For trading on the stock market in the modern world, many auxiliary tools have been developed. One of them is the economic calendar. It allows the trader to actively trade and make several deliberate and profitable transactions per day. The trader here only needs to actively monitor the events taking place in the economic sphere of life and be able to analyze them. This is where the calendar helps.

What is an economic calendar

The economic calendar can be called a kind of news aggregate. Here, a trader can see publications about the main economic events that take place in the global community. Unlike standard news tools, in the calendar you can see the information that is only planned for publication. Those. when the data appears on the calendar, it is not yet available to the general public. Thanks to this, a trader can think over his strategy, as they say, “one step ahead” and thereby bypass his competitors.

- Reports . Here you can see all kinds of reports that relate to the commission of certain operations. In addition to the title of the document, information about the time of its publication will be available, which is far from the last value on the stock market.

- Schedule of days on which exchanges will not work . Knowing these dates also plays an important role when planning your own strategy.

- In some calendars, it is possible to watch speeches and speeches of famous people on economic topics , as well as get information about when certain laws and regulations will come into force that directly or indirectly relate to stock exchanges and stock markets.

Why do we need an economic calendar for traders

Thanks to the built-in functionality of this tool, a person can follow current events taking place in the economic sphere. The analysis of these factors is very important for a trader who deals with stock market transactions. The calendar allows you to correctly calculate your strategy of action. It is only important to be able to analyze the information provided by the economic calendar. If a trader or investor can learn this, he has every chance to increase his earnings in this area by several times. In this case, the economic calendar will act as a kind of adviser, thanks to which the trader will be able to follow all the relevant information on the financial market or stock exchange, as well as receive timely forecasts for the development of certain quotes, securities, etc.

Description of the main fields

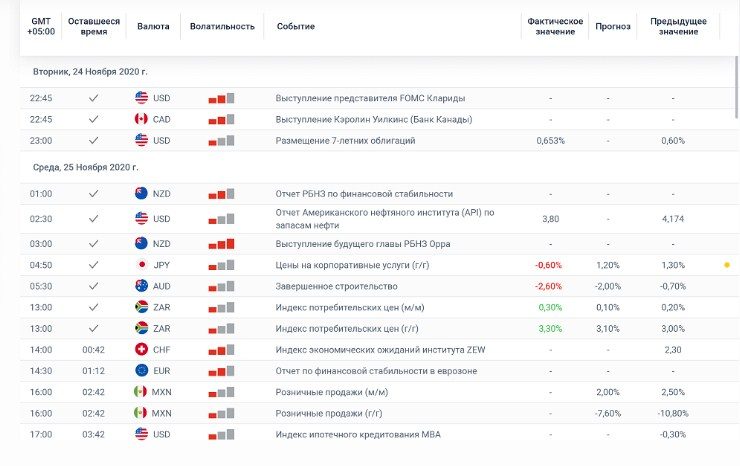

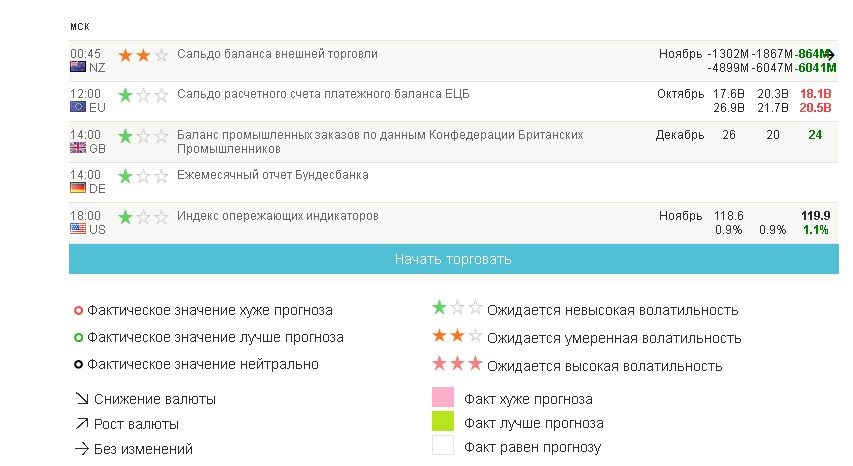

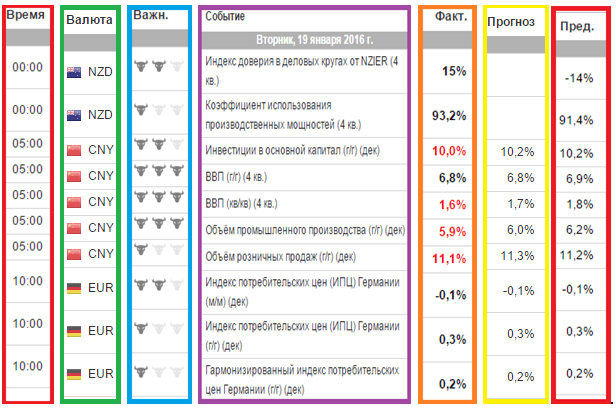

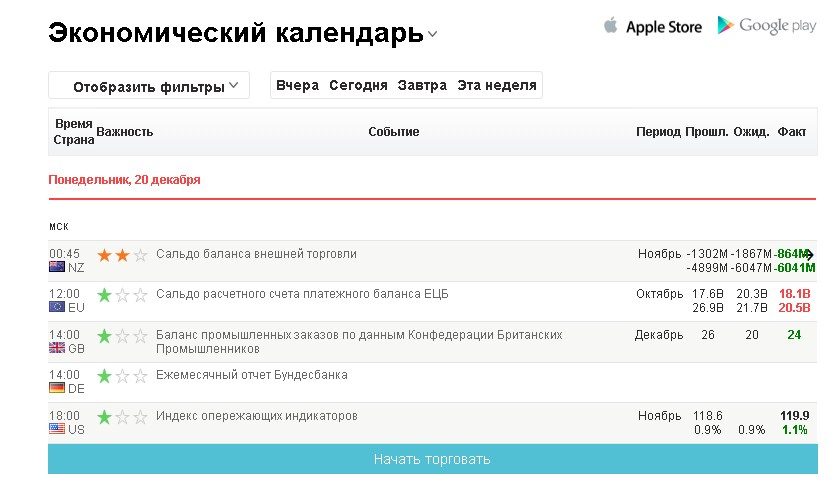

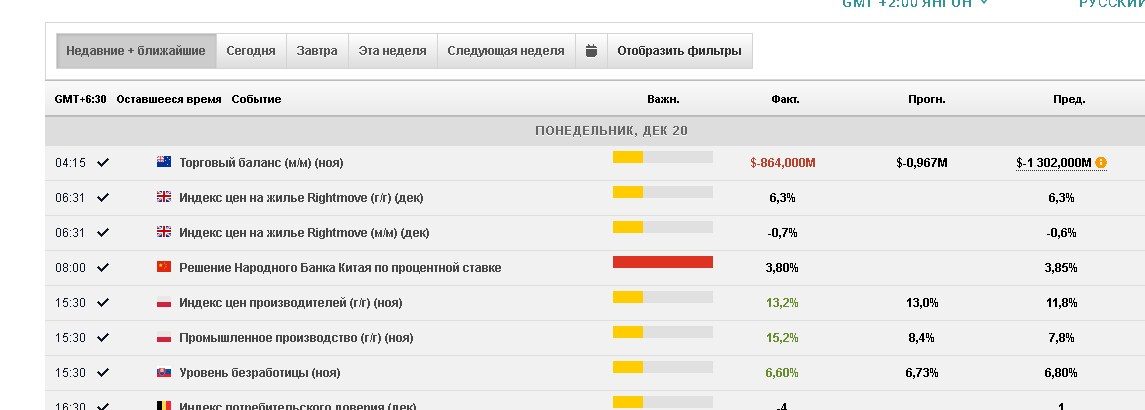

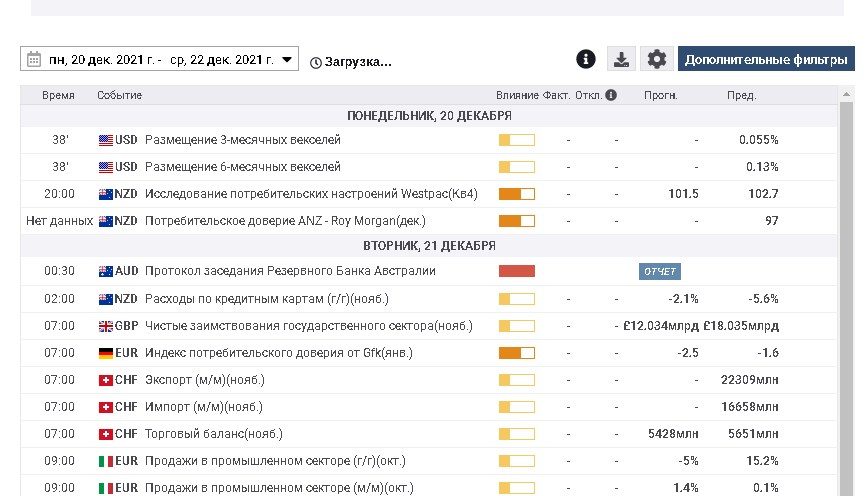

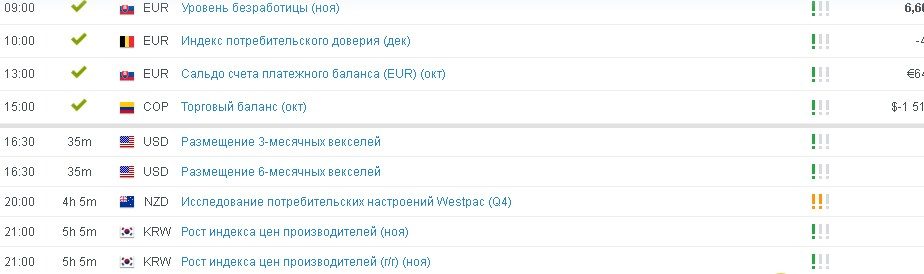

Before you start working with a particular calendar, you need to familiarize yourself with its interface and determine the purpose of each of its parts. In the future, this will help to quickly analyze information and take into account only those items that are needed at a given time. Also, the trader must immediately understand what data can be extracted from the calendar and what benefits they can bring in terms of increasing earnings. In appearance, the economic calendar is a large table, the information in which is updated on a regular basis. In its columns and rows you can find the following information:

- The date and exact time of the event . Here you can get up-to-date information about when the report, speech, price changes, publication, etc. were published. for a certain time before and after this event, the highest volatility of the currency, as well as securities, will remain on the market. You can use this to increase your earnings.

- Country . In a report or event, the place where he/she was published plays an important role. For example. In the United States of America published a report on unemployment in the country. Analyzing this event, an investor/trader can quite reasonably assume that the US dollar will soon begin to fluctuate. Having found out this, he performs the actions corresponding to this moment.

- Factual data . Here we are talking about the level of inflation, the size of GDP or other indicators that experts presented in their report. They are no less important for a person doing business in the market or stock exchange. After the publication of the report/publication, etc. information about this data appears in the calendar. They can affect the exchange rate, both in a positive and negative context. The trader only needs to be able to analyze them. Based on this data, further decisions on transactions are made.

- Forecast . The system automatically analyzes the sales data of the previous month. This is not yet accurate information, but only an assumption. However, even a forecast can affect the behavior of traders in each particular month.

- Data for the previous time period . In the economic calendar, you can view reports on the behavior of traders in each specific period of time. After analyzing how the market reacted to certain events that took place in the world, a person will be able to get an idea of how to act during any change in the market or in the world community. This can greatly help in the process of increasing your income. He, again, will go “one step ahead” of his competitors.

On the example of Forex

Assume that the predicted results turned out to be lower than the actual ones. In this case, most economic indicators will rise sharply. Accordingly, otherwise it will be the other way around. However, at this point, many will be interested in the question – does the national currency follow these indicators? Not always. It is influenced by a number of external factors. For example, many analysts in the recent past expected GDP growth to be 3%. In reality, everything turned out differently, and in fact the figure increased by only 2%. In this regard, there was a threat of a fall in the value of the national currency. On the contrary, if negative figures appear in the actual data column, this can lead to the fact that the values of quotations will increase. Of course, provided that the actual fall was not as big as traders and analysts expected. Today, many types of economic calendars have been developed. In terms of content and general appearance, they practically do not differ from each other. However, they often have a different format and focus.

Before a trader starts using the calendar on the broker’s website, he is strongly advised to learn the meaning of all the abbreviations that are used both in the calendar and on the server itself.

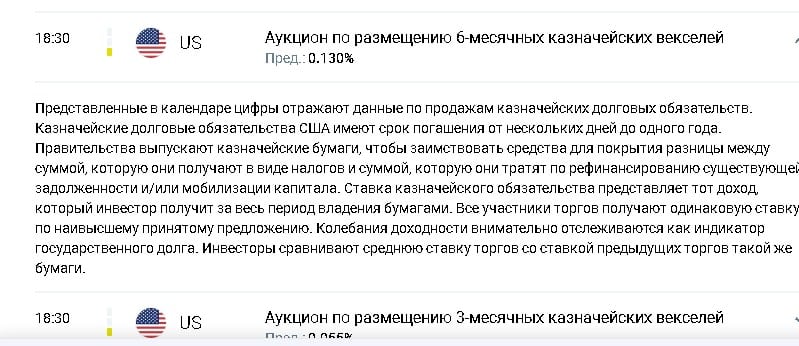

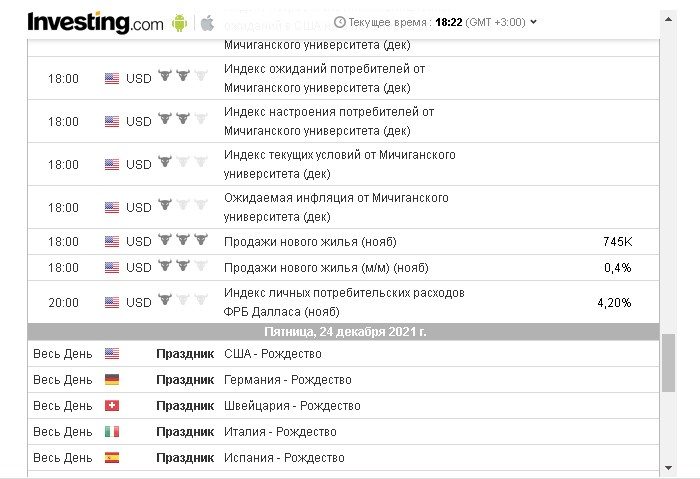

Economic online calendar from Investing.com Russia:

Calendar examples

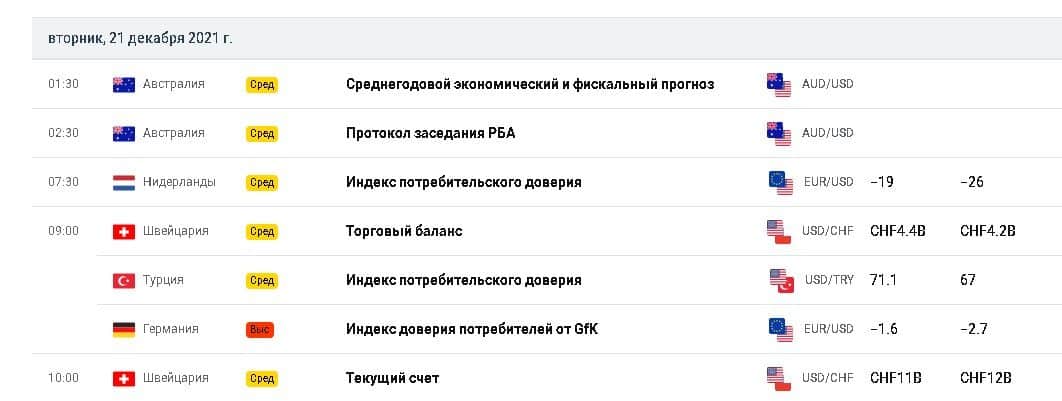

Thanks to the economic calendar, a trader can develop his own forecasts and make transactions that can potentially increase his personal income. Using this tool is not difficult and accessible to people with any level of training. In the standard version, it looks like this:

- The trader chooses the country on whose national currency he plans to earn. In the economic calendar, you can find information on transactions from all over the world, so finding the right currency will not be so difficult. However, one should not forget that in less developed countries, reports may be published on an irregular basis. Therefore, the trader has to regularly monitor the news.

- Next , an event is selected . In fact, the quotes of the national currency can be affected by any event within the country or in the international community. A trader needs to learn how to determine what factors will affect the growth or fall of the currency and, when news with a similar event is published, take the necessary actions in time to increase earnings or reduce risk. For example, a trader can buy US dollars several times a day and at the same time earn a good profit if the exchange rate continues to grow steadily during the day.

- The indicators are analyzed . If the event is still pending, this takes into account data from previous periods, as well as forecasts of professional analysts. Based on this information, a decision is made to perform various operations.

- Then you have to wait until the report or other event is published . After it happens, you can expect an increase or decrease in the exchange rate. Based on these data, a person can perform the reverse operation. Those. if he previously bought a currency, and its rate began to fall sharply, he can sell it until the main number of market participants find out about it, or vice versa, buy a currency whose rate has gone uphill.

Choosing an economic calendar – current selection

The most famous Russian-language economic calendars include:

- investing economic calendar;

- forex calendar of economic events;

- fxteam economic calendar link;

- alpari economic calendar;

- teletrade economic calendar;

- forexpros ru economic calendar;

- forex club economic calendar;

- fxstreet economic calendar;

- economic calendar;

- roboforex economic calendar.

One important fact should be noted here. Economic calendars of different models practically do not differ from each other in their interface. Their main difference is in the direction and minor features of the interface. An economic calendar can be a great assistant to a trader. Thanks to him, he will constantly be aware of all relevant information in the economic sphere. Based on these data, he can leave his own forecasts and, in accordance with them, perform various actions in the market.