A trading robot is an algorithm-based software that automatically places trades on behalf of a trader. Robots are developed by experienced traders and mostly use the “WHAT IF” condition. These algorithms are placed in the software and executed in turn. Some bots are programmed to take maximum profit from currency/cryptocurrency pairs on weekends, as there is a lower trading volume at this time. The question arises – how to choose the most suitable trading bot for trading on the stock exchanges of the world, which can overclock the deposit? Let’s try to answer this question.

- The principle of operation of robots for trading in the stock market

- Tips and tricks for choosing to trade on the stock exchange

- Review of the most effective trading robots

- Alfa-Quant Forex Robot EA

- Description of the Strategy

- Crystal Win

- Principle of operation

- Gold Trading Robot Power Trend

- Investor Trade Copier

- Robot capabilities

- revenuebot

- Principle of operation

- learn2trade

- Forex Fury

- Centobot

The principle of operation of robots for trading in the stock market

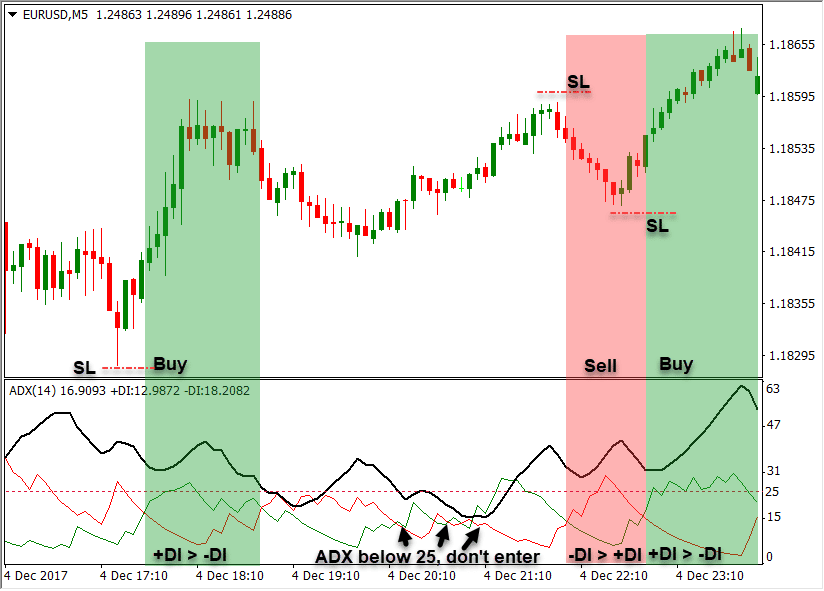

Any robot is created with one goal – to make as many successful transactions as possible using software and mathematical algorithms embedded in it. Their software includes many technical indicators. The robots themselves continuously scan the market and find the best signals and entry points. Users can access publicly available technical indicators to build their own automated trading rules. For example, you can enter a condition for creating an order with a long position when the 50-day average for currency pairs exceeds the 100-day average on a 20-minute chart. After adding such a condition, the transaction is carried out automatically. The trader does not take any action. Robots provide users with the ability to set their own indicators. Once the trade order is executed,

Tips and tricks for choosing to trade on the stock exchange

Worth considering:

- Buy robots from official developers . Avoid scam, virus software and other “nonsense”. So you protect yourself from additional risks of losing money.

- Compare the parameter “proven win rate” – it should be higher than the proven loss rate (preferably by 20-30%).

- Explore the specifications – 100% automation level. The user should be relieved of the need to enter positions manually.

- Check out the number of currency pairs that the robot offers. There should be as many of them as possible.

- Price is another important factor to consider when buying. Remember! Not always the most expensive robots give the greatest gain.

- The number of positive reviews from real users.

These tips will help you choose a trading robot. And now let’s look at the list of bots, which, in our opinion, are the most effective and proven for the global exchange market. So let’s get started.

Review of the most effective trading robots

Alfa-Quant Forex Robot EA

Alfa-Quant Forex Trading Robot is a revolutionary automated Forex trading robot based on neural network technology. It was created for intraday and swing trading.

Description of the Strategy

The robot strategy is based on a reinforcement learning model. Using deep data pools that simulate several market scenarios, the robot automatically adapts to new conditions and is able to consistently generate profits in volatile, flat and trending markets. This is what the program itself looks like:

- Possible loss coverage in case of a large number of negative trades.

- The robot is able to automatically determine the current market trend, predicts short-term price movement, volatility and opens a position with a 90% success rate.

- Ideal for scalpers as it is fully automated.

Minuses:

- Too high cost – about 300-400 dollars.

Crystal Win

Trading robot Crystal Win is a fully automated program that performs trading operations on the foreign exchange market in accordance with a given algorithm and trading settings. Ideal for both beginner traders and professionals with solid trading experience.

Principle of operation

The robot uses three scalping strategies: trading “from densities” – searching for a large bet worth several thousand dollars; breakout — search for an ideal point for a “long” entry; on drawdowns — search for the ideal point for entering short positions. The key feature of the robot is its algorithm, which implements a trading strategy with maximum security for the deposit. Placed orders are closed much faster and there are many more of them in a certain period of time. The deposit grows even with small drawdowns. This is what the robot interface looks like:

- “Multi-currency trading” – an option that significantly reduces risks, provides diversification of transactions and allows the trader to trade in small lots.

- The percentage of the transaction will be on average about 80-90%. This means that the robot trades in plus with a probability of 80-90%, which means exactly the same chance of increasing the deposit.

Minuses:

- Again, the high cost is $430.

Gold Trading Robot Power Trend

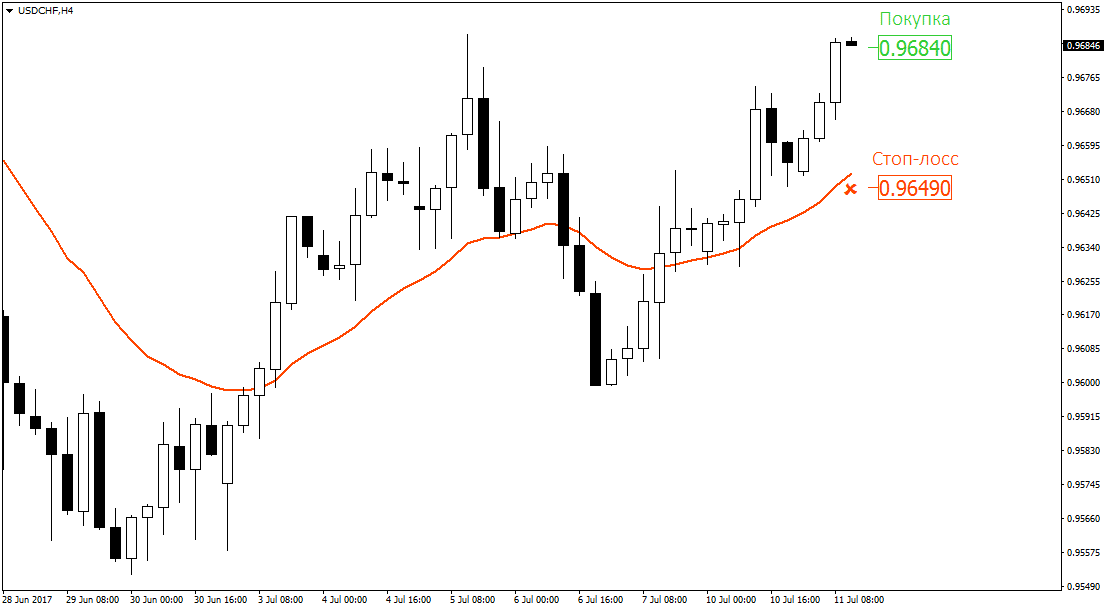

Gold is one of the very first assets to appear on the stock exchange. Compared to silver, platinum, palladium, gold is still the most sought after by traders and investors. The metal has low volatility and high profitability when trading in the long term. Investments in this asset usually pay off well and are less risky than investments in other metals. The Gold Power Trend trading robot is specially designed for trading a gold asset on the Metatrader 5 (MT5) platform. Suitable for trading both trending and flat markets. Advantages:

- There is a stop loss and take profit.

- The strategy is based on following the trend of the chart.

- High level of optimization – the ability to create your own strategies.

Flaws:

- High risk of losing money due to a sharp price drop. In a few minutes, gold can rise or fall in price by 80-100 points. The robot is not capable of quick adaptation in such conditions.

https://rumble.com/embed/vht2nh/?pub=4

Investor Trade Copier

Investor Trade Copier is a unique robot that links the investor’s account specified in advance by the user and copies transactions from it, repeating them exactly. In addition, the bot provides the user with the ability to manage transactions, as well as control profits and losses for several currency pairs using a number of parameters and settings.

Robot capabilities

- Bulk breakeven and trailing stop option to save profits.

- Setting up a deal triggered by a timer.

- Accounting for swaps and commissions when calculating profit or loss.

- A graphical toolbar that displays the current spread.

- For advanced launch conditions, free margin and the “own capital” option are available.

- Ability to filter deals by numbers, tools and comments to orders.

- Combining an unlimited number of conditions and filters.

- The ability to configure push notifications that come to the email address of the post or to the phone number.

- Timeframe to automatically save user settings, restart the system or change any options.

This is how the program interface looks like:

- High system optimization.

- Multifunctionality of settings and options.

Flaws:

- Lots of negative reviews. Users note that the robot is not able to close most of the transactions in a plus and disperse the deposit.

revenuebot

RevenueBot is a

robot designed for trading cryptocurrencies , and in particular, Bitcoin. Works with the most popular exchanges – Exmo, Livecoin, Binance, Binance Futures, Polonies, Bitfinex, Bittrex, OKEX, Bitmax, Kucoin. It does not require a large initial capital (the minimum deposit amount is $ 1). The robot itself has no trading time limits. This is what the interface looks like:

Principle of operation

The basis is a neural network that analyzes the price of a cryptocurrency in real time to find the best trade entry points for a position. Advantages:

- Trailing stop system.

- The robot is completely free. It can be downloaded from the official website – https://profinvestment.com/revenuebot.html/

- A large number of supported exchanges.

- Availability of useful options — backtests, smart order grid, volatility indicators, etc.

Flaws:

- Sometimes the program crashes.

- High commission – 20% of the profit from the work of the bot.

Overview of the trading robot: https://youtu.be/JrFE7Jbh2_8

learn2trade

Learn2trade is a forex trading robot from a London-based trading education startup. The company annually publishes online scalping courses and financially supports all independent traders. Bot trading signals have a 93% success rate. Pros:

- The ability to deliver a signal alert through a special bot in Telegram.

- Proven level of success.

Minuses:

- Low service life – the robot has been on the market for such products for only 1.5 years.

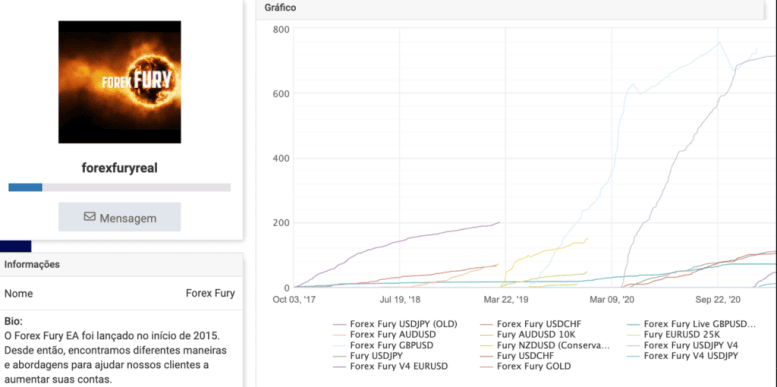

Forex Fury

Forex Fury is one of the best forex trading bots on the market. Uses low risk strategies with a drawdown of less than 20%. Compatible with a wide range of platforms – MT4, MT5, NFA, etc. Pros:

- The claimed success rate is 93%.

- Round-the-clock customer service on the project website.

Minuses:

- Expensive – $229 for registering an account on the Forex Fury website.

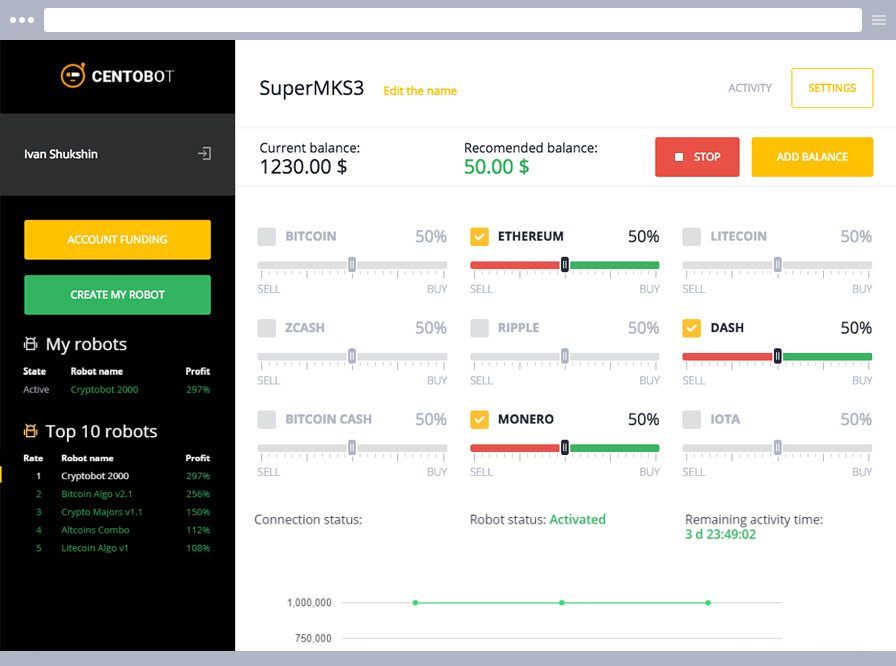

Centobot

Centobot is a whole network of bots for trading cryptocurrencies. It consists of 10 automatic robots that the user can choose for trading. Pros:

- Profitability – 300%.

- Investment return guarantee.

Minuses:

- Compatible for trading only with binary options holders.

- AvaSocial – Forex robot application (forex robot), regulated by the FCA

- Quantum_AI – artificial intelligence in the world of automatic trading on the exchanges of the world

So, at the moment there are a huge number of trading robots that optimize trading in Forex, the stock market. Each of them has both pluses and minuses. In order to choose the most suitable one, you need to know the trading strategy it works on, as well as the “stack” that it uses in its work. This factor directly affects the success of your transactions. We hope that after reading this article you will find the most suitable trading bot.