What is p2p cryptocurrency trading in simple words, how to make money trading peer-to-peer cryptocurrencies using opexflow, how to find bundles and spreads – training with the opexflow service. P2P, or “peer-to-peer” is an approach to cryptocurrency trading where there are only two parties – the buyer and the seller. Transactions in this format are made without intermediaries. Trading without the participation of third parties has both its pros and cons. We will analyze what P2P is in simple terms and how to make money on P2P trading using the opexflow ligament and spread screener for arbitrage cryptocurrencies.

- What you need to know – how P2P exchanges work, the trading process

- How a P2P transaction works

- Types of trading based on the peer-to-peer model

- Intra-exchange arbitrage

- International Arbitration

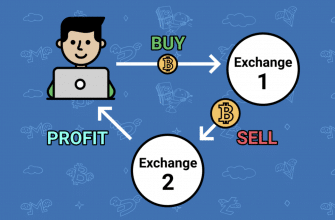

- Inter-exchange arbitrage

- Advantages and disadvantages of P2P transactions

- How to make money with P2P trading – training and tools available in Opexflow

What you need to know – how P2P exchanges work, the trading process

Crypto exchanges with P2P trading are platforms that allow the buyer to find cryptocurrency sellers, as well as vice versa – to the seller of the buyer. The platform hosts ads from sellers who are ready to exchange one cryptocurrency for another at a set rate. The exchange can set limits for both parties and provides security when making a transaction. In addition, users are given tools for market analysis and intra-exchange arbitrage. It is beneficial for cryptocurrency trading platforms, as well as for all trading participants, to use the P2P model. This is due to several reasons:

- earnings are possible under any conditions, even with a fall in the rate and volume of cryptocurrencies;

- the possibility of reselling cryptocurrencies between several exchanges;

- speed and convenience when making an exchange.

Algoarbitrage on Binance using opexflow .

How a P2P transaction works

DecentralizedCryptocurrency exchange takes place with the participation of two parties: the first (seller) and the second (buyer). Sellers use the exchange to find a second party, setting a price and adjusting it as needed. Buyers are looking for the most profitable ads for the purchase of goods that are suitable for their conditions. For security, the buyer, seller, or the exchange itself require verified account verification from the parties. On most cryptocurrency exchange sites, both parties can view information about each user, as well as the number and volume of transactions made. When a buyer finds an ad, he submits a purchase request. After the seller confirms his consent to the sale, the exchange holds his cryptocurrency until the second party confirms the payment. The service ensures the automatism and security of the transaction, so that the buyer quickly receives the crypt in full, and the seller pays for it. Then the money is sent to the first party of the transaction, and the cryptocurrency goes into the hands of the buyer, and the transaction is considered completed.

Types of trading based on the peer-to-peer model

P2P, as a cryptocurrency trading method, is also divided into several types. We will give each of them using the example of a merchant-seller making a cryptocurrency exchange with Bitcoin or another coin:

Intra-exchange arbitrage

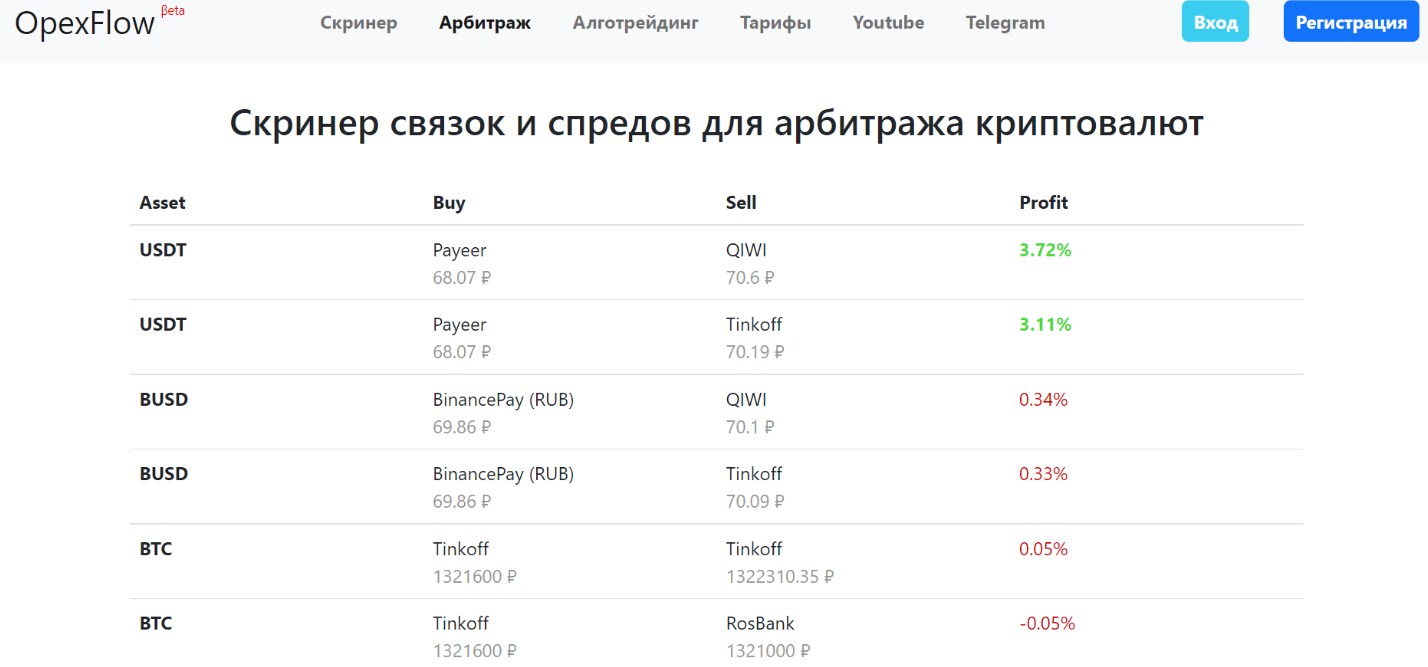

The opexflow link and spread screener allows you to track the value of each available cryptocurrency within a single exchange. The seller places his ad, focusing on the market value of other price tags. After that, the merchant can purchase another cryptocurrency, which shows a stable growth in value for resale. Arbitrage with opexflow within the same platform is a good way for beginners in the field of cryptocurrency.

International Arbitration

Conducting transactions through different countries greatly affects the possible profit. The amount received depends not only on the rate of the sold (or bought) cryptocurrency, but also on the value of the monetary unit with which the exchange takes place. Often, the profit from a single transaction in an international exchange reaches 10%, but it is also necessary to take into account the commission from transfers between different countries. Most often, international transactions take place with large amounts (from about a few hundred dollars), so only professional traders should do this. Let’s say the seller, using opexflow, decided to resell Bitcoin with a total value of 10,000 thousand dollars, and his buyer is abroad. After selling the crypt, the merchant received a profit of 10%, that is, 1,000 dollars, but due to the commission on international transfers of 6%, the profit was less – 4%.

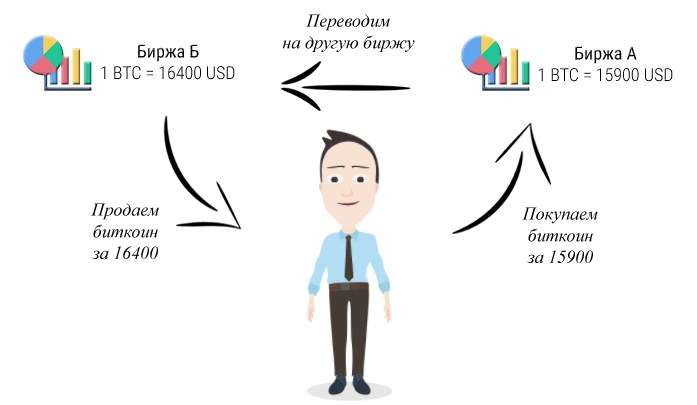

Inter-exchange arbitrage

Recently, conducting transactions involving several exchanges at the same time has become more popular. On different sites, the average prices for cryptocurrency can differ by a couple of percent, and rarely even by tens. This is used by both sellers and buyers – if the price on one exchange turns out to be less favorable than on another, then they use the second exchange to complete the transaction. The disadvantages of this approach compared to the first one are also present, as well as the commission for transfers. Most exchanges charge a commission, which is often higher than the possible profit from the resale. For example, a merchant on opexflow sold Bitcoin at a good price and found an offer on the NNN exchange with a lower purchase price. He bought BTC 2% cheaper than he sold it, but the NNN withdrawal fee is 5%. Therefore, the seller is in the red, due to choosing the wrong exchange. Therefore, it is worth looking for bundles taking into account this fact.

Advantages and disadvantages of P2P transactions

P2P, like all other trading formats, has its pros and cons. Advantages:

- Variety of payment methods . The trader has the opportunity to exchange one cryptocurrency for another through a non-cash account, but also directly using his crypto wallet.

- Trading accessibility . Cryptocurrency trading on P2P exchanges is available from anywhere in the world. Trading will not be available if you live in a country where cryptocurrency is prohibited. Also, it will not be possible to pay for the crypt in cash if the buyer or seller lives in another region.

- Transaction speed . To buy or sell a particular cryptocurrency, all you need is the consent of both parties to the exchange, after which the transaction will occur in a matter of seconds. This advantage of P2P trading can be used for short-term trading, which brings serious profits already during the day.

- Transaction security . Before the buyer pays for the purchase of cryptocurrency, the exchange will hold it from the seller until the second party makes the payment or refuses the purchase. Security is necessary for both the seller and the buyer – either side can deceive the other if the exchange takes place outside the P2P cryptocurrency platform.

- Dependency on the opposite side . Due to the rules of peer-to-peer trading, the opposite side can keep the transaction in progress for several days, and then simply cancel it.

- Small number of users . The P2P format is not yet widespread enough for any party to instantly find a partner to complete a transaction. So far, many crypto traders have not lost the habit of centralized platforms that have always acted as an intermediary. But this does not mean that the P2P model is not used by anyone.

- Incomplete security . Even though P2P trading is safer than the centralized model, participants are not completely immune from deception. Already, new fraudulent schemes are emerging that work in peer-to-peer trading.

How to make money with P2P trading – training and tools available in Opexflow

Using the P2P format, both parties to transactions get more freedom. For example, the seller has more control over pricing, and the buyer has more control over the timing of sending funds. Instead of acting as an intermediary for every transaction that takes place, the exchange makes the transaction on behalf of the seller, holding the goods until the buyer pays. Opexflow gives users the tools to make trading more profitable. The platform includes an online link and spread screener for arbitrage with 60+ types of cryptocurrencies (including popular cryptocurrencies BTC, ETH, BNB, etc.) Educational videos and consultations are also available. P2P is the most suitable option for one-time transactions of any size, but trading with intermediaries is more suitable for making permanent crypto exchange transactions. In peer-to-peer networks, users themselves set the terms of trade. At the moment, beta testing and final debugging of the bundles and spreads screener for cryptocurrency arbitrage is underway – we suggest you leave an application right now, we will contact you as soon as there are free places.