Trading robots , or bots, are a special algorithm that comes to the rescue when you need to make a difficult decision. An automated trader helps protect its owner from serious financial losses. Trading robots are able to act in the securities markets as a seller and a buyer. However, you shouldn’t think that a bot is a fail-safe mechanism with no room for error. Any program has not only advantages, but also disadvantages. Below you can find the main types of trading robots and a description of the best computer programs.

- Trading robots: what are they and why you need them

- Varieties of trading robots

- Why are robots laid out for free?

- Features of choice

- Rating of the best trading bots for Forex and cryptocurrency

- Cryptotrader

- aBOT (Arbitraging)

- Bitsgap

- Cap.Club

- Haasbot

- Zenbot

- RevenueBot

- BTC Robot

- Gunbot

- Leonardo

- HaasOnline

- PHP Trader

- Centobot

- Cryptobot v2.0

- Crypto Majors

- Ethereum Rise

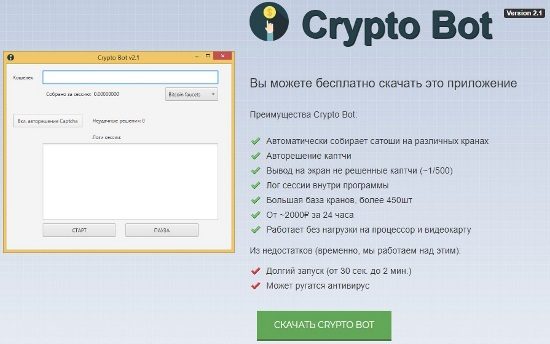

- Cryptobot v2.1

- Altcoins Combo

- Era of Bitcoin

- Bitcoin UP

- Bitcoin Profit

- Bitcoin revolution

- EXMO BOT

- BOT Trailing-stop Acceleration

- BOT Smart SAR

- BOT Level Breakout

- AUTO-PROFIT 3.0

- AUTO PROFIT V 2.1

- PITBULL V8

- FOREX TREND RIVER 2.1

- POLONIEX bot

- CEIFBOT

- IT FX

- MAKLERS CLUB

- Abi

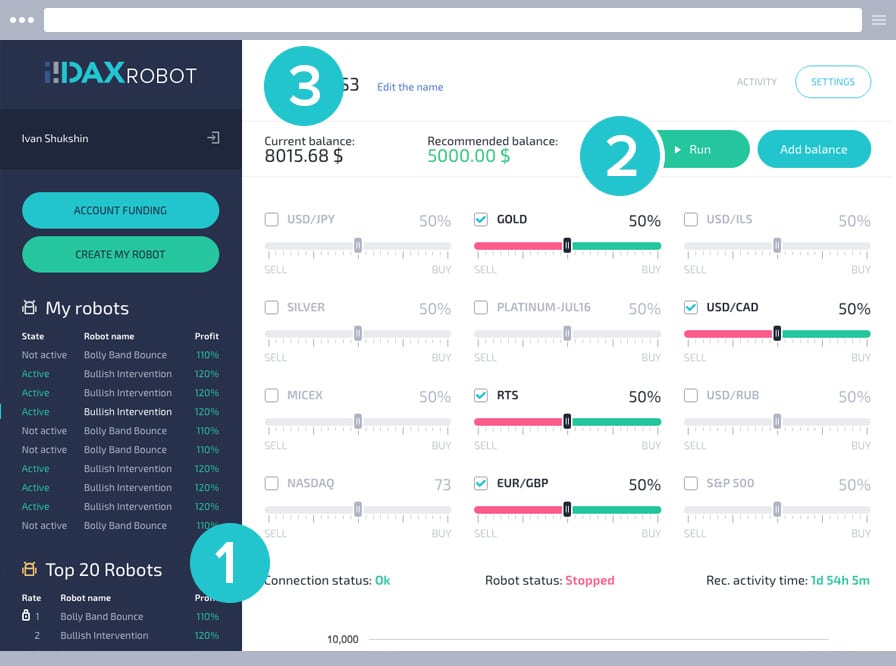

- Daxrobot

- Learn2Trade

- Forex Fury

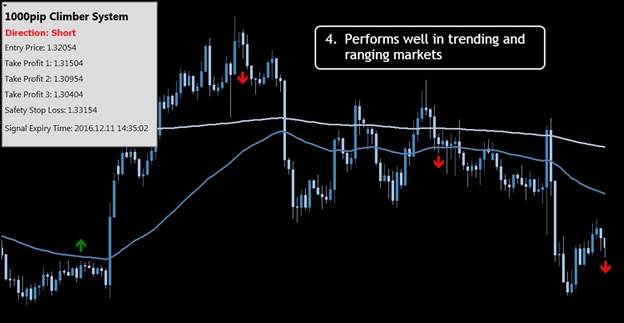

- 1000pip Climber

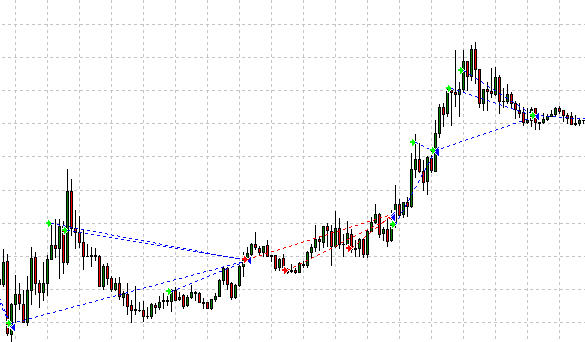

- Generic A-TLP

- Equilibrium

- Funnel trader

- Trio dancer

- comparison table

- Advantages and disadvantages

- Features of use

- Installation features

Trading robots: what are they and why you need them

A trading robot is a computer program that can fully or partially replace a broker in stock trading. An automated trader not only sets the algorithm, but also repeats the trader’s actions, independently tracking important indicators, and based on the specified conditions, the bot decides whether to make a deal or it is better to wait. A trading robot is a triune system that combines a trading terminal with a computer and program code. The difference between exchange bots is:

- restrictions on deposits / exchanges;

- behavior strategies;

- the sequence in which you can change the settings;

- short / top-loss / take-profit mechanisms.

For your information! The bot is able to take into account the graph of the price movement of an asset, as well as study information on the financial performance of the company.

Varieties of trading robots

There are different types of bots for trading on the exchange. Depending on the market, robots can be:

- Forex trading bots;

- CFD bots.

There is a subdivision depending on the trading platform:

- MetaTrader bots;

- other platforms.

- Indicator robots that work with the classic trading option based on the use of fundamental analysis indicators. This is the easiest option for users.

- Indicator-free . This type of trading program is suitable for experienced players. Traders have to raise rates until they receive their winnings. In indicator-free models, technical analysis is not used.

- News feeds that are programmed to search for key events from the news feed. The robot, after a thorough study of supply and demand, predicts market behavior. In this case, the player must independently choose the optimal time period.

- Arbitrage , in which indicators are not used and technical / fundamental analysis is not used. The trader should open / close positions, taking into account the fluctuations in quotes.

- Averaging , based on the execution of transactions according to averaged indicators. No specific stop loss is placed. The program is able to think over steps in the indicated direction, as well as open / complete operations.

- Multicurrency , which are considered the most expensive type of robot. The application is able not only to analyze the movements of various currency pairs, but also to insure risks under contracts through hedging. All losses will be covered by the profit. Risks will be minimized.

- Trending . Trend indicators are the backbone of these robots. Trading will be carried out according to the principle of searching for trend lines.

- Flat , trading on the stock exchange within the horizontal price corridor, calculated using oscillators.

Also, do not forget about robots that open short trades. Such applications are scalping. Undoubtedly, the amount of each trade will be small, however, the trader will appreciate the impressive total income. This model is considered the most dangerous.

Why are robots laid out for free?

Often, newcomers to the field of trading are interested in why developers put robots for free. There is no catch in this, because free applications are less profitable and reliable when compared to the professional versions, the use of which is possible only on a paid basis. The main goal of the manufacturer is to demonstrate the convenience of working with trading robots. As a rule, program creators who have not yet acquired sufficient experience to boldly sell their product post it for a short period completely free of charge. The algorithm of such applications has not been fully tested. The profit will be minimal, or the trader will completely go into the red. These are the main risks and disadvantages of using free versions of advisors.

Features of choice

It is very important to take a responsible approach to the process of transferring equity capital to the management of a robot for trading on the stock exchange. Experts advise to carefully study the functionality of the models you like and pay attention to the reliability and simplicity of the interface. When choosing an advisor, you need to familiarize yourself with its trading strategy, test the program on a demo account in order to determine the profitability of the assistant and use the robot in test mode for more than 8 weeks, which will make it possible to assess the stability of the trading result.

Rating of the best trading bots for Forex and cryptocurrency

Below you can find the rating of the best trading robots, which will help traders make their choice, soberly assessing the advantages and disadvantages of each bot.

Cryptotrader

Cryptotrader is a cloud bot for automating trading strategies without installing any software. The robot enables traders to work on any popular exchange. The trading bot is tested in real time. Depending on which plan is chosen, the cost of the application will be calculated (from 0.0042 BTC).

aBOT (Arbitraging)

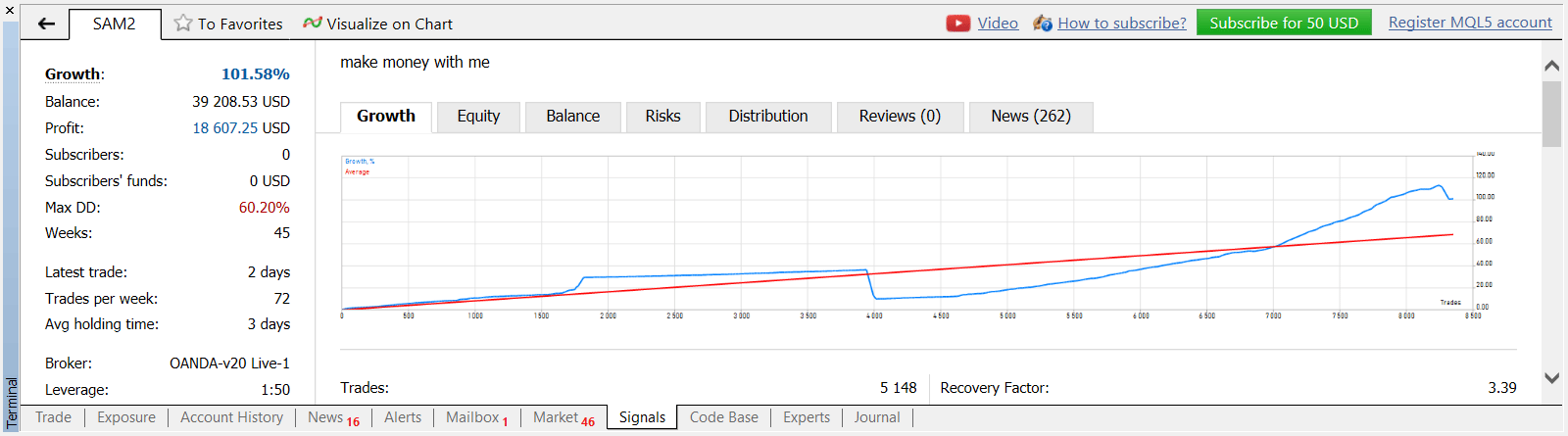

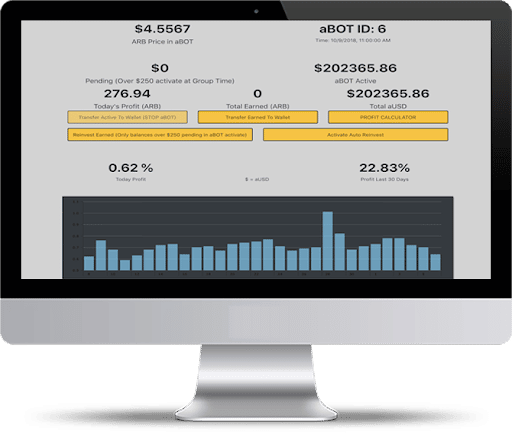

aBOT is an arbitration cryptorbot. After the algorithm finds cheap altcoins, the robot buys them and sells them on another exchange at the most favorable price. To access the bot, you must register an account with the Arbitraging.co project. The only fee charged to users on the service is transaction fees. The trader will be able to control the transactions that the robot makes. As an additional advantage, it is worth highlighting the provision of a cryptocurrency wallet, its own exchange and a semi-automatic bot by an arbitration crypto-robot.

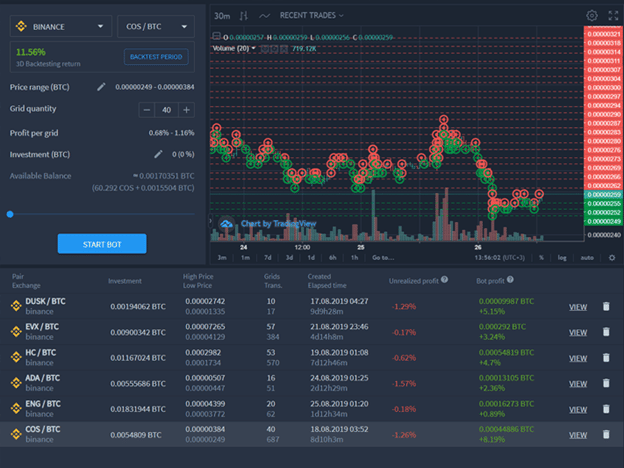

Bitsgap

Bitsgap is a popular platform that supports the full functionality required for a full-fledged cryptobot (trading / arbitrage / signals / portfolio formation). You can use the demo version to test the platform. Automatic algorithms minimize risks. There are free and paid plans. The latter set limits on the volume of trade. The presence of a smart order and a significant number of supported exchanges are the advantages of this platform. The lack of the ability to choose the Russian language – minus Bitsgap.

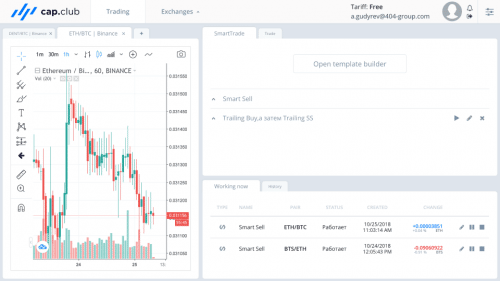

Cap.Club

Cap.Club is a platform for efficient trading. A trader can use a visual editor, a demo account, which allows him to train his trading skills. You can use a version of the platform that does not require payment and does not provide for a time limit. However, it is worth remembering about the limits set on the number of strategies. You can purchase the PRO version for $ 30 (per month).

Haasbot

Haasbot is a popular bot supported by a huge number of exchanges. The robot is engaged in automatic trading of bitcoins and other altcoins. A bot equipped with technical indicators requires a trader to participate in the trading process. The cost of the program is 0.32 BTC (payments every 3 months).

Zenbot

Zenbot is a bot that is available for major operating systems. The platform successfully executes high-frequency trades and uses arbitrage capabilities, which makes the program popular with traders. The trading bot successfully carries out multiple multitransactions with cryptocurrencies.

RevenueBot

RevenueBot is a cloud-based robot that helps you automatically trade on popular exchanges. The Martingale strategy is break-even. 24-hour trading, which uses the API keys of crypto exchanges, is carried out from the cloud. There is no need to install software on a laptop / PC. 20% of the profit received must be given by paying for bot services.

BTC Robot

BTC Robot is a platform that supports major operating systems. For Mac users, the purchase of BTC Robot will cost more than for Windows users. A significant advantage of the platform is the ease of installation and the ability to use a trial period with a 60-day refund policy.

Gunbot

Gunbot is an exchange trading robot that has many built-in strategies that include:

- Ping Pong;

- Gain;

- Bollinger Bands.

Depending on the set of functions, the cost of the tariff package will vary from 0.1 BTC to 0.3 BTC.

Leonardo

Leonardo is one of the new bots equipped with a pair of Ping Pong and Margin Maker trading strategies. The platform supports various exchanges, including Bittrex, Huobi. Installation is simple. The cost of a lifetime license is $ 89.

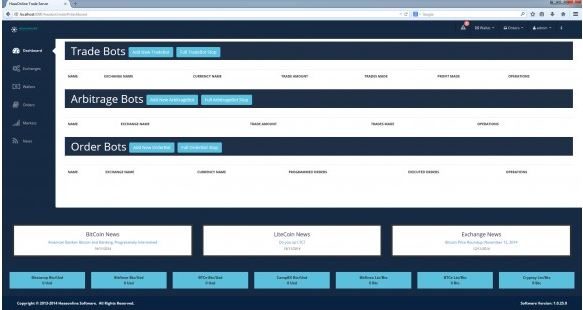

HaasOnline

Most traders use HaasOnline as their primary trading bot. Thanks to the nuclear algorithm, the software will gradually learn to take into account the wishes of the owner. Developers add new exchanges regularly.

PHP Trader

PHP Trader is a powerful platform used to trade Bitcoin and Ethereum. Before starting to use PHP Trader, the user will need to take care of creating an account on the Coinbase exchange. It should be borne in mind that the platform does not perform data analysis and is not able to predict price trends.

Centobot

The service is simple and easy to use. The functionality is advanced, so the platform can be installed not only by novice traders, but also by professionals. There is no subscription fee. If desired, users can create their own robot on their own.

Cryptobot v2.0

Cryptobot v2.0 is a bot configured to automatically trade popular cryptocurrencies. The service is based on MAC and RSI technical indicators. Up to 300% per month.

Crypto Majors

Crypto Majors is a popular platform that works with top cryptocurrencies such as:

- Bitcoin;

- Ripple;

- Ethereum.

The service is based on the technical indicators CCI and MACD.

Ethereum Rise

Ethereum Rise is a service based on the Stochastic algorithm of technical indicators and CCU. The bot is based on Ethereum.

Cryptobot v2.1

Cryptobot v2.1 is a popular platform configured to trade with the most popular exchanges. The rate of return is 250%. The work uses various trading indicators.

Altcoins Combo

Altcoins Combo is a service that uses several altcoins. Risks are diversified by investing in multiple cryptocurrencies.

Era of Bitcoin

In order to start the service, you need to register and wait for the verification process to complete. A significant advantage of using the Era of Bitcoin is the emergence of the ability to trade multiple cryptocurrencies. The only drawback is the presence of exclusively cryptocurrencies.

Bitcoin UP

Bitcoin Up is a popular crypto investment robot that automatically buys bitcoins when their value drops sharply and sells them when prices rise. The service’s profitability is high, however, the risks are also high.

Bitcoin Profit

Bitcoin Profit is a service with an algorithm capable of tracking price changes in the market as accurately as possible. Bitcoin Profit performs automated trading without requiring the participation of a trader. The only drawback is considered to be high risks.

Bitcoin revolution

Bitcoin Revolution is software designed for automated trading. The service can be used absolutely free. The job can start at $ 250.

EXMO BOT

EXMO BOT is a service that trades in all currency pairs. It is possible to trade the entire deposit or a small part of it. Individual settings are applied for each currency pair.

BOT Trailing-stop Acceleration

BOT Trailing-stop Acceleration is a service designed to make high-risk trades. Trading is aggressive. More suitable for professionals.

BOT Smart SAR

BOT Smart SAR is considered a trend indicator that detects a reversal of the market trend and covers all trend movements / timely market entry.

BOT Level Breakout

BOT Level Breakout is an equally popular trend indicator that differs from previous bots in its significant aggressiveness during trading. If market volatility is low, the service will not open deals.

AUTO-PROFIT 3.0

AUTO-PROFIT 3.0 is a grid operator whose profitability is in the range of 30-300% per month. The degree of reliability is high. Medium risks. The service can be used free of charge.

AUTO PROFIT V 2.1

AUTO PROFIT V 2.1 is a grid platform with soft martingale elements. The monthly profitability of the service is in the range of 20-350%. The reliability is very high and the risks are low.

PITBULL V8

PITBULL V8 is a neural network bot that works on several technical indicators. Learning is carried out at the market on history. The size of the monthly profitability reaches 1000%. PITBULL V8 works very aggressively, trading in automatic / semi-automatic mode.

FOREX TREND RIVER 2.1

FOREX TREND RIVER 2.1 is a popular robot that trades with the trend and analyzes the market using technical analysis indicators. The profit margin can reach 2000% per year. The algorithm includes control over risks.

POLONIEX bot

POLONIEX is a bot that is focused on working on the POLONIEX and GUNBOT exchanges of the same name. The latter platform allows trading multiple currency pairs.

CEIFBOT

Safebot is a trading robot whose activity is based on the readings of indicators that give the necessary signal to start trading at a certain stage, which was set by the trader.

IT FX

IT FX can be used free of charge, which is a significant advantage. When creating the bot, we took into account the classic trading methods, which are based on mathematical principles.

MAKLERS CLUB

MAKLERS CLUB is a robot that uses martingale. Despite the fact that the platform is able to bring significant profits, it should be borne in mind that the bot often behaves inadequately and is ready to drain the deposit for unknown reasons.

Abi

Abi is a trading software equipped with a pair of trading modes: manual and automatic. As soon as the robot detects that the moment of entering the market is approaching, it gives signals.

Daxrobot

Daxrobot is a popular service that requires accurate and confident decisions. The trader must take care of the starting capital. Even with a modest deposit, there is a chance to increase your own wealth.

Learn2Trade

Learn2Trade allows you to trade with a large number of major currency pairs, including EUR / USD. The subscription price will depend on the chosen tariff plan and the duration of the bot’s use. Beginners can take advantage of a limited number of free Forex signals.

Forex Fury

The trading success rate of this service is 93%. The platform uses a trading strategy with a low risk level. Drawdown is less than 20%. The bot is compatible with various platforms.

1000pip Climber

1000pip Climber is the best robot for consistent and strong results. This service is simple to configure. 1000pip Climber is suitable not only for advanced traders, but also for beginners.

Generic A-TLP

Generic A-TLP is a scalper Expert Advisor that works successfully between 22:00 and 3:00. On the eve of the release of financial news, experts advise disabling bots. This will maximize the profitability of trades.

Equilibrium

Equilibrium is the ideal bot for 24/7 trading. The currency pair settings are optimally matched. On bright signals, trading starts at small intervals. Equilibrium pleases users with stable income and minimal risks.

Funnel trader

Funnel Trader is a free profitable Expert Advisor based on short term strategy. Hedging and portfolio trading allow you to optimize processes and minimize risks. It is best to use the Asian session to enter the market.

Trio dancer

Trio Dancer is a bot that works on the Martingale principle. The robot is suitable only for experienced traders, because the risks of losses are high. Indicators are standard. It is important to ensure that the assistant has continuous access to the market. To do this, Trio Dancer is connected to a paid server. What robots help in trading, how to choose a bot: https://youtu.be/pqfIn0jQxn0

comparison table

| Trading robot name | Paid / Free | Price | What exchanges are used to trade on the exchange | |

| Cryptotrader | paid | From 0.0042 VTS | Any | |

| aBOT (Arbitraging) | is free | – | Any | |

| Bitsgap | Paid and free tariff plans | 0-110 $ | Bittrex, Binance, HitBTC, KuCoin, etc. (more than 30) | |

| Cap.Club | Paid and free tariff plans | 0-30 $ (per month) | Bittrex and Binance | |

| Haasbot | Paid | 0.32 BTC (every 3 months) | Huobi, Poloniex, Bitfinex, BTCC, GDAX, Kraken and Gemini | |

| Zenbot | Paid | $ 89 – cost of a lifetime license | Gemini, Kraken, Poloniex, GDAX, Bittrex and Quadriga | |

| RevenueBot | Paid – transfer of funds for bot services | 20% of the received profit | Any popular exchanges | |

| BTC Robot | Paid | $ 149 – for Windows users | Any popular exchanges | |

| Gunbot | Paid | 0.1 BTC to 0.3 BTC | Bittrex, Kraken, Poloniex and Cryptopia | |

| Leonardo | Paid | $ 89 – cost of a lifetime license | Bittrex, Bitstamp, Bitfinex, Poloniex, OKCoin and Huobi | |

| HaasOnline | Paid | 0.035 – 0.085 BTC | Most popular exchanges + developers are constantly adding new ones | |

| PHP Trader | Paid | The cost depends on the package | Coinbase | |

| Centobot | Is free | – | Binance, Poloniex and others | |

| Cryptobot v2.0 | Paid | 0.1 BTC to 0.3 BTC | Only on the most popular exchanges | |

| Crypto Majors | Paid | The cost depends on the package | Bitcoin | |

| Ethereum Rise | Paid | The cost depends on the package | Ethereum | |

| Cryptobot v2.1 | Paid | from 0.1 BTC to 0.3 BTC | Bittrex, Bitstamp, Bitfinex, Poloniex, Binance | |

| Altcoins Combo | Paid | The cost depends on the package | Any popular exchanges | |

| Era of Bitcoin | Is free | – | Bitcoin | |

| Bitcoin UP | Is free | – | Bitcoin | |

| Bitcoin Profit | Is free | – | Bitcoin | |

| Bitcoin revolution | Is free | – | Bitcoin | |

| OlympBot | Is free | – | Olymp Trade | |

| EXMO BOT | Is free | – | Eksmo | |

| BOT Trailing-stop Acceleration | Paid | 1450 p. | QUIK (Savings bank) | |

| BOT Smart SAR | Paid | 3000 RUB | QUIK (Savings bank) | |

| BOT Level Breakout | Paid | 19 900 RUB | QUIK (Savings bank) | |

| AUTO-PROFIT 3.0 | Is free | – | METATRADER 4 | |

| AUTO PROFIT V 2.1 | Is free | – | METATRADER 4 | |

| PITBULL V8 | Paid | 1500 RUB | METATRADER 4 | |

| FOREX TREND RIVER 2.1 | Paid | 2900 RUB | METATRADER 4 | |

| POLONIEX bot | Paid | 0.1 – 0.15 BTC | POLONIEX V3, GUNBOT | |

| CEIFBOT | Paid | 4500 RUB | Fopekc and CFD | |

| IT FX | Is free | – | Forex | |

| MAKLERS CLUB | Paid | 9,000 rubles for 3 months | Forex | |

| Abi | Paid | The cost depends on the package | Williams, RSI, TREND, Stochastic, CCI and MACD | |

| Daxrobot | Is free | – | Forex | |

| Learn2Trade | Paid | $ 25 per month | Forex | |

| Forex Fury | Paid | $ 229 | Forex | |

| 1000pip Climber | Paid | $ 299 | Forex | |

| Generic A-TLP | Is free | – | Metatrader: MACD, RSI | |

| Equilibrium | Is free | – | Metatrader: MACD, RSI | |

| Funnel trader | Is free | – | MACD, RSI | |

| Trio dancer | Is free | – | Metatrader: MACD, RSI |

Note! The robot works only when the terminal is turned on.

Advantages and disadvantages

Exchange trading advisor bots have both advantages and disadvantages. The advantages of trading robots are the ability to:

- saving time – it is enough for a trader to take care of downloading / testing the trading system, after which it will only be necessary to make occasional changes to the settings;

- increasing the efficiency of TVO (trade and foreign exchange transactions);

- trade facilitation – bots take into account a huge amount of information regarding the features of technical analysis;

- round-the-clock scanning of the market in the presence of Internet access without the intervention of a trader;

- elimination of emotional errors in the implementation of the transaction;

- increase in income – the increase to the deposit is in the range of 10-150%;

- a wide selection of robots , which allows the trader to customize various systems that bring profit.

If a specialist takes care of the correct setting of a trading advisor, then the bot will not cross the risk threshold. The disadvantages of using trading robots include:

- a huge number of bots that complicate the selection process;

- obsolescence of clearly defined characteristics that can no longer help in solving modern problems, therefore advisers will have to be systematically replaced;

- the inability of bots to react to drastic changes in the market.

It should be borne in mind that the risk of acquiring “left-handed” software is too great. The use of such a robot will entail serious financial losses.

Features of use

After the process of downloading and installing the trading robot is completed, you can start using it. To do this, you need to take care of how to program the bot to perform certain actions. For round-the-clock trading, only strictly mechanical platforms that do not require participation in decision-making are suitable. Despite the fact that the functions of trading advisors are very tempting, it is important for a trader not to become dependent on them, because trading should not do without supervision from a specialist trader who will always be aware of the latest news / conditions in the economy.

Installation features

Anyone, even a novice trader, can handle the process of installing a robot advisor for trading on the exchange. To do this, users:

- Download the platform and if it is archived, unpack it.

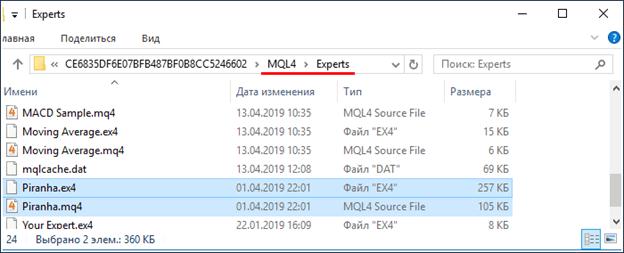

- Next, they scan the contents of the archive to make sure that the file with the .ex4 extension is present in it. If the files are divided into folders, you should look for the expert file in the experts folder.

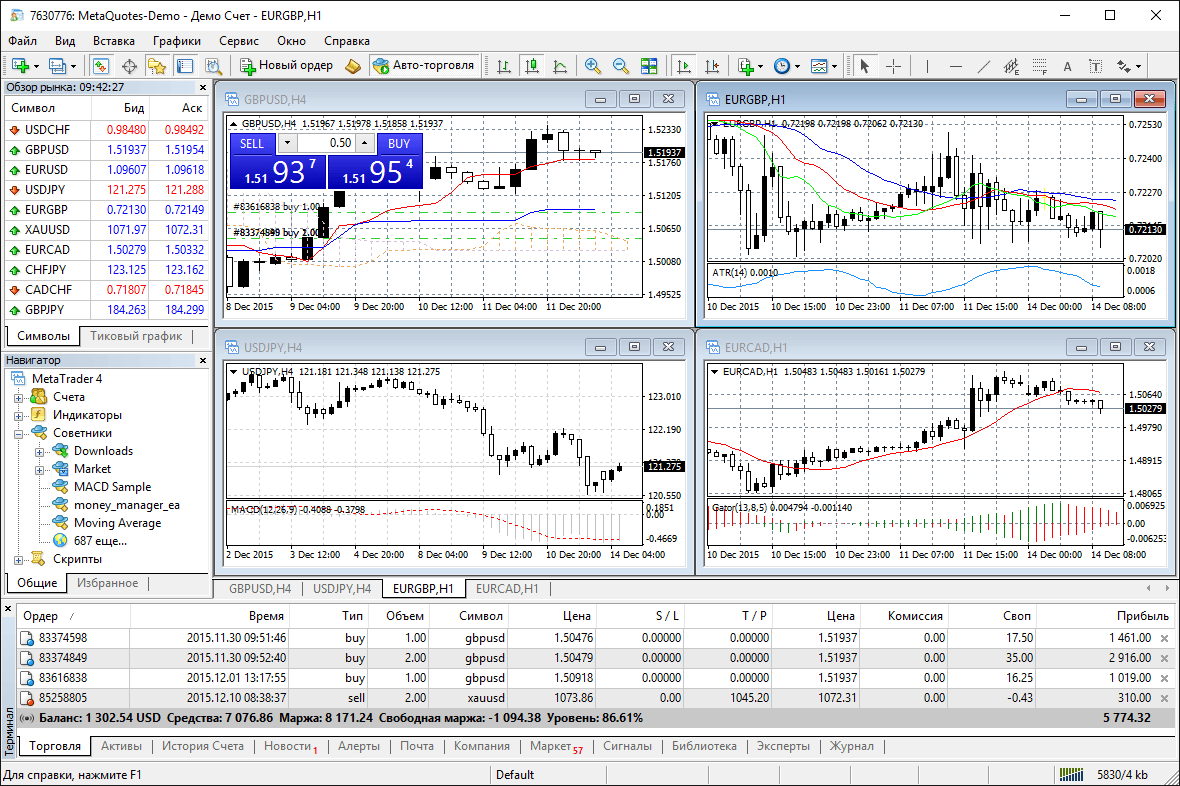

- The advisor files are uploaded to the terminal. For this purpose, open Metatrader 4, click on the File button and select the Open section of the data directory. In the window that appears on the screen, go to the MQL4 folder and then to Experts.

- The bot files are copied and moved to the Experts folder.

- The navigator window is updated. The folder is closed and the terminal is restarted.

- The installation process is complete. The bot name will appear in the Expert Advisors section. Users run it on a chart.

Installing a Forex trading robot (advisor) on MetaTrader4 (MT4): https://youtu.be/TJWFwDF-UKQ Most advisors have additional files that need to be scattered around the folders in the terminal directory:

- library files (extension .dll) are transferred to the MQL4 / Libraries folder;

- preset files with the .set extension are copied to the MQL4 / Presets folder.