Overview, configuration, capabilities of the trading terminal Quantower. An exchange terminal for the trading process on any market or exchange is one of the main tools that acts as an intermediary between a participant in exchange trading and the

stock market . The result of a trader’s trading directly depends on its functionality, practicality and quality of work. Investors who are directly dependent on a bank or a brokerage agent are often forced to conduct the trading process from sites whose conditions are not at all suitable for trading. In this article, we will look at the Quantower trading platform, its features and benefits, as well as the process of registering and setting up a workspace.

- Trading terminal Quantower: functionality and principle of operation

- Functionality

- Chart curves in trading on the Quantower platform

- Algorithmic trading

- Implementation of ready-made automated trading strategies

- Quantower interface and functionality: how to manage and configure

- Quantower Trading Simulator

- Volumetric analysis tools powered by Quantower

- Trading options on the basis of the trading terminal Quantower

- Quantower Exchange Marketplace: Installing and Configuring a Profile for Exchanges and Financial Markets

- Cost of using Quantower

Trading terminal Quantower: functionality and principle of operation

Quantower is a trading exchange platform founded in 2017 by developers to carry out the trading process on various exchanges and financial markets. The platform was developed based on the wishes and opinions of a large number of investors and traders. Exchange trading in the online format is distinguished by practicality and certain conveniences, this includes the free choice of trading terminals. However, traders are often forced to follow the rules of a bank or a brokerage company, which reduce the choice of instrument to that inconvenient and little functional minimum. As a rule, there are few opportunities and tools here, and even those that are available are impractical to use, and the introduction of new functionality is not even planned in the near future. Graphic engineers have developed a modern Quantower platform for stock trading with a large number of tools, it is equipped with all the necessary interface features and has good functionality. We will consider it in more detail.

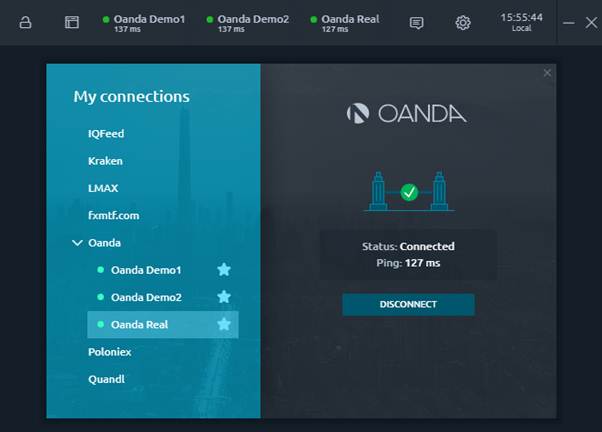

- forex indicators: Oanda, FXCM, LMAX and others;

- for members involved in cryptocurrency trading: Binance, Kraken, Poloniex, HitBTC, etc.;

- for working with financial instruments: IQFeed, CQG.

Automatic connection to several management companies and data providers at once makes it possible to evaluate the current state and position of currencies, financial instruments and other assets from one source for subsequent placement of an order on another resource without the need to reconnect.

Reference! If a trader has multiple trading accounts, Quantower will synchronize and connect all accounts to its system with the entire trading process on each bank account.

Functionality

The Quantower trading terminal has a wide range of various tools and add-ons for different trading styles. You can publish orders through the order book or using a graphic image. The program is equipped with more than 50 technical indicators divided into 6 groups: Channels, Moving averages, Oscillators, Trend, Volatility and Volume.

Chart curves in trading on the Quantower platform

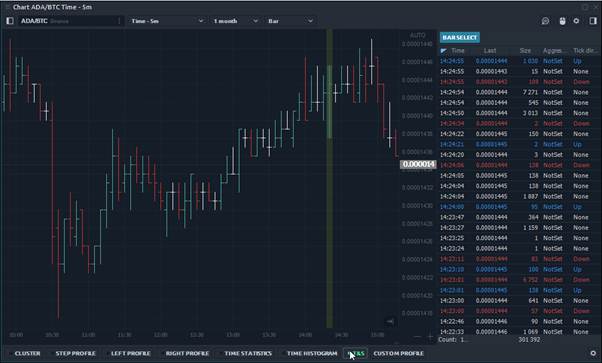

The Quantower trading terminal includes more than eight familiar and advanced types of graphical tools:

- a chart that includes information on all completed transactions for a particular trading instrument;

- periodic charts with a choice of any time period;

- technical analysis using various methods: tic-tac-toe, Kagi, Renko, Line break, bar injection, etc.;

- candlestick indicators, such as Heiken Ashi .

Note! With the help of an additional overlay function, you can display from two elements on one graphic image.

Algorithmic trading

The Quantower exchange trading platform provides the ability to create custom modules. That is, a trader can create automated trading strategies and indicators, create independently compiled software modules that are dynamically connected to the main program, and also connect to a banking center or a broker. Writing your own applications is carried out in a specialized programming language – C#.

Interesting! In the near future, the developers plan to introduce such programming languages as R, Python, as well as a visual editor into the Quantower trading terminal in order to simplify the work process and maximize functionality.

Implementation of ready-made automated trading strategies

In order to test the ready-made trading algorithm, the Quantower platform was equipped with the History Player function. Algorithmic strategies can be implemented on any brokerage center or data provider. Testing is carried out on charts chosen by traders and any time intervals. https://articles.opexflow.com/trading-training/algoritmicheskaya-torgovlya.htm

Note! You can test several elements at once.

To implement a trading platform on historical data, the Quantower platform provides the Historical Symbols function. Through it, you can transfer historical data, carry out technical analysis of various exchanges and markets for financial instruments, as well as check the developed automated trading algorithms for errors.

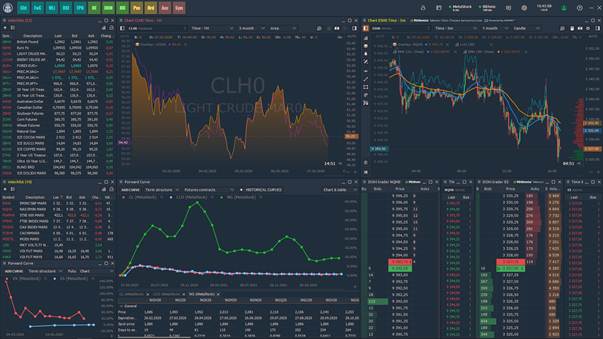

Quantower interface and functionality: how to manage and configure

The Quantower trading terminal includes several ways to manage workspaces:

- group distribution – makes it possible to combine an unlimited number of areas into one group;

- linking – this method links several panels together, forming one single large-scale working window;

- templates – save changed parameters, indicators and styles of one workspace, as well as group distributions and previously formed bundles, so that in the future it would be convenient to deploy them in one click.

Such functionality allows you to make the process of setting the working panel parameters almost limitless, that is, this once again indicates that each participant in exchange trading will be able to configure the program in such a way that the workflow is as convenient and efficient as possible for his trading style.

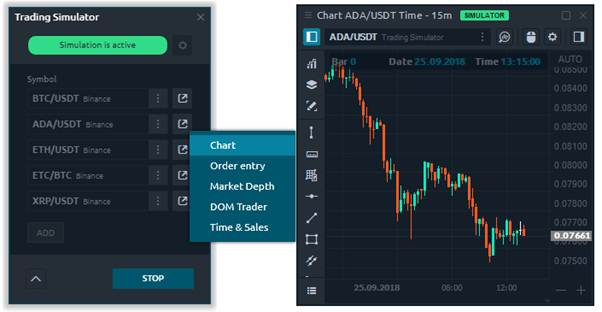

Quantower Trading Simulator

The Quantower trading terminal has a functional Trading Simulator panel, which has a large set of tools and makes it possible to simulate the execution of an exchange order for a specified connection, including those that do not even allow trading. The main advantage of this feature is that a participant in exchange trading practices the style of his work in real time, but he does not risk money investments. Given the fact that the cryptocurrency markets are not able to provide their participants with a demo version of trading, this practice will be a great solution for crypto traders.

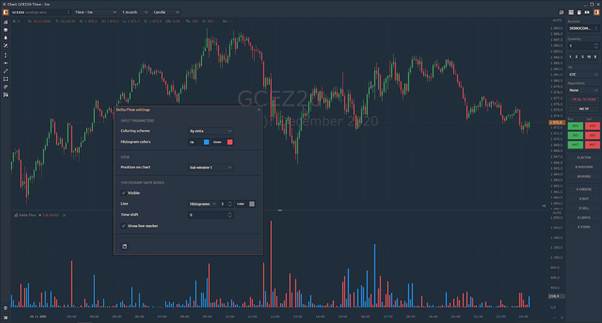

Volumetric analysis tools powered by Quantower

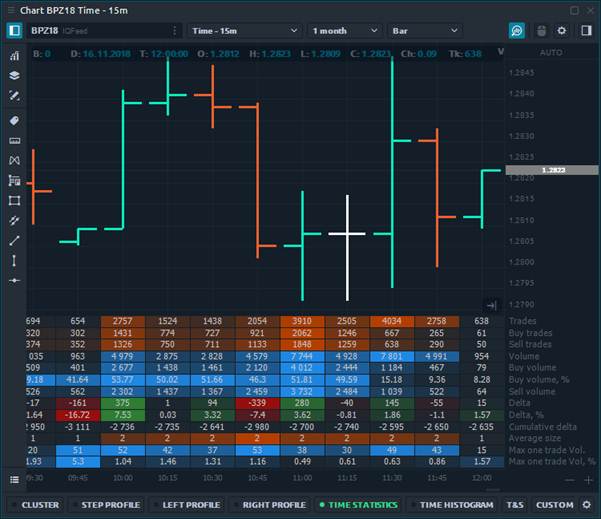

As we mentioned earlier, the developers of the Quantower trading terminal, having listened to the participants in exchange trading, have implemented a fairly wide functionality for volume analysis. The terminal allows you to see the traded volume on each price module, assess the situation of confrontation between buyers and sellers, and also suggest further actions of traders and investors regarding the future price level. Tools for volume analysis in the system are divided into five groups:

- footprint chart – shows the distribution of volume in each element of the quotes chart, which in turn displays the movement of the price module for a specified period of time;

- volume profile – shows volume data in a horizontal graph format;

- statistics for each element of the quotes chart – this section displays volume statistics for each individual graphical element of the quotes chart, namely the overall scale, trades, customizable parameters, etc.;

- vertical volume chart – this section is almost identical to the group with statistical data for each element of the quote chart, or rather its functionality; a vertical volume chart in the format of a vertical histogram shows the volume for each bar, however, unlike statistics, it allows the trader to visually analyze the information for each bar not only by shades, but also by the shape of the chart;

- Time&Sales historical protocol – all completed transactions for the working period are collected here in sequential order in the specified bar; each trader can set up this section for himself.

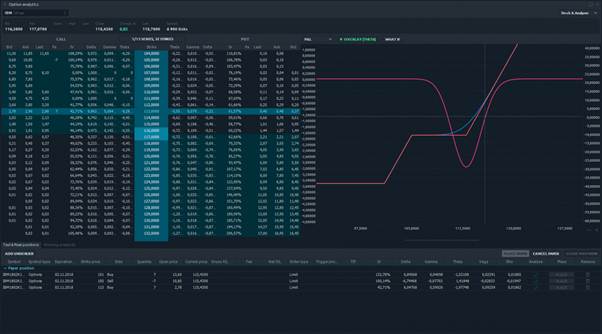

Trading options on the basis of the trading terminal Quantower

Exchange traders trading contracts that provide for the option buyer’s right to purchase or sell a standard financial instrument in a specified period and at a certain price will be surprised by the presence of an option module on the Quantower marketplace. Entering the working panel and specifying a trading instrument, the trader will see a standard option board with numerous option series. To analyze option designs, Quantower developers have implemented the Option Analyzer functional module into their platform, which shows the element format, as well as option charts.

Note! A systematic module of overlaying graphical tools on top of each other makes it possible to evaluate several element parameters at once.

The implementation of test elements is carried out from the option board in one click:

- Select the required execution price.

- In the Position Documents section, specify the required number of applications for the purchase / sale of assets.

- The selected strike prices will be displayed in the table of test positions, and the required option profile will appear on the graphical curve.

Quantower Exchange Marketplace: Installing and Configuring a Profile for Exchanges and Financial Markets

First of all, a participant in exchange trading must go to the official platform of the developer of the Quantower trading terminal, from here download and install this program on his personal computer. The download and installation process is easy, does not cause difficulties and does not take much time.

Note! You should download the Quantower trading platform only from the base of the official website of the developers https://www.quantower.com/, since this resource is protected and verified. Downloading and installing an application from third-party sources may lead to the installation of unwanted malware, viruses and other troubles on the PC system. Also, often scammers and hackers have access to the unofficial version, which can subsequently hack into the trader’s account, which will entail a number of other unpleasant consequences.

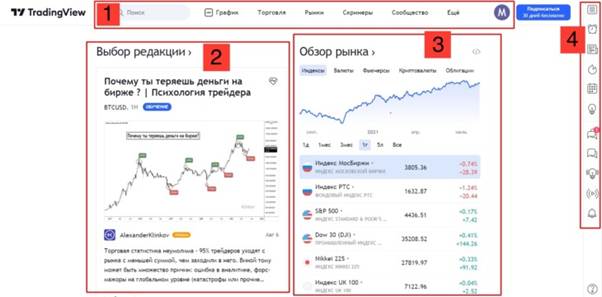

When launching the application for the first time, a participant in exchange trading will be on an emulator account, which will tell and clearly show the basic functionality and capabilities of the site. At this stage, the trader must set up a connection to an information provider, such as TradingView, in order to see the price modules that sellers install here and now.

- Click on the connection point and specify the program in the pop-up window with information providers.

- Select “Demo”, then “Connect”.

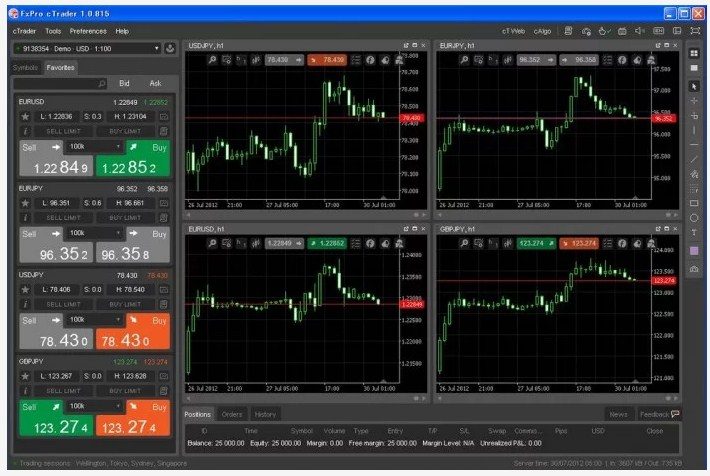

- Go through the authorization procedure in the cTrader application so that the price modules are imported to the site.

Reference! Basic templates are located in the menu on the top panel on the left side, however, a trader can create his own.

Cost of using Quantower

The developers of the Quantower trading terminal offer exchange traders a choice of four options for using the program:

- Free version – connects to only one server and includes all basic functionality.

- Crypto Package – connects to crypto markets, a participant in exchange trading can conduct a full analysis of volumes, the basic functionality is expanded with additional features. Monthly fee – $40 (2700 Russian rubles).

- Multi-asset Package – a trader can connect to any exchanges and financial markets, volume analysis is available, advanced functionality. Monthly fee – $50 (3400 Russian rubles).

- All-in-one Package – a trader can connect to any available servers, has access to all the functionality of the platform, including paid and analytical modules. Monthly fee – $100 (6750 Russian rubles).

Also, a participant in exchange trading can buy a license for the Quantower trading terminal one-time. The cost of such a permit is $790 (53,200 rubles), $990 (66,700 rubles), $1,290 (87,000 rubles) in accordance with the above-described selected tariff for using the program. The Quantower trading terminal is a platform for medium-term and long-term experienced participants in exchange trading, who, in the style of their work, combine independent and algorithmic trading. Novice traders can use the free version, because before purchasing the full package of tools and features, you need to have enough knowledge and experience in this area, as well as a stable income from this activity. Otherwise, choosing an expensive program may be pointless.

Чомусь в переліку індикаторів відсутній індикатор “Fractals”, хоча заявлений починаючи з версії 1.125.1 (Beta). Програму оновив, але індикатор відсутній. 🙁

Bonjour , j’utilise votre plateforme avec Phidias comme propfirme … je ne trouve plus le ticker du gold mgc ou gc Comment faire pour le récupèrer Merci