EXANTE is an investment company providing clients with access to the largest international financial markets. She is the developer of her own trading terminal, which is effectively used by both novice traders and professionals. The company is constantly developing and strives for full market coverage while maintaining competitive rates.

Features of the EXANTE platform

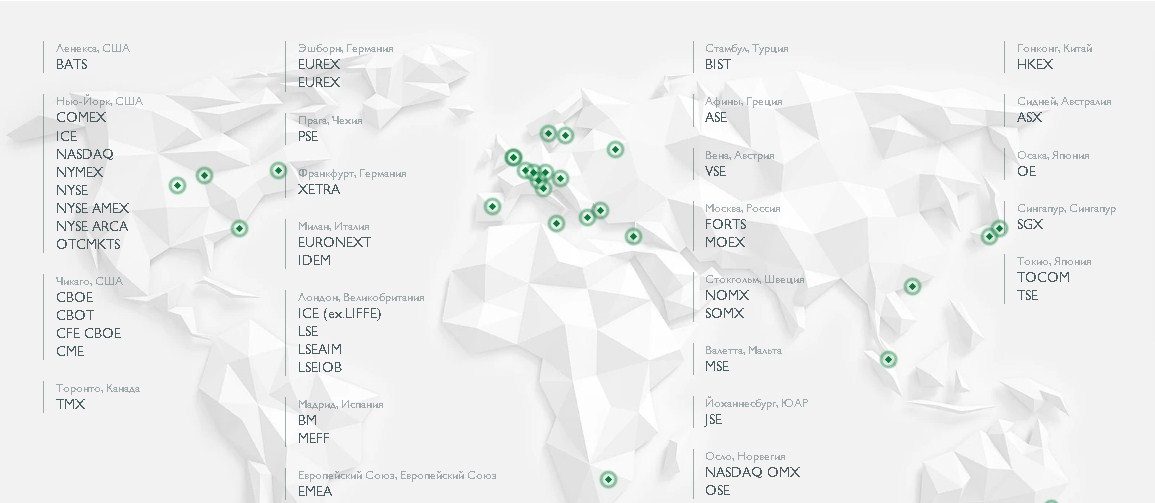

The EXANTE platform provides access to over 30,000 financial instruments listed on the world’s largest stock exchanges. It has many useful tools and an intuitive interface, which makes trading simple and comfortable. The main features of the EXANTE trading system:

- provided access to the largest stock markets;

- the adaptive structure of the terminal is suitable for both beginners and professionals;

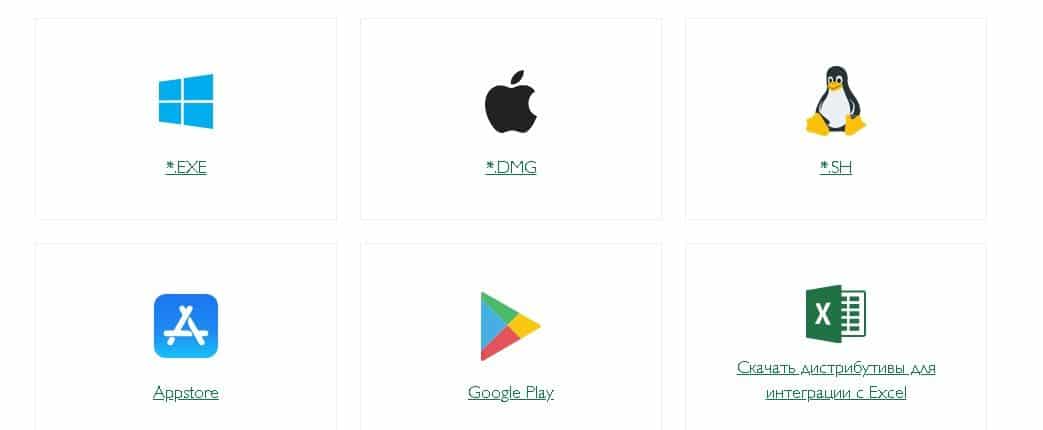

- the program is implemented in several versions, incl. for operating systems of computers and mobile devices.

You can open an account using the link https://exante.eu/en/#open-an-account

Using the trading terminal

The EXANTE trading platform is organized according to the principle of modules, each of which performs a specific function. This makes the terminal universal. by opening and rearranging the necessary windows, the trader provides functionality for solving any problems.

- Intelligent search system among more than 30 thousand financial instruments . It is implemented using a module located in the left column of the program interface. To find an asset, enter the first characters of its name into the line and select the one you need in the drop-down list.

- Fast schedule management . To view the dynamics of the value of an asset, it is dragged from the “Tools” module to the central window. When you press the right mouse button in the range of the graph, a drop-down list appears in which you select the type of setting. For example, you can change the time interval, apply indicators, and so on.

- Graphic Tools . The trader has access to objects for drawing: lines, geometric shapes, alphabetic symbols, etc. The control panel for these tools is located above the chart of the selected asset.

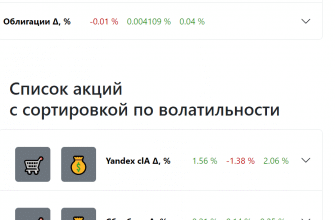

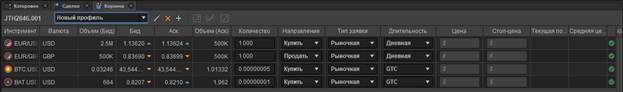

- List of quotes . Presented in conjunction with growth or decline indicators. The list can be formed at your discretion by dragging the necessary tools from the left column.

- Options table . The module displays lists of call and put options, contract execution costs, Greek odds. There is a price filter that allows you to select current positions, the parameters of which correspond to the selected strategy.

The reviews left about the EXANTE terminal indicate that it is very convenient to work with the terminal. The presented tools cover almost all customer needs. You can download the EXANTE trading terminal for different platforms https://exante.eu/ru/downloads/:

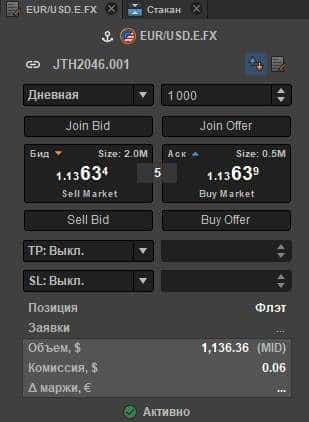

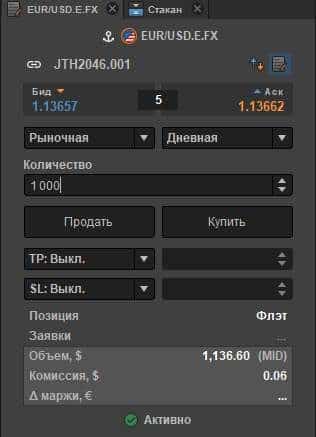

Transactions

The terminal provides 2 ways to make transactions: quick and standard orders. The first one is implemented in the module, which is loaded in the right column when the program is opened. If it is not there, or you want to launch a standard window, go to the “Trade” item of the main menu and select the appropriate line. Before placing an order, a financial instrument is dragged from the list to the module window. Then indicate the amount and click Sell Market (Sell) or Buy Market (Buy). Also, a trader using the Join Bid and Join Offer buttons has the opportunity to place a limit order to sell an asset at the offer or ask price, respectively.

Algorithmic trading on EXANTE

Algorithmic trading , which is becoming more and more popular today, seems difficult or impossible to beginners without

programming skills . However, EXANTE has a tool that allows you to quickly create bots in the form of simple Excel macros. The Microsoft Excel program for providing algorithmic trading was chosen by the creators of the platform for a reason. It allows you to use COM-compatible programming languages, incl. very easy to learn Visual Basic for Applications (VBA). Any person will quickly master its syntax.

EXANTE Broker Tariffs

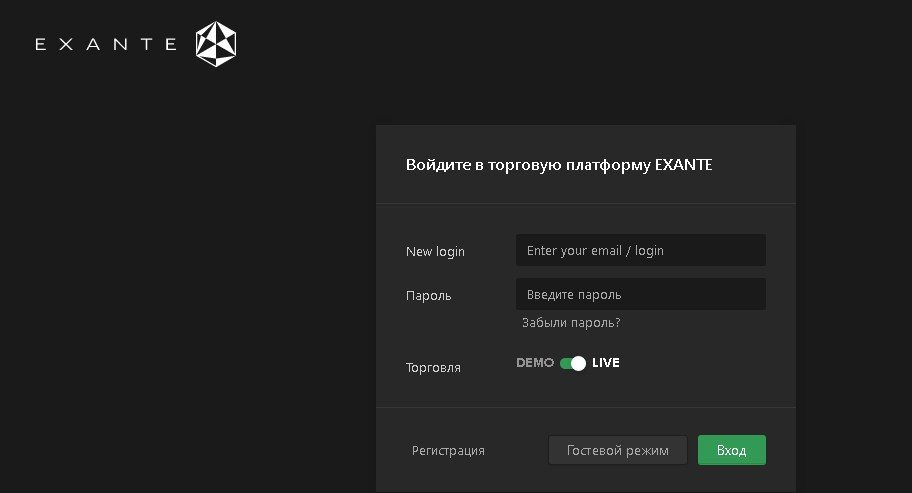

You can start trading immediately after opening and depositing an account with the EXANTE broker. To do this, the trader registers on the site and uploads the necessary documents proving his identity and confirming registration at the place of residence. Login to EXANTE personal account at https://exante.eu/trade/auth:

The minimum deposit to work with EXANTE is 10,000 euros.

Within the company, there are 2 types of commission fees: exchange and service. The first ones depend on the policy of the chosen stock exchange, the second ones are assigned and charged by the broker at the time of placing orders or other actions of the client. Exchange fees are set by the exchange and may change over time. The amount of fees at the main sites is presented in the table.

| Exchange | Rate |

| American Stock Exchange (AMEX) | $0.02 per share |

| New York Stock Exchange ( NYSE ) | $0.02 per share |

| NASDAQ | $0.02 per share |

| Moscow Exchange ( MOEX ) | 0.01% |

| London Stock Exchange (LSE) | 0.05% |

| Tokyo Stock Exchange (TSE/TYO) | 0.01% |

On other exchanges, the fee can be as high as 0.1%. EXTANCE does not charge a fee for the fact of having an account, however, it sets several other types of commissions. Some of them have a fixed value, the rest often change depending on the conditions. At the same time, tariffs are considered optimal.

| Fee object | Rate | Decryption |

| Withdrawals | $30/€30/£30 per transaction | Charged at the time of withdrawal. Might be a little higher depending on the bank |

| Placing short positions | 12% of the transaction amount | Suitable for highly liquid stocks. For hard-to-reach assets, it is higher and is calculated upon request |

| Manual execution of orders | €90 | Charged for voice (telephone) trading of instruments available online |

| night trading | Variable | Depend on market conditions and are indicated in the investor’s personal account |

| Trader’s inaction | €50 per month | Applies to accounts that meet the following conditions:

|

| Negative balance | Variable | Depends on the currency of the account and is published in the personal account |

| Bond storage | 0.3% per year | Charged the same as overnight fees |

EXANTE broker does not charge commissions for deposit replenishment, transfers between different accounts of one client, margin trading. Connection via FIX API and HTTP API protocols is provided free of charge

The HTTP API allows you to create elegant, fast financial applications that use large amounts of data. Choosing in his favor provides an opportunity to receive detailed information about all EXANTE instruments and quotes history. FIX API is a protocol for exchanging financial information. EXANTE supports the full version of FIX Protocol ver. 4.4, which is recognized as the industry standard in securities trading. It is recommended for low latency connections and complex settings. Connections can only be used by traders whose deposit amount is at least €50,000 (or equivalent in another currency). Perhaps, novice traders will be confused by the types and amounts of commission fees. However, EXANTE’s clients are mostly advanced investors with sufficient financial backing. Among the advantages are the presence of a license from a broker, the ability to trade foreign assets, and easy withdrawal of funds. Over the years, the company has only improved the service. The number of financial instruments has significantly expanded, some working conditions have been simplified, new useful functions have been added to the terminal.