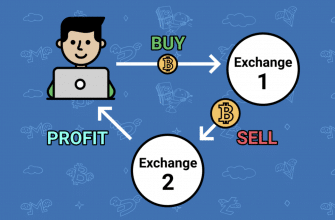

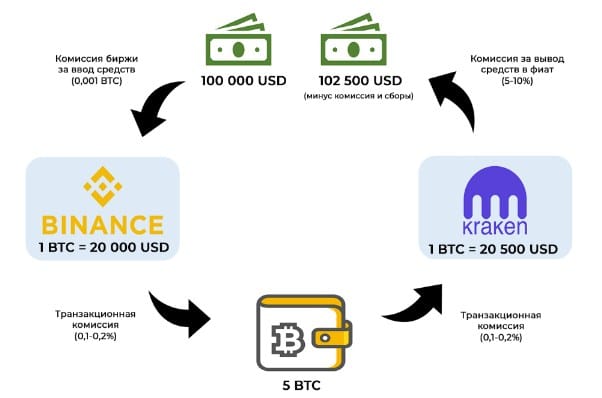

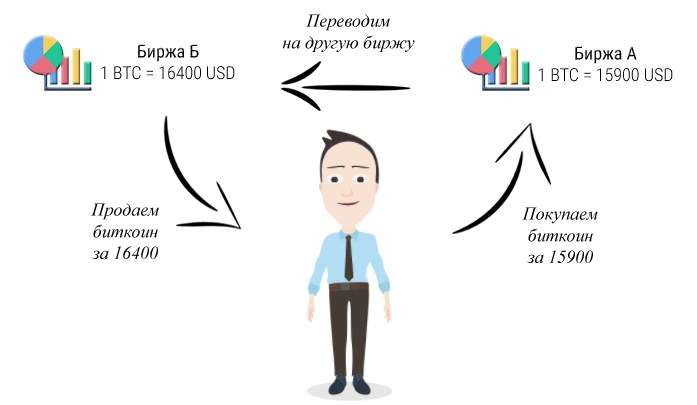

What is p2p cryptocurrency arbitrage, how to make money on arbitrage through the opexflow link and spread scanner, working links for 2023, training within the platform.Earnings on P2P cryptocurrency arbitrage involves a series of transactions with small time intervals. The income of an arbitrator is the difference between the cost of buying and selling assets. In the case of P2P, all transactions take place between two market participants without the direct participation of intermediaries. The basics of P2P arbitrage is the search for currency pairs, the value of which varies. For example: an asset costs $1,000 on one site and $900 on another. To get a profit, you need to buy an asset from a user on the first exchange, and then sell it on the second site to another. In reality, the spread rarely exceeds a few percent.

Earn money on crypto arbitrage with opexflow.com screener

First, you need to understand what a cryptocurrency screener is. In arbitration, this is the name of a tool that helps a trader make short-term and medium-term transactions, leveling risks. The main tasks of most screeners are the ability to filter cryptocurrencies by various metrics, time intervals, and technical indicators. Almost every screener has basic features, but the opexflow.com solution looks more convincing due to the following features. For example: ● displaying the volumes of major market players; ● informing about spreads and bundles online so that the user can choose the right strategy without wasting time; ● minimal data update delay. Screener opexflow.com In addition, the project allows you to filter assets by a variety of parameters, for example, leaders of growth or decline. Also, a function is being developed in opexflow.com that will select assets based on oscillator data, market trends, and rate dynamics. This will minimize the risks for P2P arbitrage.

Screener opexflow.com In addition, the project allows you to filter assets by a variety of parameters, for example, leaders of growth or decline. Also, a function is being developed in opexflow.com that will select assets based on oscillator data, market trends, and rate dynamics. This will minimize the risks for P2P arbitrage.

Risks of P2P Arbitrage

The sphere of P2P cryptocurrency arbitrage is associated with many risks. It all starts with the possible high volatility of the asset, and ends with an outright scam and attempts to deceive beginners. For example, the high volatility of a coin can negatively affect the general bank of an arbitrageur if the asset is not sold for a long time. What other risks are there?

- blocking a bank account under 115-FZ – usually it is removed by a simple call to the bank, but there are cases where the account was completely blocked;

- loss of funds if the asset falls in price during the transaction;

- the likelihood of fraud on the part of the counterparty – the user who sells or buys the asset;

- blocking funds within the platform;

- loss of funds due to carelessness or the use of unverified exchangers and exchanges.

The most common problem that increases the risks at times is fraud. Fraudsters come up with the most sophisticated ways to deceive even experienced traders, and it is almost impossible to fight the emergence of new schemes at this stage.

At the end of 2022, viruses began to spread actively on Windows, which replace the wallet address in the MetaMask extension. That is, when a user wants to receive assets, someone else’s address is copied and the transfer goes to scammers. Based on this story, you can understand how important it is to be careful in the field of cryptocurrency arbitrage.

Finding a working P2P connection – success in arbitration

Bundles traders call the entire transaction cycle from the purchase to the sale of an asset. The cycle is considered completed when the trader has received or lost a percentage of the invested funds. To make money on cryptocurrency arbitrage, you need to be able to look for profitable bundles – they can be divided into 2 types.

Permanent

Permanent links appear during the working day. The simplest links are those based on the difference in rates on two P2P exchanges or sites. Spread per round is usually in the region of 1-2%. There is a high probability that rates will change, so you need to act quickly when working with such bundles.

Momentary

Working with momentum links involves high risks, but the spread can reach 20%, and sometimes more. Such a spread is associated with a high volatility of the asset, so it is impossible to delay with momentary links. However, sometimes the purchased asset can grow, in which case the expectation will add interest to the original bank – the main thing is not to overdo it.

How to find a link

The search for a bundle is primarily a comparison of rates for assets, so you can manually find a profitable offer. However, today there are specialized services – screeners. The opexflow.com/p2p screener always has ready-made bundles that are good for the job. You can also find offers on exchanges and third-party platforms, and based on this data, create your own bundle, which is not in the screener. Opexflow.com always has up-to-date data that is updated with minimal delay. Ready-made bundles are displayed in the form of a table, and the search for your own is carried out using a wide filter. You can study preferential rates for the first testers of the service here .

How much can you earn on p2p arbitrage

There are no specific amounts and restrictions in P2P arbitration. Income is limited only by: ● the trader’s bank; ● percentage of the spread from the found link; ● competition; ● number of working hours. With the screener opexflow.com, income will increase significantly, since it is quite easy to find profitable bundles on this service. The filters are adjusted to the existing bank, and the data on the volumes of large players in a particular market will allow you to assess the competition.

Where else can a screener be useful

Often, novice traders, when a profitable combination appears, do not even think about why the asset has sharply fallen in price / risen in price. If you do not have basic ideas about the market, then it may turn out that the trader will lose all his funds. The reason for the high spread may be the high volatility of the asset, but the rate may sharply turn in the opposite direction. To avoid this situation, the opexflow.com screener offers to get acquainted with analytical data based on graphs. Using them, you can understand why the spread for a particular bond has increased sharply and assess the risks. A functionality is also being developed, within which opexflow.com offers to get acquainted with the trading volumes of specific trading pairs for a day, week or month. This functionality is indispensable for assessing competition in the P2P market with a specific asset. Currently, beta testing and final debugging of the screener for bundles and spreads for arbitrage of opexflow cryptocurrencies is underway – you can leave a request right now, we will contact you as soon as there are free places.