

- intuitive interface;

- trading according to a clear algorithm;

- rich functionality;

- great job tech support.

Judging by the feedback from traders, no significant shortcomings were found in this bot.

Bond Scalper

Bond Scalper is a popular bot that, if set up correctly and following the recommendations, will help you avoid losing trades. The interface is intuitive, the process is simple, there are no Internet requirements, which is considered the main advantage of the bot. If the program crashes, nothing will happen to the user’s position. However, the bot also has disadvantages. Traders note that a more adaptive trailing stop is not enough to work effectively

Note! Experts advise to constantly monitor and analyze the order book throughout the entire time of work. Therefore, the use of the Bond Scalper robot will help to significantly save the trader’s time.

GerchikBot

GerchikBot is a semi-automated bot that greatly facilitates the process of trading stocks in the stock markets. GerchikBot does not deviate from the given strategy and automatically places stop losses. The advantages of a trading robot include:

- systematic conclusion of transactions;

- exact observance of the trading algorithm;

- transactions at a given price;

- risk control for each of the positions;

- automatic calculation of Take Profit and closing of positions.

It should be borne in mind that the program independently tightens the stop loss following the price and conducts a large number of transactions at the same time. There were no significant disadvantages during the use of GerchikBot.

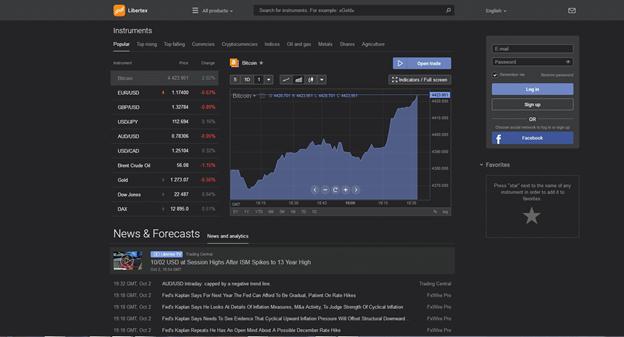

Libertex

Libertex is considered one of the best trading bots. The program can be used by both beginners and professionals. The bot interface is clear. The developers made sure that novice traders could be trained. The site contains more than 30 video tutorials on working with the terminal. The quotes chart presented on the Libertex platform includes timeframes, as well as a convenient zoom function. There is a convenient service that allows you to change the format for displaying the value of an asset. It can be a line or Japanese candlesticks. The Libertex trading platform is regularly updated. Withdrawals are standard: e-wallets, bank accounts and cards. This bot is compatible with devices running operating systems such as Android and iOS, macOS and Windows. Transaction fees are fixed. There is only one type of account – “Classic”,

Beginners can use a demo account, which will provide an opportunity to get acquainted with the nuances of the site and the market as a whole.

The following features are available in the Libertex account:

- replenishment of the account / transfer of funds;

- viewing stock statistics;

- transaction history;

- customer service;

- choice of trading instrument;

- analytics;

- quotes;

- news/economic calendar.

The advantages of the bot for trading stocks and bonds Libertex, traders include:

- instant registration that allows you to access your account;

- Ease of use;

- clear interface;

- reliability;

- availability of popular trading instruments on one platform;

- tight spreads.

It can only be a little frustrating that the developer offers only 2 types of accounts – training (Demo) and Standard (similar to Classic). The center account, like the Pro version, is not provided.

Note! Most traders use a demo account to test the effectiveness of their strategies.

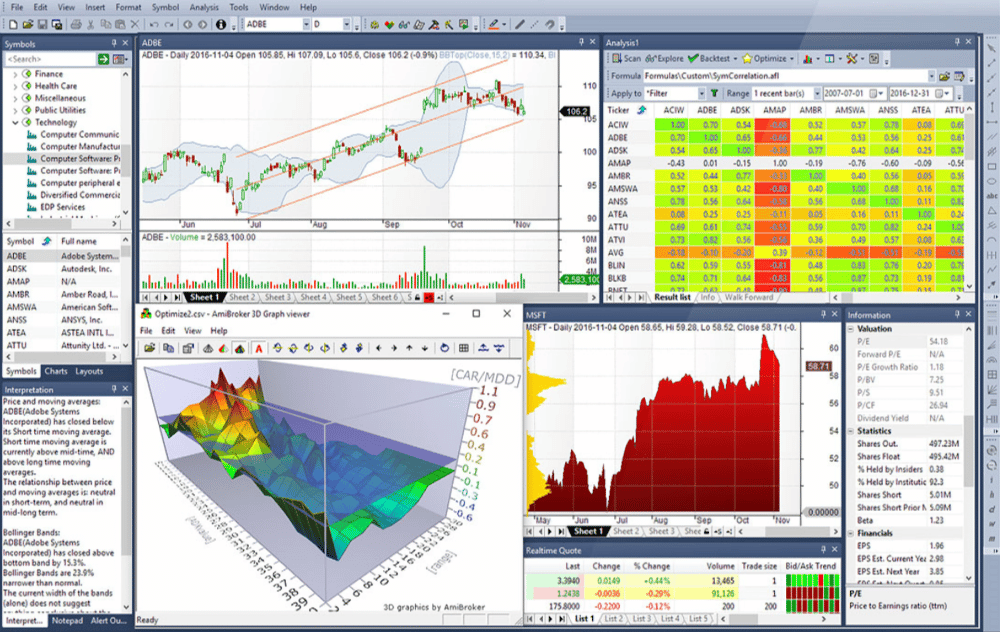

MetaStock

MetaStock is a popular bot that is most suitable for experienced traders who need high-quality technical analysis. If you encounter any problem related to the operation of the program, the technical support service is ready to help and recommend the most effective ways to resolve the problem. MetaStock D/C provides end-of-day exchange data, while MetaStock R/T adds real-time intraday Refinitiv data. The strengths of the robot for trading shares and bonds MetaStock include:

- reliability;

- excellent deep backtesting;

- price forecast for unique shares;

- the presence of a large library of additional professional strategies;

- the ability to work in the program not only online, but also offline;

- excellent technical support service.

Note! System backtesting is excellent because it allows the trader to check if the strategy has worked in the past.

TradeMiner

TradeMiner is a popular trading robot that will please you with a clear interface and extensive functionality. The program contains functions: chart analyzer, trading alerts, educational support. Thanks to the variety of charts included in the bot, traders are able to view:

- results of transactions for several years;

- detailed trading trend logs for recent years;

- the level of profit versus risk.

TradeMiner users receive email alerts that their selected seasonal trading is about to start. In the “Settings” tab, traders have the ability to filter the number and types of stocks. TradeMiner offers great videos to help beginners figure out how to use the program the right way. You can also use webinars and audio materials for training. TradeMiner works great on PC, Linux or Mac as well as futures, stocks or Forex markets.

- clear interface;

- reliability;

- quick sorting and data analysis;

- Ease of use.

Note! Double-clicking on a stock immediately opens a chart, which can also be attributed to the benefits.

TradeMiner does not cover all stocks, but mostly only those included in the DJIA,

S&P 500 and NASDAQ 100 indices. This is considered the main disadvantage of this bot.

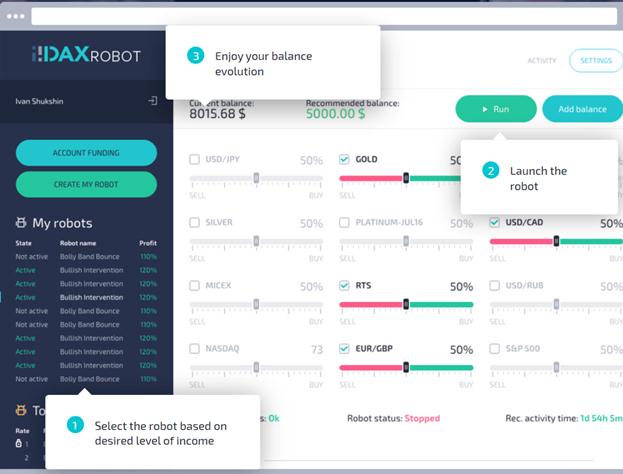

DaxRobot

Users who have installed DaxRobot can use the trial version with a demo account, which will allow them to understand how the program works and which strategy to prefer. The initial deposit is $250. DAXrobot is software that does not need to be downloaded to the user’s computer. The trader has access to a 24/7 support service with video assistance options. There is also a chat system that will be needed in case the visitor wants to ask any questions. The withdrawal process is carried out within 60 minutes.

- clear interface;

- availability of a trial version with a demo account;

- reliability.

However, there are no less reasons for frustration among traders who have chosen DaxRobot: there are no confirmed back-testing results, and the initial deposit amount is quite high.

BlackBoxStocks

BlackBoxStocks is a bot that allows traders to set up automated trades. Using this program, users can trade stocks/bonds/options. Traders can easily make complex decisions without having to open multiple windows. BlackBoxStocks is great for both newbies and more experienced traders. Users of this bot receive push notifications when a stock sells above or below a certain price. It is also possible to set up individual trading alerts for specific stocks, according to your own strategy with one-click access from the buy/sell window.

Interesting to know! Traders using the BlackBoxStocks bot have the ability to set up and manage all aspects of trading signals from sounds to pop-ups in one place.

Thanks to the “Alert Log” option, traders will not miss any important notification. Users will be able to view all their messages in one place. The alert log saves everything from alerts of price spikes/rapid declines/active stocks in the hours after market entry to trading day market data alerts to the user. If necessary, you can use the stock symbol search tool in the Stock Scanner. This will enable you to quickly and easily identify and compare stocks. Using real-time information directly from the charts, traders can create their own strategies. The advantages of the BlackBoxStocks bot include:

- access to an unlimited number of basic stock trading strategies;

- reliability;

- convenient user interface;

- the ability to communicate with other traders in an active chat room 24/7;

- the presence of its own volatility indicator.

A little frustrating is only the minimum amount of educational materials for beginners.

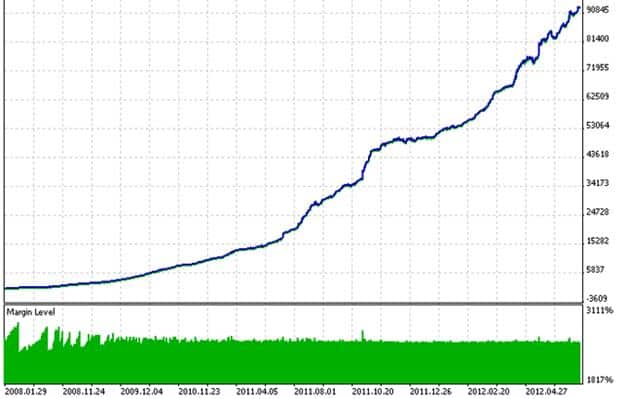

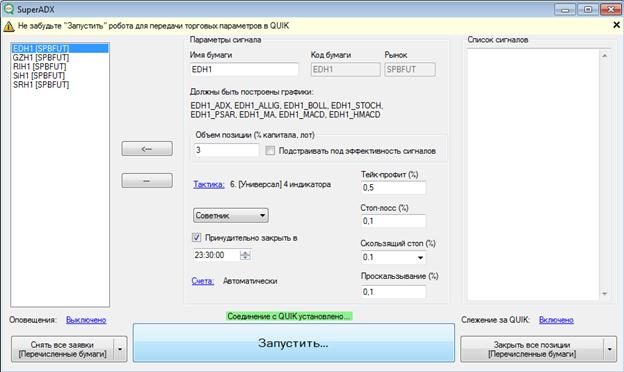

SuperADX

SuperADX is a unique trading bot that is popular among traders in the Russian Federation. To start trading stocks and bonds, you will need:

- choose an exchange and a trading pair;

- create a virtual wallet;

- choose the appropriate work algorithm and set the bot settings;

- run SuperADX and start tracking your earnings.

The strengths of the SuperADX robot include:

- the ability to manually configure the bot;

- clear interface;

- termination of trading and liquidation of all positions when the balance reaches a predetermined threshold;

- the possibility of independent movement of stop orders placed by the robot;

- reliability.

Judging by the feedback from traders, this bot has no shortcomings.

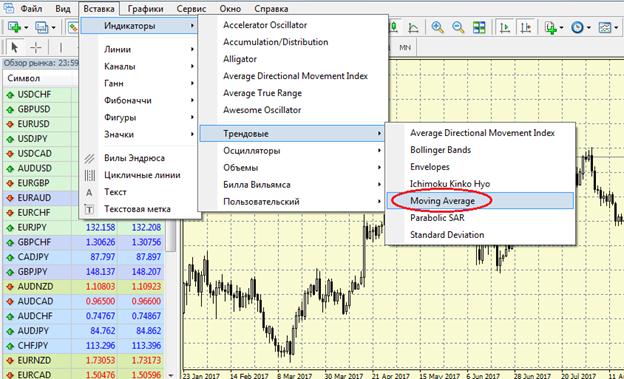

QuikFan

QuikFan is a popular bot that works exactly according to a given algorithm. Traders using this program can trade simultaneously on 14 different timeframes. The presence of various settings allows you to filter lateral movement. This trading robot is used in conjunction with the Quik platform. Benefits of QuikFan:

- intuitive interface;

- the ability to trade on 14 timeframes;

- a large number of settings;

- no failures in work;

- reliability.

https://articles.opexflow.com/software-trading/torgovyj-terminal-quik.htm The lack of trailing stops is a little frustrating. However, the developers are working on improving the bot, therefore, perhaps in the near future this shortcoming will be eliminated.

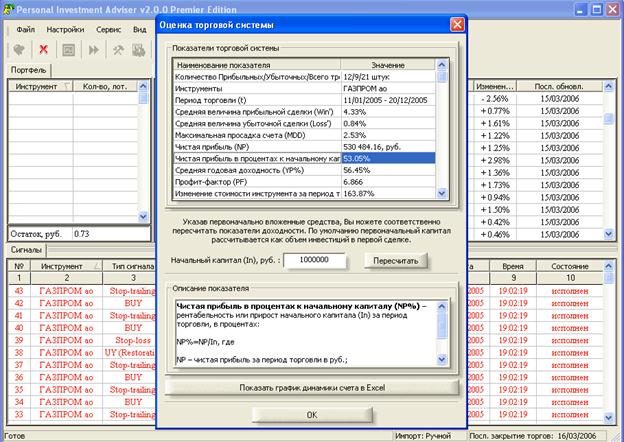

Personal Investment Adviser

Personal Investment Adviser is a bot that RF traders can use to trade stocks/bonds/futures/commodities/ADRs. Personal Investment Adviser already has a ready-made and proven trading algorithm based on two basic trading principles: channel and trend-following models.

Interesting to know! The trading algorithms of the bot are subject to the golden rule of trading – let profits run and fix losses at a low level.

The benefits of the Personal Investment Adviser program for traders include:

- a significant reduction in the likelihood of large capital losses;

- reliability;

- immediate receipt of information about the issuer;

- the ability to track the prevailing trends in the market, their dynamics, “strong” and “weak” instruments.

The interface for beginner traders is a bit complicated. This is the main disadvantage of Personal Investment Adviser.

Octopus Trader

Octopus Trader is a bot that can trade several instruments at the same time using one or different tactics. Users can choose the direction of trade manually or automatically. Trailing stop is applied in 6 variations. When opening positions manually, traders can use stop protection. To test the work of various strategies, it is worth using a virtual account. It is possible to set stop loss and take profit using the ATR indicator. Benefits of Octopus Trader:

- intuitive interface;

- reliability;

- trading according to a clear algorithm;

- rich functionality;

- risk control and loss limitation;

- the presence of 23 strategies that can be used in trading;

- the ability to adjust stop orders in real time, including with an open position.

The only drawback is that the use of the robot is possible only on a paid basis.

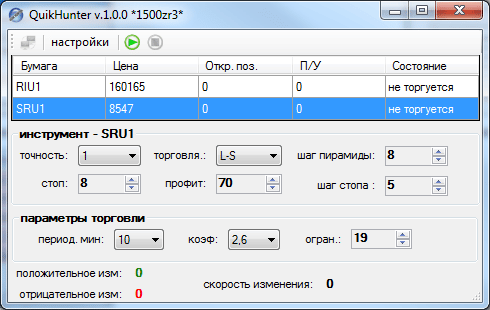

QuikHunter

QuickHunter is a bot, the use of which will allow a trader to succeed in trading stocks and bonds. However, it is very important to take care of the correct selection of parameters. Experienced traders advise additionally using information from WebPIAdviser, which will make it possible to make informed decisions. The strengths of the program include:

- simple interface;

- high speed of work;

- clear settings;

- reliability.