A trading robot is an algorithm-based software that automatically places trades on behalf of a trader. Many robots are programmed in such a way as to take the maximum benefit from transactions on weekends, because it is during this period that a reduced trading volume can be observed.

The abundance of robots is often confusing. Which program should be preferred? Below you can find a description of the best trading robots that are used by traders around the world.

Free and paid algorithmic trading bots for trading stocks and other securities on the global exchange

In order not to make a mistake when choosing software for trading stocks and bonds on the stock exchange, you should study the rating of the best robots that will please you with a clear interface and reliability.

DAXrobot

DAXRobot is a popular trading robot that can be used to trade stocks and bonds. The DAXRobot program uses signals to determine suitable prices. The robot eliminates any psychological or emotional prejudice when making a deal, which is a significant advantage. DAXrobot does not have a mobile trading app for traders to use. This EA does not have a demo account. Instead, customers can test the available robots found on the DAXrobot web platform. The graph appears at the moment when the user is testing the bot. If traders do not deposit funds that can unlock the robot, they still have the opportunity to test each of its functions.

Note! A $10 service fee is applied when clients do not make any transactions for the entire month.

The strengths of DAXRobot traders include:

- 24/7 customer support;

- the ability to create your own robots on the platform;

- reliability;

- simple, user-friendly interface;

- generating accurate signals.

Users can pair their robots using certain indicators before trading. A bit frustrating:

- too high minimum deposit rate ($250);

- commission for inaction;

- no mobile app.

SuperADX

SuperADX is a reliable robot that can be used to trade stocks and bonds. Users using this bot can choose the appropriate tactics for each traded asset. It is possible to receive income both in a growing (Long) and in a falling market (Short). There is also a function of placing protective orders (stops / trailing stops) on any open position. SuperADX can be used not only as a robot, but also as an advisor. The benefits of SuperADX for traders include:

- Manual configuration of bots. Users can set some parameters at their own discretion, without leaving the entire trading process to the adviser.

- The high speed of the software, which was achieved thanks to specially designed servers and connection technologies.

- Reliability.

- Possibility to set the start and end time of the trading of the robot.

- Exposing to an open position of stops / trailing stops.

Despite the fact that SuperADX has many advantages, traders are frustrated by the instability of results and too high risks.

Executor

Executor is a modern stock trading software. The robot operates on the basis of the Sterling Trader Pro infrastructure. Through the browser, you can open access and control. The developers allowed traders to choose the direction and set risk parameters. Only after setting these settings, the bot starts trading stocks. In this case, universal entry / exit points are used. The software is capable of closing a huge number of trades at the same time. The robot itself can control the degree of risk and perform all the work on entering/exiting positions.

Note! Outside the specified price range, the EA does not trade. The program perfectly tolerates technical failures. Control from 2-3 devices is available.

The advantages of Executor are:

- reliability;

- possibility of independent setting of risk parameters;

- user-friendly interface;

- wide functionality.

Traders who use the robot in trading stocks and bonds on the stock market do not highlight any disadvantages.

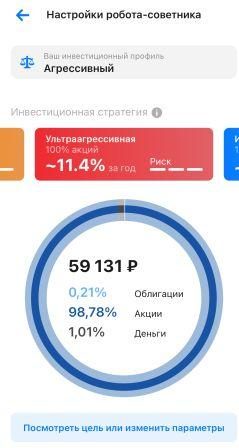

VTB

VTB is a free service that can select a strategy for the user’s financial goals. The robot controls the process of making transactions and sends recommendations to the trader as to which stocks are better to sell / buy in a particular period. VTB managers are working on the creation of the portfolio. The user can independently make decisions or listen to the advice of the bot. Connecting a robot for trading stocks and bonds allows you to get a good income and save time that a trader spends on conducting independent data analysis. Specialists are very pleased with the VTB program:

- good technical support service;

- reliability;

- available interface.

The bot offers suitable strategies, which is especially important when a newbie has started trading. Traders using the VTB trading robot do not observe significant drawbacks. Working with the program is easy and fast.

betterment

Betterment provides clients with a carefully selected and diversified portfolio of stock and bond exchange-traded funds (ETFs). The selection methodology is designed to optimize for higher returns by investing in ETFs that are inexpensive and tax efficient. Betterment’s current portfolio is fully diversified with Vanguard and iShare ETFs. In cases where a trader needs the help of a financial expert, you can turn to him for advice through the Betterment application. Betterment Digital, is the basic version that requires no minimum balance and charges the client an annual fee of 0.25%. (Betterment previously offered an annual management fee of 0.15% to 0.25% depending on the total balance.)

Betterment Plus requires a minimum deposit of $100,000 and charges 0.40% per annum.

The strengths of the bot, traders include:

- the possibility of opening an account for free;

- a small commission

- excellent support service;

- reliability;

- the possibility of obtaining expert advice (help from a personal financial consultant);

- Multiple portfolio options

The disadvantages of Betterment are as follows:

- external accounts are not taken into account when placing assets;

- lack of access to asset diversification.

Note! Betterment has an option where users can communicate with experts and get their opinion.

Interactive Advisors

Interactive Advisors is a popular robot for trading stocks and bonds on the stock exchange. The developers have given users the opportunity to choose the most suitable options from passively or actively managed portfolios created with the help of ETFs, mutual funds, individual stocks and much more. With a user-friendly website, opening an account with Interactive Advisors is easy. On the home page, you will need to click on the asset allocation portfolio managed by Interactive Advisors. Next, you need to register and answer 9 questions to receive portfolio recommendations. The minimum investment amount is $1000. The strengths of Interactive Advisors stock and bond trading robot include:

- reliability;

- possibility of independent setting of risk parameters;

- user-friendly interface;

- the presence of a mobile application;

- wide functionality.

Good to know! Asset management fee, depending on the portfolio, ranges from 0.08% to 1.50%.

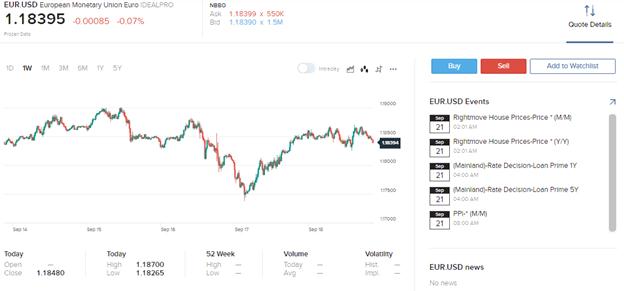

thinkorswim

Thinkorswim can automatically trade multiple stocks. The robot is based on an intelligent algorithm that scans stocks in real time and creates a stock screening map, according to which the most profitable options (growth leaders) in terms of profitability are automatically determined. As a rule, they show the largest increase or decrease for the current period (scan period). The advantages of Thinkorswim Robot Multi Stocks Screener include:

- the ability to scan and filter stocks based on maximum profit/volatility;

- reliability;

- multifunctionality;

- clear interface.

Judging by the feedback from traders, there are no significant shortcomings in the bot.

TrendSpider

TrendSpider is a multifunctional bot. The program performs automatic analysis of trend lines. Thanks to this, the user will have precise control over the aggressiveness of the algorithm. Another special feature of TrendSpider is multi-timeframe analysis. This option allows you to add technical indicators and selected trendlines to the second timeframe of the same chart.

Note! Traders can overlay popular indicators on the chart.

The advantages of the TrendSpider robot include:

- clear interface;

- the ability to quickly analyze price behavior;

- reliability;

- automatic trend line analysis.

Only the slow loading of charts can be a little frustrating.

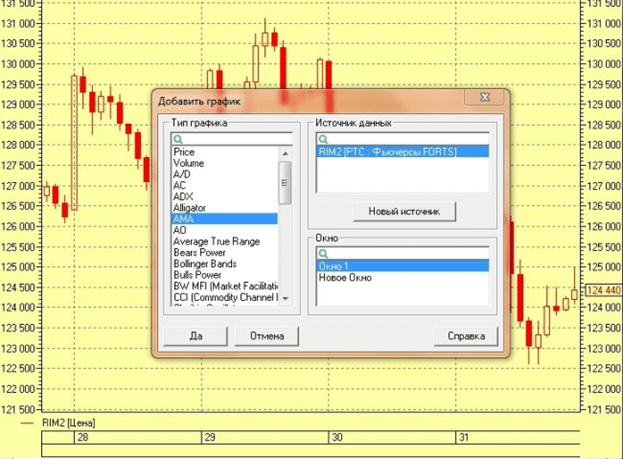

QuikFan

QuikFan is a popular bot that works according to a well-defined algorithm. If you correctly select the working timeframes, users will always be able to go positive, even if short-term trends mistakenly show downward movement. At the same time, losses from the capital allocated to it will be offset by profits from long-term trends and vice versa. There are no failures in operation. The strengths of QuikFan include:

- possibility of simultaneous trading on 14 timeframes;

- a large number of settings, which allows each merchant to customize the program to suit their wishes;

- reliability;

- the ability to filter lateral movement using various settings.

QuikHunter

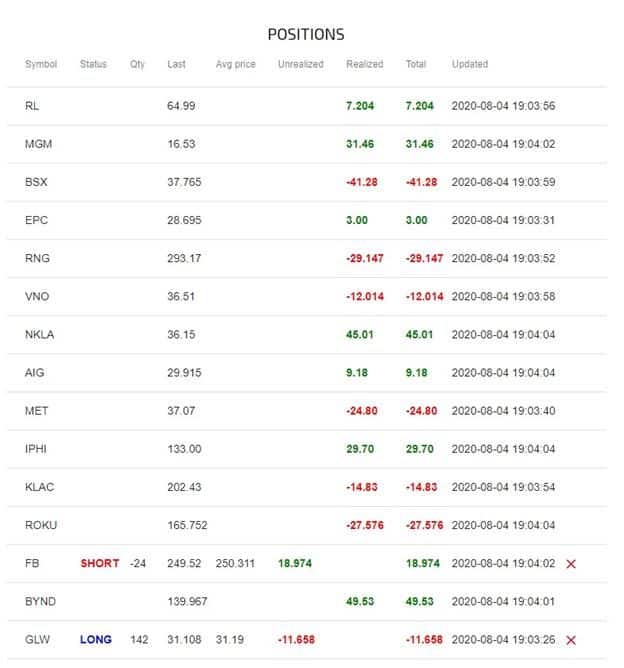

QuikHunter is a momentum trading robot created by developers to trade the most liquid stocks and futures. The program tracks and enters the impulse movement based on the dynamics of volumes and prices. Users can independently choose the direction of trading: Long/Short, Short or Long. The trading process is carried out using quick buttons: BUY and SELL. QuikHunter benefits for traders include:

- the possibility of simultaneous trading of several shares and futures;

- the use of various tamframes for analyzing price dynamics;

- reliability;

- the ability to limit losses and maintain profits at a certain level.