Features of the bitsgap bot, connection and setup for the successful use of the Bitsgap bot for trading on Binance. The development of the trading system makes the system of automatic trading more and more popular

. Its main goal is to relieve the trader of the need to actually be around the clock in close proximity to the PC. Bitsgap is one of those resources.

Rules for Using the Bitsgap Bot for Automated Trading on Futures

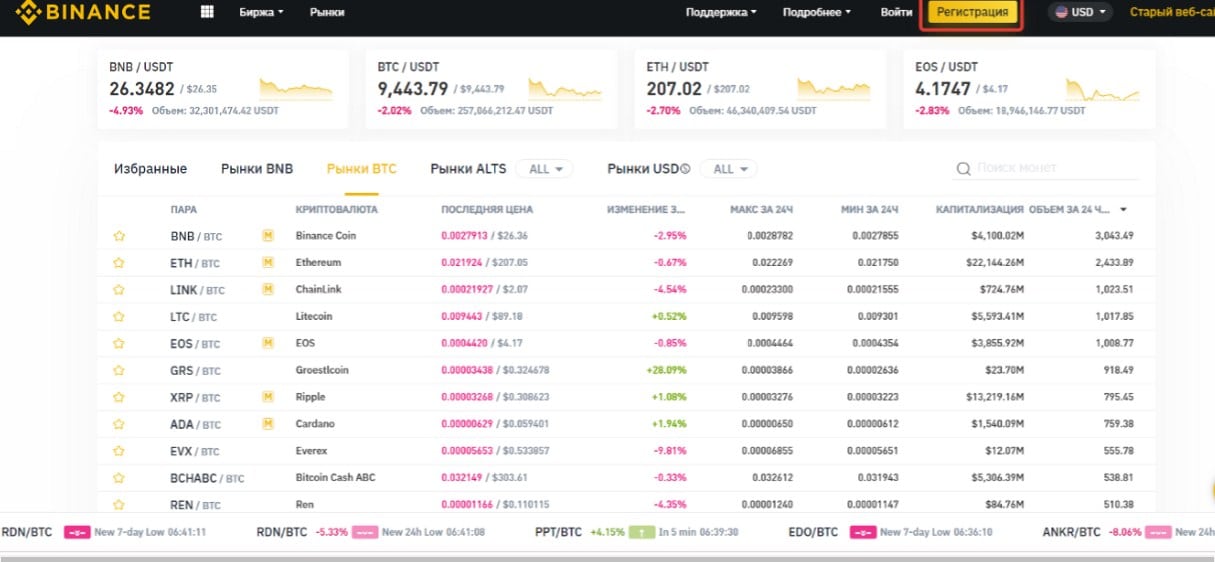

The presented Bitsgap platform was the result of the development of specialists, allowing us to present an automated solution for performing futures trading on the Binance exchange. The Bitsgap com platform is also offered in Russian to expand the attractiveness of use by Russian-speaking users. After testing was completed, the resource became as open as possible to users, helping to significantly expand the algorithmic trading trading strategies used. The presented bot has collected relevant strategies that allow you to make a profit on the futures market, using the spot markets Classik, Spot. The data is indicated on the site bitsgap com. Using a bot is equally convenient when applying two strategies: falling and growing.

What are the features of the bot

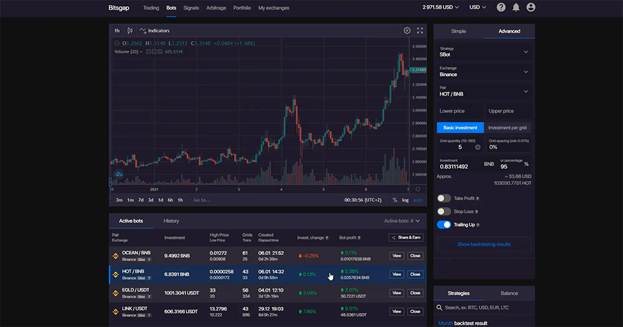

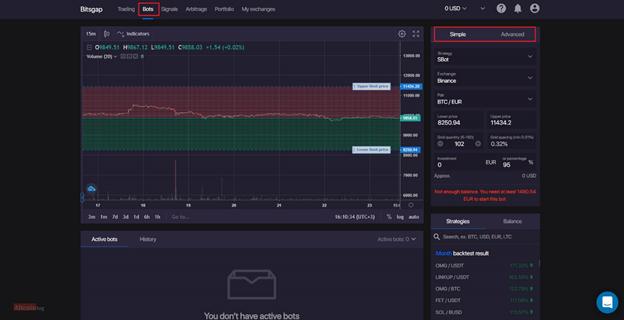

You can conveniently launch a trading bot on your own and is accessible even to a beginner. An important condition for the prospects for successful use is the initial definition with the initial strategy for generating profits. In the case of planning the price movement upwards, the Long strategy is used. To make money on falling prices, the Short strategy is used. It is convenient to use the performance indicator of the bot. In such a situation, the Profit indicator becomes the main one.

- When applying cross margin , the balance between all open positions is used, which avoids the risk of liquidation, the downside is the risk of closing all positions, in such a situation, all positions are closed and the margin balance is completely lost.

- Own margin is applied per position for an individual margin position. Liquidated when exhausted. For each position, if necessary, the volume is reduced or increased manually. In some cases it is possible to double the stamp size.

What is Stop Loss with automatic trailing

Using this strategy allows you to significantly increase the profitability of trading. To register, you only need to activate the special Sing In button located in the upper right corner of the home page screen. The account is created manually through mail or accounts in Google or Facebook. Registration through these accounts is easier and more affordable. To gain access to the trading platforms, just two clicks are enough.

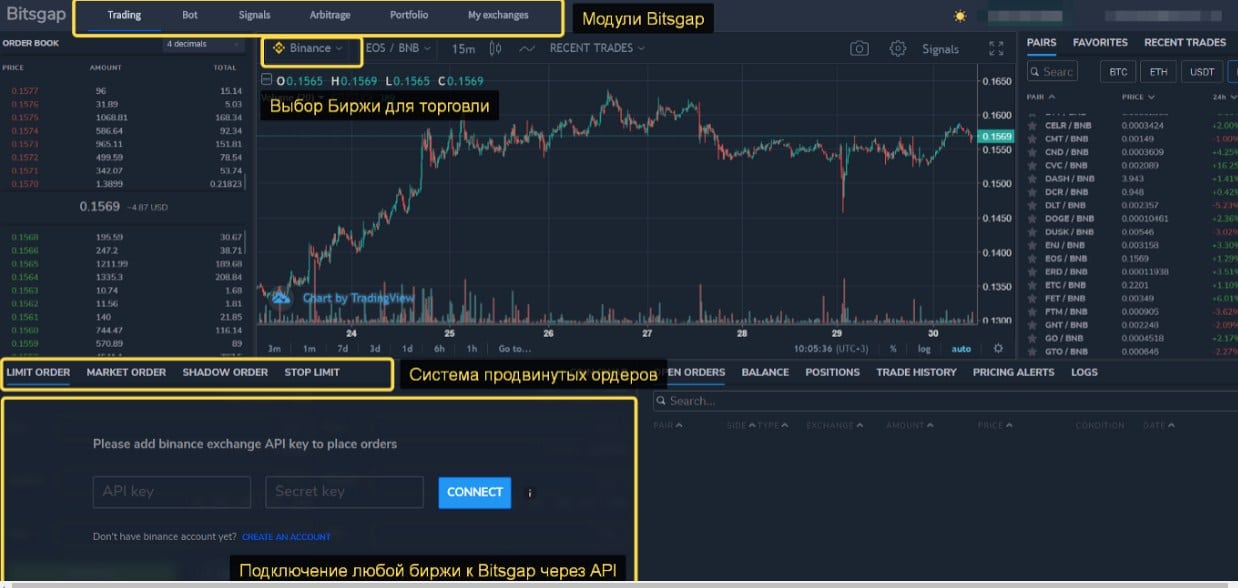

- Automatic creation of bots for trading, setting up for buying or selling in automatic mode, used in accordance with the chosen strategy.

- Application of signals for automatic monitoring of the market, helping to make the necessary decisions in a timely and efficient manner.

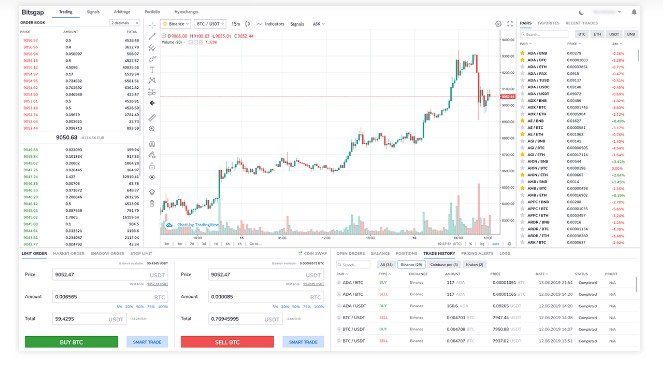

- The use of trading opportunities that involve the creation of stop orders, limit, even in the case when they are not supported by a specific exchange, to maximize profits, the bitsgap bot uses the Smart Trade function when trading on binance.

- Rates are arbitrated, allowing you to benefit from the price difference between several crypto exchanges.

- A “live” portfolio management is provided, which allows you to benefit from the disposal of information about all the coins in the portfolio.

When working, crypto exchange keys are used. They allow you to create orders on behalf of the user. It is convenient that the Bitsgap platform in Russian is fully open.

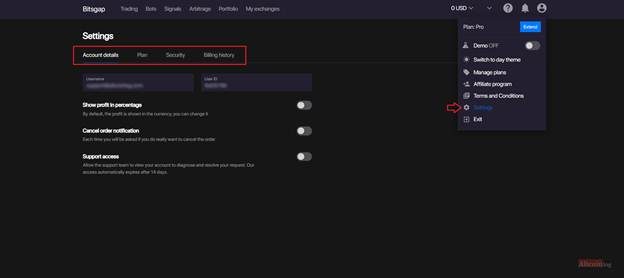

Performing registration and account setup

The procedure for connecting exchanges

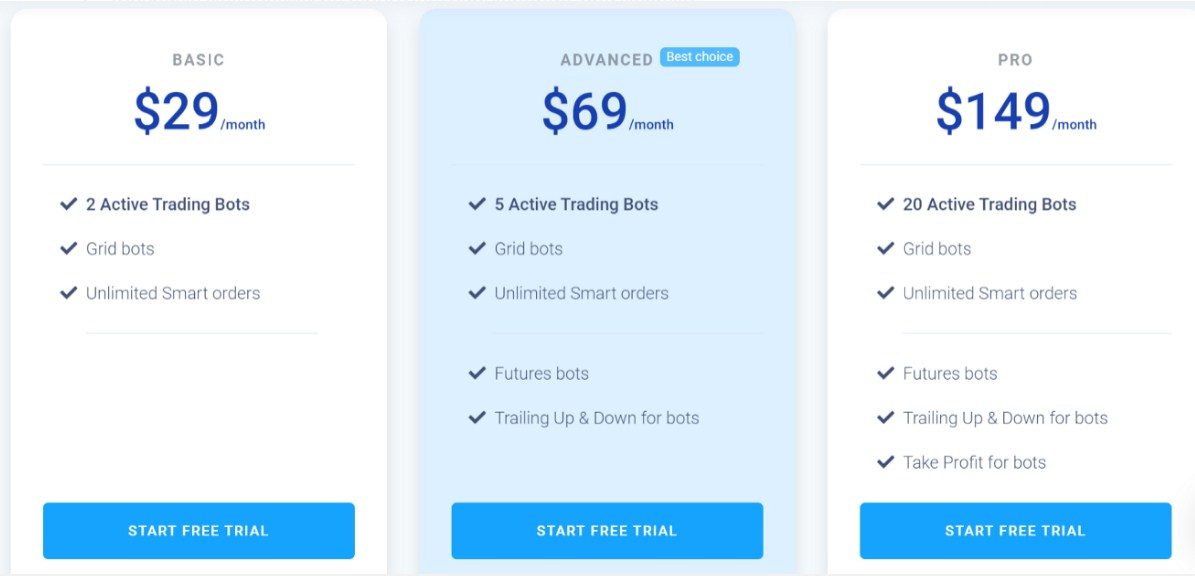

By going to the official website of Bitsgap, the visitor can connect cryptocurrency exchanges. Connected to almost all leading sites. Each of them is ready to provide API keys to users. Separately, among the possibilities, it is required to highlight bitsgap arbitration. This has become possible since the recognition of cryptocurrencies as high-tech coins that can be fully used in settlements. Platforms began to work at maximum intensity about 4-5 years ago. The advantage of the sites is the unification of traders under a single heading. This simplifies the procedure for managing cryptocurrency portfolios. At the same time, bitsgap holding is today recognized as one of the most promising platforms. There are currently three tariff plans available to users. Their combination makes it possible to successfully hold coins, having the strongest potential, allowing you to make the most profitable sales and purchases. Available pricing plans include:

- Basic – allows you to use the full range of standard features, which has two trading bots and a limit of up to $ 25,000.

- Advanced – with an increase in the trading limit to $100,000 and the use of 8 trading bots.

- PRO increases the limit in turnover and is not limited, it is possible to use up to 15 trading bots, all the functions of the platform are applied.

Advantages and disadvantages of the platform

Market analysts point out that bitsgap com is a fairly young resource, founded by specialists from Estonia in 2017. The main goal of the creators was the formation of a single universal platform that allows you to simultaneously trade on several sites without unnecessary additional transitions in the one-stop mode. Now a feature is the willingness to execute trades simultaneously on about 20 global crypto exchanges. At the same time, the advantages include the ability for traders to both trade completely independently and switch the use of the site automatically using robots. For successful use, it is important to understand how to set up the bitsgap bot for trading on Binance correctly. All options and settings are indicated on the main page. Next, the connection of different bots is set depending on the chosen trading style and the need to perform different tasks. Currently, the Bitsgap bot offers users the following benefits of using the platform:

- over 600 pairs with cryptocurrencies, showing a very wide range of assets;

- for users, the operation of several tariff plans is convenient, moreover, independent switching is provided, if necessary, it is possible to contact representatives of technical support services for help, with a one-time payment for the use of the tariff for up to 6 months, the cost of the tariff is reduced;

- there are no additional trading commissions for transactions and fees for depositing additional funds;

- bot trading is carried out without additional commissions;

- integration is performed with all leading crypto-exchanges;

- the trial version of the tariff during the test 7 days for a new user is open without verification;

- functional trading platform is functional based on TradingView.

At the same time, users also distinguish the disadvantages of the presented new bot. These may include:

- lack of prospects for trading with leverage;

- the site does not have an official license from the current regulator;

- the site does not have an online reference site and information about a reference contact phone number.

https://articles.opexflow.com/trading-bots/dlya-torgovli-na-birzhe.htm At the same time, user reviews confirm the benefits of using the resource. They mark the success of using the resource by active users. At the same time, the platform involves the use of the resource’s capabilities by passive traders who prefer to delegate their functions to robots and use an automated mode in trading.