Overview of the OsEngine open source platform for algorithmic trading, functionality, interface, installation and creation of trading robots based on the Os.Engine terminal. Os.Engine is a modern trading terminal for

algorithmic trading and creating and testing

robots for tradingat its base. https://articles.opexflow.com/trading-bots/s-otkrytym-isxodnym-kodom.htm Thanks to the efforts of the developers, users can use a large number of technical indicators, customizable charts and 8 types of candles. Also open access to 30 pre-installed robots, creating individual indicators and checking their work in test mode. The presence of built-in connectors allows algorithmic traders to connect not only to the Moscow stock exchange (Mosbirzhe), but also to cryptocurrency/foreign markets. Below you can learn more about the functionality of the trading terminal, its structure, creating robots from scratch and the features of working with Os.Engine.

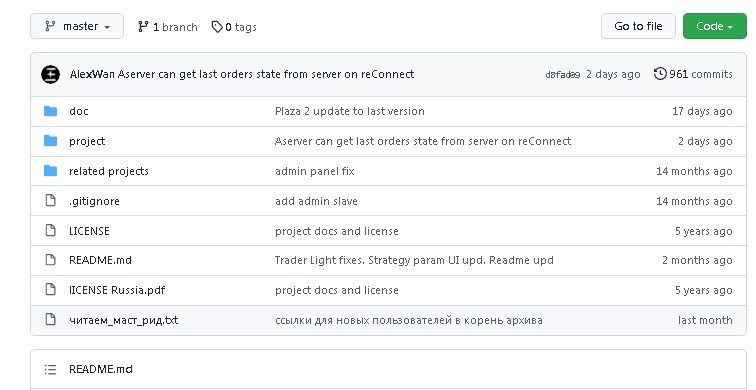

Open Source Algo Trading Platform available on

GitHubfollow the link https://github.com/AlexWan/OsEngine, where you can download the installation files, the Git Hub license file, and others. The Os.Engine project is fully open source and has permissive Apache 2 licenses.

- Os.Engine functionality

- Os.Engine structure for solving algorithmic trading problems

- Algo trading

- Test environment

- Charts and technical analysis

- Available connections

- Features of Os.Engine

- Main menu

- How to run the platform in test mode

- Panel customization features

- Position tracking

- Connection

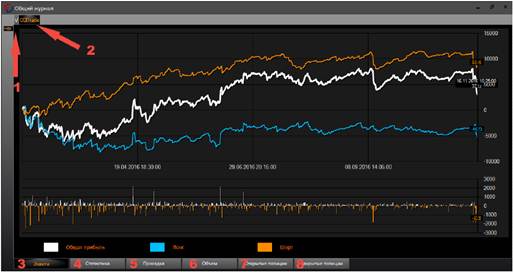

- General magazine

- Advantages and disadvantages

Os.Engine functionality

The trading robot is aimed primarily at short-term / medium-term specialists in the field of algorithmic trading. Os.Engine is a complete environment that allows you to create, test and run trading bots. A significant advantage of this

open source terminal is the presence of a wide range of ready-made algorithms (countertrend / patterns / HFT / arbitrage / semi-automatic trading on technical analysis indicators and others).

Note! Users can create individual indicators and test their work in test mode.

Os.Engine structure for solving algorithmic trading problems

The Os.Engine platform consists of several protocols that allow you to automate the trading process. They can be divided into the following categories:

- Optimizer/Tester/Miner being a system of protocols, the functions of which are to perform a search/analysis. The possibility of portfolio testing (more than 2 bots) and multi-market trading emulation is allowed.

- Data – a parameter designed to download historical data from various markets (candles/glasses/transaction tapes).

- Bot Station is an option that allows you to run algorithms in different markets. Traders can engage in trading by sending SMS alerts or emails. To control the work of the bot, experts advise using the transaction log.

Algo trading

To implement algorithmic trading, Bot Station is used, which launches the algorithm on the market, as well as the bot creation layer (Visual Studio). In the latter, it is possible to prescribe the code of your own robot. The scope of the workspace is not limited by the size of the code. Traders can create algorithms of any complexity.

Advice! You can get detailed information about robots based on Os.Engine and the principle of their work on the official website of the developer.

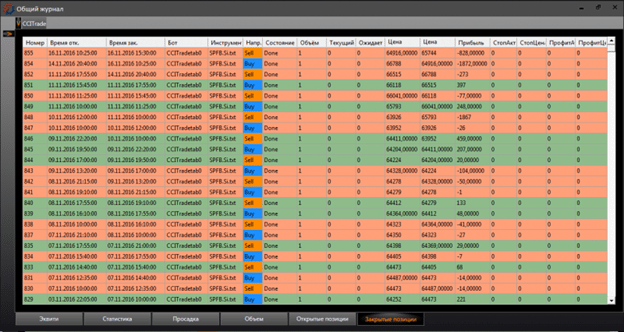

Test environment

The shared log is the main tool of the test environment. Experts advise traders to take a responsible approach to maintaining transaction statistics and evaluating the effectiveness of the strategy. In test mode, tabs are available by type:

- account growth;

- drawdowns;

- positions that are currently open or closed;

- volume.

The system performs an efficient analysis of the entire portfolio or examines specific orders in detail. The risk manager built into the program allows you to keep losses under control. Users have the option of setting the maximum possible percentage of losses.

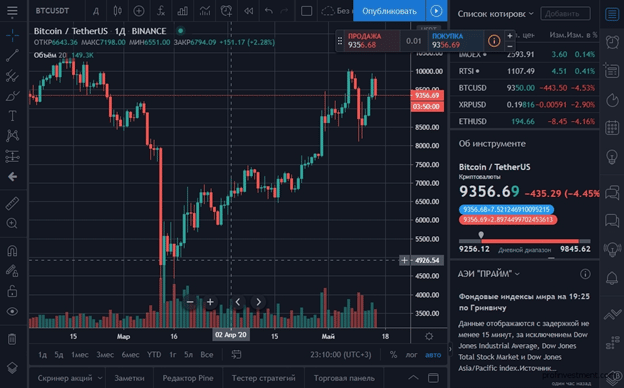

Charts and technical analysis

The developers have set “Japanese candlesticks – classic” charts by default. However, if necessary, you can choose a different type of candles: Revers / Ticks / Renco, etc. The duration of timeframes is within 1 second – 1 month. You don’t have to worry about connecting indicators of horizontal volumes. They are connected to all charts automatically. Among the large number of technical analysis indicators (there are more than 50), the most popular are:

- Ichimoku;

- MACD

- RSI;

- VWAP;

- Ivashov Range.

Note! Using Visual Studio, each trader will be able to create their own indicator.

OS Engine – an environment for creating and testing trading robots: https://youtu.be/a6spkWi-3cw

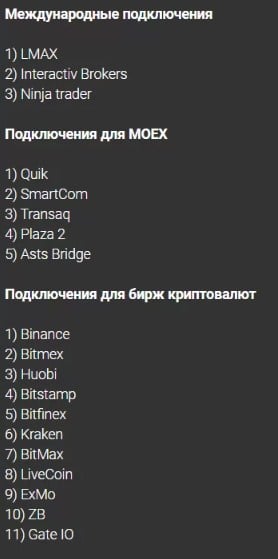

Available connections

The user has 2 ways to connect: through other trading terminals using the connector / and directly. Can be connected to:

- Moscow Exchange (quick terminal, SmartCom, Plaza 2, Transaq will be used ) ;

- cryptocurrency exchanges – Binance/Bitmex/Huobi/Bitstamp, etc.;

- Forex broker OANDA.

Through brokers LMAX, Ninja Trader, Interactive Brokers, connection to foreign markets is allowed.

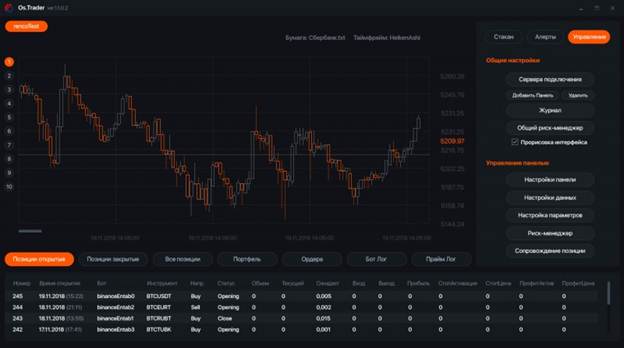

Features of Os.Engine

It can be unclear for novice traders how to work with the trading platform for algorithmic trading Os.Engine. Below you can get acquainted with the peculiarities of working in the Os.Engine environment and find out how you can set position tracking.

Main menu

In order to get to the Main Menu, users download and run the program. The process of selecting modules is quite complicated, because only the number of the most basic of them reaches four: tester/robot/data/converter. The tester is a module that opens the option of testing strategies and simulating trading. The Robot module, in turn, is responsible for conducting real trading on the stock exchange. The Date module is designed to download and store historical candlestick data, as well as order book slices using Finam connectors/server. Thanks to the Converter, data is converted from ticks to candles with a specified timeframe.

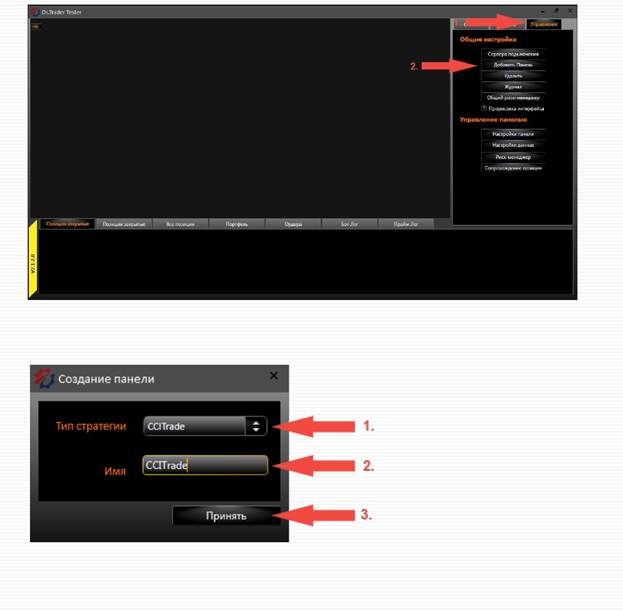

How to run the platform in test mode

To create a new panel, traders click on the “Add Panel” command. A selection window will open on the screen. After that, users proceed to the panel settings. First of all, choose the appropriate type (for example, a robot on the CCI indicator). Then enter the name, which must be unique. At the final stage, just click on the “Accept” button.

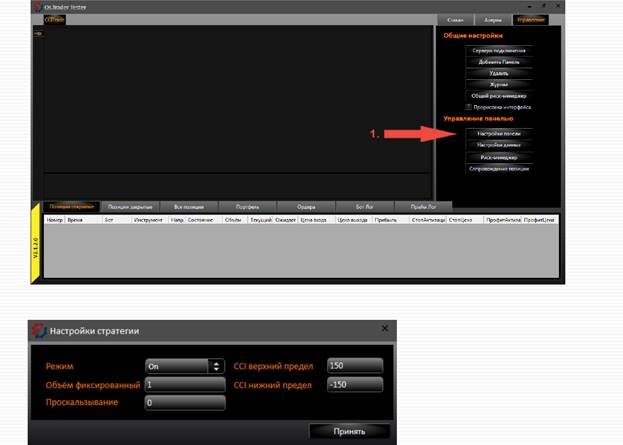

Panel customization features

Not every panel contains individual settings. To configure the robot, you will need to go to the appropriate panel. With the help of panels, traders get the opportunity to implement various trading strategies within this library (separate bots / individual trading terminals).

Position tracking

Standard methods for tracking a position can be assigned to any combinations that were opened within a particular panel. By clicking on the “Position Tracking” command, the user calls up the settings. A window will appear on the screen with the following items:

- Stop – the usual stop orders, which are set at the real price of entry into the position +/- the value of “From entry to Stop”. Additionally, you can set slippage.

- Profit . At the real price of entry into a position +/- the value “From entry to Profit” is set and an ordinary profit order. If necessary, additional slippage is allowed, with which a final purchase or sale order is placed in the system.

- Temporary withdrawal of applications , which allows you to control the time period during which the application will be executed. As soon as the time runs out, the application will be withdrawn from the exchange. In cases where applications for opening are not fully executed, the position will be rejected. In case of partial execution of the order, the position will remain open.

- Reaction to the withdrawal of applications for closure . It may happen that the request to close the ticket does not work. For example, a stop order does not work, and the market moves away from it.

The maximum pullback from the price is the distance in points, by which the price can “depart” from the order price. After that, the system revokes the order. There are situations when the system withdraws an order from a position opened the day before. Do not panic, because no one will interfere with using the block. After the reaction is posted, Market will take care of closing the client’s market position. Limit, in turn, will take care of closing its limit order with the slippage set in advance.

Note! The settings listed above are not able to replace the individual tactics of placing stops / profits inside the bots. In the case when a stop is provided within the bot, and the user has additionally configured the panel, a conflict cannot be avoided.

It should be borne in mind that if the “Reaction to the withdrawal of orders for closing” is disabled, traders will remain defenseless during the period of sharp market movements. You also need to remember that all tabs on the support settings panel are individual. In cases where the bot uses more than 2 tools, you will need to check if the support is configured for each tab.

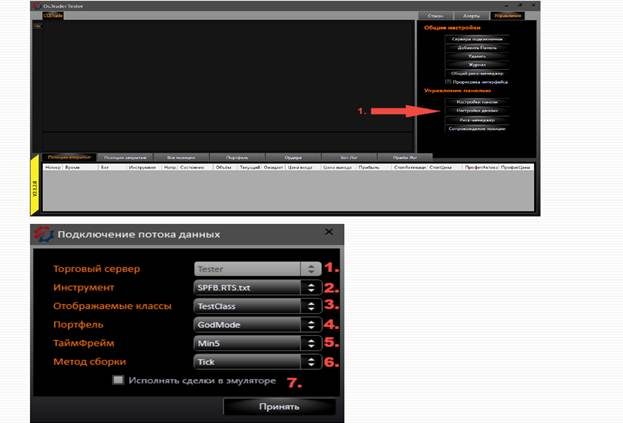

Connection

To enable the panel to connect to the server for further data retrieval, users will need to tap on the Data Settings category. After that, traders:

- Click on the name of the server to which you want to connect.

- Choose an instrument that will be used in trading in the future.

- Go to the Displayed classes, open a Trading Account (Portfolio), on which transactions are planned.

- Opens the Timeframe of data (received) and the method of assembling candles. At the end of the process, transactions in the emulator are additionally executed.

General magazine

In the Os.Engine trading terminal, you can get acquainted with the statistics on trading or testing. To do this, it will be enough to go to the General Journal by clicking on the button of the same name in the Main Menu. As soon as the journal opens, the user will immediately be taken to the “Equity” section, where you can study graphical information about the account growth. In addition, the total profit, income from short / long transactions, data for each individual traded panel will be displayed. Traders can view general information on all tabs.

Advantages and disadvantages

Os.Engine, like any other trading terminal, has not only advantages, but also disadvantages, well, for this platform, they can only be subjective and in the absence of programming skills from the trader. The strengths of the platform include:

- completely open source;

- the presence of built-in ready-made bots, the number of which exceeds 30;

- Russian-speaking support;

- wide functionality;

- providing users with training materials, using which traders can learn how to write bots on their own);

- the possibility of inter-exchange arbitration;

- the presence of a magazine / mailing list / scalper glass / multi-level logging and a permissive license.

Judging by the feedback from Os.Engine users who have managed to appreciate the advantages of the terminal, there are no reasons for negative emotions. No deficiencies were identified during use. Os.Engine is an open source trading terminal, the advantages of which will be appreciated not only by beginners, but also by trading professionals. Everyone can master the program if they have basic programming skills, which is a significant advantage, as well as wide functionality. Os.Engine is suitable not only for professional traders, but also for beginners who are just mastering this type of activity.

Informationbreach – Update daily 50M recor leaked per day

Great in data leak: With over 30 billion collected passwords

Super fast search speed: Allows easy and super fast search of any user or domain.

Many options for buy, many discout. Just 2$ to experience all functions, Allows downloading clean data from your query.

Go to : https://Informationbreach.net

Абсолютно стабилен в работе всегда здесь. Никогда не видел никаких сбоев или перебоев.

Прочитал про казино онлайн и решил попробовать 7к казино официальный сайт. Все работает как описано, никаких подвохов.