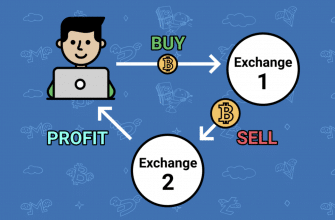

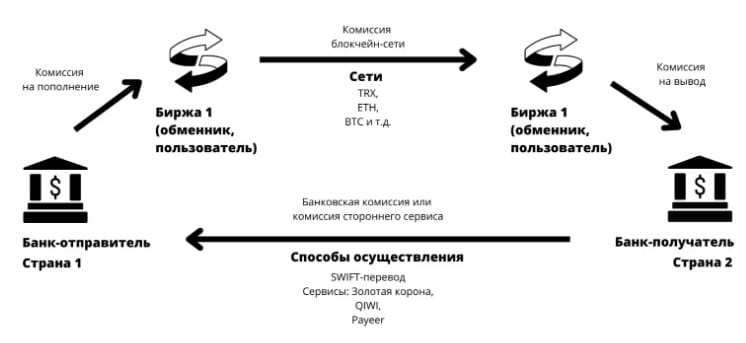

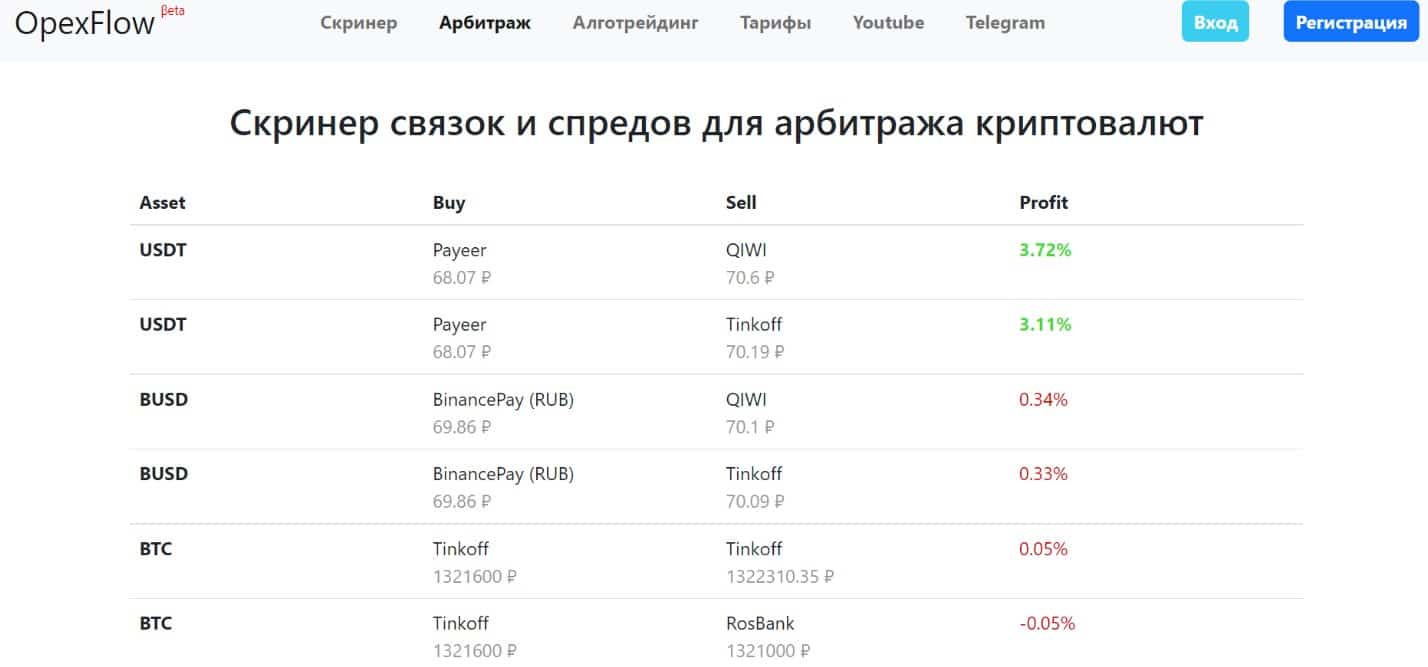

What you need to know about international cryptocurrency arbitrage in 2023 – how to find bundles, spreads using the opexflow screener.Buying/selling digital assets can be considered as one of the most profitable tools in online stock trading. At the same time, income can be increased with the help of special services that provide up-to-date data on the difference in cryptocurrency rates on world crypto exchanges. International cryptocurrency arbitrage is a logically connected transaction that allows you to make a profit on price fluctuations of the same or related monetary units at the time of trading operations on crypto exchanges in different countries. This takes into account not only the change in the exchange rate, but also the liquidity of the selected currency, or rather the level of demand for a particular type of digital asset. Trading is carried out according to the P2P program – Person-to-Person and Peer-to-Peer, that is, between people, and not through exchangers. P2P tradingInternational arbitrage is possible using the opexflow.com service – a screener for links and spreads for cryptocurrency arbitrage. The platform tools are designed to compare crypto pairs on several trading floors in different countries at once.

A useful tool for international arbitration in crypto markets

Effective international crypto arbitrage is carried out using a screener of bundles and spreads. The screener automatically scans the change in quotes on different exchanges of the world and finds suitable trading options – pairs. The results are displayed for all popular crypto exchanges. According to the specified parameters, the system determines the place of sale and purchase of currency units on favorable terms and notifies the user. Daily manual trading and tracking prices on crypto platforms is not an easy task even for an experienced trader. At the same time, from a physical point of view, it is almost impossible to check the liquidity of digital assets in all popular projects of the international level. Therefore, automated scanning of spreads and bundles is a convenient profitable way for successful trading.

Spread History Tracking

The screener is used to track the history of spreads for previously detected events. The tool allows you to check cryptocurrency pairs in the arbitrage trades chart and determine the frequency of occurrence or absence of arbitrage situations regarding the selected assets. This will help the trader to assess the size of transactions and the activity of the appearance of spreads among a particular currency pair. Also, in the process of automated scanning, the screener monitors the frequency of occurrence of the same pairs on the same trading floors. Thus, strategy development is simplified. International cryptocurrency arbitrage will bring a stable income when using the opexflow.com service. In the platform, information is updated at short intervals. The scanner determines market indicators with high accuracy, assesses the risk and helps to determine the necessary pairs. Statistical and technical indicators are supported. You can view various charts to select the most profitable trading schemes. [caption id="attachment_16504" align="aligncenter" width="1428"]

Benefits of using an opexflow screener

It is possible to create a promising bond structure and find profitable spreads using the opexflow screener. This is a program for automatic scanning of spreads and quotes on crypto exchanges and P2P platforms. The tool allows you to earn on the jumps in the exchange rate of various currencies. The opexflow.com screener has the following advantages:

- integration with reliable platforms;

- simplified and clear interface;

- by default, the parameters are optimally configured;

- simple management and training in the use of tools (there is a video and instructions);

- current information is displayed;

- filters, trading bots and analysis indicators are available.

The information displayed in the graphs is updated regularly and quickly. It will be easy for traders to track orders, compare rates and check the liquidity of cryptocurrency units in a dynamic crypto market. Multilingual instructions allow you to quickly understand the tools and functions of the service. [button href="https://articles.opexflow.com/cryptocurrency/arbitrazh.htm" hide_link="yes" size="small" target="_self"]More about opexflow arbitrage