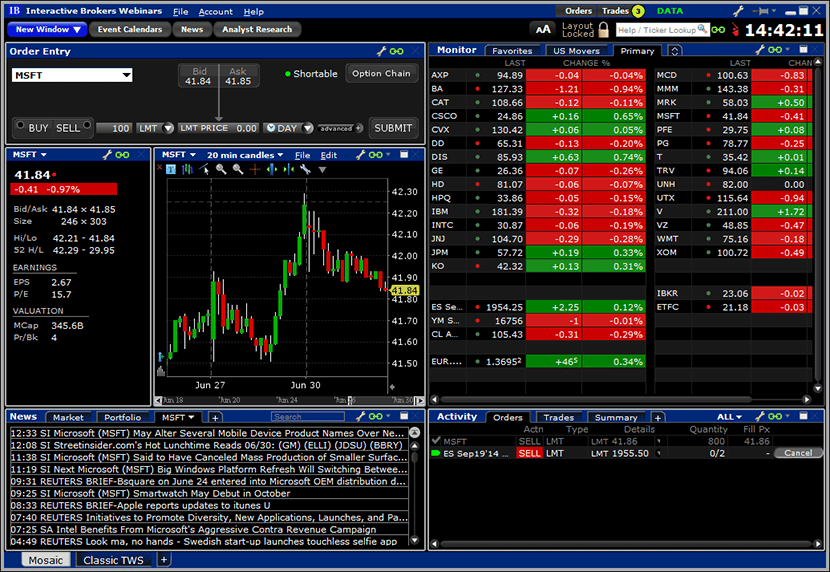

A complete overview of the Trader Workstation platform from Interactive Brokers. Trader Workstation is a powerful multifunctional exchange service developed by the American multinational brokerage firm Interactive Brokers. The platform provides many opportunities, one of which is trading in securities and currencies, as well as expanding the investment portfolio by acquiring new instruments. In addition, the terminal provides a large selection of orders (an order to buy / sell a certain number of assets) and technical indicators (a graphical cost curve that indicates the current trends of the exchange).

- Trader Workstation market system: why do we need the TWS platform and what functionality does it have

- Tools used for trading in Trader Workstation

- Graphic images and constructions

- Studying the price: prospects for its changes

- Stock Reading Technology

- How to download, install and set up the Trader Workstation trading platform

- The process of downloading and installing the Trader Workstation terminal

- Setting up IB Trader Workstation

- Training to work with the Trader Workstation terminal

- Advantages and disadvantages of TWS

Trader Workstation market system: why do we need the TWS platform and what functionality does it have

The IB Trader Workstation terminal is one of the basic systems for sufficiently experienced and knowledgeable exchange traders who want to diversify their

investment portfolio and engage in the purchase / sale of securities and currencies. The global trading terminal Workstation has a classic, minimalistic and intuitive interface with a wide range of functionality for short and long transactions and investments.

Note! The terminal for exchange trading is configured and used manually, system automation is not provided. At the same time, a participant in exchange trading can apply suitable algorithms to set up trading in the course of his work.

Tools used for trading in Trader Workstation

The terminal includes various algorithms that allow you to set up a trading exchange. So, one of these instructions is “Accumulation / Distribution”. It divides large orders for the purchase / sale of cryptocurrency into several small ones and presents orders with different time intervals. This feature makes it possible to keep a large order secret from other traders. The following tool ComboTrader allows you to collect combinations of available orders. Participants in exchange trading can divide into certain categories strategic combinations for the same assets. This mode is also configured manually.

Important! The terminal provides 18 ready-made templates for the formation of order combinations.

Another important tool is SpreadTrader. The tool allows you to create complex futures and options spreads. Volatility Lab – the name of the function speaks for itself. It allows you to analyze past and future prospective price volatility on the stock exchange.

Graphic images and constructions

Traders using the Trader Workstation terminal have access to the construction of graphic images, the formation of candles on certain time periods – from 60 seconds to several years.

Note! Users can also use interval functions and generate interactive graphs that reflect the situation over time.

Applications can be sent directly from constructed images, which can include both one valuable object and several at the same time. On graphical curves, the user can fix commands by time period, cost, and other parameters. To optimize the order management panel, the terminal suggests using the ChartTrader tool.

For a convenient process of analyzing graphic images, Trader Workstation provides more than 120 financial and system tools.

Studying the price: prospects for its changes

To understand how the price will behave further, technical analysis is used. As tools to analyze the prospects for price changes, IB TraiderWorkstation offers to use a special indicator – Bollinger bands, oscillators, etc. Algorithms can be applied to graphic images to clearly see the maximum and minimum price parameters that rule trends on the stock exchange.

Stock Reading Technology

The stock reader on this trading platform optimizes combinations and search settings. The search for instruments is carried out on all markets available to the terminal: profitable assets are scanned and selected on the stock exchanges of the United States, as well as from all over Eurasia.

It’s important to notice! Favorite scanners will be saved for regular analysis of the exchange.

How to download, install and set up the Trader Workstation trading platform

The IB Trader Workstation terminal is free for all users and is available for download for all exchange traders. However, in the process of installation, configuration and further use, there are several features that we will now consider.

The process of downloading and installing the Trader Workstation terminal

You can find and download the version of the service on your personal computer on the broker’s official website – Interactive Brokers https://www.interactivebrokers.co.uk/ru/home.php.

It is important to download the terminal only from trusted sources, in this case, from the official website of the broker. Installing the service from third-party resources may lead to the appearance of viruses on the PC, as well as the subsequent hacking of a real trading account and computer.

- not all orders are supported by the training platform;

- transactions are opened only at the best offered asset prices;

- the situation with sending an order to buy/sell an asset when the stop trigger price is reached in the demo version may differ from the real terminal;

- execution of the balance on the purchase / sale operation cannot be carried out.

A complete list of restrictions can be found on the official website of the broker.

To install IB Trader Workstation, you need to open an account with a broker providing services. If this condition is not met, access to the terminal is blocked.

Setting up IB Trader Workstation

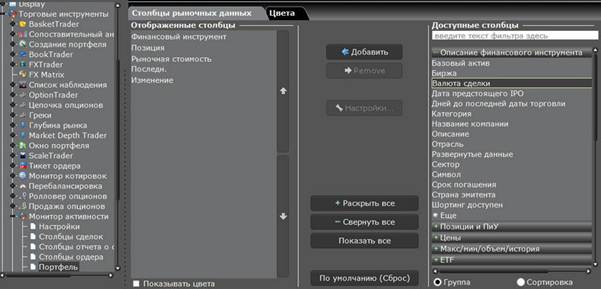

To start optimizing the platform for yourself, you should click on the settings icon shown in the screenshot below. Each panel that you will configure has such a section, however, for stable operation, we are only interested in the right panel, located at the top of the screen. After going to the settings section, the system takes the user to the next stage:

- We select the desired column from those presented on the right side (rsrss).

- Click on the “Add” button

The selection is incredibly large, with over 60 columns available for ETF positions alone. Therefore, here you need to experiment, which is more suitable for you and will suit your strategy. Let’s highlight the main columns that are often used by traders in their work, and consider them in more detail:

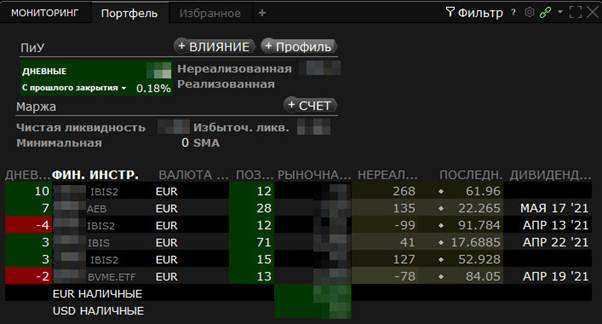

- A daily summary of profits and/or losses as of a specific point in time (daily P&L). This is the profit or loss earned on the acquired asset. This indicator indicates the volatility of the document, rounding the measurement to the nearest whole number by default.

- financial instrument. The exchange presents various types of securities: from stocks to futures and various shares. Their identifiers are collected in this column with the number of the market where they were purchased. If you hover over the identifier with the mouse, the user will see a description of the asset, which is very convenient and allows you not to try among the papers.

- The currency in which the price of the asset is set . Everything is intuitive here.

- Position . This column reflects the number of acquired assets.

- Market value . This is the price of the position, calculated by multiplying the current market value of the asset by their number. Here you can see the available funds on the account in different currencies. If you hover over the position with the mouse, information will appear on the percentage in the portfolio, rounded to the nearest whole value.

- The total of profit and loss for each asset . You should look here when you plan to buy a security: negative indicators often indicate a possible large profit. The value is rounded up to an integer.

- The last column is the cost at which the order was placed for the last time. This indicator is not rounded, it is indicated to the fourth decimal place.

- The date on which the issuer announces the list of participants in exchange trading who receive payments. In the terminal, it is indicated in different ways and if you hover over it with the mouse, you can see the dates on which payments will be made for 12 months in advance.

How to set up the TWS trading terminal from Interactive Brokers: https://youtu.be/nngPjRBejKM

Training to work with the Trader Workstation terminal

By trial and error, you can learn the platform, understand its functionality and work algorithm on your own. However, mistakes made in the process of self-knowledge of the platform can lead to negative consequences, and some traders simply do not want to spend time on this. In both cases, it is better to trust professional specialists who will quickly tell and demonstrate how to work with the Trader Workstation terminal.

- understand step by step the process of opening an account with an IB broker;

- learn how to work with the trading terminal, including making money transactions between the broker’s accounts;

- figure out how to withdraw funds from the platform to your account and exchange them for another currency;

- learn how to competently and profitably acquire and sell foreign securities;

- understand how to work with graphic curves, built-in analysis tools and other terminal parameters.

All this a new user who starts his work on IB Trader Workstation will be able to put into practice in a short period of time.

Advantages and disadvantages of TWS

Almost all users of the IB Trader Workstation trading platform note only its positive aspects:

- a wide range of functionality;

- the ability to equip the main control panel with those tools that are really useful in the trading process;

- flexible settings;

- the platform allows you to buy / sell not only assets, but also currency pairs, indices, etc.;

- The system is free and available to every exchange trading participant.

The disadvantages include only the fact that the exchange trading terminal is not suitable for every trader, and even more so it will not be useful to a beginner. Also, in order to use the functionality of the system minimally and without errors, you will need some knowledge about it – self-study will take an indefinite amount of time, and you will have to pay extra for training courses. IB Trader Workstation is an exchange trading platform designed for experienced exchange traders and investors who cooperate with large corporations and stock exchanges. Such a system is suitable for both short-term and for transactions designed for a long period of time.